|

市場調査レポート

商品コード

1850227

ビルディングオートメーションシステム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ビルディングオートメーションシステム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月25日

発行: Mordor Intelligence

ページ情報: 英文 195 Pages

納期: 2~3営業日

|

概要

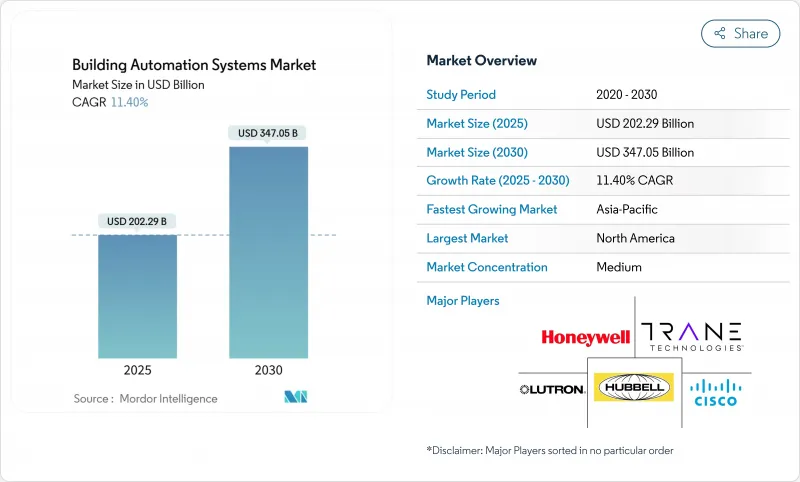

ビルディングオートメーションシステム市場規模は、2025年に2,022億9,000万米ドルに達し、CAGR 11.40%を反映して2030年には3,470億5,000万米ドルに達すると予測されています。

商業施設のエネルギー料金の50%を占めるHVACは、依然として主要なコストドライバーであるため、HVACを照明やセキュリティとリンクさせる自動化プラットフォームが優先的に投資されています。カリフォルニア州の2025年タイトル24基準は、現在、すべての新しい非住宅プロジェクトにOpenADRプロトコルに従う需要応答制御を含めることを義務付けています。米国エネルギー省は、ASHRAE 90.1-2022によって商業ビルの効率が2019年版より9.8%向上すると決定しました。EUやアジア太平洋における同様の枠組みは、正確な炭素報告を義務付けているため、オーナーは自動化をオプションではなく、不可欠なものと考えています。市場リーダーは、戦略的買収によって製品範囲を拡大し、長期的なサービス契約を締結しています。また、ワイヤレスBACnetによって、改修プロジェクトの設置時間を70%短縮しています。

世界のビルディングオートメーションシステム市場の動向と洞察

エネルギー効率の向上と規制の強化

新しいエネルギー規制により、オートメーションは裁量的なアップグレードから規制要件へと変わりつつあります。EU Energy Performance of Buildings Directive(EU建築物のエネルギー性能指令)は、すべての住宅建築物に対して、2030年までに少なくともEランク、2033年までにDランクに到達することを義務付けており、所有者は照明、HVAC、メーターの自動化を余儀なくされています。カリフォルニア州の2025年規則では、非住宅用HVACシステムに対して遠隔セットポイント調整を要求し、4,000W以上の照明負荷は15%の自動電力削減を提供しなければならないです。ミシガン州は、ASHRAE90.1-2022を反映した新しい商業コードを制定しました。これらの基準は、従来の投資回収の議論を取り除き、ビルディングオートメーションシステム市場の耐久性のある成長フロアを確立しています。

スマートビルディングに対する政府のインセンティブ

財政政策は、初期資本支出を抑えることで規制を補完します。米国では、インフラ投資・雇用法(Infrastructure Investment and Jobs Act)とインフレ削減法(Inflation Reduction Act)がオートメーションのハードウェアとソフトウェアに補助金を出し、シュナイダーエレクトリックのテネシー工場拡張(1億4,000万米ドル)のようなプロジェクトを支援しています。カリフォルニア大学サンディエゴ校のワイヤレス・サーモスタット・プロジェクトでは、電力会社のリベートにより、コストが29万5,700米ドルから1万4,600米ドルに削減され、0.2年の投資回収が実現した。アジア太平洋では、シンガポールのグリーンビルディング・マスタープランが、スマートビルの改修費用の最大50%をカバーする補助金を提供しています。このような優遇措置により、ビルディングオートメーションシステム市場全体において、導入曲線が加速し、販売サイクルが短縮されます。

高い初期費用と改修費用

改修プロジェクトは、機器の価格を上回る可能性のある人件費や配線費を克服しなければなりません。ハネウェルのAdvance Control for Buildingsは、既存のケーブル配線を活用することで、レトロフィットの設置時間を40%短縮しますが、それでも小規模な物件では資本的な制約があります。エネルギー・サービス契約などの資金調達ソリューションは、太陽光発電のPPA構造に比べて未発達のままであり、インセンティブが限られている市場では導入速度の足かせとなっています。

セグメント分析

ハードウェアは、主にセンサー、コントローラー、フィールドデバイスを通じて、2024年の売上高の55.90%を依然として供給しています。一方、ソフトウェアは、所有者が永久ライセンスからサブスクリプションモデルに移行するにつれて、CAGR 12.40%で成長しています。ソフトウェアのビルディングオートメーションシステム市場規模は、2024年の29%から2030年には1,320億米ドルに達し、総売上の38%に相当すると予測されています。シュナイダーエレクトリックのSaaSポートフォリオは2024年に140%上昇し、データ分析、遠隔診断、サイバーセキュリティサービスがいかに経常収益を生み出すかを示しています。

付加価値の多くは、異機種をつなぐクラウドAPIを通じて引き出されます。ジョンソンコントロールズのフラット化されたMetasysアーキテクチャは、統合時間を半減し、デバイスのスループットを向上させ、ハネウェルのConnected Solutionsは、成果ベースの契約でハードウェアとソフトウェアをバンドルしています。その結果、ビルディングオートメーションシステム市場は、初期資本サイクルではなく、資産寿命にわたって最適化するソフトウェア定義ソリューションへと移行し続けています。この移行はまた、規制当局が調達ガイドラインに成文化し始めているサイバーセキュリティとデータ主権に関する問題を高めています。

セキュリティとアクセス制御は、企業のリスク軽減の優先順位を反映して、2024年に50.30%の売上シェアを維持します。ビルエネルギー管理システムはCAGR 11.80%で拡大し、ビルディングオートメーションシステム市場規模に占めるシェアは2024年の19%から2030年には24%に上昇します。電力会社は現在、年間1kWあたり60~100米ドルのピークカット料金を支払い、エネルギー管理の投資回収率を向上させています。ABBとサムスンは、住宅エネルギー管理をSmartThings Proに統合し、商業オートメーションと消費者向けIoT領域の融合を強調しています。

エネルギー基準では、HVAC、照明、プラグ負荷からデータを取得する継続的な試運転ダッシュボードがますます求められています。そのためオーナーは、エネルギー管理をアドオンとして扱うのではなく、基本的な建設仕様にバンドルしています。50サイト以上の商業ポートフォリオでは、ポートフォリオ分析によって光熱費が12%削減され、企業の排出量ベースラインが縮小され、環境、社会、ガバナンスの報告がサポートされます。このようなメリットをプロフォーマに織り込んだ開発者は、グリーンローンの割引を受けられるようになり、ビルディングオートメーションシステム市場に自己強化サイクルを生み出しています。

ビルディングオートメーション・制御システム市場は、コンポーネント(ハードウェア、ソフトウェア、サービス)、システムタイプ(HVAC制御システム、照明制御システム、セキュリティ・入退室管理システム、その他)、通信技術(有線、無線)、エンドユーザー(住宅、商業、産業、施設・政府)、地域別に区分されます。市場予測は金額(米ドル)で提供されます。

地域別分析

北米の売上シェアは38.00%で、連邦政府の脱炭素化指令により、2029年までに連邦施設における化石燃料の90%廃止が義務付けられているため、2030年までリードを保つと予測されます。GSAのオクラホマシティ連邦ビルは、グリッド・インタラクティブ制御によって41%のエネルギー削減を達成し、他の機関のベンチマークとなりました。カリフォルニア州とミシガン州の州レベルの基準は、民間プロジェクトの基準値を引き上げ、寛大な税額控除は、改修ポートフォリオの純費用を削減します。

アジア太平洋は、CAGR12.20%で最も急成長している地域です。中国の第14次5カ年計画では、スマートシティの予算にビルオートメーションが盛り込まれ、シンガポールのグリーンビルディング基本計画では、性能に基づく改修が推進されています。ABBとサムスンは、消費者向けプラットフォームの主流にエネルギー分析を統合するために提携し、対応可能な需要を高級オフィスから大衆向けアパートまで拡大した。新興ASEAN経済圏は、各国のエネルギー基本計画が公共部門の使用事例に資金を提供することで、年率8.1%の成長を達成しました。

欧州は、2033年までの段階的な改修目標を定めた「建築物のエネルギー性能指令」の恩恵を受けています。ドイツのAI経済は年率15%で拡大しており、高度自動化を支える人材プールと研究開発基盤を提供しています。北欧諸国は、ネット・ゼロのホテルや複合施設の開発をリードしており、デンマークのアルシク・ホテルは、継続的な効率化のために宿泊予約システムと空調を統合しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- エネルギー効率の向上と規制の推進

- スマートビルディングに対する政府のインセンティブ

- IoTとクラウドの統合が導入を加速

- AIベースのパフォーマンス契約

- 中小企業向け低コストBAS

- 市場抑制要因

- 初期費用と改修費用が高め

- サイバーセキュリティと相互運用性のギャップ

- BASコミッショニング人材不足

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場規模と成長予測

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- システムタイプ別

- HVAC制御システム

- 照明制御システム

- セキュリティおよびアクセス制御システム

- エネルギー管理システム

- 火災および生命安全システム

- 通信技術別

- 有線

- 無線

- エンドユーザー別

- 住宅

- 商業

- 産業

- 機関/政府

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- その他欧州地域

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies plc

- Lutron Electronics Co. Ltd

- Hubbell Inc.

- United Technologies Corp.

- Hitachi Ltd.

- Huawei Technologies Co., Ltd.

- Emerson Electric Co.

- Mitsubishi Electric Corp.

- Johnson Controls International plc

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Delta Controls Inc.

- Distech Controls(Acuity Brands)

- Carrier Global Corp.(Automated Logic)

- Bosch Building Technologies

- Legrand SA

- Signify N.V.

- Azbil Corporation

- KMC Controls Inc.

- Alerton(Honeywell)

- Crestron Electronics

- Rockwell Automation Inc.