|

市場調査レポート

商品コード

1641838

テレマティクス:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| テレマティクス:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

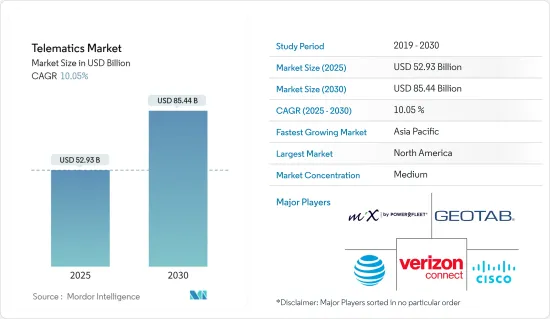

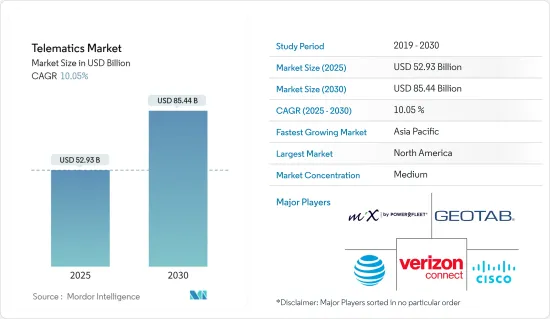

テレマティクスの市場規模は2025年に529億3,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは10.05%で、2030年には854億4,000万米ドルに達すると予測されます。

テレマティクス市場は、技術の進歩とリアルタイム・データ・ソリューションに対する需要の高まりによって、自動車産業の中で急速に発展している分野です。テレマティクス技術は、車両から外部システムへのデータ・トランスミッションを可能にし、企業が車両を監視・管理し、車両性能を追跡し、安全性とセキュリティを確保することを可能にします。モノのインターネット(IoT)機能の統合により、テレマティクス・システムはますます高度化し、データ分析を通じて車両運行に関するより深い洞察を提供しています。これらのソリューションは、車両管理、GPS追跡、自動車保険など様々なアプリケーションに及んでいます。

テレマティクスの主要企業とイノベーション:

主なハイライト

- 継続的な革新:MiX Telematics、Geotab Inc.、Verizon Telematicsなどの主要企業は、より正確で包括的なデータサービスを提供するために継続的に技術革新を行っています。

- 消費者向けアプリケーション:テレマティクス技術は個人消費者の間でも人気が高まっており、相手先商標製品メーカー(OEM)やアフターマーケットプロバイダーが組み込み型と携帯型の両方のデバイスを提供しています。こうした消費者の関心の高まりは、安全機能の強化、車両診断、燃費向上に対する需要の高まりに起因しています。

- クラウドベースのソリューション:さらに、クラウドベースのテレマティクス・ソリューションの需要が高まっており、テレマティクス・データを企業システムとシームレスに統合できるようになっています。これにより、車両管理が簡素化されるだけでなく、運用コストも削減されます。

テレマティクス市場のセグメンテーション:

主なハイライト

- OEMとアフターマーケットプレーヤー:テレマティクス市場は、OEMとアフターマーケットプレーヤーが提供するソリューションによって区分され、スマートフォンベース、ポータブル、組み込みデバイスが含まれます。これらのデバイスは、多様な消費者のニーズに合わせて調整されており、エントリーレベル、ミッドティア、ハイエンドのソリューションが用意されています。

- 地域別市場:北米、欧州、アジア太平洋が自動車テレマティクス市場を独占しています。テレマティクス技術の利点に対する消費者の意識の高まりに加え、自動車の安全性と効率性に関する厳しい規制が普及の原動力となっています。

コネクテッドデバイスの急増が市場の可能性を拡大

主なハイライト

- コネクテッドデバイスの台頭がテレマティクス市場を大きく形成しています。IoT対応テレマティクスシステムを搭載する車両が増加し、車両とインフラ間のデータ伝送がよりスムーズかつ効率的になった。

- 商用テレマティクスこれは、大規模な車両を管理するためにリアルタイムのデータに依存する商用テレマティクス・ソリューションにとって特に重要です。企業は、パフォーマンス指標を監視し、業務効率を高めることができるため、最適化された経路、燃料使用量、メンテナンスから利益を得ることができます。

- コネクテッド・カーに対する消費者の需要:コネクテッド・カー・テレマティクスは大幅な成長を遂げており、消費者はGPS追跡、リアルタイムの交通情報更新、緊急対応機能などの高度な機能を提供する自動車を選ぶ傾向が強まっています。スマートフォンベースのテレマティクス・アプリケーションは、消費者に車両データへの容易なアクセスを提供することで、この成長をさらに後押ししています。

- クラウドベースのプラットフォーム:クラウドベースのテレマティクス・プラットフォームの採用は、リモート・データ・アクセスを可能にすることで、車両管理を一変させました。これらのプラットフォームは拡張性と適応性を提供し、運輸業から個人的な車両所有に至るまで、多様な業界のニーズに対応しています。

車両診断への需要が技術革新を促進

主なハイライト

- シームレスな車両診断に対する需要の高まりが、特に車両管理におけるテレマティクス・システムの進歩を後押ししています。

- フリートヘルス・モニタリング:大規模な車両を管理する企業は、コストのかかる故障を回避し、ダウンタイムを削減するため、リアルタイムの車両健康データを必要としています。テレマティクスのデータ分析を利用することで、フリート管理者はエンジンの健康状態、燃料消費量、タイヤ空気圧などの主要なパフォーマンス指標を追跡することができ、予防保守が可能になります。

- 予防的診断:消費者にとっては、車両に組み込まれたテレマティクス・システムによって、定期メンテナンスのための自動アラートによる事前診断が可能になります。これにより、予期せぬ車両故障のリスクが大幅に軽減され、安全性が向上します。こうした簡単な診断ツールは、コネクテッド・カー・アプリケーションに不可欠な要素になりつつあり、需要をさらに促進しています。

- テレマティクスの革新:テレマティクスのソフトウエアとハードウエアの技術革新は、よりスマートでデータ主導の診断への需要が高まるにつれて進み、商用車と個人向け車両の両方のオーナーに恩恵をもたらしています。

テレマティクス市場の動向

スマートフォン・ソリューションが大きな市場シェアを占める見込み

世界のテレマティクス市場は、コネクテッド・ビークル・ソリューションの進化と、自動車、運輸、物流などの業界全体における採用の増加により、急速な成長を遂げています。市場を形成する主な動向には、スマートフォンベースのテレマティクスの重要性の高まり、アジア太平洋地域での大幅な拡大などがあります。

- スマートフォンベースのソリューション:これらのソリューションは、その効率性とアクセシビリティにより主流になりつつあります。車両管理テレマティクスはスマートフォンアプリへの依存度が高まっており、専用のハードウェアを必要とせずにGPS追跡、ドライバー行動モニタリング、車両診断などの機能を提供しています。

- 燃費とパフォーマンスの分析:スマートフォンアプリ内のテレマティクス・データ分析は、燃料消費、運転行動、車両性能に関するリアルタイムの洞察を提供することで、業務運営に変革をもたらしつつあります。

- 利用ベースの保険(UBI):スマートフォンのテレマティクスはUBIにも対応しており、テレマティクスのデータは保険会社が運転行動に基づいて保険料をより正確に計算するのに役立っています。このコスト削減効果は、保険業界におけるUBIの普及を後押ししています。

アジア太平洋地域が大きな成長を遂げる見込み

アジア太平洋地域では、コネクテッドカーとIoT対応テレマティクス・ソリューションの需要の高まりが主な要因となって、テレマティクスの導入が大きく伸びています。

- 中国の自動車市場中国ではコネクテッド・カー・テレマティクスのブームが起きており、システムはリアルタイムの追跡や診断などの高度な機能を提供しています。排出ガス削減と交通流の改善を目的としたテレマティクスを推進する政府の政策が、この成長に寄与しています。

- インドの物流セクターインドでは、クラウドベースのシステムを通じて経路の最適化や燃費の向上を目指す企業が増えており、物流・輸送分野でのテレマティクスの導入が進んでいます。

- 日本のテレマティクス革新:日本はテレマティクスのイノベーションをリードし続けており、特にコネクティッドカー・エコシステムのためのテレマティクスとIoTの統合をリードしています。日本の自動車メーカーは次世代テレマティクス・ソリューション開発の最前線にいます。

テレマティクス業界の概要

テレマティクス市場は、世界的コングロマリットと専門プレーヤーが混在する半統合市場です。

多様な市場プレーヤー:AT&T、Geotab Inc.、Cisco Systems Inc.、Verizon、MiX Telematicsなどの大手企業が様々なテレマティクス・ソリューションを提供しています。世界通信企業はネットワーク・インフラを活用し、専門企業は車両追跡と管理に注力しています。

新たな戦略:市場プレイヤーの主な成功要因としては、AIを活用した予測分析の統合、電気自動車テレマティクスへの進出、より拡張性の高いクラウドベースのソリューションの提供などが挙げられます。今後の成長には、自動車メーカーとの提携やサービスの多様化が欠かせないです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- コネクテッドデバイスの台頭

- 簡単な車両診断の膨大な需要

- 市場抑制要因

- データ漏洩の脅威

- 設置に伴う高コスト

- 業界バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場セグメンテーション

- チャネル別

- 相手先ブランド製造(OEM)

- アフターマーケット

- ソリューション別

- スマートフォン

- ポータブル

- 組み込み型

- 提供タイプ別

- ハードウェア

- サービス(エントリーレベル、ミッドティア、ハイエンド)

- 地域別

- 北米

- 欧州

- アジア

- オーストラリアおよびニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情勢

- 企業プロファイル

- Mix Telematics

- AT&T Inc.

- Geotab Inc.

- Verizon Telematics

- Cisco Systems Inc.

- Aplicom Oy

- Microlise Ltd

- LG Electronics Inc.

- Trimble Inc.

- Ctrack Global(Inseego Corp. Company)

第7章 投資分析

第8章 市場機会と今後の動向

The Telematics Market size is estimated at USD 52.93 billion in 2025, and is expected to reach USD 85.44 billion by 2030, at a CAGR of 10.05% during the forecast period (2025-2030).

The telematics market is a rapidly evolving sector within the automotive industry, driven by advancements in technology and rising demand for real-time data solutions. Telematics technology enables the transmission of data from vehicles to external systems, allowing companies to monitor and manage their fleets, track vehicle performance, and ensure safety and security. With the integration of Internet of Things (IoT) capabilities, telematics systems are becoming increasingly sophisticated, providing deeper insights into vehicle operations through data analytics. These solutions span across various applications such as fleet management, GPS tracking, and automotive insurance.

Key Players and Innovations in Telematics:

Key Highlights

- Ongoing innovation: Key players like MiX Telematics, Geotab Inc., and Verizon Telematics are continuously innovating to offer more accurate and comprehensive data services, which are essential for businesses relying on vehicle operations.

- Consumer applications: Telematics technology is also gaining popularity among individual consumers, with original equipment manufacturers (OEMs) and aftermarket providers offering both embedded and portable devices. This surge in consumer interest is attributed to the increasing demand for enhanced safety features, vehicle diagnostics, and improved fuel efficiency.

- Cloud-based solutions: Additionally, cloud-based telematics solutions are growing in demand, allowing for seamless integration of telematics data with enterprise systems. This not only simplifies fleet management but also reduces operational costs.

Telematics Market Segmentation:

Key Highlights

- OEMs and aftermarket players: The telematics market is segmented by the solutions provided by OEMs and aftermarket players, which include smartphone-based, portable, and embedded devices. These devices are tailored to meet the needs of diverse consumers, with entry-level, mid-tier, and high-end solutions available.

- Geographical markets: North America, Europe, and Asia-Pacific dominate the automotive telematics market. The widespread adoption is driven by stringent regulations concerning vehicle safety and efficiency, alongside rising consumer awareness of telematics technology benefits.

Surge in Connected Devices Expands Market Potential

Key Highlights

- The rise of connected devices is significantly shaping the telematics market. With more vehicles now equipped with IoT-enabled telematics systems, data transmission between vehicles and infrastructure has become smoother and more efficient.

- Commercial telematics: This is particularly crucial for commercial telematics solutions, which rely on real-time data to manage large fleets. Companies benefit from optimized routing, fuel usage, and maintenance, thanks to the ability to monitor performance metrics and enhance operational efficiency.

- Consumer demand for connected vehicles: Connected car telematics is seeing substantial growth, with consumers increasingly opting for vehicles that offer advanced features like GPS tracking, real-time traffic updates, and emergency response capabilities. Smartphone-based telematics applications have further boosted this growth by providing consumers with easy access to vehicle data.

- Cloud-based platforms: The adoption of cloud-based telematics platforms has transformed vehicle management by allowing remote data access. These platforms provide scalability and adaptability, catering to the needs of diverse industries, from transportation to personal vehicle ownership.

Demand for Vehicle Diagnostics Fuels Technological Innovation

Key Highlights

- The growing demand for seamless vehicle diagnostics is pushing advancements in telematics systems, particularly within fleet management.

- Fleet health monitoring: Companies managing large fleets require real-time vehicle health data to avoid costly breakdowns and reduce downtime. By using telematics data analytics, fleet managers can track key performance indicators such as engine health, fuel consumption, and tire pressure, enabling preventive maintenance.

- Proactive diagnostics: For consumers, telematics systems embedded in vehicles allow for proactive diagnostics, with automatic alerts for routine maintenance. This significantly reduces the risk of unexpected vehicle failures and enhances safety. These easy diagnostics tools are becoming an integral part of connected car applications, further fueling demand.

- Telematics innovation: The market continues to see innovations in telematics software and hardware as the demand for smarter, data-driven diagnostics grows, benefiting both commercial and personal vehicle owners.

Telematics Market Trends

Smartphone Solution is Expected to Hold a Major Market Share

The global telematics market is experiencing rapid growth, driven by advancements in connected vehicle solutions and their increased adoption across industries such as automotive, transportation, and logistics. Key trends shaping the market include the rising importance of smartphone-based telematics and significant expansion in the Asia-Pacific region.

- Smartphone-based solutions: These solutions are becoming dominant due to their efficiency and accessibility. Fleet management telematics increasingly relies on smartphone apps, offering features such as GPS tracking, driver behavior monitoring, and vehicle diagnostics without needing specialized hardware.

- Fuel efficiency and performance analytics: Telematics data analytics within smartphone apps is transforming business operations by providing real-time insights into fuel consumption, driving behavior, and vehicle performance.

- Usage-based insurance (UBI): Smartphone telematics also supports UBI, where telematics data helps insurers calculate premiums more accurately based on driving behavior. This cost-saving benefit is driving its adoption within the insurance industry.

Asia Pacific is Expected to Witness Significant Growth

The Asia-Pacific region is witnessing significant growth in telematics adoption, largely driven by the rising demand for connected cars and IoT-enabled telematics solutions.

- China's automotive market: China is experiencing a boom in connected car telematics, with systems offering advanced features like real-time tracking and diagnostics. Government policies promoting telematics to reduce emissions and enhance traffic flow are contributing to this growth.

- India's logistics sector: In India, telematics adoption in logistics and transportation is increasing as companies seek to optimize routes and improve fuel efficiency through cloud-based systems.

- Japan's telematics innovation: Japan continues to lead telematics innovation, particularly in integrating telematics with IoT for connected car ecosystems. Japanese automakers are at the forefront of developing next-generation telematics solutions.

Telematics Industry Overview

The telematics market is semi consolidated, featuring a mix of global conglomerates and specialized players.

Diverse market players: Major players like AT&T, Geotab Inc., Cisco Systems Inc., Verizon, and MiX Telematics offer various telematics solutions. Global telecommunications companies leverage their network infrastructure, while specialized firms focus on fleet tracking and management.

Emerging strategies: Key success factors for market players include integrating AI-driven predictive analytics, expanding into electric vehicle telematics, and offering more scalable cloud-based solutions. Partnerships with automotive manufacturers and diversification of services will be critical for future growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Connected Devices

- 4.2.2 Huge Demand of Easy Vehicle Diagnostics

- 4.3 Market Restraints

- 4.3.1 Threat of Data Breaches

- 4.3.2 High Costs Associated With Installations

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 impact on the market

5 MARKET SEGMENTATION

- 5.1 By Channel

- 5.1.1 Original Equipment Manufacturers (OEM)

- 5.1.2 Aftermarket

- 5.2 By Solution

- 5.2.1 Smartphone

- 5.2.2 Portable

- 5.2.3 Embedded

- 5.3 By Offering Type

- 5.3.1 Hardware

- 5.3.2 Services (Entry-level, Mid-tier, High-end)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mix Telematics

- 6.1.2 AT&T Inc.

- 6.1.3 Geotab Inc.

- 6.1.4 Verizon Telematics

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Aplicom Oy

- 6.1.7 Microlise Ltd

- 6.1.8 LG Electronics Inc.

- 6.1.9 Trimble Inc.

- 6.1.10 Ctrack Global (Inseego Corp. Company)