|

市場調査レポート

商品コード

1851237

自動車用コネクタ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用コネクタ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月03日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

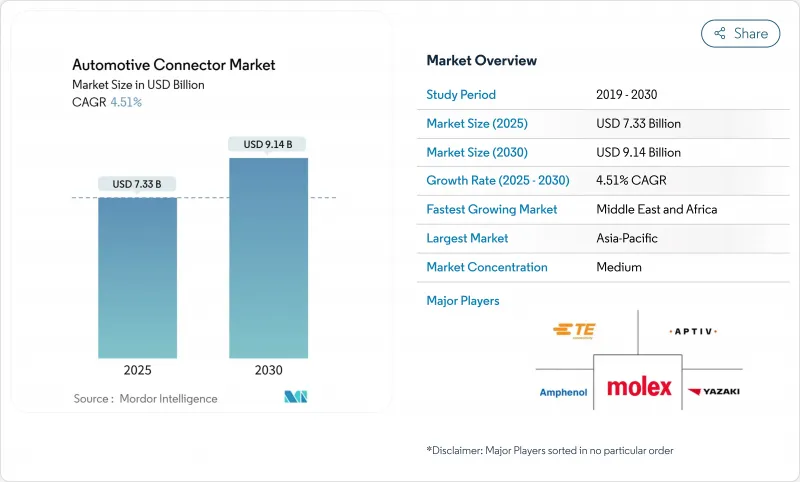

2025年の自動車用コネクタ市場規模は73億3,000万米ドル。

2030年には91億4,000万米ドルに達すると予測され、自動車プラットフォームが電動化およびソフトウェア定義アーキテクチャに移行するにつれて、CAGR 4.51%で成長します。

内燃パワートレインに関連する需要が頭打ちになる一方で、高電圧・高速データ相互接続が拡大するためです。分散型ECUからゾーン型電子構造への移行により、ハーネスの長さが短縮され、車両重量が削減されます。コネクタの複雑さが増すため、高密度ミックスドシグナル機能を持たないレガシーサプライヤには変位リスクが生じる。厳しい安全規制、データが豊富なADAS機能、800Vバッテリーシステムにより、IP67/IP6K9K規格に適合しながら電力とマルチギガビット信号を伝送する密閉型高性能インターフェースの注文が増加しています。OEMがフォールトトレラントリンク、無線更新性、サイバーセキュアなデータパスを要求する中、半導体グレードの製造精度とソフトウェア統合サポートを組み合わせるサプライヤーが勝者となります。

世界の自動車用コネクタ市場動向と洞察

加速する電動化と高電圧Eパワートレイン

48Vおよび800V電気アーキテクチャへの移行は、従来の12Vシステムを超えて電気ターボチャージング、回生ブレーキ、高出力充電機能をサポートするため、コネクタ要件を根本的に作り変えます。Aptivの高電圧相互接続は現在、最大250Aの電流容量で400V~1000Vの電圧範囲をサポートし、より高速な充電と効率向上への業界のシフトに対応しています。

48Vマイルドハイブリッドシステムの出現により、デュアル電圧アーキテクチャの課題が生じ、12Vレガシーシステムと48V電力供給ネットワークを安全に分離・管理するための課題がコネクタに求められています。TE ConnectivityのAMP+HVA 280システムは、この進化の一例であり、最大850Vのアプリケーションで安全性を高めるために、高電圧インターロックと2段階フローティングラッチを統合しています。この電動化の波は乗用車だけでなく商用車にも拡大し、イートンの電力接続ソリューションは大型アプリケーションで効率的なエネルギー転送を可能にし、より広い輸送電動化指令をサポートします。一つの車両内で複数の電圧領域を管理する複雑さは,絶縁を維持し,診断能力を提供し,多様な動作条件にわたってフェイルセーフ動作を保証することができる洗練されたコネクタシステムに対する需要を促進する.

世界的な安全・排ガス規制の強化

EUは新車に自動緊急ブレーキと前方衝突警報の搭載を義務付けているなど、規制の枠組みは高度な安全システムをますます義務付けるようになっており、センサーの統合とリアルタイムのデータ処理に対するコネクター需要を直接促進しています。NHTSAによる車車間通信規格の推進は、5.9GHz DSRCおよびセルラーV2Xプロトコルをサポートできる高周波数、低遅延コネクターに対する新たな要件を生み出しています。CISPR 25電磁両立性規格は、特に10GHz以上の伝導放射に対してますます厳しくなっており、コネクターメーカーは高度なシールドとフィルタリング機能の統合を余儀なくされています。

ソフトウェア定義の自動車へのシフトは、無線アップデートと継続的な監視システムがシグナルインテグリティとサイバーセキュリティ機能を強化したコネクターを要求するため、これらの要件を増幅しています。中国の新エネルギー車指令やカリフォルニア州の先進クリーンカーⅡ規制は、特にバッテリー管理システムや充電インフラなどのコネクター仕様に地域的な差異を生じさせるため、グローバルサプライヤーはコスト効率を維持しながら、多様な規制環境に適応できるプラットフォーム・フレキシブルなソリューションを開発する必要があります。

不安定な銅・金属商品価格

再生可能エネルギーや電気自動車の分野での供給制約や需要の急増により、銅の価格が上昇しており、自動車用コネクタのサプライチェーン全体に大きなコストプレッシャーを与えています。電気自動車は従来の内燃機関車よりもかなり多くの銅を必要とし、1台の電気自動車が約83キログラムの銅を使用するのに対し、従来の自動車は23キログラムです。銅クラッドアルミニウムや銅クラッドスチール導体を含むCopperweldのバイメタル・ソリューションは、電気的性能特性を維持しながら、銅の使用量を最大83%削減できる可能性を提供します。銅の採掘が政治的に不安定な地域に集中しているため、サプライチェーンのリスクがさらに高まります。同時に、貿易摩擦や輸出規制が価格変動をさらに悪化させ、自動車OEMはヘッジ戦略や長期供給契約の実施を余儀なくされ、コネクタの調達や設計の最適化の柔軟性が制限される可能性があります。

セグメント分析

パワートレイン・アプリケーションは、2024年の自動車用コネクタ市場規模の33.60%と最大の市場シェアを維持しています。これは、ICEおよびハイブリッド・パワートレインのいずれにおいてもエンジン管理、トランスミッション制御、燃料噴射システムの重要性が継続していることを反映しています。しかし、ADASと自律走行システムは、高度な安全機能に対する規制の義務付けと、より高いレベルの車両自動化への業界の進展によって、2025年~2030年のCAGRが17.8%となり、最も急成長するセグメントとして浮上します。

安全およびセキュリティ・アプリケーションは、エアバッグ・システム、電子安定制御、衝突回避技術の統合が進むことで恩恵を受ける。同時に、車体配線と配電のセグメントは、複数の機能をより少ない、より洗練された制御ユニットに統合するゾーンアーキテクチャの実装に適応します。快適性、利便性、娯楽システムは、プレミアム機能に対する消費者の期待がすべての車両セグメントで拡大するにつれて、着実な成長を遂げます。同時に、ナビゲーションと計器アプリケーションは、高解像度ディスプレイと拡張現実インターフェースをサポートするように進化します。

電気自動車に特化した充電およびエネルギー管理アプリケーションの出現は、従来の自動車用コネクタ市場には存在しなかった新しいカテゴリーであり、電動化パワートレインに向けた業界の根本的な変化を浮き彫りにしています。このセグメンテーションの転換は、機械的な車両システムから電子的な車両システムへの幅広い移行を反映しており、従来のパワートレインコネクタは、バッテリーシステム、DC-DCコンバータ、回生ブレーキネットワークを管理できる高電圧・大電流ソリューションによる置き換えに直面しています。ADASアプリケーションの急速な成長は、これらのシステムが同時に複数のソースからのセンサーデータのリアルタイム処理を必要とするため、高周波、低遅延伝送の専門知識を持つコネクターサプライヤーにチャンスをもたらします。

乗用車は2024年の自動車用コネクタ市場シェアの54.20%を占め、生産台数の多さと1台当たりの電子コンテンツの増加の恩恵を受けています。しかし、二輪車は2030年までCAGR 11.5%で最も急成長するセグメントです。小型商用車は、eコマースの成長とラストワンマイルデリバリーの最適化によって安定した需要を維持しています。一方、中型および大型商用車では、高度なテレマティクスと車両管理システムの採用が増加しており、堅牢で高性能のコネクターソリューションが必要とされています。これらのアプリケーションでは、IP67/IP6K9K定格と乗用車の要件を超える極端な温度範囲での動作が要求されるため、商用車セグメントはコネクターの耐久性と耐環境性の革新を推進しています。

二輪車の成長は、都市化の動向と、混雑した都心部での電気輸送に対する規制の支持を反映しており、スペースに制約のあるアプリケーションに最適化された小型軽量コネクタに対する需要を生み出しています。商用車の電動化は、運行コストの削減と排ガス規制の遵守を求める運行会社の努力によって加速しています。このため、急速充電とエネルギー密度の高いバッテリーシステムをサポートする高電圧コネクターの需要が高まる。自律走行技術が異なる軌跡をたどって発展するにつれて、乗用車と商用車の区分はますます意味を持つようになり、商用車アプリケーションは、制御された運転環境と専用のインフラ投資により、より高い自動化レベルを早期に達成する可能性があります。

地域分析

アジア太平洋地域は2024年の自動車用コネクタ市場収益の38.60%を占め、首位を維持した。これは、エレクトロニクスのサプライチェーンが密集していること、自動車生産台数が世界一であること、電気自動車や電気バスを支持する国家政策があることによる。中国のOEMは、ゾーン・ハーネスを自社で製造し、技術移転条項の下で第2級コネクター・メーカーを現地合弁会社に引き込んでいます。日本の既存企業は、住友商事の「30VISION」のようなCASEプログラムを推進し、800Vプラットフォームに最適化されたコンパクトで低挿入力のモデルを発表しています。韓国のサプライヤーは、バッテリーのノウハウを、セル・ツー・パック・アーキテクチャをサポートする大電流基板端子に注ぎ込んでいます。東南アジア諸国は、汎用圧着にかかる人件費は低いが、熱帯の豪雨に対応するためにIP67等級を求める傾向が強まっており、自動車用コネクタ市場は価格帯を問わず拡大しています。

中東とアフリカは、現在では小規模だが、政府系ファンドが電気自動車工場や充電回廊を設立しているため、2030年までのCAGRは15.20%に達する見込みです。サウジアラビアはEVクラスターを育成し、現地で高圧ケーブルを調達しています。レオニのアガディール新工場は、北アフリカのワイヤーハーネスの勢いを象徴しています。厳しい暑さと埃が高温用LCPハウジングと強化ガスケットフランジの需要を喚起。地域ごとの含有量規制は、多国籍企業に国産ポリマーコンパウンドの認定を促し、弾力性を高めつつも重複した検証を要求しています。

北米と欧州は、成熟しつつも技術革新に富む地域です。米国のOEMは、ハンズフリーのレベル3スタックを高級トリムに統合し、20Gbpsボードコネクタとシリコングレードのクリーンルームプロセスの供給に拍車をかけています。欧州の気候目標は400kWの急速充電ハブを加速させ、温度センサー内蔵の1,000Vコンタクターを義務付ける。TE Connectivityのグリーンストックプログラムは余剰在庫を再利用し、埋立廃棄物とカーボンフットプリントを削減します。2024年のサプライチェーンショックは、錫メッキとプラスチック成形のオンショアリングを促進し、自動車用コネクタ市場における戦略的自律性を確保しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 加速する電動化とe-パワートレインの高電圧化

- ADASと自律走行機能の急速な普及

- 高速データリンクを必要とするソフトウェア定義自動車

- 世界の安全・排ガス規制の強化

- ゾーン型e/eアーキテクチャへの移行が高密度コネクターを促進する

- 車載インフォテインメントとコネクティビティユニットの急増

- 市場抑制要因

- 銅と金属商品価格の変動

- 高機能樹脂(PPS、LCP)の不足

- 過酷な自動車環境における信頼性の課題

- 10Gbpsを超える信号速度におけるEMIコンプライアンスのハードル

- バリュー/サプライチェーン分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測(単位:米ドル)

- 用途別

- パワートレイン

- 安全とセキュリティ

- 車体配線と配電

- 快適性、利便性、娯楽性

- ナビゲーションと計装

- ADASと自律システム

- 充電とエネルギー管理(EV)

- 車両タイプ別

- 乗用車

- 小型商用車

- 中型および大型商用車

- 二輪車

- バス&コーチ

- 推進タイプ別

- 内燃機関(ICE)車

- ハイブリッド電気自動車(HEV)

- プラグインハイブリッド車(PHEV)

- バッテリー電気自動車(BEV)

- 燃料電池電気自動車(FCEV)

- コネクタタイプ別

- 電線対電線

- 電線対基板

- 基板対基板

- i.O.および円形

- FFC/FPCおよびマイクロ

- 高速/高電圧

- 接続シール別

- 密封

- 非防水

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- インドネシア

- ベトナム

- フィリピン

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- 南アフリカ

- エジプト

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc.(Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- J.S.T. Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG