|

市場調査レポート

商品コード

1910631

音楽:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Music - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 音楽:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

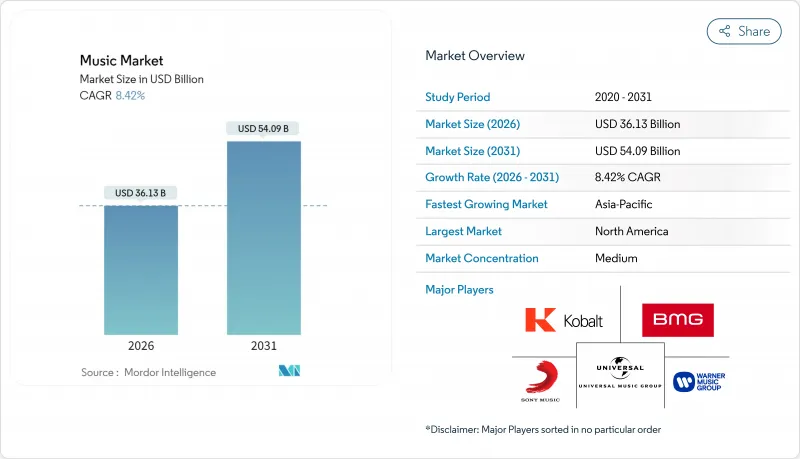

2026年の音楽市場規模は361億3,000万米ドルと推定され、2025年の333億2,000万米ドルから成長が見込まれます。

2031年までの予測では540億9,000万米ドルに達し、2026年から2031年にかけてCAGR8.42%で拡大する見通しです。

2025年時点でストリーミングは音楽市場シェアの67.73%を占め、物理媒体からアクセスベースの消費形態への継続的な移行を裏付けております。これと並行して、演奏権、ライブ体験、商業ライセンシングの拡大が収益成長に深みを加えております。新興経済国におけるスマートフォンの普及、帯域幅の向上、可処分所得の増加が需要の勢いを増幅させる一方、カタログ取得や没入型オーディオフォーマットがプレミアム層の収益化を強化しております。競争戦略では垂直統合とデータ駆動型A&Rが優先され、B2Bライセンシング、ローカライズされたコンテンツ、ファン直販エコシステムに機会が生まれています。

世界の音楽市場の動向と洞察

音楽ストリーミングサブスクリプションの急速な普及

現在、基本サブスクライバー獲得よりもプレミアム層の最適化が重視されています。2024年にSpotifyが独立系レーベルおよび出版社に支払った45億米ドルは、ロイヤルティ支払いの増加を示していますが、同プラットフォームの重点はロスレスコーデック、独占配信、ARPU向上につながるバンドル型バーチャルイベントへと移行しています。高価値層はより豊富なデータ分析を促進し、アーティスト発掘とマーケティング支出効率を形作ります。先進国市場では価格帯の細分化が焦点となる一方、新興地域ではモバイル決済の統合を背景に純粋なボリューム成長を実現しています。この促進要因は総ストリーミング数を増加させ、演奏権収入を押し上げ、ライブ配信コンサートのクロスチャネル・バンドリングを支えています。

新興市場におけるスマートフォンとインターネット普及率の向上

インド、インドネシア、ブラジルにおけるインフラ整備の進展により、新たなリスナー層が創出され、物理的な小売環境の制約を回避するモバイルファーストの消費形態が定着しています。インドの録音音楽収益は2024年に19億米ドル(240億ルピー)に達し、地域言語カタログと低コストデータプランを原動力に、2026年までに29億米ドル(370億ルピー)へ成長する見込みです(CAGR14.7%)。収益化は依然として広告収入に依存した形態が主流ですが、ローカライズされたコンテンツは高いエンゲージメントと広告プレミアムを獲得しています。組み込み型マイクロペイメント機能により、アーティストとファンの直接取引が可能となり、仲介マージンが縮小し、価値分配構造が再構築されています。

持続的な著作権侵害とデジタル海賊版

米国レコード産業協会(RIAA)の推計によれば、2024年の米国における違法消費による収益損失は125億米ドルに上ります。特に法執行が脆弱で広告収入モデルが普及していない地域では、ストリーミングリッピングツールが合法プラットフォームを脅かしています。ピアツーピアプロトコルを活用した分散型流通チャネルは、コンテンツ削除措置を複雑化させます。権利者は、本来ならアーティスト育成に充てられるべき資源を、法的措置や透かし技術に振り向けることになります。このマクロ的な影響により、海賊版が蔓延する地域では投資収益率(ROI)の期待値が低下し、プレミアムサービスの展開が遅れています。

セグメント分析

2025年時点で音楽市場の67.95%を占めるストリーミングは、プレミアム層の拡大と地域浸透の深化に伴い緩やかな成長が見込まれます。演奏権はライブ体験とBGMライセンシングへの再注目を反映し、CAGR9.07%で最も急速な収益増加を貢献します。デジタルダウンロードは急激に縮小し、音楽市場におけるシェアを低下させています。一方、レコードのニッチな復興はコレクター向けのブティック的価値を付加しています。シンクロナイズ権収入は映画やゲームの制作拡大に伴い増加し、加入者数に依存しない非線形的な成長を実現しています。

マーチャンダイジングおよびライセンシング事業は、世界のブランドライセンシングの勢いに支えられ、2024年には前年比16.4%増の50億9,000万米ドルを記録しました。コンサート来場者のグッズ購入率は19%に上昇し、体験型記念品への持続的な需要を示しています。プラットフォームは単一アプリ環境内でチケット販売、ライブストリーミング、グッズ発送へと多角化し、ユーザー1人あたりの生涯価値を高めると同時に、単一収入源への依存を軽減しています。

2025年、ポップ音楽は音楽市場シェア27.65%を維持しましたが、ラテン音楽は国境を越えたコラボレーションとソーシャル動画拡散に適したリズム性を背景に、2031年までの年間平均成長率(CAGR)8.70%という最高成長軌道を示しました。ヒップホップとラップはストリーミング再生回数を維持し、エレクトロニック音楽のサブジャンルはフェスティバル・サーキットと没入型オーディオビジュアル演出の恩恵を受けています。ロックはツアー需要を回復し、プレミアム盤のビニールレコード購入に積極的なノスタルジックなファン層を基盤としています。

DSPのキュレーションが従来の分類よりも「ムード」を重視する中、ジャンル融合が加速しています。メキシコ地方音楽やK-POPは、アルゴリズムによる発見を通じてローカルコンテンツが世界のチャートに躍進する好例です。クラシックとジャズはニッチな分野ながら、一人当たりの支出額が高く、高級広告向けのシンクロナイズ需要に支えられています。ジャンル横断的な多様化は、人気変動の周期的な影響を相殺し、音楽市場全体のパフォーマンスを安定化させています。

地域別分析

北米は2025年時点で音楽市場の34.21%を占め、高いARPU(ユーザー1人あたりの平均収益)と成熟したプレミアム層の浸透が基盤となっています。高度な権利管理構造と充実したライブ公演網が収益化を促進。カナダでは政府支援のコンテンツ基金が国内アーティストの輸出基盤を強化し、米国テックハブでは没入型オーディオとAI推薦エンジンの開発が先行。規制議論はAI生成コンテンツの所有権へ移行し、DSPとメジャーレーベル間で積極的なライセンシング枠組みが構築されています。

アジア太平洋地域は2031年までCAGR9.02%で最も急速に成長する地域です。中国のエコシステムは依然として国内志向ですが、テンセント系プラットフォームは国際的なライセンシング展開を拡大しています。インドの急成長は、現地言語カタログ、ショート動画との連携、摩擦のないマイクロ決済に起因します。日本と韓国は、音楽・ドラマ・ゲームサブスクリプションを組み合わせたエンターテインメントパッケージによるプレミアムコンテンツの収益化を実現しています。地域成長は、継続的なインフラ整備と権利制度の調和に依存します。

欧州では消費者保護規制とカーボン目標を活用し、世界のプラットフォーム基準に影響を与えています。デジタルサービス法により無許可アップロードへの責任が強化され、積極的なコンテンツIDシステムの導入が促進されています。ラテンアメリカではジャンル特化型成長が顕著で、特にレゲトンの主流化が貢献しています。ただし通貨変動がロイヤルティ還流を複雑化させています。中東・アフリカ地域ではユーザー数が急増しているもの、広告収入依存と決済ゲートウェイの制約により収益は伸び悩んでいます。国境を越えたライセンシングコンソーシアムは、経済発展による可処分所得の増加に伴い、取引の効率化と潜在的な支出の解放を目指しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 市場定義と範囲

- 調査の前提条件

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 音楽ストリーミングサブスクリプションの急速な普及

- 新興市場におけるスマートフォンとインターネットの普及率上昇

- ソーシャルメディアおよびショートフォーム動画プラットフォームの成長が音楽発見を促進

- レコード会社およびプライベート・エクイティによる積極的な投資とカタログ買収

- 没入型オーディオフォーマット(ドルビーアトモス、ソニー360RA)の普及がARPUを押し上げる

- ブロックチェーンを活用したファン向け直接収益化モデル(NFT、分割所有権)

- 市場抑制要因

- 持続的な著作権侵害とデジタル海賊行為

- トップクリエイター側の交渉力強化がロイヤルティコストを押し上げる

- 新興市場におけるライセンシング制度の分断化がサービス開始を遅延させています

- ストリーミング向けデータセンターのエネルギー使用に対する炭素排出量の監視強化

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界利害関係者分析

- マクロ経済要因が市場に与える影響

第5章 市場規模と成長予測

- 収益創出形式別

- ストリーミング

- デジタルダウンロード(ストリーミングを除く)

- 物理製品

- 公演権

- 同期収益

- マーチャンダイジング・ライセンシング事業

- ジャンル別

- ポップ

- ロック

- ヒップホップ/ラップ

- エレクトロニック/ダンス

- クラシック

- ジャズ

- カントリー

- ラテン

- 流通チャネル別

- オンラインプラットフォーム

- オフライン/実店舗小売

- エンドユーザー別

- 個人消費者

- 商業施設(バー、ホテル、小売店)

- メディア・エンターテインメント制作会社(映画、テレビ、ゲーム)

- ブランドおよび広告主

- イベントおよびコンサート主催者

- 地域別

- 北米

- 米国

- カナダ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリアおよびニュージーランド

- その他アジア太平洋

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Universal Music Group N.V.

- Sony Music Entertainment(Sony Corporation of America)

- Warner Music Group Corp.

- BMG Rights Management GmbH

- Kobalt Music Group Ltd.

- Spotify Technology S.A.

- Apple Inc.(Apple Music)

- Amazon.com, Inc.(Amazon Music)

- Alphabet Inc.(YouTube Music)

- Tencent Music Entertainment Group

- Deezer S.A.

- Tidal Music AS

- SoundCloud Global Limited and Co. KG

- Pandora Media, LLC(Sirius XM Holdings Inc.)

- NetEase Cloud Music(NetEase, Inc.)

- Anghami Inc.

- Melon Company(Kakao Entertainment)

- Yandex Music LLC

- Boomplay Music Group Limited

- JioSaavn LLC

- KKBOX Inc.

- Curb Records, Inc.

- Believe S.A.

- CD Baby, Inc.