|

市場調査レポート

商品コード

1637728

クラウドベースコンタクトセンター:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Cloud-based Contact Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クラウドベースコンタクトセンター:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

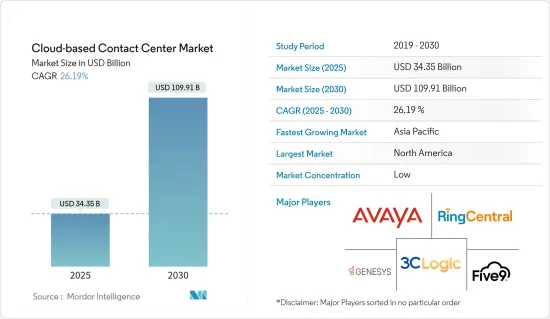

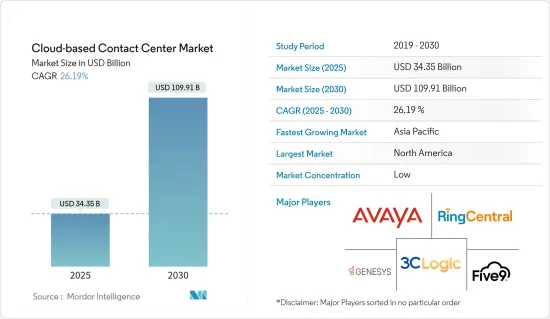

クラウドベースコンタクトセンターの市場規模は、2025年に343億5,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは26.19%で、2030年には1,099億1,000万米ドルに達すると予測されます。

クラウドベースコンタクトセンター市場とは、顧客とのやり取りやコミュニケーションを管理するためのクラウドベースのサービスを提供する業界を指します。クラウドコンピューティング技術を利用して、コンタクトセンターの機能と性能をインターネット経由で提供します。

主なハイライト

- クラウドベースコンタクトセンターは拡張性に優れているため、企業は変化する顧客需要に応じてキャパシティを容易に調整できます。企業はエージェントやリソースを迅速に追加・削除でき、最適なパフォーマンスとコスト効率を確保できます。

- クラウドベースのサービスに対する需要の高まりが、クラウドベースコンタクトセンター市場成長の大きな原動力となっています。この需要の高まりにはいくつかの要因があります。クラウドベースコンタクトセンター・サービスは、企業のニーズに応じて業務を拡大・縮小できる柔軟性を提供します。企業は、物理的なインフラの制約を受けることなく、エージェントの追加や削除、コンタクトセンターの新規開設、新規市場への進出などを容易に行うことができます。この拡張性により、企業は変化するビジネス要件や顧客需要に迅速に対応することができます。

- 市場の成長を牽引しているのは、クラウドベースコンタクトセンターに伴う資本コストの削減と迅速な展開です。従来のオンプレミス・コンタクトセンターでは、ハードウェア、ソフトウェア・ライセンス、インフラのセットアップ、メンテナンスに多額の先行投資が必要だった。一方、クラウドベースコンタクトセンターは、サブスクリプションまたは従量課金モデルで運用されるため、資本支出を大幅に削減できます。

- 企業は、サーバーやネットワーク・インフラなどのハードウェア機器の購入やメンテナンスにかかる高額な初期費用を回避できます。その代わりに、クラウド・サービス・プロバイダーが提供するインフラを活用し、必要なリソースに対してのみ料金を支払うことができます。この費用対効果の高いモデルにより、あらゆる規模の企業が、経済的な負担を負うことなく、高度なコンタクトセンター機能を利用できるようになります。

- クラウドベースのサービスを利用する際、企業は顧客データのプライバシーと保護について懸念するかもしれないです。データはクラウド上に保存され処理されるため、不正アクセスやデータ侵害、データ漏えいのリスクが懸念されます。このような懸念に対処するためには、一般データ保護規則(GDPR)などのデータ保護規制を遵守することが極めて重要です。機密情報を保護するため、クラウドサービスプロバイダーは暗号化、アクセス制御、データ分離などの強固なセキュリティ対策を導入することが多いです。コンプライアンスを実証し、強固なデータ・プライバシー慣行を確保することで、こうした懸念を軽減することができます。

クラウドベースコンタクトセンター市場の動向

IT・通信エンドユーザー業界が大きな市場シェアを占める見込み

- クラウドベースコンタクトセンター市場は、ITおよび電気通信業界で大きな成長と導入が進んでいます。クラウドベースコンタクトセンターは、従来のオンプレミスのソリューションに比べていくつかの利点があり、ITおよび通信事業者にとってますます魅力的なものとなっています。

- クラウドベースコンタクトセンターは、需要に応じて柔軟に拡張・縮小できます。顧客からの問い合わせやサポート要件が変動することが多いIT・通信企業は、リソースを最適化する上でこの拡張性が有益だと考えています。

- クラウドに移行することで、企業はインフラストラクチャーの初期費用を回避し、実際に使用するリソースに対してのみ料金を支払うことができます。この費用対効果の高いモデルは、業務効率の向上と経費削減を目指すIT企業や通信企業に特に魅力的です。

- パブリック・クラウド・プラットフォームは、迅速な導入プロセスを提供します。IT・通信企業は、大規模なハードウェア投資や複雑なインフラ設定を行うことなく、クラウドベースコンタクトセンターを迅速に立ち上げ、構成することができます。これらのプラットフォームはシームレスなスケーラビリティを提供するため、企業はコンタクトセンターのリソースを需要や事業拡大に応じて調整することができます。

- クラウドベースコンタクトセンター市場では、パブリッククラウドプラットフォームの利用と採用が増加していることが、クラウドベースのソリューションの需要拡大を大きく後押ししています。フレクセラ・ソフトウェアによると、2023年には、回答者の47パーセントがすでにアマゾン・ウェブ・サービス(AWS)で重要なワークロードを実行しているといいます。

- 企業がカスタマーサービス業務において俊敏性、拡張性、コスト効率を優先するにつれ、クラウドベースコンタクトセンター・ソリューションに対する需要は増加すると予想されます。クラウドベースコンタクトセンター市場は、卓越したカスタマー・エクスペリエンスを提供する上でクラウド技術が提供する利点を企業が認識するにつれて、大きな成長が見込まれます。

アジア太平洋地域が急成長市場になる見込み

- アジア太平洋地域では、クラウドベースコンタクトセンター市場が大きく成長しています。アジア太平洋地域では、業界全体で急速なデジタル変革が進んでいます。顧客サービス能力を強化し、デジタル時代の競争力を維持するために、クラウドベースのサービスを採用する企業が増えています。このデジタルトランスフォーメーションの推進が、クラウドベースコンタクトセンターサービスの需要を促進しています。

- アジア太平洋地域では、インターネット利用者の人口が急増し、スマートフォンの普及率も高まっています。このインターネットとモバイル接続の普及は、クラウドベースコンタクトセンターが繁栄するための肥沃な土壌を提供しています。これにより、企業はより多くの顧客にリーチし、複数のデジタル・チャネルでシームレスなカスタマー・サポートを提供することができます。

- アジア太平洋地域の顧客の期待は急速に進化しています。消費者は今、さまざまなコミュニケーション・チャネルにおいて、パーソナライズされた一貫性のある顧客体験を期待しています。オムニチャネル・コミュニケーション、アナリティクス、人工知能(AI)主導の自動化などの先進機能を備えたクラウドベースコンタクトセンター・サービスは、企業がこうした進化する顧客の要求に応えることを可能にします。

- アジア太平洋地域には活気ある中小企業(SME)セクターがあり、多くの中小企業がクラウドベースコンタクトセンターサービスのメリットを認識しています。これらのサービスは、中小企業にコスト効率と拡張性に優れたオプションを提供し、カスタマーサポート業務の確立、顧客エンゲージメントの強化、大企業との競合を可能にします。クラウドベースのモデルでは、ハードウェアやソフトウェアへの先行投資が不要なため、中小企業にとってより利用しやすいものとなっています。

- この地域のいくつかの国は、政府の支援政策やイニシアティブを通じて、デジタルの導入を積極的に推進しています。こうした取り組みにより、企業がクラウドベースコンタクトセンター・ソリューションやその他のデジタル技術に投資しやすい環境が整っています。

クラウドベースコンタクトセンター産業の概要

クラウドベースコンタクトセンター市場は非常に細分化されており、Avaya Contact Center(Ayaya Group)、RingCentral Inc.、Genesys Telecommunications Laboratories Inc.、3CLogic Inc.、Five9 Inc.などの大手企業が存在します。さらに、クラウドベースコンタクトセンターはさまざまな業界で利用されており、ベンダーに成長機会をもたらしています。同市場のプレーヤーは、サービス提供を強化し、持続可能な競争優位性を獲得するために、提携、協業、買収などの戦略を採用しています。

2022年12月、ルーメン・テクノロジーズはLumen Solutions for Contact Centre-Genesys Cloudを発表しました。この発売は、クラウドベースのエクスペリエンス・オーケストレーションの著名なプレーヤーであり、コンタクトセンター・テクノロジーの世界のリーディング・サプライヤーであるジェネシスとの協力関係の拡大を意味します。ルーメンとジェネシスの協業は、顧客に強化されたコンタクトセンター・ソリューションを提供することを目的としたこの新しいサービスの開発につながった。

2022年8月、世界最大級のITインフラ・サービス・プロバイダーであるキンドリルは、世界な提携を発表し、ファイブナインとの関係を拡大し、顧客と従業員にパーソナライズされたエクスペリエンスを提供するクラウドベースコンタクトセンター・ソリューションで協業するとともに、急速に変化するデジタル・ビジネスのニーズと要件をナビゲートするビジネスを支援しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- クラウドベースのソリューションに対する需要の高まり

- 資本コストの削減とクラウドコンタクトセンターの迅速な展開

- 市場抑制要因

- クラウドベースのソリューションに関するセキュリティ上の懸念

第6章 市場セグメンテーション

- タイプ別

- 自動コール分配

- エージェントパフォーマンスの最適化

- ダイヤラー

- インタラクティブ・ボイス・レスポンス

- コンピューターテレフォニー統合

- 分析およびレポート

- サービス別

- プロフェッショナルサービス

- マネージドサービス

- エンドユーザー業界別

- 銀行、金融サービス、保険(BFSI)

- ITおよび電気通信

- メディア・エンターテイメント

- 小売

- 物流・運輸

- ヘルスケア

- その他のエンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Avaya Contact Center(Ayaya Group)

- RingCentral Inc.

- Genesys Telecommunications Laboratories Inc.

- 3CLogic Inc.

- Five9 Inc.

- Connect First Inc.

- Mitel Networks Corporation

- Aspect Software Parent Inc.

- 8X8 Inc.

- NICE inContact

- Teleforge Corporation

- 1Stream Inc.

- AVOXI Inc.

- Odigo SAS

第8章 投資分析

第9章 将来展望

The Cloud-based Contact Center Market size is estimated at USD 34.35 billion in 2025, and is expected to reach USD 109.91 billion by 2030, at a CAGR of 26.19% during the forecast period (2025-2030).

The cloud-based contact center market refers to the industry that provides cloud-based services for managing customer interactions and communications. It involves using cloud computing technologies to deliver contact center functionalities and capabilities over the Internet.

Key Highlights

- Cloud-based contact centers are highly scalable, allowing businesses to easily adjust their capacity based on changing customer demands. Organizations can quickly add or remove agents and resources, ensuring optimal performance and cost efficiency.

- The increasing demand for cloud-based services has been a significant driver for the growth of the cloud-based contact center market. Several factors contribute to this growing demand. Cloud-based contact center services offer organizations the flexibility to scale their operations up or down based on their needs. Businesses can easily add or remove agents, open new contact center locations, or expand into new markets without physical infrastructure limitations. This scalability allows organizations to adapt quickly to changing business requirements and customer demands.

- The market's growth is driven by reduced capital expenses and faster deployment associated with cloud-based contact centers. Traditional on-premises contact centers require substantial upfront investments in hardware, software licenses, infrastructure setup, and maintenance. In contrast, cloud-based contact centers operate on a subscription or pay-as-you-go model, significantly reducing capital expenditures.

- Organizations can avoid the high initial costs of purchasing and maintaining hardware equipment, such as servers and networking infrastructure. Instead, they can leverage the infrastructure provided by the cloud service provider, paying only for the resources they need. This cost-effective model allows businesses of all sizes to access advanced contact center capabilities without a heavy financial burden.

- Organizations may be concerned about their customer data's privacy and protection when utilizing cloud-based services. Since the data is stored and processed in the cloud, there is a perceived risk of unauthorized access, data breaches, or data leakage. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial to address these concerns. To protect sensitive information, cloud service providers often implement robust security measures, including encryption, access controls, and data segregation. Demonstrating compliance and ensuring strong data privacy practices can help alleviate these concerns.

Cloud-Based Contact Centers Market Trends

IT and Telecom End User Industry is Expected to Hold Significant Market Share

- The cloud-based contact center market was experiencing significant growth and adoption in the IT and Telecom industries. Cloud-based contact centers offer several advantages over traditional on-premise solutions, making them increasingly attractive to IT and telecom businesses.

- Cloud-based contact centers provide flexibility in terms of scaling up or down based on demand. IT and Telecom companies, which often experience fluctuations in customer inquiries and support requirements, find this scalability beneficial in optimizing their resources.

- Moving to the cloud allows companies to avoid upfront infrastructure costs and only pay for the resources they actually use. This cost-effective model particularly appeals to IT and Telecom companies aiming to improve their operational efficiency and reduce expenses.

- Public cloud platforms offer a rapid deployment process. IT and Telecom companies can quickly set up and configure cloud-based contact centers without the need for extensive hardware investments or complex infrastructure setups. These platforms provide seamless scalability, allowing businesses to adjust their contact center resource-based demand and business expansion.

- The increasing usage and adoption of public cloud platforms have significantly driven the growing demand for cloud-based solutions in the cloud-based contact center market. According to Flexera Software, in 2023, 47 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- As organizations prioritize agility, scalability, and cost-efficiency in their customer service operations, the demand for cloud-based contact center solutions is expected to increase. The cloud-based contact center market will likely witness significant growth as businesses recognize the advantages offered by cloud technology in delivering exceptional customer experiences.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific region is experiencing significant cloud-based contact center market growth. The Asia Pacific region is witnessing a rapid digital transformation across industries. Businesses increasingly adopt cloud-based services to enhance customer service capabilities and stay competitive in the digital era. This digital transformation drive is fueling the demand for cloud-based contact center services.

- The Asia Pacific region has a large and rapidly growing population of Internet users, coupled with increasing smartphone penetration. This widespread Internet and mobile connectivity provides fertile ground for cloud-based contact centers to thrive. It enables businesses to reach a larger customer base and provide seamless customer support across multiple digital channels.

- Customer expectations in the Asia Pacific region are evolving rapidly. Consumers now expect personalized and consistent customer experiences across various communication channels. With advanced features such as omnichannel communication, analytics, and artificial intelligence (AI)-driven automation, cloud-based contact center services enable businesses to meet these evolving customer demands.

- The Asia Pacific region has a vibrant small- and medium-sized enterprise (SME) sector, and many SMEs are recognizing the benefits of cloud-based contact center services. These services offer SMEs cost-effective and scalable options to establish customer support operations, enhance customer engagement, and compete with larger enterprises. The cloud-based model eliminates the need for upfront investments in hardware and software, making it more accessible for SMEs.

- Several countries in the region have been actively promoting digital adoption through supportive government policies and initiatives. These initiatives create a conducive environment for businesses to invest in cloud-based contact center solutions and other digital technology.

Cloud-Based Contact Centers Industry Overview

The cloud-based contact center market is highly fragmented, with the presence of major players like Avaya Contact Center (Ayaya Group), RingCentral Inc., Genesys Telecommunications Laboratories Inc., 3CLogic Inc., and Five9 Inc. Moreover, the cloud-based contact center is used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies such as partnerships, collaborations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

In December 2022, Lumen Technologies launched Lumen Solutions for Contact Centre - Genesys Cloud. This launch signifies Lumen's expanded collaboration with Genesys, a prominent player in cloud-based experience orchestration and a leading global supplier of contact center technology. The collaboration between Lumen and Genesys has led to the development of this new offering aimed at providing enhanced contact center solutions to customers.

In August 2022, Kyndryl, one of the largest global providers of IT infrastructure services, announced a global partnership and expanded its relationship with Five9 to collaborate on cloud-based contact center solutions that provide personalized experiences to customers and employees while assisting businesses in navigating the rapidly changing needs and requirements of the digital business landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Cloud-based Solutions

- 5.1.2 Reduced Capital Expenses and Faster Deployment of Cloud Contact Center

- 5.2 Market Restraints

- 5.2.1 Security Concerns Regarding Cloud-based Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Automatic Call Distribution

- 6.1.2 Agent Performance Optimization

- 6.1.3 Dialers

- 6.1.4 Interactive Voice Response

- 6.1.5 Computer Telephony Integration

- 6.1.6 Analytics and Reporting

- 6.2 By Service

- 6.2.1 Professional Services

- 6.2.2 Managed Services

- 6.3 By End-User Industry

- 6.3.1 Banking, Financial Services and Insurance (BFSI)

- 6.3.2 IT and Telecom

- 6.3.3 Media and Entertainment

- 6.3.4 Retail

- 6.3.5 Logistics and Transport

- 6.3.6 Healthcare

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avaya Contact Center (Ayaya Group)

- 7.1.2 RingCentral Inc.

- 7.1.3 Genesys Telecommunications Laboratories Inc.

- 7.1.4 3CLogic Inc.

- 7.1.5 Five9 Inc.

- 7.1.6 Connect First Inc.

- 7.1.7 Mitel Networks Corporation

- 7.1.8 Aspect Software Parent Inc.

- 7.1.9 8X8 Inc.

- 7.1.10 NICE inContact

- 7.1.11 Teleforge Corporation

- 7.1.12 1Stream Inc.

- 7.1.13 AVOXI Inc.

- 7.1.14 Odigo SAS