|

|

市場調査レポート

商品コード

1432971

燃料電池UAV:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)Fuel Cell UAV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 燃料電池UAV:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 80 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

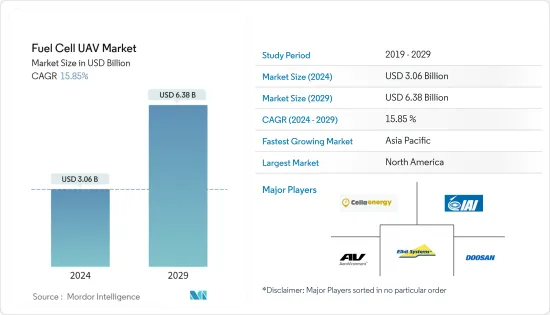

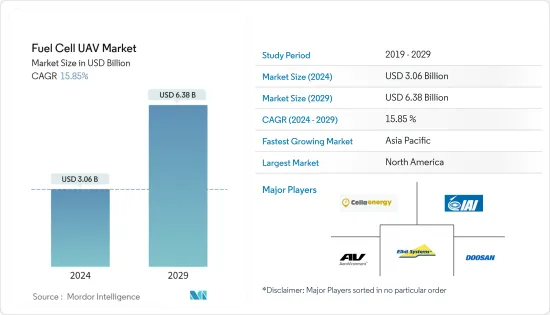

燃料電池UAVの市場規模は、2024年に30億6,000万米ドルと推定され、2029年には63億8,000万米ドルに達すると予測され、予測期間中(2024年~2029年)のCAGRは15.85%で成長する見込みです。

主なハイライト

- 燃料電池UAV市場は、COVID-19パンデミックによりかつてない課題を目の当たりにしました。パンデミックの出現により、世界各国で国境閉鎖や封鎖が行われ、サプライチェーンやロジスティクスに影響を及ぼし、燃料電池UAVメーカーに必要な原材料が届かなくなりました。さらに、燃料電池システムの生産が減少した背景には、さまざまな企業によるレイオフによる人員削減や、世界のさまざまな防衛軍による燃料電池UAVシステムの受注減少もあります。

- COVID後の市場は、商業部門と軍事部門の両方が業務を遂行するために燃料電池システムに対する需要を増加させたため、力強い回復を示しました。さらに、労働人口の増加、国境の開放、世界各国の防衛予算の増加も、予測期間中に燃料電池UAVシステムの生産を押し上げると予想されます。

- 従来のUAVは、ガソリンやジェット燃料を使用して操縦を推進しており、こうしたエネルギー源を継続的に使用するため、ガソリンだけでなく再生不可能な資源も徐々に枯渇しています。さらに、これらの燃料の需要が高まるにつれて供給が制限され、その結果、これらの燃料は高価なものとなっています。さらに、化石燃料の枯渇により、研究者はUAVの動力源となる代替燃料源を探すようになりました。

- 一方、水素燃料電池は最近、中・大型ドローンのリチウムイオンバッテリーに代わる実行可能な代替燃料として登場しました。さらに、水素燃料電池を利用することで、重量/出力比の効率も向上しています。水素を燃料とする燃料電池は、小型の内燃機関よりも信頼性が向上し、安全で低メンテナンスの運用が可能になるため、UAVにとって魅力的な価値を提供し、近い将来、市場が大きく成長することが期待されています。

燃料電池UAV市場の動向

予測期間中に最も高いCAGRで成長すると予測される軍事セグメント

- 軍事セグメントは予測期間中に大きな成長を示すと予測されています。このような成長の主な要因としては、世界中の様々な防衛軍の予算の増加や、重要な戦場任務を遂行するための様々な軍関係者による先進的な燃料電池UAVシステムに対するニーズの増加が挙げられ、これらの要因が近い将来の市場成長に寄与すると予想されます。

- 軍事分野では、監視、偵察、戦闘能力を強化するための先進的なUAV技術に対する需要が高いです。燃料電池UAVは、飛行耐久時間の延長、ステルス運用、物流負担の軽減を実現し、軍事用途に適しています。さらに、軍事部門は最先端技術に投資するために必要な資源と予算を持っており、その結果、この分野は市場で決定的な優位性を獲得しています。

- 燃料電池の用途は、兵士の装備品への電力供給から無人航空機の飛行まで幅広く、燃料電池は現在、世界中の防衛関係者にとって魅力的な選択肢になりつつあります。燃料電池は無人機の飛行時間を数時間延長し、わずか数分で充電できます。無人航空機(UAV)は通常、有人飛行が危険または困難な軍事作戦に使用されます。さらに、戦場シナリオの複雑化に伴い、重要な任務遂行のため、世界各国の防衛関係者によるUAVの利用が増加しています。

- 軍事分野でのUAV活用の必要性から、世界中の様々な防衛メーカーがUAVの動力源となる代替エネルギー源の発見や、先進的な燃料電池システムの開発に注力するようになり、投資件数も増加しています。さらに、軍事技術の発展や官民協力の高まりは、軍事分野で有利な機会を提供すると期待されています。

- 現在のシナリオでは、水素を動力源とする無人機などの先進技術が軍事分野で採用されています。例えば、2023年2月、イスラエルのある企業は、イスラエル国防総省と協力し、従来のクアッドコプターが扱うことができるペイロードよりも大きく、より長距離を運ぶことができる水素を燃料とするドローンを供給すると発表しました。さらに2019年5月には、ロシア映画が水素燃料電池で動くドローン「Gjis UAV」を大規模な博覧会「Army-2019」に持ち込むと発表しました。International Aero Navigation Systems Concern製のこのUAVは、少なくとも9,800フィートの高度上限、3マイルの操作半径、35マイル以上の巡航速度を誇っています。さらに、水素を燃料とするUAVを使用する利点は、ユーザーが燃料カートリッジに水を注ぐだけで、反応により水素が放出され、このUAVに数時間電力を供給できるため、追加の物流や燃料インフラなしで運用できることです。このように、燃料電池システムに関する技術開発の進歩と、世界中のさまざまな防衛関係者による先進的な燃料電池UAVの採用ニーズの高まりにより、燃料電池UAV市場は予測期間中、軍事分野で大きな成長を遂げることが予想されます。

アジア太平洋は予測期間中に顕著な成長を見せると予測される

- アジア太平洋は予測期間中に最も高い成長を示すと予測されています。アジア太平洋の様々な国の予算が増加し、インドや中国などの国々によるドローン技術や燃料電池技術の面での技術進歩や、これらの国々による先進的な燃料電池UAVシステムの獲得ニーズと相まって、今後数年間の市場の成長を促進するでしょう。

- アジア太平洋では、中国やインドなどの国々によるハイテク軍事用ハードウェアの取得が伸びています。中国は燃料電池UAVシステムに関して著しい発展を遂げています。中国には様々なメーカーが存在するため、技術研究や製品開発において優位に立っています。さらに、中国は高度な能力を持つ無人機の開発に多額の投資を行っています。例えば、2020年3月、中国は水素燃料電池ドローンの飛行時間の世界記録を達成したと発表しました。信頼できる業界筋によると、Xinyan Chuangneng Technology Company Ltd.が中国国際航空と共同開発した研究用ドローンが、最長331分間の屋外無中断飛行を達成したと発表しました。両社の協力により、331分間飛行可能な6ローターの水素燃料電池ドローンが開発されました。この成果は世界記録を更新し、水素燃料電池システムの開発において中国を最前線に押し上げました。さらに、このドローンのコア技術は水素燃料電池であり、必要な電力を生成するために水素燃料電池に水素を供給する高圧水素貯蔵ボトルを備えています。さらに、共同開発する両社は、小型・高性能・軽量で出力密度の高い2kWの金属板セル空冷スタックとシステムの開発に成功し、ドローンに組み込むことに成功したとしています。

- インドも近年、燃料電池UAVシステムの成長を目の当たりにしています。現在のシナリオでは、インドはドローンと燃料電池の技術をアップグレードするために、先進的なドローンと燃料電池メーカーといくつかのパートナーシップを結んでいます。さらに、インドは現在、世界の様々な市場プレイヤーの水素燃料電池搭載ドローンの重要な実験場としても浮上しています。例えば、2021年8月、Honeywell Corporationは、よりクリーンで静かな水素燃料電池でドローンの航続距離を3倍に伸ばす新技術を開発したと発表し、そのようなドローンがインドでテストされることになりました。このドローンは、新しい「技術スイート」を利用することで開発され、このドローンの飛行時間を長くし、人間の介入を少なくすることを可能にします。さらに、HoneywellのBVLOS(Beyond Visual Line of Sight)技術を搭載したドローンは、バッテリーと見通し線上の無線リンクを使用する従来のドローンと比較して、より遠くまで飛行し、より多くの重量を運搬し、最大3キロメートル先の危険を回避し、世界中のどこにいても進行状況を動画でストリーミングすることができます。このように、中国やインドなどの国々における燃料電池UAVシステムに関する高度な技術開拓や、先進的なドローンシステムの開発ニーズは明るい見通しを持っており、予測期間中に燃料電池UAV市場がアジア太平洋で大きな市場成長を示すことにつながると思われます。

燃料電池UAV産業の概要

燃料電池UAV市場は細分化されており、様々なプレーヤーが大きなシェアを占めています。著名な市場プレイヤーとしては、Cella Energy Ltd.、AeroVironment, Inc.、Elbit Systems Ltd.、Israel Aerospace Industries Ltd.、Doosan Corporationなどが挙げられます。市場の主なプレーヤーは、それぞれの作戦を実行するために民間と軍事の両方で使用される高度な燃料電池UAVシステムの開発に焦点を当てています。

また、先進的な燃料電池UAVシステムの製造に向けた研究開発への支出が増加していることから、近い将来、より良い機会が創出されると考えられています。さらに、さまざまなメーカーが水素燃料電池システムのような先進的な燃料電池システムを利用するようになっており、これが予測期間中の燃料電池UAV市場の成長をサポートすると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

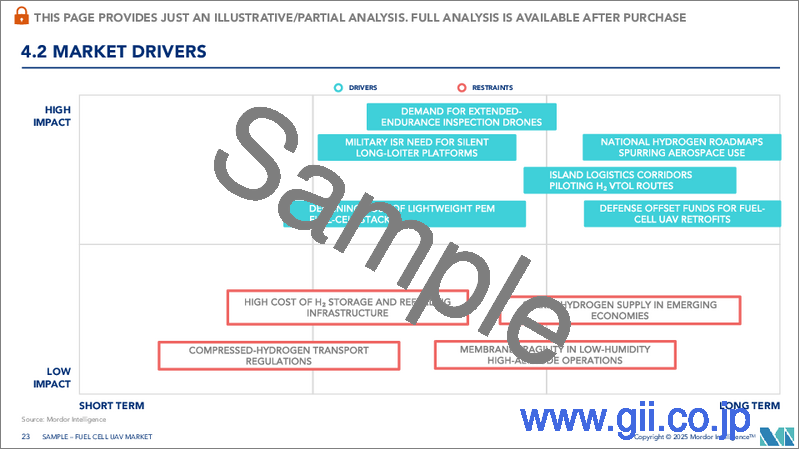

- 市場促進要因

- 継続的な技術向上と様々な業界リーダーの関与が市場成長を牽引

- 市場抑制要因

- UAVソリューション用燃料電池の高コスト

- ポーターのファイブフォース分析

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- エンドユーザー

- 商業

- 軍事

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Fuel Cell Manufacturers

- Cella Energy Ltd.

- Doosan Corporation

- PLUG POWER INC.(EnergyOr)

- HES Energy Systems Pte. Ltd

- Intelligent Energy Limited

- MMC

- Sierra Lobo, Inc.

- Spectronik Pte. Ltd.

- Ultra

- UAV Manufacturers

- AeroVironment, Inc.

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Teledyne Technologies Incorporated(Aeryon Labs Inc.)

- ISS Aerospace

- Fuel Cell Manufacturers

第7章 市場機会と今後の動向

- 有利な成長機会と技術開発につながる官民パートナーシップの増加

The Fuel Cell UAV Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 6.38 billion by 2029, growing at a CAGR of 15.85% during the forecast period (2024-2029).

Key Highlights

- The fuel cell UAV market witnessed unprecedented challenges due to the COVID-19 pandemic. The advent of the pandemic led to border closures as well as lockdowns in various countries across the world, and this affected the supply chain and logistics, which prevented essential raw materials from reaching the manufacturers of fuel cell UAVs. Additionally, the decline in the production of fuel cell systems can also be attributed to the reduction in workforce owing to layoffs by various companies as well as the decline in orders for fuel-cell UAV systems by various defense forces worldwide.

- The market showed a strong recovery post-covid due to increasing demand for fuel cell systems by both the commercial and military sectors to carry out their operations. Moreover, the growing workforce, the opening of borders as well as increased defense budget of various countries across the world is also expected to boost the production of fuel-cell UAV systems during the forecast period.

- Conventional UAVs make use of gasoline or jet fuel to propel their operations, and this has led to gasoline as well as non-renewable resources gradually being depleted owing to the continuous use of such energy sources. Moreover, the increasing demand for these fuels has limited their supply, thereby making such fuels expensive to obtain. In addition, the depletion of fossil fuels has led to researchers looking for alternative sources of fuel that will help power UAVs.

- On the other hand, hydrogen fuel cells have recently emerged as a viable alternative fuel to replace Li-ion batteries in mid to large-size drones. Moreover, making use of hydrogen fuel cells has also led to an increase in terms of efficiency in weight/power ratios. Hydrogen-powered fuel cells offer compelling value for UAVs due to improved reliability over small internal combustion engines, enhancing safe and low maintenance operation, and this is expected to lead to the market witnessing significant growth in the near future.

Fuel Cell UAV Market Trends

The Military Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

- The military segment is expected to show significant growth during the forecast period. The main factors which are attributable to such growth include an increase in the budget of various defense forces worldwide and the increased need for advanced fuel cell UAV systems by various military personnel to carry out critical battlefield missions, and it is expected that these factors will contribute to market growth in the near future.

- The military sector has a high demand for advanced UAV technologies to enhance surveillance, reconnaissance, and combat capabilities. Fuel Cell UAVs offer extended flight endurance, stealthy operations, and reduced logistical burden, making them well-suited for military applications. Additionally, the military sector has the necessary resources and budget to invest in cutting-edge technologies, which in turn leads to the segment gaining a critical advantage in the market.

- Applications of fuel cells range from powering soldier gear to flying unmanned aircraft, and fuel cells are currently becoming an attractive option for defense personnel worldwide. Fuel cells can increase the airtime of drones by hours and charge in just minutes. Unmanned aerial vehicles (UAVs) are typically used for military operations where manned flights would be too risky or difficult. Moreover, the growing complexity of battlefield scenarios has led to an increase in the usage of UAVs by defense personnel of various countries worldwide in order to carry out critical mission functions.

- The necessity of making use of UAVs by the military segment has led to an increase in the number of investments by various defense manufacturers around the world who are now focusing on finding out alternative sources of energy to power UAVs and develop advanced fuel-cell systems. In addition, developments in military technology and rising public-private collaborations are expected to offer lucrative opportunities in the military segment.

- In the current scenario, advanced technologies such as hydrogen-powered drones are being adopted in the military segment. For instance, in February 2023, an Israeli company announced that they are working with the Israeli MoD n supplying drones fueled by hydrogen that can carry payloads that are larger than what traditional quadcopters can handle and for greater distances. Moreover, in May 2019, a Russian film announced that they are bringing a Gjis UAV, a drone powered by hydrogen fuel cells, to the massive Army-2019 exposition. The UAV, which has been made by International Aero Navigation Systems Concern, boasts an altitude ceiling of at least 9,800 feet, a 3-mile operational radius, and a cruising speed of over 35 mph. Moreover, the advantage of using a hydrogen-powered UAV is that it can operate without additional logistics or fuel infrastructure as users have to simply pour water into a fuel cartridge, and the resulting reaction releases hydrogen that can power this UAV for several hours. Thus, advancement in terms of technological developments regarding fuel cell systems and the increasing need for the adoption of advanced fuel cell UAVs by various defense personnel worldwide is expected to lead to the fuel cell UAV market witnessing significant growth in the military segment during the forecast period.

Asia-Pacific Will Showcase Remarkable Growth During the Forecast Period

- Asia-Pacific is projected to show the highest growth during the forecast period. The increase in the budget of various countries in the Asia-Pacific region, coupled with technological advancements in terms of drone technology and fuel cell technology by countries such as India and China, as well as the need for acquiring advanced fuel cell UAV systems by these countries, will propel the growth in the market in the years to come.

- There has been growth with regard to high-tech military hardware acquirement in the Asia-Pacific region by countries such as China and India. China is witnessing significant developments with respect to fuel cell UAV systems. The presence of various manufacturers in China has led to China having an advantage with regard to technological research and product development. Moreover, China is investing heavily in the development of drones having advanced capabilities. For instance, in March 2020, China announced that it had achieved a world record flight time for a hydrogen fuel cell drone. According to trusted business sources, a research drone that had been developed by Xinyan Chuangneng Technology Company Ltd., together with China National Airways, announced that they had achieved an uninterrupted outdoor flight of up to 331 minutes. The collaboration between the two companies has resulted in the development of a six-rotor hydrogen fuel cell drone that can fly for 331 minutes. This achievement has broken the world record and has put China at the forefront in terms of the development of hydrogen fuel cell systems. In addition, the core technology of the drone is a hydrogen fuel cell which is equipped with a high-pressure hydrogen storage bottle to provide hydrogen for the hydrogen fuel cell in order to generate the necessary electricity. Moreover, both the collaborating companies have claimed to successfully develop a 2kW metal plate cell air-cooled stack and system with a small size, excellent performance, and lightweight, with high power density, which has been successfully integrated into the drone.

- India has also been witnessing growth in fuel cell UAV systems in recent years. In the present scenario, India has entered several partnerships with advanced drone and fuel cell manufacturers in order to upgrade their drone and fuel cell technologies. Moreover, India has now also emerged as a key testing ground for hydrogen fuel cell-powered drones of various global market players. For instance, in August 2021, Honeywell Corporation announced that they had developed a new technology that would increase the range of drones by three times with cleaner, quieter hydrogen fuel cells, and such drones will be tested in India. The drone will be developed by making use of a new 'technology suite' that will allow these drones longer flight hours and with less human intervention. Moreover, compared with traditional drones using batteries and line-of-sight radio links, drones equipped with Honeywell's Beyond Visual Line of Sight (BVLOS) technologies can fly farther, carry more weight, avoid hazards up to three kilometers away, and stream video of their progress anywhere in the world. Thus, advanced technological development with regards to fuel cell UAV systems in countries such as China and India and the need for the development of advanced drone systems will have a positive outlook and will lead to the fuel cell UAV market witnessing significant market growth in the Asia-Pacific region during the forecast period.

Fuel Cell UAV Industry Overview

The fuel cell UAV market is fragmented in nature, with various players holding significant shares in the market. Some prominent market players are Cella Energy Ltd., AeroVironment, Inc., Elbit Systems Ltd., Israel Aerospace Industries Ltd., and Doosan Corporation, amongst others. The key players in the market are focusing on the development of advanced fuel cell UAV systems which will be used both by commercial and military in order to carry out respective operations.

In addition, growing expenditure on research and development towards manufacturing advanced fuel cell UAV systems will lead to creating better opportunities in the near future. Moreover, various manufacturers are now making use of advanced fuel cell systems, such as hydrogen fuel cell systems, and this is expected to support the growth of the fuel cell uav market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Continuous improvement in technology and involvement from various industry leaders leading to market growth

- 4.3 Market Restraints

- 4.3.1 High Cost of Fuel Cells for UAV Solutions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Commercial

- 5.1.2 Military

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Qatar

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Fuel Cell Manufacturers

- 6.2.1.1 Cella Energy Ltd.

- 6.2.1.2 Doosan Corporation

- 6.2.1.3 PLUG POWER INC. (EnergyOr)

- 6.2.1.4 HES Energy Systems Pte. Ltd

- 6.2.1.5 Intelligent Energy Limited

- 6.2.1.6 MMC

- 6.2.1.7 Sierra Lobo, Inc.

- 6.2.1.8 Spectronik Pte. Ltd.

- 6.2.1.9 Ultra

- 6.2.2 UAV Manufacturers

- 6.2.2.1 AeroVironment, Inc.

- 6.2.2.2 Elbit Systems Ltd.

- 6.2.2.3 Israel Aerospace Industries Ltd.

- 6.2.2.4 Teledyne Technologies Incorporated (Aeryon Labs Inc.)

- 6.2.2.5 ISS Aerospace

- 6.2.1 Fuel Cell Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing public-private partnerships leading to lucrative growth opportunities and technological developments