|

市場調査レポート

商品コード

1907292

産業用パッケージ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Industrial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 産業用パッケージ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

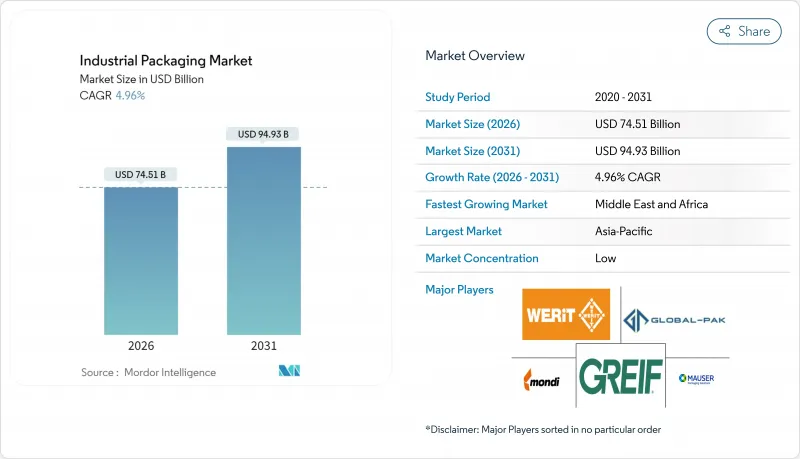

2026年の産業用パッケージ市場規模は745億1,000万米ドルと推定され、2025年の709億9,000万米ドルから成長が見込まれます。

2031年までの予測では949億3,000万米ドルに達し、2026年から2031年にかけてCAGR4.96%で拡大する見通しです。

需要の回復力は、ECフルフィルメントの拡大、現場包装の自動化加速、および製造セクター全体で材料選択と業務優先順位を形作る厳格な規制枠組みの強化を反映しています。EC物流では、複数の配送拠点を経ても耐えられる保護仕様と、容積重量を抑えた包装が求められており、自動化投資は人手不足の労働市場において生産者が労働力依存度を抑える一助となります。アジア太平洋地域は輸出志向型製造業が密集していることを背景に、2024年の収益の40.45%を占めました。一方、中東・アフリカ地域はエネルギー、インフラ、食品加工分野への投資計画を背景に、2030年までCAGR6.34%で最も急速に成長しています。

世界の産業用パッケージ市場の動向と洞察

持続可能かつ再生可能な素材の台頭

産業購買部門では、再生材含有率の義務化や企業の持続可能性目標が調達基準の中心となっています。欧州連合(EU)は2030年までにプラスチック製品の再生材含有率30%を義務付けており、コンバーター企業は原料調達の見直しを迫られています。セルロース系複合材料は、食品・医薬品用途に適した強度と耐湿性を備え、ISO 14855の生分解性基準を満たします。ファイザー社は自社包装をリサイクル可能な形態に切り替えることで包装廃棄物を25%削減しつつ、FDA 21 CFR 211の無菌性規則を遵守しました。生産者は、新規禁止規制に準拠しつつPFASを代替するバイオベースコーティングへの投資により、樹脂価格の変動リスクをヘッジしています。研究開発が拡大する中、早期導入企業はコスト面とコンプライアンス面での優位性を獲得し、顧客維持率の向上を図っています。

電子商取引と越境貿易フローの拡大

2024年、米国の電子商取引売上高は1兆1,400億米ドルに達し、小売売上高の16.4%を占めました。複数回取り扱われる小包には緩衝材と容積重量効率に優れた設計が求められます。1日2,000件以上の出荷を行う施設では、99.5%の精度で梱包でき人件費を40%削減するロボットの導入が増加しています。テスラは適応型包装システム導入後、資材使用量を18%削減しました。医薬品の規制複雑化により、市場横断的なICH表示プロトコルを満たす標準化された世界のフォーマットへの移行が進んでいます。

樹脂・鋼材価格の変動

2024年の鋼材価格は650~850米ドル/トンで推移し、長期契約を結ぶドラムメーカーを圧迫しました。ポリエチレンとポリプロピレンは15~20%変動し、原材料費がコストの60~70%を占めるため、生産者が打撃を吸収しました。ダウのサプライヤーは12%の利益率低下に見舞われました。柔軟な価格設定と短期契約が増加する一方、再交渉は2024年以前比で25%増加し、関係に負担がかかっています。

セグメント分析

中間バルクコンテナは2031年までに6.98%のCAGRで最速成長が見込まれ、350~700バールの複合容器を必要とする水素プロジェクトが牽引役となります。ドラム缶は2025年に産業用パッケージ市場の35.02%を占め、多目的化学品の基幹容器としての地位を維持しています。

IBCは水素ハブ向け70億米ドルの資金調達による恩恵を受ける一方、スチールドラムの需要は原材料価格の変動に直面しつつも、確立された国連認証の認知度を享受しております。フレキシブルIBCはATEX準拠の帯電防止素材を採用し、爆発性雰囲気分野に対応しております。

プラスチックは2025年に46.02%のシェアで優位を維持しましたが、規制強化の圧力が高まっています。PFASフリーバリアコーティング技術の成熟に伴い、紙・繊維素材は6.61%のCAGRが見込まれます。

TAPPIの測定によると、バリア性板紙の生産量は25%増加し、自動車メーカーはプラスチック製リターナブルコンテナに30%の再生材含有を義務付けています。高度なセルロースフィルムはポリエチレンと同等の酸素バリア性能を発揮し、紙の使用事例を拡大しています。

地域別分析

アジア太平洋地域は輸出主導型製造業と国内包装機械生産量の8.1%成長により、2025年収益の40.12%を占めました。中東・アフリカ地域は200億米ドル規模の石油化学プロジェクトに支えられ、6.18%のCAGRで地域成長率トップとなる見込みです。

北米ではメキシコ輸出が15%増の4,920億米ドルに達し、ニアショアリングの恩恵を受けております。欧州では循環型経済プロトコルが強化され、リサイクル可能な形態が優遇されております。

サウジアラビアの産業政策により、国連規格に適合する大型ドラム缶や複合IBC容器の需要が拡大。インドでは3,400カロールインドルピー(4億800万米ドル)規模の食品加工投資が繊維系二次包装を促進。日本の化学物質安全規制が高バリア多層包装への転換を後押し。UAEの産業戦略は製造業GDP比率25%を目標とし、地域パレット・コンテナプールの需要を喚起。

アフリカ大陸自由貿易協定(AfCFTA)枠組みは域内貿易を促進し、標準化された産業用パッケージ市場ソリューションの国境を越えた展開の道を開きます。サハラ以南のインフラ整備は、セメントや化学薬品の輸送用大型袋・ドラム需要を拡大します。欧州港湾ではEDI書類の拡大により通関が加速され、バルクコンテナへの国際標準ラベル採用が進んでいます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 持続可能かつリサイクル可能な素材の台頭

- 電子商取引の拡大と越境貿易の流れ

- 食品グレードおよび医薬品バルクロジスティクスの成長

- 現地包装自動化の導入状況

- 再利用可能包装プールビジネスモデル

- 複合IBCに対する水素供給チェーンの需要

- 市場抑制要因

- 樹脂および鋼材価格の変動性

- 世界の環境規制の強化

- バリアコーティングにおけるPFAS/マイクロプラスチック禁止

- ニアショアリングによる長距離輸送包装量の減少

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済要因が市場に与える影響

第5章 市場規模と成長予測

- 製品別

- 中間バルクコンテナ(IBC)

- ドラム缶

- サックス

- ペール缶

- その他の製品

- 材料別

- プラスチック

- 金属

- 紙および繊維ベース

- その他の材料

- エンドユーザー業界別

- 化学品および医薬品

- 食品・飲料

- 自動車

- 石油、ガスおよび石油化学製品

- 建築・建設

- その他のエンドユーザー業界

- 包装容量別

- 50 L以下

- 51-500 L

- 501-1,000 L

- 1,001-2,000 L

- 2,000 L超

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ケニア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- Mondi plc

- Smurfit WestRock

- Amcor plc

- International Paper Company

- Packaging Corporation of America

- Schutz GmbH & Co. KGaA

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG

- Tank Holding Corp.

- Visy Industries Holdings Pty Ltd

- Pact Group Holdings Ltd

- Brambles Limited(CHEP)

- Global-Pak, Inc.

- Nefab AB

- Snyder Industries, LLC

- Myers Container, LLC

- Veritiv Corporation

- Snyder Industries, Inc.

- Pyramid Technoplast Ltd