|

市場調査レポート

商品コード

1640319

金融サービスアプリケーション:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Financial Services Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 金融サービスアプリケーション:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

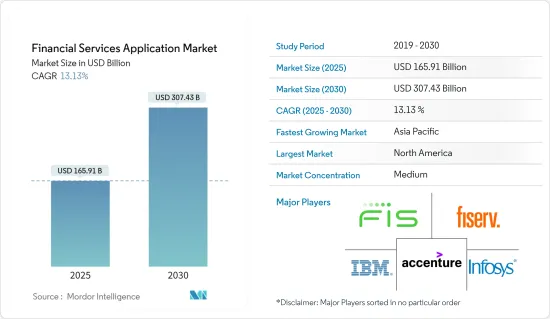

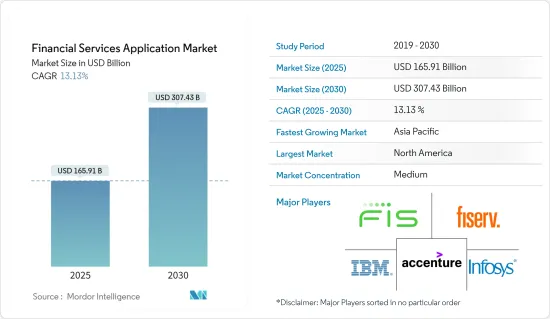

金融サービスアプリケーションの市場規模は、2025年に1,659億1,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは13.13%で、2030年には3,074億3,000万米ドルに達すると予測されます。

金融機関による個人間決済、オンライン送金、アラート、その他のサービスなど、さまざまなオンライン・ソリューションやイノベーションの導入傾向が高まる中、金融サービスアプリケーションは重要性を増しています。

主なハイライト

- 金融サービス分野ではデジタル技術の導入が加速しています。現金での支払い、ファイナンシャル・アドバイザーとの対面での面談、さらにはATMの利用など、金融サービスのあらゆる側面が縮小しています。

- 世界中の企業は、顧客データを活用して利用パターンや需要のピーク、消費の変動を総合的に分析し、意思決定につなげるシステムを必要としています。そのため、ビッグデータを効果的に扱うシステムの必要性が高まっています。こうしたビジネス・アナリティクス・ツールに対する需要が、市場を牽引しています。

- 銀行・金融部門は、リスク管理文化を促進するためにテクノロジーを活用し、意思決定の主流にリスクを組み込んでいます。一貫して業績を監視し、関連するマーケット・インテリジェンスを提供し、ビジネスと収益性に関する洞察を提供しています。

- さらに、人工知能、ビジネスインテリジェンスツール、自動化ツールなどのテクノロジーを活用し、金融サービス部門はデジタル口座開設、チャットボット、ピアツーピア決済、デジタルローンなど、利用者に新たな利便性を提供しています。アクセンチュアによると、人工知能は2035年までに金融業界で1兆2,000億米ドルを占めるといいます。

- 決済取引、カード決済、即時決済は急速に増加・変化しており、世界中の数百万世帯に影響を及ぼしています。決済取引の増加に伴い、サイバー犯罪やデータ漏洩の可能性も高まっています。金融サービスは、サイバー犯罪によって数十億米ドルの損失を被る可能性があると推定されています。いくつかの企業は、サイバー犯罪のリスクを軽減するために、セキュリティやコンプライアンス要件に対応するための戦略的パートナーシップや新製品開発に注力しています。例えば、2023年5月、マスターカードはガーナ・サイバーセキュリティ局との提携により、ガーナで初の「詐欺とサイバーセキュリティ・フォーラム」を開催しました。このイベントは主に、規制当局、金融機関、フィンテックを含むエコシステム全体の主要なプレーヤーが一堂に会し、最近の不正行為の動向を研究し、ガーナにおけるサイバーセキュリティの様々な重要な側面に取り組むものです。

- COVID-19の大流行は、流動性不足、短期的な信用需要の低下、ビジネスモデルのコスト削減、主要な業務活動のデジタル化、政府による新しいガイドラインや改訂ガイドラインへの対応など、金融サービス部門にいくつかの経営課題を課しました。

- 現在のシナリオでは、金融サービス機関は、ビジネス上の要求を満たすために、効果的で信頼性の高いビジネス・インテリジェンス・ソリューションを必要としています。さらに、金融機関の増加により、このような金融サービスへのニーズが高まっており、市場成長の促進が期待されています。

金融サービスアプリケーション市場動向

BI&アナリティクス・アプリケーションが高成長を遂げる見込み

- 金融セクターは、世界経済において最もデータ集約的なセクターの1つです。銀行やその他の金融機関には、取引、支払い、引き出し、セールスポイントなどの顧客データが含まれており、洞察を得るために使用することはできません。

- 金融業界では、ビジネス・インテリジェンスが組織の可能性、商品、サービスを最大化するのに役立ちます。Power BIのようなリアルタイム分析ツールは、金融会社が正確な意思決定を行うのに役立ちます。

- BIソリューションは、KPI測定、ナレッジ管理、分析、レポーティング、コラボレーションにおいて効果的に付加価値を与えることができます。さらに、BIツールは特定のイベントを通知するトリガーとしても活用されています。さらに、市場ではセルフサービス分析ツールの採用が増加しており、エンドユーザーは最小限の専門知識で洞察を得ることができます。

- 金融分野でBIを利用することで、ビジネスが容易になり、他の機関よりも競争優位に立つことができます。銀行、クレジットカード会社、保険代理店などは、常に新規顧客を増やして市場シェアを拡大しなければならないです。ビジネス・インテリジェンスは、企業が目標を達成するために必要な情報を提供します。

- ビッグデータ分析もまた、この業界におけるビジネスインテリジェンスに不可欠なアプリケーションと考えられています。大量の生データからパターン、動向、相関関係を明らかにし、企業がデータに基づいた意思決定を行うのに役立ちます。したがって、ビッグデータ分析の全体的な採用が増加することで、予測期間中に市場が飛躍的な成長を遂げることが予想されます。

北米が大きな市場シェアを占める

- 米国では、顧客によりパーソナライズされたサービスを提供するために、銀行や金融機関が人工知能などの最新技術を採用する傾向が強まっています。

- 同国は、FinTechのパイオニアであることが主な理由で、金融テクノロジーの採用において重要な市場の1つであり、さらに同地域には大手金融機関が存在することも追い風となっています。

- 世界中の企業は、顧客データを利用して利用パターン、需要のピーク、消費の変化を徹底的に分析し、意思決定に至ることができるシステムを必要としています。そのため、ビッグデータを効率的に処理するシステムの必要性が高まっており、ビジネス分析ツールに対するこのような需要が市場を牽引しています。金融サービスアプリケーションの導入が進むにつれて、組織における意思決定の高度化が進み、利害関係者の安心感が高まっています。

- さらに、より多くの人々が口座を開設し、オンラインで財務を管理するようになったため、デジタル取引量は増加しています。このような成長に伴い、なりすまし詐欺や口座乗っ取りなど、より巧妙な詐欺が発生し、企業や消費者に影響を及ぼしています。

- Mastercardは、決済と金融サービスにおいて安全でシンプルかつインテリジェントな選択肢を提供するというビジョンを推進するため、強化されたオープンバンキングの口座開設ソリューションを導入しました。このイノベーションは、口座名義人の確認と本人確認に関する洞察を単一のAPIに統合し、企業がセキュリティと透明性に対する顧客のニーズに応えられるよう支援するものです。

- 2023年10月、セキュアなID企業であるCLEARは、唯一の再利用可能なKnow Your Customer(KYC)ソリューションで、金融サービスにおける最初の製品を発表しました。CLEARのワンクリックKYCソリューションは、主に摩擦のない消費者体験を提供し、特に顧客が面倒なKYCチェックを完了する必要がある場合に、金融サービス会社が従来の契約減少に対抗するのを支援することを目的としています。

- さらに2023年5月、ストライプはマイクロソフトとの戦略的パートナーシップを発表し、北米のビジネスがマイクロソフトのTeamsで直接支払いを受け付けられるよう支援します。StripeはTeams Paymentsをサポートし、バーチャルクラス、アポイントメント、イベントなどの開催中に、ミーティングホストがリアルタイムでカード決済を行えるようにします。企業は、Teamsのセッションに参加するための条件として、Stripeを通じた前払いを設定できるようになります。

金融サービスアプリケーション業界の概要

金融サービスアプリケーション市場は、国内市場だけでなく国際市場でも多数のプレーヤーが活動しているため、競争は中程度です。主要企業が採用する主な戦略は、製品やサービスの革新、合併、買収です。同市場の主なプレーヤーには、アクセンチュア(Accenture Plc)、日本法人、オラクル(Oracle Corporation)などがあります。

- 2024年1月- 世界の決済サービスプロバイダーであるWorldlineとGoogleは、Worldlineのデジタルトランスフォーメーションをさらに強化するため、Google Cloudの高度なクラウドベースの技術を活用する戦略的パートナーシップを締結しました。パートナーシップの重要な部分として、グーグルはワールドラインと協力し、欧州におけるグーグルの顧客のためのシームレスなオンライン決済を強化します。さらに、両社は共同でさまざまな市場開拓の機会に取り組み、金融機関だけでなく加盟店にも新しく強化されたデジタル顧客体験を提供します。

- 2024年1月- ボーダフォンとマイクロソフト・コーポレーションは、アフリカと欧州全土の3億を超える企業、公共機関、消費者に拡張されたデジタル・プラットフォームを提供する上で、主に両社の強みを活用する10年間の戦略的パートナーシップを締結。このパートナーシップにより、両社は主に、マイクロソフトのジェネレーティブAIを活用したボーダフォンの顧客体験の変革、ボーダフォンのマネージドIoT接続プラットフォームのハイパースケール化、企業向けの新しいデジタル・金融サービスの構築、世界のデータセンタークラウド戦略の見直しを共同で行います。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界バリューチェーン分析

- COVID-19の市場への影響評価

第5章 市場力学

- 市場概要

- 市場促進要因

- 金融機関数の増加

- カスタマー・エクスペリエンス重視の高まり

- 市場抑制要因

- 高い導入コスト

第6章 市場セグメンテーション

- 提供サービス別

- ソフトウェア

- 監査、リスク、コンプライアンス管理

- BIおよび分析アプリケーション

- ビジネス・トランザクション処理

- カスタマー・エクスペリエンス

- エンタープライズIT

- サービス

- コンサルティングサービス

- インテグレーションサービス

- トレーニング&サポートサービス

- 運用と保守

- ソフトウェア

- 展開別

- クラウド

- オンプレミス

- 企業規模別

- 中小企業

- 大企業

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Accenture PLC

- FIS Corporation

- Fiserv, Inc.

- IBM Corporation

- Infosys Limited

- Misys

- Oracle Corporation

- SAP SE

- TCS Ltd

- Temenos Group Ag

第8章 投資分析

第9章 市場の将来展望

The Financial Services Application Market size is estimated at USD 165.91 billion in 2025, and is expected to reach USD 307.43 billion by 2030, at a CAGR of 13.13% during the forecast period (2025-2030).

With the rising trend of introducing various online solutions and innovations, like person-to-person payment, online transfers, alerts, and other services by financial institutions, financial services applications have gained significant importance.

Key Highlights

- The rise in digital technology adoption is accelerating in the financial services sector. Paying in cash, attending face-to-face meetings with financial advisors, and even using ATMs are all curtailing aspects of financial services.

- Businesses worldwide require systems that can use customer data to comprehensively analyze usage patterns, demand peaks, and consumption fluctuations to arrive at decisions. It increases the need for a system that handles big data effectively. This demand for business analytics tools drives the market forward.

- The banking and financial sector incorporates risk in mainstream decision-making, using technology to promote a risk management culture. It consistently monitors performance, provides relevant market intelligence, and delivers business and profitability insights.

- Moreover, using technology, such as artificial Intelligence, business intelligence tools, and automation tools, the financial services sector offers new convenience to users, such as digital account opening, chatbots, peer-to-peer payments, and digital loans. According to Accenture, artificial Intelligence will account for USD 1.2 trillion in the financial industry by 2035.

- Payment transactions, card payments, and instant payments are rapidly increasing and changing, impacting millions of households worldwide. As the number of payment transactions rises, the chances of cybercrime and data breaches also rise. It is estimated that financial services could lose billions of dollars only due to cybercrime. Several companies are focusing on strategic partnerships and new product development to address security and compliance requirements to reduce the risk of cybercrime rates. For instance, in May 2023, Mastercard hosted its first-ever Fraud and Cyber Security Forum in Ghana in partnership with the Ghana Cyber Security Authority. The event primarily brings together key major players in the entire ecosystem, involving regulators, financial institutions, and fintech, to study the recent fraud trends and address the various crucial aspects of cybersecurity in Ghana.

- The COVID-19 pandemic imposed several business challenges on the financial services sector, such as liquidity shortage, short-term drop in demand for credit, cost-reduction in business models, digitizing key operational activities, and adapting to new and revised guidelines by governments.

- In the current scenario, financial services organizations need an effective and reliable business intelligence solution to meet their business demands. Moreover, due to an increasing number of financial institutions, there is a need for such financial services, which is expected to promote market growth.

Financial Services Applications Market Trends

BI & Analytics Application is Expected to Witness High Growth

- The financial sector is one of the most data-intensive sectors in the global economy. Banks and other financial institutions include customer data, such as transactions, payments, withdrawals, and sales points, which they cannot use to gain insights.

- In the financial industry, business intelligence helps the organization maximize its potential, products, and services. Real-time analytics tools like Power BI help financial firms make accurate decisions.

- BI solutions can effectively add value in KPI measurement, knowledge management, analytics, reporting, and collaboration. Further, BI tools are also utilized as a trigger for notifying specific events. Additionally, the market witnessed increased adoption of self-service analytics tools, wherein end users can achieve insights with minimal technical knowledge.

- Using BI in the financial sector makes business easier and gives a competitive advantage over other institutions. Banks, credit card companies, insurance agents, etc., must constantly add new customers to their base and expand their market share. Business intelligence gives companies the information needed to reach their goals.

- Big data analytics is also considered an integral application for business intelligence in the industry. It helps uncover patterns, trends, and correlations in large amounts of raw data to help companies make data-informed decisions. Hence, a rise in the overall adoption of Big data analytics is anticipated to make the market witness exponential growth during the forecast period.

North America to Hold a Significant Market Share

- In the United States, there lies a growing trend in terms of adopting the latest technologies, including artificial intelligence by banks and financial organizations to offer more personalized services to customers.

- The country is one of the significant markets for financial technology adoption, mainly due to being a pioneer in FinTech, further buoyed by the presence of major financial giants in the region.

- Businesses worldwide need systems that can use customer data to exhaustively analyze usage patterns, demand peaks, and consumption changes and arrive at a decision. It boosts the need for a system that handles big data effectively, and this demand for business analytics tools drives the market forward. The growing adoption of financial service applications increased the sophistication of decisions being taken in organizations, providing increased reassurance to stakeholders.

- Furthermore, digital transaction volumes are increasing as more people open accounts and manage their finances online. With that growth comes more sophisticated fraud, such as synthetic identity fraud and account takeover, impacting businesses and consumers.

- Mastercard introduced an enhanced Open Banking account opening solution to advance its vision of providing safe, simple, and intelligent choices in payments and financial services. This innovation consolidates account holder verification and identity insights into a single API to help businesses meet customer needs for security and transparency.

- In October 2023, CLEAR, the secure identity company, declared its first product in financial services with one of the only reusable Know Your Customer (KYC) solutions. CLEAR's one-click KYC solution primarily delivers a frictionless consumer experience that is mainly aimed at helping financial services companies combat the traditional drop-off in signups, especially when customers are required to complete cumbersome KYC checks.

- Moreover, in May 2023, Stripe announced a strategic partnership with Microsoft to help North American Business to accept payments directly in Microsoft Teams. Stripe would power Teams Payments, allowing meeting hosts to take real-time card payments during virtual classes, appointments, events, and many more. Businesses can now set advance payment through Stripe as a requirement to join a Teams session.

Financial Services Applications Industry Overview

The financial services application market is moderately competitive, owing to the presence of a large number of market players operating both in domestic as well as international markets. The market appears to be mildly concentrated, with the key strategies adopted by major players being product and service innovation, mergers, and acquisitions. Some of the major players in the market are Accenture Plc, Corporation, and Oracle Corporation, among others.

- January 2024 - Worldline, a worldwide provider of payment services, and Google entered into a strategic partnership to leverage advanced cloud-based technologies from Google Cloud to enhance Worldline's digital transformation further. As a crucial part of the partnership, Google would work with Worldline to augment seamless online payments for Google's customers in Europe. In addition, both companies would jointly address various go-to-market opportunities and deliver new and enhanced digital customer experiences for merchants as well as financial institutions.

- January 2024 - Vodafone and Microsoft Corporation entered into a 10-year strategic partnership that mainly leverages their respective strengths in providing scaled digital platforms to over 300 million businesses, public sector organisations, as well as consumers throughout Africa and Europe. Through the partnership, the companies would mainly collaborate to transform Vodafone's customer experience utilizing Microsoft's generative AI, hyperscale Vodafone's managed IoT connectivity platform, build new digital and financial services for businesses, and overhaul its global data centre cloud strategy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Increased Number of Financial Institutions

- 5.2.2 Increasing Emphasis on Customer Experience

- 5.3 Market Restraints

- 5.3.1 High Deployment Costs

6 MARKET SEGMENTATION

- 6.1 By Offerings

- 6.1.1 Software

- 6.1.1.1 Audit, Risk, and Compliance Management

- 6.1.1.2 BI and Analytics Applications

- 6.1.1.3 Business Transaction Processing

- 6.1.1.4 Customer Experience

- 6.1.1.5 Enterprise IT

- 6.1.2 Services

- 6.1.2.1 Consulting Services

- 6.1.2.2 Integration Services

- 6.1.2.3 Training and Support Services

- 6.1.2.4 Operations and Maintenance

- 6.1.1 Software

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By Size of Enterprise

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 FIS Corporation

- 7.1.3 Fiserv, Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Infosys Limited

- 7.1.6 Misys

- 7.1.7 Oracle Corporation

- 7.1.8 SAP SE

- 7.1.9 TCS Ltd

- 7.1.10 Temenos Group Ag