|

|

市場調査レポート

商品コード

1444039

自動運転車:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Autonomous (Driverless) Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動運転車:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 96 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

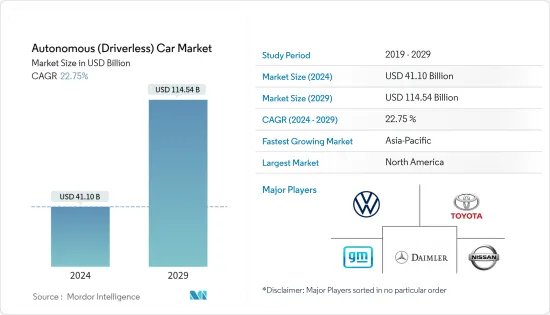

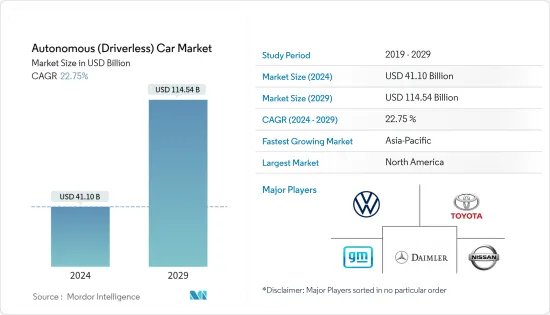

自動運転車の市場規模は2024年に411億米ドルと推定され、2029年までに1,145億4,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に22.75%のCAGRで成長します。

新型コロナウイルス感染症(COVID-19)のパンデミックは自動車セクター全体に影響を及ぼし、自動車メーカーは生産工場の生産量削減を余儀なくされています。パンデミックは、生産から研究開発に至るまで多くのOEMの業務にも影響を及ぼし、短期的な混乱を引き起こし、自動運転車の導入と展開を遅らせています。

交通安全の向上に焦点を当てた政府の規制がますます厳しくなっているため、スマートフォンと統合された高度な技術を搭載した自動運転車が開発されており、市場関係者が顧客を引き付ける機会が生まれています。人工知能、機械学習、およびレーダー、ライダー、GPS、コンピュータービジョンなどのその他のセンサーの分野における最近の技術の進歩により、メーカーは自動車の自動運転機能を向上できるようになりました。

現在、市場ではレベル2とレベル3の自動運転車が最も注目を集めていますが、レベル4とレベル5(SAEの基準による)は2030年までに広く受け入れられると予想されています。その結果、これらのレベル2とレベル3の車の成長は、予測期間中に市場を推進すると予想されます。

北米が市場で重要な役割を果たすと予想され、次にアジア太平洋、欧州が続きます。北米の大手自動車メーカー、テクノロジー大手、専門スタートアップが自動運転車(AV)技術の開発に投資を開始しています。中国、日本、インド、韓国などの国々で自動運転車の需要が高まっているため、アジア太平洋地域でも予測期間中に成長が見込まれると予想されます。

自動運転車市場動向

半自動運転車セグメントは予測期間中に重要性を増すと予想される

SAE(自動車技術者協会)の国際自動運転規格に従って、レベル1~3の自動運転機能を備えた自動車が半自動運転車の市場セグメントで考慮されています。より安全で効率的な運転システムに対するニーズの高まりにより、半自動運転車の開発と導入が促進されています。さらに、いくつかの地方政府は厳しい運転法と安全法を制定し、企業が自社の自動車にこれらの技術を提供することをさらに奨励しています。

いくつかの技術の進歩は、市場の成長に適した環境を促進するのに役立ちました。さらに、多数の乗用車の存在により、運転体験を向上させるニーズが高まり、半自動運転車の導入が促進されています。これは、COVID-19パンデミック時の売上に顕著に表れています。

パンデミック下でも自動運転車の販売は増加し、2020年にはレベル2機能を搭載した車が約1,120万台販売され、これは2019年比78%増となった。このような好ましい市場環境のおかげで、世界中の自動車メーカーがは消費者を魅了するために新しい半自動運転車モデルを導入しています。例えば、

2021年4月、シトロエンは新型SUV「C5 X」を発表しました。この新型モデルはガソリン版とプラグインハイブリッド版の両方が用意されました。 C5 Xは、現行法に準拠したレベル2の半自動運転を提供します。

2021年4月、北京現代汽車はコンパクトクロスオーバーSUVの新型ツーソンLを発売しました。 i-GMPプラットフォームを採用し、1.5リッターターボエンジン(最高出力147kW、最大トルク253Nm)を搭載し、7速デュアルクラッチトランスミッションを組み合わせる。この車両には、23の安全機能と支援機能が含まれ、レベル2の自動運転をサポートするヒュンダイスマートセンスシステムが搭載されています。

前述の要因に基づいて、半自動運転車セグメントは予測期間中に注目を集める可能性があります。

北米が市場で圧倒的なシェアを握る可能性が高い

北米は、予測期間中に自動運転車市場を独占すると予想されています。この地域は、強力で確立された自動車会社のクラスターや、Google、Microsoft、Appleなどの世界最大のテクノロジー企業の本拠地などの要因により、自動運転車の先駆者となっています。特に米国では、自動運転車はすでにテストされています。カリフォルニア、テキサス、アリゾナ、ワシントン、ミシガン、および米国の他の州で使用されています。ただし、その機動性は現在、特定のテスト領域と運転条件に限定されています。

さまざまな地元企業とは別に、この国には他国からの企業の参入も見られます。例えば、

ベトナムの国内自動車メーカービンファストは2021年2月、カリフォルニア州の公道で自動運転車をテストする許可を取得したと発表しました。同社は米国市場で電気自動車を商品化するためにこの許可を求めました。

2021年 4月、ホンダとベライゾンは、MCityでVerizon 5Gウルトラワイドバンドと5Gモバイルエッジコンピューティング(MEC)の検討に取り組んでいることを発表しました。両社は、Honda SAFE SWARMでVerizon 5G Ultra-widebandとMECを使用することで、各車両に搭載されるAIの必要性をどのように削減できるかをテストしています。

2021年 3月、モーショナルは、次世代ロボタクシーの車両プラットフォームとして全電気自動車のヒュンダイ IONIQ 5を使用すると発表しました。提携により、一部の市場の消費者は、2023年からLyftアプリを通じてMotionalのロボタクシーを予約できるようになります。MotionalのIONIQ 5には、レベル4の自動運転機能が搭載されます。

したがって、北米地域は前述の開発の恩恵を受ける可能性が高く、予測期間中に自動運転車に対する安定した需要が見られると予想されます。

自動運転車業界の概要

自動運転自動車市場は、適度に統合されています。メーカーとは別に、ハードウェア企業やソフトウェア企業などの企業は、自動車分野での自動運転技術に対する需要の高まりに応えることに注力し始めています。したがって、自動運転車の開発に向けた提携、協力、投資が自動車分野で大幅に増加しています。これらの取り組みは、主に複数の国で自動運転車技術を促進するための政府や民間部門からの支援が増加していることにより、予測期間中も成長し続ける可能性があります。

2021年 1月、Automotive Grade Linuxは、Aicas、AVL、Citosを新しいブロンズメンバーに加えたと発表しました。 AGLは、自動運転を含むあらゆる車両テクノロジーの開発を加速するために、自動車メーカー、サプライヤー、テクノロジー企業を結集するLinux Foundationのオープンソースプロジェクトです。

2021年1月、自動車テクノロジー企業のVeoneer Inc.とQualcomm Technologies Inc.は、スケーラブルなADAS(先進運転支援システム)およびコラボレーティブ自動運転(AD)ソリューションの提供で両社が協力する契約に署名しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- タイプ別

- 半自動運転車

- 完全自動運転車

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Uber Technologies Inc.

- Daimler AG

- Waymo LLC(Google Inc.)

- Toyota Motor Corp.

- Nissan Motor Co. Ltd

- Volvo Car Group

- General Motors Company

- Volkswagen AG

- Tesla Inc.

- BMW AG

- Aurora Innovation Inc.

第7章 市場機会と将来の動向

The Autonomous Car Market size is estimated at USD 41.10 billion in 2024, and is expected to reach USD 114.54 billion by 2029, growing at a CAGR of 22.75% during the forecast period (2024-2029).

The COVID-19 pandemic has impacted the overall automotive sector, compelling automakers to reduce the output at their production plants. The pandemic has also affected the operations of many OEMs, ranging from production to R&D, and created short-term disruptions that have delayed autonomous cars' deployment and rollouts.

Due to increasingly stringent government regulations focusing on increasing road safety, more autonomous cars are being developed with highly advanced technologies integrated with smartphones and creating opportunities for market players to attract customers. The recent technological advancements in the fields of artificial intelligence, machine learning, and other sensors like RADAR, LIDAR, GPS, and computer vision, have enabled manufacturers to increase self-driving capabilities in cars.

At present, Level 2 and Level 3 autonomous cars are most prominent in the market, while Level 4 and Level 5 (as scaled by SAE) are expected to reach wider acceptance by 2030. As a result, the growth of these Level 2 and Level 3 cars is expected to propel the market during the forecast period.

North America is expected to play a significant role in the market, followed by Asia-Pacific and Europe. Major automaker companies, technology giants, and specialist start-ups across North America have started investing in developing autonomous vehicle (AV) technology. As demand for self-driving cars is picking up across countries like China, Japan, India, and South Korea, the Asia-Pacific region is also expected to witness growth over the forecast period.

Autonomous Vehicle Market Trends

Semi-autonomous Cars Segment Anticipated to Gain Significance during the Forecast Period

Following the SAE (Society of Automotive Engineers) International Automated Driving Standards, cars with Level 1-3 automation features have been considered in the market segment for semi-autonomous vehicles. The growing need for safer and more efficient driving systems promotes the development and adoption of semi-autonomous vehicles. Moreover, several regional governments have placed stringent driving and safety laws, further encouraging companies to offer these technologies in their automobiles.

Several technological advancements have helped foster a conducive environment for the market's growth. Moreover, the presence of a high number of passenger cars has elevated the rising need to enhance the driving experience and is promoting the adoption of semi-automated vehicles. This has been evident in sales during the COVID-19 pandemic.

Even during the pandemic, autonomous cars witnessed a rise in sales, as in 2020, around 11.2 million cars were sold with Level 2 features, which was an increase of 78% over 2019. Owing to such a favorable environment in the market, automakers worldwide are introducing new semi-autonomous vehicle models to attract consumers. For instance,

In April 2021, Citroen unveiled its new model, C5 X SUV. This new model was offered in both gasoline and plug-in hybrid versions. C5 X offers semi-autonomous Level 2 driving in compliance with current legislation.

In April 2021, Beijing Hyundai Motor Co. Ltd launched the new Tucson L, a compact crossover SUV. The vehicle is built on the i-GMP platform, and it is equipped with a 1.5 liters turbocharged engine (maximum power output of 147 kW, peak torque of 253 Nm), mated to a 7-speed dual-clutch transmission. The vehicle features the Hyundai Smart Sense system, which includes 23 safety and assistance functions and supports Level 2 autonomous driving.

Based on the aforementioned factors, the semi-autonomous cars segment is likely to gain prominence over the forecast period.

North America Likely to Hold Dominant Share in the Market

North America is expected to dominate the autonomous (driverless) car market during the forecast period. The region has been a pioneer of autonomous vehicles due to factors like strong and established automotive company clusters and being home to the world's biggest technology companies like Google, Microsoft, Apple, etc. Particularly in the US, self-driving cars have already been tested and used in California, Texas, Arizona, Washington, Michigan, and other states of the US. However, their mobility is currently restricted to specific test areas and driving conditions.

Apart from various local companies, the country is witnessing the entry of companies from other countries. For instance,

In February 2021, Vietnam's domestic automaker Vin Fast announced that it had obtained a permit to test autonomous vehicles on California's public streets. The company sought this permit to commercialize its electric vehicles in the US market.

In April 2021, Honda and Verizon announced that they are working at MCity to explore Verizon 5G Ultra-Wideband and 5G Mobile Edge Compute (MEC). The companies are testing how using Verizon 5G Ultra-Wideband and MEC in the Honda SAFE SWARM can reduce the need for AI onboard each vehicle.

In March 2021, Motional announced that it would be using the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation robotaxi. Through its partnership, consumers in select markets will be able to book a Motional robotaxi through the Lyft app starting in 2023. Motional's IONIQ 5 will be equipped with Level 4 autonomous driving capabilities.

Thus, the North American region is likely to benefit from the aforementioned developments, and it is expected to witness stable demand for autonomous cars during the forecast period.

Autonomous Vehicle Industry Overview

The autonomous (driverless) car market is a moderately consolidated one. Apart from manufacturers, players, including hardware and software firms, have started focusing on catering to the growing demand for autonomous driving technology in the automotive sector. Thus, partnerships, collaborations, and investments toward developing autonomous vehicles have increased significantly in the automotive sector. These initiatives are likely to continue growing during the forecast period, primarily due to increasing support from governments and private sectors across several countries to promote autonomous driving vehicle technology.

In January 2021, Automotive Grade Linux announced that it had included Aicas, AVL, and Citos as new bronze members. AGL is an open-source project at the Linux Foundation that brings together automakers, suppliers, and technology companies to accelerate the development of all vehicle technologies, including autonomous driving.

In January 2021, automotive technology company Veoneer Inc. and Qualcomm Technologies Inc. signed an agreement under which the companies will collaborate on delivering scalable Advanced Driver Assistance Systems (ADAS) and Collaborative and Autonomous Driving (AD) solutions.

Some of the leading companies in the autonomous (driverless) car market include Volkswagen, Toyota Motor Corporation, General Motors Company, Ford Motor Company, Nissan Motor Company Ltd, Daimler AG (Mercedes-Benz), BMW, Volvo Cars, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Semi-autonomous Vehicles

- 5.1.2 Fully-autonomous Vehicles

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Uber Technologies Inc.

- 6.2.2 Daimler AG

- 6.2.3 Waymo LLC (Google Inc.)

- 6.2.4 Toyota Motor Corp.

- 6.2.5 Nissan Motor Co. Ltd

- 6.2.6 Volvo Car Group

- 6.2.7 General Motors Company

- 6.2.8 Volkswagen AG

- 6.2.9 Tesla Inc.

- 6.2.10 BMW AG

- 6.2.11 Aurora Innovation Inc.