|

市場調査レポート

商品コード

1432840

RNA干渉(RNAi)-世界市場シェア分析、産業動向・統計、成長予測(2024~2029年)Global RNA-interference (RNAi) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| RNA干渉(RNAi)-世界市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 114 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

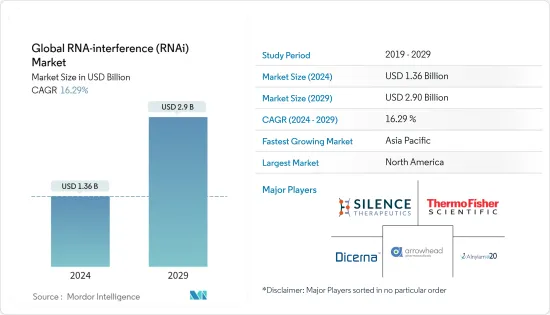

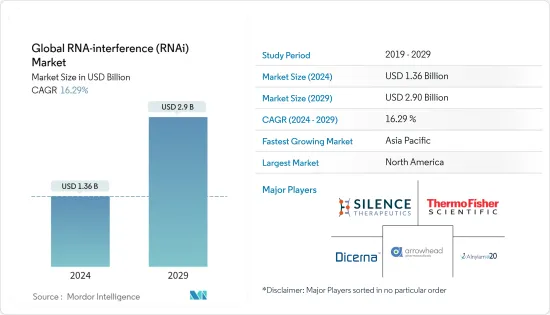

世界のRNA干渉(RNAi)市場規模は2024年に13億6,000万米ドルと推定され、2029年には29億米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは16.29%で成長する見込みです。

COVID-19は市場の成長に大きな影響を与えると予想されます。RNA干渉(RNAi)はCOVID-19疾患治療薬の開発に効果的に使用されるため、需要の増加が見込まれています。2020年7月に発表された「Prospects for RNAi therapy of COVID-19」と題された論文によると、COVID-19病に対するRNAiは、SARS-CoV-2の生存と複製に不可欠なウイルスタンパク質と、ウイルスの細胞侵入と輸送に関与する宿主因子のような2つの異なるカテゴリーの標的に向けられる可能性があります。COVID-19治療の開拓におけるRNA干渉(RNAi)のこのような潜在的利益は、市場の成長を促進すると予想されます。

市場成長を促進する特定の要因には、分子診断、特にがんへの応用の増加、合成デリバリー・キャリアの改良とRNAの化学修飾などがあります。

がんの診断と治療は現在、個別化医療と分子診断にRNAi技術を取り入れることで転換期を迎えています。変化した細胞分子や代謝産物を同定するためのハイスループット技術が利用可能になったことで、様々ながん診断や標的化アプローチにRNAi技術を利用することができるようになった。2021年3月に発表された「がんのRNAi療法の見通しに関する洞察」と題された論文によると、RNAiによってterget遺伝子の発現がノックされ、腫瘍の維持に不感受性のこれらのノードの位置が特定され、副作用もリスクも低く、固有の免疫抑制がブロックされ、腫瘍に対する免疫攻撃が誘発されます。さらに、RNAi技術の利点のひとつは、腫瘍の成長を制御するための有効な標的薬剤を迅速に開発できることです。診断目的には、低分子干渉RNA(siRNA)やマイクロRNA(miRNA)を利用することができます。ヒトゲノムのほぼすべての遺伝子を不活性化するsiRNAが市販されたことで、分子診断や生物医学研究のペースが劇的に加速しています。例えば、2020年12月には、RNAi治療薬の開発と商業化を含む既存の協力範囲を拡大しました。同社は、siRNAドラッグの標的デリバリーにおける最新の進歩と確立された能力を活用し、腫瘍や神経疾患に対するRNAi治療薬の開発を深化させました。このように、分子診断におけるRNAiの応用が増加し、治療技術としての実行可能性が高まることが、RNAi市場の成長を後押しする可能性があります。

このように、上記の要因は、予測期間中の市場の成長を促進すると予想されます。

RNAi技術の市場動向

治療薬タイプではがん領域が大きな市場シェアを占める見込み

予測期間中、腫瘍学分野が大きな市場シェアを占めると予想されます。

効果的な治療薬に対する需要の高まりにつながる世界人口のがん罹患率の増加は、研究セグメントの成長を促進すると予想されます。国際がん研究機関が発表したGLOBOCAN 2020報告書によると、2020年に新たにがんと診断された症例は世界中で推定19,292,789人、がんが原因で死亡した人は約9,958,133人でした。同レポートによると、診断されたがん症例のうち、男性では10,065,305例、女性では9,227,484例が報告されており、2040年には男性で15,585,096例、女性で13,302,846例に達すると予測されています。このような世界人口のがん罹患率の増加は、市場の成長を促進すると予想されます。

核酸分解酵素に耐性がある低分子干渉RNA(siRNA)の開発や、カチオン性リポソームやナノ粒子などの非ウイルス性ベクターの開発といった最近の進歩は、この障害を克服し、がん治療におけるRNAiベースの治療薬の臨床利用を促進することができます。Enzon Pharmaceuticals社(Santaris Pharma社)、テキサス大学、OncoGenex社、Isarna Therapeutics社、Astrazeneca社(Ionis Pharmaceuticals社)、INSYS Therapeutics社などの企業や研究機関によるがん治療のための実質的なパイプラインが市場を牽引すると予想されます。例えば、ノバルティスは2021年12月、低比重リポ蛋白に対する低分子干渉RNA(siRNA)治療薬Leqvioについて、初回投与と3ヵ月後の1回投与の後、年2回の投与で米国食品医薬品局の承認を取得しました。また、多くの企業ががん治療用のオリゴヌクレオチドを送達するナノキャリアの研究開発に投資しており、がん領域への貢献が期待されます。

このように、上記の要因は予測期間中、研究セグメントの成長を促進すると予想されます。

北米が市場を独占、予測期間中も同様と予想

北米は、対象疾患の罹患率の上昇と先進的な治療薬や診断薬に対する需要の高まりにより、市場の成長に有利な機会を提供すると期待されています。例えば、米国がん協会の報告書によると、2022年には米国で新たに190万人以上のがん患者が診断されると予想されています。さらに、米国でがんと診断される人の80%は55歳以上、57%は65歳以上です。このように、がんの有病率が高く、罹患する老年人口が増加しているため、診断と治療に対する需要も米国では高く、これが米国の研究市場の成長を促進すると予想されています。

米国には、開発パイプラインにあるRNAi治療薬が数多くあります。多くのバイオテクノロジー企業が、RNAi治療薬開発のためにかなり高額な投資を行っています。主要な製薬開発企業は、予測期間中にこの市場が期待される収益成長を利用しようと、多くの中小企業と提携契約やライセンシング契約を結んでいます。例えば、2021年のデンバーでは、アストラゼネカとイオニス・ファーマシューティカルズの契約は、RNA干渉(RNAi)技術に多額の投資を行っている大きな取引の一つです。RNAi治療に対する承認の増加は、予測期間中の市場の成長を促進すると予想されます。例えば、2021年12月、ノバルティスは、初回投与と3カ月後に1回、年に2回の投与を行う、最初で唯一の低密度リポ蛋白に対する低分子干渉RNA(SiRNA)療法であるLeqvioの米国食品医薬品局の承認を取得しました。

このように、上記の要因は調査対象地域における市場の成長を促進すると予想されます。

RNAi技術産業の概要

RNA干渉(RNAi)(RNAi)市場は競争が激しく、少数の大手企業で構成されています。Alnylam Pharmaceuticals、Arrowhead、Dicerna Pharmaceuticals(Novo Nordisk A/S)、Thermofisher Scientific、Silence Therapeutics PLCなどの企業が、RNA干渉(RNAi)(RNAi)市場でかなりのシェアを占めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 分子診断、特にがんにおけるアプリケーションの増加

- 合成デリバリーキャリアの改良とRNAの化学修飾

- 市場抑制要因

- 厳しい規制と償還環境の変化

- RNAの不安定な免疫原性の可能性

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 用途別

- 創薬・医薬品開発

- 治療

- がん領域

- 眼疾患

- 呼吸器疾患

- B型およびC型肝炎

- 自己免疫性肝炎

- 神経疾患

- その他の治療

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

- 北米

第6章 競合情勢

- 企業プロファイル

- Alnylam Pharmaceuticals

- Arcturus Therapeutics

- Arrowhead Pharmaceuticals, Inc.

- Dicerna Pharmaceuticals(Novo Nordisk A/S)

- Ionis Pharmaceuticals Inc.

- Merck & Co. Inc.(Sigma Aldrich)

- Silence Therapeutics PLC

- Qiagen NV

- Phio Pharmaceuticals Corp.

- Thermo Fisher Scientific Inc.

第7章 市場機会と今後の動向

The Global RNA-interference Market size is estimated at USD 1.36 billion in 2024, and is expected to reach USD 2.9 billion by 2029, growing at a CAGR of 16.29% during the forecast period (2024-2029).

COVID-19 is expected to have a significant impact on the growth of the market. The demand for RNA interference is expected to increase as it is effectively used for the development of COVID-19 disease therapeutics. According to the article titled 'Prospects for RNAi therapy of COVID-19' published in July 2020, RNAi against COVID-19 disease can potentially be directed against two different categories of targets such as viral proteins essential in survival and replication of SARS-CoV-2 and Host factors involved in cellular entry and trafficking of the virus. Such potential benefits of RNA interference for the development of COVID-19 therapy is expected to drive the growth of the market.

Certain factors that are driving the market growth include the increasing number of applications in molecular diagnostics, particularly in cancer, and improving synthetic delivery carriers and chemical modifications to RNA.

Cancer diagnosis and treatment are currently undergoing a shift with the incorporation of RNAi techniques in personalized medicine and molecular diagnostics. The availability of high throughput techniques for the identification of altered cellular molecules and metabolites allows the use of RNAi techniques in various cancer diagnosis and targeting approaches. According to the article titled ' Insight into the prospects for RNAi Therapy of Cancer' published in March 2021 the expression of terget genes is knocked by RNAi, locating these nodes which are insipensable to tumor maintenance, with low side effects and low risk, blocking the inherent immunosuppression and triggering immune attacks on tumors. Moreover one of the advantages of RNAi technology is the rapid development of efficacious and targeted drugs for controlling tumor growth. For diagnostic purposes, small interfering RNAs (siRNA) or microRNAs (miRNA) can be utilized. The commercial availability of siRNAs to silence virtually any gene in the human genome is dramatically accelerating the pace of molecular diagnosis and biomedical research. For instance in December 2020 expanded its existing cooperation scope, including the development and commercialization of RNAi therapeutic drugs. the company used its latest progress in targeted delivery of siRNA drugs and its established capabilities to deepen the development of RNAi drugs for tumors and neurological diseases. Thus, increasing the application of RNAi in molecular diagnosis and its viability as a therapeutic technique may boost the growth of the RNAi market.

Thus the above mentioned factors are expected to fuel the growth of the market during the forecast period.

RNAi Technology Market Trends

Oncology is Expected to Hold Significant Market Share in the Therapeutics Type

The oncology segment is expected to hold a significant market share during the forecast period.

The increasing incidence of cancer among the global population leading to the rise in demand for effective therapeutics is expected to drive the growth of the studied segment. As per the report of the International Agency for Research on Cancer published GLOBOCAN 2020 report, there were an estimated 19,292,789 new cases of cancer diagnosed in 2020 and about 9,958,133 people died due to cancer, all over the world. As per the same source, of the total diagnosed cancer cases, 10,065,305 cases were reported in males and 9,227,484 cases were reported in females. the incidence of cancer cases in males was expected to reach 15,585,096 by 2040 and 13,302,846 in females by 2040. Such an increasing incidence of cancer among the global population is expected to drive the growth of the market.

Recent advancements, such as the development of small interfering RNA (siRNA) tolerant to nucleases and the development of non-viral vectors, such as cationic liposomes and nanoparticles, can overcome this obstacle and facilitate the clinical use of RNAi-based therapeutics in the treatment of cancer. Substantial pipeline for cancer therapies by companies and institutes such as Enzon Pharmaceuticals (Santaris Pharma), University of Texas, OncoGenex, Isarna Therapeutics, Astrazeneca (Ionis Pharmaceuticals), and INSYS Therapeutics, Inc. are expected to drive the market. For instance, In December 2021, Novartis received United States Food and Drug Administration approval for Leqvio, the small interfering RNA (siRNA) therapy for low-density lipoprotein with two doses a year, after an initial dose and one at three months. In addition, many companies have invested in R&D for nanocarriers to deliver oligonucleotides for cancer treatment, which is expected to contribute to the oncology verticle.

Thus the above mentioned factors are expected to drive the growth of the studied segment during the forecast period.

North America Dominates the Market and Expected to do the Same in the Forecast Period

North America is expected to provide lucrative opportunities for the growth of the market owing to the rising incidence of target diseases and growing demand for advanced therapeutics and diagnostics. For instance, according to the American Cancer Society's report in 2022 over 1.9 million new cancer cases are expected to be diagnosed in the United States 2022. and additionally, 80% of the people diagnosed with cancer in the United States are 55 years of age or older and 57% are 65 or older Thus, due to the high prevalence of cancer, and the rising affected geriatric population, the demand for diagnostics and treatment is also high in the country which is expected to drive the growth in the studied market in the United States.

The United States has a number of RNAi therapeutics that are in developmental pipelines. A number of biotechnology companies have made considerably high investments for RNAi therapeutic development. key pharmaceutical developers have entered into collaboration agreements or licensing deals with a number of smaller firms in an attempt to capitalize on the expected growth in revenue that this market can have over the forecast period. For instance, in Dember 2021, AstraZeneca's agreement with Ionis pharmaceuticals is one of the big deals that are investing heavily into RNA-interference technology. The increasing approvals for the RNAi therapy is expected to drive the growth of the market during the forecast period. For instance in December 2021 , Novartis received United States Food and Drug Administration approval for Leqvio, the first and only small interfering RNA (SiRNA) therapy to low- density lipoprotein with two doses a year, after an initial dose and one at three months.

Thus the above mentioned factors are expected to drive the growth of the market in the studied region.

RNAi Technology Industry Overview

The RNA-interference (RNAi) market is highly competitive and consists of a few major players. Companies like Alnylam Pharmaceuticals, Arrowhead, Dicerna Pharmaceuticals (Novo Nordisk A/S), Thermofisher Scientific, Silence Therapeutics PLC, among others, hold a substantial market share in the RNA-interference (RNAi) market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Applications in Molecular Diagnostics, Particularly in Cancer

- 4.2.2 Improving Synthetic Delivery Carriers and Chemical Modifications to RNA

- 4.3 Market Restraints

- 4.3.1 Stringent Regulations and Changing Reimbursement Environment

- 4.3.2 Unstable Potentially Immunogenic Nature of RNA

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Application

- 5.1.1 Drug Discovery and Development

- 5.1.2 Therapeutics

- 5.1.2.1 Oncology

- 5.1.2.2 Ocular Disorders

- 5.1.2.3 Respiratory Disorders

- 5.1.2.4 Hepatitis B and C

- 5.1.2.5 Autoimmune Hepatitis

- 5.1.2.6 Neurological Disorders

- 5.1.2.7 Other Therapeutics

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alnylam Pharmaceuticals

- 6.1.2 Arcturus Therapeutics

- 6.1.3 Arrowhead Pharmaceuticals, Inc.

- 6.1.4 Dicerna Pharmaceuticals (Novo Nordisk A/S)

- 6.1.5 Ionis Pharmaceuticals Inc.

- 6.1.6 Merck & Co. Inc. (Sigma Aldrich)

- 6.1.7 Silence Therapeutics PLC

- 6.1.8 Qiagen NV

- 6.1.9 Phio Pharmaceuticals Corp.

- 6.1.10 Thermo Fisher Scientific Inc.