|

市場調査レポート

商品コード

1851307

航空機装備品電気化:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)More Electric Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機装備品電気化:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月01日

発行: Mordor Intelligence

ページ情報: 英文 105 Pages

納期: 2~3営業日

|

概要

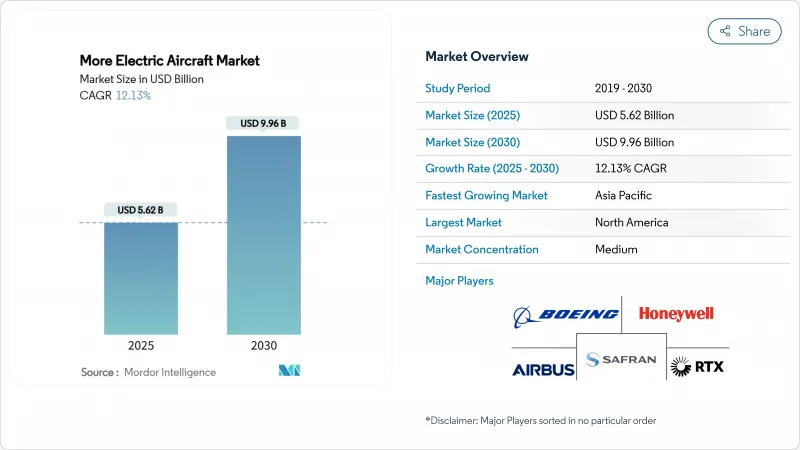

航空機装備品電気化(MEA)の市場規模は2025年に56億2,000万米ドル、2030年には99億6,000万米ドルに達し、CAGR 12.13%で成長すると予測されています。

燃料価格の上昇、二酸化炭素削減義務、ハイパワーエレクトロニクスの成熟により、航空会社や機体は油圧・空圧サブシステムを電気的アーキテクチャに切り替える傾向にあります。航空会社は、エンジンが環境制御のために空気を排出しなくなったことで、燃料消費を最大20%削減できたと報告しており、また、電力密度の高い発電機と半導体バッテリーが、より長い電気的耐久性を支えています。B787のような固定翼プログラムは、ブリードレス運用を実運用で証明しており、eVTOL開発者は同じ論理を都市ミッションに適用しています。その結果、既存企業と新興企業は、ワイドバンドギャップ半導体、熱制御材料、高電圧認証枠を確保し、需要に追いつこうと競争しています。

世界の航空機装備品電気化市場動向と洞察

燃料消費とCO2削減のための電動化推進

燃料は航空会社の運航経費の20~30%を占めるため、キロワットクラスの電動パワートレインは、排出ガス削減効果に加えて経済的にも魅力的です。GEエアロスペースのCLEEN IIIデモンストレーションは、ブリードエアの配管を取り除き、ターボファンコアを最適な推力設定に近づけて運転できるようにする90kWのスタータージェネレーターを提供します。コリンズ・エアロスペース社が787型機に搭載したブリードレス環境制御パックは、電気サブシステムがメンテナンス計画を容易にすると同時に、いかに二酸化炭素排出量を削減するかを示しています。こうして航空会社は、予測可能な点検間隔と流体漏れの減少を実現し、予定外の地上待機時間を減らすことができます。このような金銭的、コンプライアンス的な二重の見返りは、航空機の種類を問わず、電動化されたラインフィットやレトロフィット・プログラムへの継続的な投資を強化するものです。

世界的な排出規制の強化

現在、自主的な誓約に代わって、拘束力のある規則が導入されています。米国連邦航空局(FAA)は、2024年4月に発効する燃費基準を採択し、新型ジェット機の1シートキロ当たりの最大燃料を設定しました。欧州の"ReFuelEU "指令は、2030年までに6%、2050年までに70%の持続可能な航空燃料を増加させることを航空会社に義務付けており、ドロップイン燃料と電気ブーストを混合したハイブリッド電気アーキテクチャを促しています。ICAOのグローバル・オフセット・スキームは、検証可能な排出削減を要求しているため、OEMは電気的統合を加速せざるを得ないです。たとえばエアバスは、規制のガードレールの範囲内にとどまるために、2035年までにゼロエミッションの商用モデルを実現することを公の目標としています。

高電圧認証のハードル

電気推進は日常的にDC1,000Vを超えるが、過去の規制では270Vアーキテクチャが中心でした。FAAはBETA TechnologiesのH500Aに対し、新しいアークフォルトモードと絶縁破壊モードに対処するための特別条件を発行しました。FAAとEASAの間で異なるルール作りがグローバルな検証を複雑にしており、開発者は複数のワーストケースシナリオを想定した設計を余儀なくされています。ボーイングのB777-9型機は、従来の電力を使用しない運航について、さらなる精査に直面しており、レガシー・プログラムが電圧エンベロープが拡大した場合に、いかに認証の遅れに見舞われるかを浮き彫りにしています。このような不確実性は開発サイクルを長期化させ、予算を膨張させるため、航空機装備品電気化市場の主要成長率を抑制しています。

セグメント分析

2024年航空機装備品電気化市場の39.56%は民間機体です。これは航空会社がメンテナンス費用を抑制するために油圧システムを分散型電気サブシステムに置き換えたためです。航空会社は、ライン交換可能なユニットが流体駆動ではなくソリッドステートであることで、予測可能なライフサイクルコストを強調しています。一方、eVTOLカテゴリーは2030年まで15.65%のCAGRを記録し、都市間エアタクシー事業に対する投資家の信頼が高まっていることを示します。Joby社とArcher社による認証取得のマイルストーンは、概念から近い将来のサービスへと認識を転換させ、地域オペレーターからのフリート注文を引き出しました。軍事用プログラムは、主にレーダー信号低減のために電動アクチュエータを採用し、ビジネス航空は客室騒音と空港排出の低減のために電動アクチュエータを採用しています。

このセグメントの乖離は、航空機装備品電気化市場が従来の需要指標を見直す可能性を示唆しています。2028年以降に300機以上のハイブリッド電気式リージョナル航空機を受け入れるというJSXの計画は、リージョナル航空会社が、実現可能であれば、いかに古い航空機を飛び越えるかを示しています。受注が加速すると開発リードタイムが短縮されるため、サプライチェーンは半導体をeVTOLファウンダーに最初に割り当てることを余儀なくされます。ハイサイクル・バッテリーのセル生産は限られているため、レガシー・ナローボディのレトロフィットの入り口となります。それでも、航空機の完全更新が経済的に困難な場合には、旧型の民間機用の後付けキットが普及し、航空機クラス間でバランスの取れた注文構成が確保されます。

2024年航空機装備品電気化市場規模の63.55%は固定翼型が占めるが、これはB787やA350のような認証されたリファレンス・プログラムが収益運航における電気環境制御を実証しているおかげです。こうした例は、ナローボディ機体への高電圧の改修を承認する際に、規制当局や貸主を安心させる。同時に、回転翼と電動リフトのコンセプトは、直接駆動電気モーターがもたらすホバリング効率の段階的変化に後押しされ、CAGR12.4%で拡大します。

DARPAのXRQ-73ハイブリッド電気ドローンは、ローターリフトと固定翼の巡航を融合させ、パワーエレクトロニクスが垂直飛行アセットにステルス性と耐久性を与えることを実証しています。Electraの短距離離陸地域実証機は、この溝をさらに崩壊させ、将来の分類学が翼のプランフォームよりもミッション・プロファイルに焦点を当てることを示唆しています。ロータリーのプログラムも、ギアボックスの潤滑ラインがないことを利用し、軽量化とメンテナンスの軽減を図っています。このようにカテゴリーが曖昧になることで、統一された認証の枠組みが促進され、従来とは異なるレイアウトの参入がスムーズになり、航空機装備品電気化市場内のプラットフォームの多様性が維持される可能性があります。

地域分析

北米は2024年の支出額の35.23%を占め、これは防衛予算がメガワット実証機を支援し、FAAが電気推進認証のための初期経路を提供したためです。米国の確立されたTier-1サプライヤーは、研究室、試験装置、人的資本パイプラインを併設する成熟したエコシステムを支えています。NASAの電動パワートレイン飛行実証プログラムは、GEとボーイングのエンジニアをペアにして、2027年までに地域プラットフォームでハイブリッド推進力の飛行試験を行うもので、地域の勢いを強めています。

欧州は、Clean Aviation補助金と空港の脱炭素化政策に後押しされ、金額ベースで第2位にランクされています。GOLIATやエコパルスなどのEUプロジェクトは、液体水素の取り扱い、超電導ケーブル、ハイブリッド電気飛行試験などに公的資金を投入しています。EASAとFAAとの整合化により、eVTOLの大西洋横断バリデーションが加速され、デュアルレジストリのオペレーターの市場投入までの時間が短縮されます。とはいえ、欧州のサプライヤーは半導体調達において通貨インフレに直面しており、ウエハーの割り当てを確保するためにアジアの鋳造所との合弁事業を促しています。

アジア太平洋は12.45%のCAGRで最も高い成長を記録します。中国民用航空局はeVTOLロジスティクスと旅客シャトル用に専用の低高度通路を設定し、商業展開のスケジュールを短縮しました。国家は2030年までに1兆元規模の一般航空産業の構築を計画しており、外国のTier2サプライヤーを誘致するために補助金と規制の確実性を注入します。日本と韓国は、より広範な認証の前にショーケースを提供するため、万博タイプのイベントでの都市実証飛行に重点を置いています。しかし、空港の準備は遅れています。インドは、UDANコネクティビティ・スキームの下、短距離路線用の電動リージョナル・ターボプロップを模索しています。アジア太平洋地域の多様な市場参入は、バッテリー、モーター、アビオニクスベンダーの持続的な受注につながり、アジア太平洋地域が航空機装備品電気化市場の主要なボリュームドライバーであり続けることを確実にしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 燃料消費とCO2削減のための電動化推進

- 世界の排ガス規制の強化

- 高出力モーターとSiC/GaNエレクトロニクス

- 固体電池がパワースパイク負荷を可能にする

- ESGに牽引されるAPUの後付け需要

- ステルス重視の電動アクチュエーション(防衛)

- 市場抑制要因

- 高電圧認証のハードル

- 高密度パワーモジュールの熱信頼性

- 航空グレードSiCサプライチェーンの希少性

- 空港MROインフラの遅れ

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- ライバルの激しさ

第5章 市場規模と成長予測

- 航空機タイプ別

- 商用航空

- 軍事航空

- ビジネスおよび一般航空

- 無人航空機(UAV)

- アーバンエアモビリティ/eVTOL

- プラットフォーム別

- 固定翼

- 回転翼

- システム別

- 発電および管理

- 発電

- 電力変換

- 配電

- 作動システム

- フライトコントロール

- ランディングギアアクチュエーション

- 熱管理システム

- エンジンスタートシステム

- 環境制御システム

- その他

- 発電および管理

- エンドユーザー別

- OEM

- アフターマーケット

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Airbus SE

- The Boeing Company

- Collins Aerospace(RTX Corporation)

- Safran SA

- Honeywell International Inc.

- General Electric Company

- Rolls-Royce plc

- BAE Systems plc

- Parker-Hannifin Corporation

- Moog Inc.

- Eaton Corporation plc

- Thales Group

- Liebherr Group

- Crane Co.

- Diehl Aviation GmbH

- GKN Aerospace(Melrose plc)

- magniX USA, Inc.

- Ampaire Inc.

- Wright Electric Inc.