|

市場調査レポート

商品コード

1640695

高度認証-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Advanced Authentication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 高度認証-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

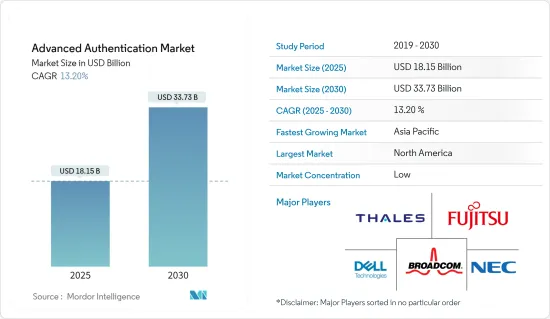

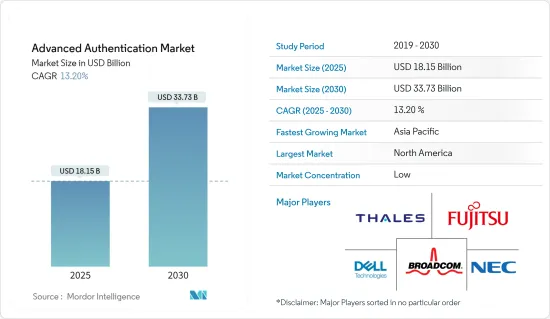

高度認証市場の市場規模は2025年に181億5,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは13.2%で、2030年には337億3,000万米ドルに達すると予測されます。

高度認証市場を牽引する要因としては、モビリティの導入が進み、企業は従業員やパートナー、その他の利害関係者がより機密性の高い情報にアクセスできるようにしなければならないというプレッシャーを感じていることが挙げられます。セキュリティの脅威は増加の一途をたどっています。ハッカーはデータを盗む新しい方法を見つけ、企業や個人ユーザーから機密情報を盗む新しいウイルスが開発されています。ほとんどのユーザーがオンラインでの取引を好むようになった現在、便利で安全なアクセスを保証する認証ソリューションの導入は組織にとって不可欠となっています。

主要ハイライト

- あらゆる組織は、何かの真実や個人のID確認を確認するために、信頼できるセキュリティシステムを必要としています。基本的なパスワードや伝統的パスワードが破られたり、コピーされたり、共有されたりして、データが盗まれたり、ハッキングされたりするリスクがあります。

- モビリティの採用が増加していることも、高度認証ソリューション市場の成長に寄与している要因です。企業は、従業員、パートナー、その他の利害関係者が、どこからでも、どのデバイスからでも、より機密性の高い情報にアクセスできるようにしなければならないというプレッシャーを感じています。このため、高度認証システムは、企業の組織戦略にとって重要な側面となっています。

- 高度認証ソリューションのベンダーは、既存の認証方法を開発し、改良しています。最も一般的に使用されている認証方法には、バイオメトリクス、スマートカード、トークンなどがあり、セキュリティリスクを軽減しています。

- さらに、企業はセキュリティを強化するために、ユーザーに対して二段階認証を自動で有効にしています。例えば、Googleは昨年この取り組みを発表し、プレスリリースで、この取り組みによってパスワードの盗難によって乗っ取られるアカウント数が50%減少したと指摘した後、2022年2月に1億5,000万人以上のユーザーに対して2段階認証を有効にしました。この取り組みでは、200万人のYouTubeユーザーにも有効化を求めています。

- サイバー犯罪者は、COVID-19の期間中に攻撃を急ピッチで強化し、不安定な社会・経済状況による不安や恐怖を利用しています。インターポールは、COVID-19がサイバー犯罪にどのような影響を与えたかを調査し、主要標的が個人や中小企業から大企業、重要インフラ、政府へと変化したことを明らかにしました。

また、POLITICOの分析によると、米国では昨年、約5,000万人が機密の健康データを侵害され、過去3年間で3倍に増加しました。昨年、サウスダコタ州を除くすべての州で、医療プロバイダーや保険会社からこの種の問題が報告されました。このため、今後数年間は高度認証の必要性が高まりました。

高度認証市場の動向

バイオメトリクスが予測期間中に大きな市場シェアを占める

- バイオメトリクスは、指紋、網膜、虹彩、手のひら、音声、音声など、人間の身体的特徴に基づいて個人を分析・認証します。この認証方法は、その主要利点、すなわち、否認不能、譲渡不能、特定不能であるため、不正行為から高度に保護されることから、広く採用されています。

- この技術は、フォレンジック、政府、銀行と金融機関、企業ID管理など、さまざまなエンドユーザーにわたって導入が成功しています。さらに、手ごろな価格のモバイル機器に指紋センサが広く搭載されるようになったことや、政府の国民IDプログラムによって、この技術の認知度と採用率が高まっている

- 2022年9月、道路交通・高速道路省(MoRTH)は、市民がAadhaarデジタルIDを使っていくつかの交通関連サービスをオンラインで利用できるようにする通達を出しました。このようなサービスを非接触かつフェイスレスで提供することは、市民のコンプライアンス負担を軽減すると同時に、時間の節約に大いに役立つと考えられます。

- また、2022年5月、Mastercardは生体認証基準を設定するプログラムを開始し、消費者が笑顔で支払えるようになりました。同社のバイオメトリック・チェックアウト・プログラムは、バイオメトリック決済認証サービスを開発する銀行、加盟店、技術プロバイダーのための技術セキュリティとプライバシー基準を設定する枠組みです。

- さらに2022年6月、国家データベース登録局(Nadra)と首都開発局(CDA)は、イスラマバードでより安全な財産移転のための包括的な生体認証システムを開発する契約を締結しました。このシステムは、イスラマバードでの不動産譲渡に関する偽造を減らし、違法な手段や人物による欺瞞的な試みを排除するのに役立ちます。CDAでは年間約2万件の不動産売買・譲渡取引が行われています。

北米が大きな市場シェアを占める

- 米国内の組織は、日常業務を遂行する上でコンピューター・ネットワークや電子データへの依存度を高めており、個人情報や財務情報もオンラインで転送・保管されることが増えています。人々は日々の取引にオンラインサービスを利用する傾向が高まっています。このため、高度認証サービスの重要性が高まっている

- さらに、同国の組織犯罪に関与するプロのID窃盗犯の洗練されたレベルは向上し続けており、同国の企業による対策の必要性が生じています。また、BYODの動向はますます大きくなっており、スマートカード、物理的トークン、KPI(Key Performance Indicator)などの高度認証方法が、機密情報へのアクセスやクライアント・サーバーへのログインに使用されやすくなっています。

- 認証をより安全にするため、銀行、小売、医療など、この地域の多くのエンドユーザー産業は、マイクロチップ付きのクレジットカードやデビットカードだけでなく、オンラインサービスやクラウドサービスに双方向認証システムを追加しています。

- 2022年10月、ID認証ソフトウェアメーカーのMitek Systemsは、マルチモーダル生体認証を用いたパスワードレス認証プラットフォームを発表しました。このプラットフォームは、ユーザーが自撮り写真を撮ったり、携帯電話でフレーズを話したりすることで、デジタルアカウントにアクセスできるようにするものです。 こうした展開により、対象となっている北米市場が活性化しています。

さらに、BIO-Key International Inc.は、BIO-Key MobileAuthを2022年5月にアップグレードし、複数の認証ソリューションを不要にすると発表しました。新しいバイオメトリクス認証とプッシュ・トークン認証のオプションにより、より幅広いユースケースをサポートし、従来の認証の不十分さに対処します。

高度認証産業概要

高度認証市場は競争が激しく、複数の大手企業で構成されています。市場シェアでは、現在数社が市場を独占しています。市場で圧倒的なシェアを持つこれらの大手企業は、海外における顧客基盤の拡大に注力しています。これらの企業は、市場シェアと収益性を高めるために、戦略的な協業イニシアティブを活用しています。

2022年10月、NECマレーシアは、IRIS Corporation Berhad(IRIS)の子会社であるIRIS Information Technology Systems Sdn Bhd(IITS)がマレーシアの国家統合入国管理システム(NIISe)に国境管理ソリューションと自動生体認証システムを導入するための技術パートナーとして選定されました。

2022年10月、ExperianとProve Identity Inc.は、高度本人確認技術を通じて金融包摂を推進する世界のパートナーシップを発表しました。この提携により、企業は暗号認証などの高度本人確認技術を利用できるようになり、より多くの消費者を迅速かつ安全に確認できるようになります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 政府の規制と施策

- 技術スナップショット

- 技術概要

- 展開方法

- さまざまな認証方法

- 高度認証アプリケーション

第5章 市場力学

- 市場促進要因

- クラウドユーザー数とデータセンター数の増加

- セキュリティ侵害件数と関連コストの増加

- 市場抑制要因

- 高いアップグレードと交換コスト

第6章 市場セグメンテーション

- 認証方式

- スマートカード

- バイオメトリクス

- モバイルスマートクレデンシャル

- トークン

- ユーザーベースの公開鍵基盤

- その他の認証方法

- エンドユーザー産業

- BFSI

- 医療

- 政府機関

- 防衛

- ITとテレコム

- その他

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- メキシコ

- ブラジル

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Fujitsu Ltd.

- Thales Group(Gemalto NV)

- NEC Corp.

- Broadcom Inc.(CA Technologies)

- Dell Technologies Inc.

- Safran Identity and Security SAS

- Lumidigm Inc.

- Validsoft

- Pistolstar

- Securenvoy

第8章 投資分析

第9章 市場機会と今後の動向

The Advanced Authentication Market size is estimated at USD 18.15 billion in 2025, and is expected to reach USD 33.73 billion by 2030, at a CAGR of 13.2% during the forecast period (2025-2030).

Factors driving the Advanced Authentication Market include increased adoption of mobility, and enterprises are feeling pressure to enable employees, partners, and other stakeholders to access more sensitive information. Security threats have been increasing continuously. Hackers are finding new ways to steal data, while new viruses are being developed to steal sensitive information from enterprises and individual users. With most users now preferring to perform transactions online, it becomes imperative for the organization to deploy authentication solutions that help ensure convenient and secure access.

Key Highlights

- Every organization needs a reliable security system to confirm the truth of something or a person's identity. Too often, the basic or traditional password method is broken, copied, or shared, putting data at risk of being stolen or hacked.

- The increased adoption of mobility is the other factor contributing to the growth of the market for advanced authentication solutions. Enterprises are feeling pressure to enable employees, partners, and other stakeholders to access more sensitive information from anywhere and on any device. This makes advanced authentication systems a critical aspect of an enterprise's organizational strategy.

- Vendors of advanced authentication solutions are developing and improving their existing authentication methods. Some of the most commonly used authentication methods are biometrics, smartcards, tokens, and several others for mitigating security risks.

- Further, companies are auto-enabling two-step verification for users for enhanced security. For instance, in February 2022, Google enabled two-step verification for more than 150 million users after announcing the effort last year and noting in a press release that the action had caused the number of accounts hijacked by password theft to decrease by 50%. The initiative has also involved requiring two million YouTube users to enable it.

- Cybercriminals have boosted their attacks at a rapid pace amid COVID-19, thereby exploiting the uncertainty and fear caused by the unstable social and economic situation. Interpol looked at how COVID-19 affected cybercrime and found that the main targets had changed from individuals and small businesses to large corporations, critical infrastructure, and governments.

Also, according to a POLITICO analysis, nearly 50 million people in the United States had their sensitive health data breached last year, a threefold increase in the last three years. Last year, these kinds of problems were reported by healthcare providers and insurers in every state except South Dakota. This increased the need for advanced authentication over the next few years.

Advanced Authentication Market Trends

Biometrics to Hold Significant Market Share During the Forecast Period

- Biometrics analyzes and authenticates individuals based on human physical characteristics, such as fingerprint, retina, iris, palm, speech, and voice, among others. This authentication method has been widely adopted, owing to its key advantages, namely its non-repudiation, non-transferable, and non-identifiable nature, thus providing a high level of protection against fraud.

- The technology has found successful implementation across various end-users, such as forensics, governments, banking and financial institutions, and enterprise identity management, among others. Moreover, the widespread availability of fingerprint sensors in affordable mobile devices and the government's national ID programs have increased awareness and adoption of this technology.

- In September 2022, The Ministry of Road Transport and Highways (MoRTH) issued a notification allowing citizens to access several transport-related services online with their Aadhaar digital ID. Providing such services in a contactless and faceless manner will go a long way in saving time for citizens while easing their compliance burden.

- Also, in May 2022, Mastercard launched a program to set biometric authentication standards, allowing consumers to pay with a smile. The company's Biometric Checkout Program is a framework to set technology security and privacy standards for banks, merchants, and technology providers developing biometric payment authentication services.

- Furthermore, in June 2022, National Database and Registration Authority (Nadra) and Capital Development Authority (CDA) signed an agreement to develop a comprehensive biometric verification system for safer property transfers in Islamabad. The system will help reduce forgery and eliminate deceptive attempts by illegitimate means or persons regarding the transfer of properties in Islamabad. Approximately 20,000 transactions of sale, purchase, and transfer of properties take place annually in CDA.

North America to Hold a Significant Market Share

- Organizations across the United States are increasingly dependent on computer networks and electronic data to conduct their daily operations, and growing pools of personal and financial information are also transferred and stored online. People are more likely to use online services for day-to-day transactions. This has made it more important for the country to have advanced authentication services.

- Moreover, the sophistication level of professional identity thieves involved in organized crime in the country continues to grow, creating a need for countermeasures to be used by companies in the country. Also, the BYOD trend is getting bigger and bigger, which makes it easier for advanced authentication methods like smart cards, physical tokens, and key performance indicators (KPIs) to be used to access sensitive information or log in to client servers.

- To make authentication more secure, many end-user industries across the region, such as banking, retail, and healthcare, have added two-way authentication systems to their online or cloud services, as well as credit and debit cards with microchips.

- In October 2022, Mitek Systems, an ID verification software maker, launched a passwordless authentication platform with multimodal biometrics. The platform enables users to access digital accounts by taking a selfie and speaking a phrase with their phone. Such developments are boosting the North American market under consideration.

Furthermore, BIO-Key International Inc announced that its BIO-Key MobileAuth will be upgraded in May 2022, eliminating the need for multiple authentication solutions. New biometric and push token authentication options to support a wider range of use cases and address the insufficiencies of traditional authentication.

Advanced Authentication Industry Overview

The advanced authentication market is highly competitive and consists of several major players. In terms of market share, few players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In October 2022, NEC Malaysia was selected as a technology partner for the implementation of its border Control Solution and Automated Biometric Identification System for Malaysia's National Integrated Immigration System (NIISe), IRIS Information Technology Systems Sdn Bhd (IITS), a subsidiary of IRIS Corporation Berhad (IRIS).

In October 2022, Experian and Prove Identity Inc announced a global partnership to further financial inclusion through advanced identity verification technology. The partnership will give more access to companies for advanced identity technology, such as cryptographic authentication, that they can use to verify more consumers in a quick and secure manner.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Government Policies and Industry Regulations

- 4.5 TECHNOLOGY SNAPSHOT

- 4.5.1 Technology Overview

- 4.5.2 Deployment Methods

- 4.5.3 Different Authentication Methods

- 4.5.4 Advanced Authentication Applications

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Number of Cloud Users and Data Centers

- 5.1.2 Increasing Number of Security Breaches and Related Costs

- 5.2 Market Restraints

- 5.2.1 High Upgrade and Replacement Costs

6 MARKET SEGMENTATION

- 6.1 Authentication Methods

- 6.1.1 Smart Cards

- 6.1.2 Biometrics

- 6.1.3 Mobile Smart Credentials

- 6.1.4 Tokens

- 6.1.5 User-based Public Key Infrastructure

- 6.1.6 Other Authentication Methods

- 6.2 End-user Industry

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Government

- 6.2.4 Defense

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd.

- 7.1.2 Thales Group (Gemalto NV)

- 7.1.3 NEC Corp.

- 7.1.4 Broadcom Inc. (CA Technologies)

- 7.1.5 Dell Technologies Inc.

- 7.1.6 Safran Identity and Security SAS

- 7.1.7 Lumidigm Inc.

- 7.1.8 Validsoft

- 7.1.9 Pistolstar

- 7.1.10 Securenvoy