|

|

市場調査レポート

商品コード

1640540

ウェアラブルテクノロジー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Wearable Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ウェアラブルテクノロジー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

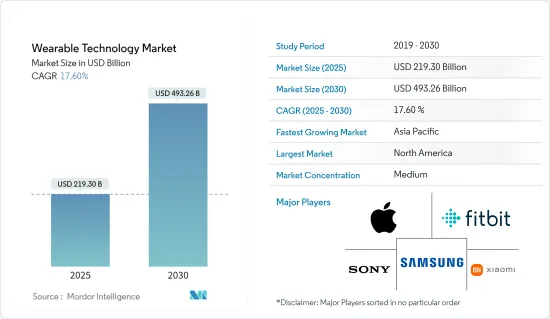

ウェアラブルテクノロジー市場規模は2025年に2,193億米ドルと推定され、予測期間(2025-2030年)のCAGRは17.6%で、2030年には4,932億6,000万米ドルに達すると予測されます。

主なハイライト

- ウェアラブルテクノロジーの進化は、MEMSセンサの台頭によるところが大きいです。特に、GPSとIMU(加速度計、ジャイロスコープ、地磁気計で構成)に大きく依存するスマートフォンの普及を受けて、ウェアラブルデバイスにはこれらのセンサーが統合されるようになった。この統合により、フィットネス・トラッキング・ウェアラブルの機能が大幅に向上し、さまざまな身体活動を詳細にモニターできるようになった。

- コンシューマリズムにおける技術の進歩は、健康をモニターし、動きを追跡し、ソーシャルメディア通知を提供するウェアラブルテクノロジーの台頭につながった。スマートウォッチ、フィットネストラッカー、VR/ARヘッドセットなどのデバイスは、人口の間でますます普及しています。その結果、ウェアラブルの人気は今後も高まり続けると予想され、企業は日常生活にウェアラブルを取り入れる革新的な方法を模索する必要に迫られています。

- スマート衣料は、特にウェアラブルテクノロジー市場において大幅な需要増を経験しており、健康とフィットネス業界を変革しようとしています。e-テキスタイルまたはスマート・ファブリックとして知られるこれらの衣服は、高度なセンサー、ハードウェア、テキスタイルを組み込んでおり、従来の衣服を凌駕するパーソナライズされたインサイトとモニタリング機能を提供します。着用者の活動、睡眠パターン、心拍数、血圧、体温などの健康指標を追跡する能力により、同市場は予測期間中に大幅な成長が見込まれます。

- しかし、ウェアラブルテクノロジーの急速な普及により、特に個人の健康データの管理と保護において、倫理やプライバシーに関する重大な懸念が浮き彫りになっており、これが市場の成長に課題となっています。例えば、最近の事件では、フィットネストラッカーやウェアラブルに関連する6,100万件以上の記録を含む安全性の低いデータベースが、アップルやフィットビットユーザーのデータをネット上に流出させました。WebsitePlanetとセキュリティ研究者は、フィットネストラッキングやウェアラブルデバイス、アプリから数千万件のレコードを含む、パスワードで保護されていないこのデータベースを発見しました。保護されていないデータベースは、何百ものウェアラブル、医療機器、アプリから健康とウェルネスのデータにアクセスするための統合ソリューションを提供するGetHealth社のものだった。

- ウェアラブルテクノロジー市場は、COVID-19の大流行からさまざまな影響を受けました。良い面では、消費者がバイタルサインや睡眠パターンをモニターしようとしたため、フィットネストラッカーやスマートウォッチなど、健康に焦点を当てたウェアラブルの需要が増加し、個人の健康への関心の高まりを反映しました。ウェアラブルはまた、患者の遠隔監視に大きな役割を果たし、病院の負担を軽減しました。しかし、ロックダウンは生産とサプライチェーンを混乱させ、製品の入手性に影響を与えました。景気減速により、一部の消費者はウェアラブルよりも必需品の購入を優先するようにもなった。

- パンデミック後の時代には、健康意識の高まりと遠隔患者モニタリングの継続的成長により、市場は回復しました。血圧モニタリングや転倒検知などの機能を備えたウェアラブルの進歩により、ウェアラブルは予防的・積極的ヘルスケアにおける貴重なツールとして確固たる地位を築き、高い需要が見込まれます。

ウェアラブルテクノロジー市場動向

スマートウォッチが市場成長を牽引する見込み

- 数多くの利点に後押しされ、若年層の間でスマートウォッチへの関心が高まっていることが、市場の成長を後押しする重要な要因となっています。常につながっていることが重視されるようになり、スマートウォッチの需要が急増しています。今日のスマートウォッチは、ユーザーが手首でシームレスに通知、通話、メッセージを受信できるため、ポケットやバッグからスマートフォンを取り出す必要がなく、指先ですべてを操作できます。

- 例えば、Huawei European Health Survey 2023によると、スペインの回答者の45%がスマートウォッチを所有していると回答し、2023年時点で68%が健康目的で新しいスマートウォッチの購入に興味を示しています。一方、トルコでは回答者の80%近くが健康機能を備えた新しいスマートウォッチの購入に関心を持っていました。

- スマートウォッチメーカーは、アスリート、スポーツ愛好家、冒険を求める人など、特定の消費者層をターゲットにした製品イノベーションを戦略的に進めています。このようなニッチに焦点を当てることで、売上拡大を狙っています。これらのスマートウォッチはフィットネス指標を提供するだけでなく、重要な健康パラメータに関する洞察を提供することで、より健康的なライフスタイルを促進します。

- スマートウォッチへの拡張現実(AR)の統合は、スマートウォッチの需要を大きく成長させる要因になると見られています。ARは、ユーザーが手首に装着したデバイスを通じて現実世界にデジタル情報を重ね合わせることを可能にすることで、スマートウォッチをさらに進化させようとしています。この動向は、ナビゲーションやゲーム、さらには教育にも応用される可能性があり、ユーザーと周囲の環境との関わり方に革命をもたらします。

- さらに、調査対象市場で事業を展開するベンダーは、新技術を統合したスマートウォッチを発表しています。例えば、Realmeは2024年7月、ChatGPTによるAIアシスタントを搭載したRealme Watch S2を発表しました。この時計は、手首に直接インテリジェントな回答や支援を提供することで、他のスマートウォッチとは一線を画し、シームレスでスマートなユーザー体験を提供しています。このような技術革新は、世界の若年層や技術に精通した人々の間でスマートウォッチの採用をさらに促進しています。

北米が主要市場シェアを占める見込み

- この地域の消費者は、新技術をいち早く取り入れることで知られています。ライフスタイルを向上させたり、健康上のメリットをもたらすガジェットやウェアラブル製品に対する消費者の強い関心が需要の増加を促し、ウェアラブルテクノロジー分野のさらなる発展を促進しています。この地域は、平均可処分所得が高いという利点があります。このような経済的柔軟性により、消費者は裁量的なアイテム、特にウェアラブル製品により多くの支出をすることが可能となり、市場の成長可能性が拡大しています。

- 同地域の人口は、ますます健康と幸福を優先するようになっています。フィットネス指標、睡眠パターン、健康バイタルをモニターするウェアラブルは、この需要に対応しています。このような予防ヘルスケアへの注目は、革新的なウェアラブルソリューションの強力な市場を牽引しています。特に、米国国立心肺血液研究所(NHLBI)が実施した「健康情報全国動向調査」の結果によると、米国成人の約3分の1がスマートウォッチなどのウェアラブル端末を使用して健康状態を把握しています。ウェアラブルデバイスユーザーのうち、80%以上が健康モニタリング強化のためにデバイスデータを医師と共有することを望んでいます。しかし、心血管疾患を患っているか、そのリスクがある成人の4人に1人未満しかウェアラブル端末を使用していないです。

- 高給取りのプロスポーツ選手が予防可能な怪我をする可能性を排除するために、多くのスポーツ協会が投資を増やしていることが、この地域における市場の成長を促進すると予想されます。例えば、ゴールデンステート・ウォリアーズは、スマート衣料メーカーのアトスと協力し、怪我予防と選手のパフォーマンス向上のためにこれらの製品を使用しています。この投資は、スマート・ウェア業界情勢における米国の陸上競技部門の関与のほんの一部に過ぎないです。

- 米国以外では、カナダでもウェアラブルの需要が高まっています。同国は、軍事プログラム(衣料品を含む)のために十分な支出と資金を提供すると予想されています。ベルは米国とカナダでさまざまな特許を取得しており、そのウェアラブルテクノロジーが、病気の愛する人を監視したい個人と、大規模な集団を追跡したい機関の両方でどのように利用されるかという包括的なビジョンを示しています。

- さらに2023年10月、クアルコム・テクノロジーズ社とグーグルは戦略的パートナーシップを確立し、グーグルのWear OS向けに設計されたRISC-Vベースのウェアラブルソリューションを発表しました。この高度なフレームワークは、エコシステム内でのカスタム、電力効率、高性能CPUの統合を推進することを目的としています。両社は、Snapdragon Wearプラットフォームの強化に取り組んでおり、Wear OSエコシステム向けのスマートウォッチシリコンの主要プロバイダとしてのクアルコムの地位を強化しています。このような戦略的イニシアチブは、この地域における市場の成長をさらに促進しています。

ウェアラブルテクノロジー産業の概要

ウェアラブル市場競争は中程度であり、複数のプレーヤーが大きなシェアを占めています。これらのプレーヤーは、市場での競争力を維持するために、製品や技術の革新、提携、合併、買収を行っています。

- 2024年7月:サムスンはパリで開催された製品発表会で、AIを搭載したGalaxy Ringを発表し、スマートリング市場への参入を表明しました。この戦略的な動きは、サムスンのウェアラブルテクノロジー・ポートフォリオを拡大するだけでなく、ヘルス・モニタリング分野での地位も強化します。これらの新しいウェアラブルにはサムスンの最先端技術が組み込まれており、ユーザーにプロアクティブ・ヘルスケア・ソリューションを提供し、市場でのリーダーシップを強化しています。

- 2024年6月AIを搭載したタッチレス・センシング・ウェアラブルに特化した技術企業であるWearable Devices Ltd.は、Augmented World Expo(AWE)2024で、Qualcomm Technologies社との協力による拡張現実(XR)の統合における最新の能力を披露しました。この提携により、Wearable Devices社の革新的なウェアラブルソリューションとクアルコムの最先端のXR技術の相乗効果が強調され、消費者と企業の両方にとって没入型体験の変革が期待されます。

- 2024年5月ByteDance Ltd社は、中国のイヤホンメーカーであるOladance社を約5,000万米ドルで買収しました。この買収は、ByteDanceのウェアラブルテクノロジーへの戦略的シフトを浮き彫りにし、スマートフォン以外の技術的足跡を拡大する可能性があります。ByteDanceの子会社であるTikTokは、この買収を完了させ、深センでOladanceと協力するために人員を配置しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 業界バリューチェーン分析

- COVID-19がウェアラブルテクノロジー市場に与える影響

第5章 市場力学

- 市場促進要因

- フィットネスやヘルスケアで使用される小型デバイスに対する顧客の嗜好の高まり

- ウェアラブルデバイスの次世代ディスプレイの成長見込みの高まり

- ヘッドマウントディスプレイの利用拡大

- 市場抑制要因

- バッテリー寿命の短さ

第6章 市場セグメンテーション

- デバイスタイプ別

- スマートウォッチ

- ヘッドマウントディスプレイ

- リストバンド

- イヤーウェアラブル

- その他のデバイスタイプ(スマート衣料)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Samsung Group

- Oculus VR LLC(Facebook)

- Alphabet Inc.

- Sony Corporation

- HTC Corporation

- Fitbit Inc.

- Xiaomi Inc.

- Apple Inc.

- Microsoft Corporation

- DAQRI Company

- AIQ Smart Clothing Inc.

第8章 投資分析

第9章 市場の将来

目次

Product Code: 54484

The Wearable Technology Market size is estimated at USD 219.30 billion in 2025, and is expected to reach USD 493.26 billion by 2030, at a CAGR of 17.6% during the forecast period (2025-2030).

Key Highlights

- The evolution of wearable technology is largely attributed to the rise of MEMS sensors. Wearable devices now integrate these sensors, particularly in response to the widespread use of smartphones, which heavily rely on GPS and IMU (comprising an accelerometer, gyroscope, and magnetometer). This integration has significantly enhanced the capabilities of fitness-tracking wearables, enabling them to closely monitor various body activities.

- Technological advancements in consumerism have led to the rise of wearable technology that monitors health, tracks movements, and provides social media notifications. Devices such as smartwatches, fitness trackers, and VR/AR headsets are becoming increasingly prevalent among the population. Consequently, the popularity of wearables is expected to continue growing, prompting companies to find innovative ways to integrate them into daily life.

- Smart clothing is experiencing a significant increase in demand, particularly within the wearable technology market, and is set to transform the health and fitness industry. Known as e-textiles or smart fabrics, these garments incorporate advanced sensors, hardware, and textiles, providing personalized insights and monitoring capabilities that surpass traditional clothing. With their ability to track the wearer's activity, sleep patterns, and health indicators such as heart rate, blood pressure, and body temperature, the market is expected to see substantial growth over the forecast period.

- However, the rapid adoption of wearable technology has highlighted significant ethical and privacy concerns, particularly in managing and protecting personal health data, which challenges the market's growth. For example, a recent incident involved an unsecured database containing over 61 million records related to fitness trackers and wearables, exposing data of Apple and Fitbit users online. WebsitePlanet and security researchers discovered this non-password-protected database, which contained tens of millions of records from fitness tracking and wearable devices and apps. The unsecured database belonged to GetHealth, a company that provides a unified solution to access health and wellness data from hundreds of wearables, medical devices, and apps.

- The wearable technology market experienced a mixed impact from the COVID-19 pandemic. On the positive side, demand for health-focused wearables, such as fitness trackers and smartwatches, increased as consumers sought to monitor vital signs and sleep patterns, reflecting a heightened focus on personal well-being. Wearables also played a significant role in remote patient monitoring, reducing the strain on hospitals. However, lockdowns disrupted production and supply chains, affecting product availability. The economic slowdown also led some consumers to prioritize essential purchases over wearables.

- In the post-pandemic era, the market has rebounded due to increased health awareness and the continued growth of remote patient monitoring. Advancements in wearables with features like blood pressure monitoring and fall detection are expected to see high demand, solidifying wearables as valuable tools in preventive and proactive healthcare.

Wearable Technology Market Trends

Smartwatches Expected to Drive Market Growth

- The increasing interest in smartwatches among the younger demographic, driven by their numerous benefits, is a key factor propelling the market's growth. With a growing emphasis on staying connected, the demand for smartwatches has surged. Today's smartwatches enable users to seamlessly receive notifications, calls, and messages on their wrists, eliminating the need to retrieve their smartphones from pockets or bags, providing everything at their fingertips.

- For instance, according to Huawei European Health Survey 2023, 45% of respondents in Spain reported they owned a smartwatch, while 68% expressed interest in buying a new smartwatch for health purposes as of 2023. Meanwhile, almost 80% of respondents in Turkey were interested in purchasing a new smartwatch with health features.

- Smartwatch manufacturers are strategically targeting specific consumer segments, such as athletes, sports enthusiasts, and adventure seekers, through tailored product innovations. By focusing on these niches, they aim to drive sales growth. These smartwatches not only provide fitness metrics but also promote a healthier lifestyle by offering insights into vital health parameters.

- The integration of augmented reality (AR) into smartwatches is poised to be a significant growth driver in the demand for smartwatches. AR is set to elevate smartwatches by enabling users to overlay digital information onto the real world through their wrist-worn devices. This trend could have applications in navigation, gaming, and even education, revolutionizing how users interact with their surroundings.

- Furthermore, the vendors operating in the market studied are introducing smartwatches with new technology integration. For instance, in July 2024, Realme launched its Realme Watch S2, enabled with AI assistant powered by ChatGPT, which distinguishes this watch from other smartwatches by delivering intelligent answers and assistance directly on the wrist, offering a seamless and smart user experience. Such innovations are further driving the adoption of smartwatches among younger and tech-savvy populations globally.

North America Expected to Hold Major Market Share

- Consumers in the region are recognized for their early adoption of new technologies. Their strong interest in gadgets and wearables, which either enhance their lifestyles or provide health benefits, has driven increased demand, thereby fostering further advancements in the wearable tech sector. The region benefits from a higher average disposable income. This financial flexibility enables consumers to spend more on discretionary items, particularly wearables, thereby expanding the market's growth potential.

- The region's population is increasingly prioritizing health and well-being. Wearables, which monitor fitness metrics, sleep patterns, and health vitals, are addressing this demand. This focus on preventive healthcare is driving a strong market for innovative wearable solutions. Notably, findings from the Health Information National Trends Survey, conducted by the National Heart, Lung, and Blood Institute (NHLBI), indicate that nearly a third of American adults use wearables, such as smartwatches, to track their health. Among wearable device users, over 80% of these users are willing to share their device data with their doctors for enhanced health monitoring. However, less than one in four adults with or at risk for cardiovascular disease uses a wearable device.

- Increasing investments by numerous sports associations to eliminate the possibility of any preventable injuries to highly paid professional athletes are expected to fuel the growth of the market in the region. The Golden State Warriors, for instance, are collaborating with smart clothing company Athos to use these products for injury prevention and player performance. This investment represents only a fraction of the involvement of the US athletics sector in the smart clothing industry landscape.

- Apart from the United States, the demand for wearables is also increasing in Canada. The country is expected to provide sufficient expenditures and funding for its military programs (including clothing). Bell has various patents in the United States and Canada that lay out a comprehensive vision for how its wearable technology could be used both by individuals looking to monitor ill loved ones and by institutions wanting to track large populations.

- Moreover, in October 2023, Qualcomm Technologies Inc. and Google established a strategic partnership, introducing a RISC-V-based wearables solution designed for Wear OS by Google. This advanced framework aims to drive the integration of custom, power-efficient, and high-performance CPUs within the ecosystem. Both companies are dedicated to enhancing the Snapdragon Wear platforms, reinforcing Qualcomm's position as the leading provider of smartwatch silicon for the Wear OS ecosystem. Such strategic initiatives are further augmenting the market's growth in the region.

Wearable Technology Industry Overview

The wearable technology market is moderately competitive, with several players holding significant shares and the presence of numerous smaller and niche players operating in the market. These players are witnessing product and technology innovation, partnerships, mergers, and acquisitions to maintain a competitive edge in the market.

- July 2024: At a product launch event in Paris, Samsung introduced its AI-powered Galaxy Ring, marking the company's entry into the smart ring market. This strategic move not only expands Samsung's wearable technology portfolio but also strengthens its position in the health monitoring sector. These new wearables incorporate Samsung's most advanced technologies, providing users with proactive healthcare solutions and reinforcing its market leadership.

- June 2024: Wearable Devices Ltd, a technology company specializing in AI-powered touchless sensing wearables, showcased its latest capabilities in the integration of extended reality (XR) in collaboration with Qualcomm Technologies at the Augmented World Expo (AWE) 2024. This partnership underscores the synergy between Wearable Devices' innovative wearable solutions and Qualcomm's state-of-the-art XR technology, which is poised to transform immersive experiences for both consumers and businesses.

- May 2024: ByteDance Ltd acquired Oladance, a Chinese earphone manufacturer, for approximately USD 50 million. This acquisition highlights ByteDance's strategic shift toward wearable technology, potentially expanding its technological footprint beyond smartphones. TikTok, a subsidiary of ByteDance, has finalized the transaction and deployed its personnel to collaborate with Oladance in Shenzhen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on Wearable Technology Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Customer Preference for Svelte and Small Devices for use in Fitness and Healthcare

- 5.1.2 Rising Growth Prospects for Wearable Devices' Next-Generation Displays

- 5.1.3 Rising use of Head-Mounted Displays

- 5.2 Market Restraints

- 5.2.1 Short Battery Life

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Smart Watches

- 6.1.2 Head-mounted Displays

- 6.1.3 Wristbands

- 6.1.4 Ear-wearables

- 6.1.5 Other Device Types (Smart Clothing)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 India

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Group

- 7.1.2 Oculus VR LLC (Facebook)

- 7.1.3 Alphabet Inc.

- 7.1.4 Sony Corporation

- 7.1.5 HTC Corporation

- 7.1.6 Fitbit Inc.

- 7.1.7 Xiaomi Inc.

- 7.1.8 Apple Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 DAQRI Company

- 7.1.11 AIQ Smart Clothing Inc.