|

市場調査レポート

商品コード

1685701

藻類オメガ3成分:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Algae Omega-3 Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 藻類オメガ3成分:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

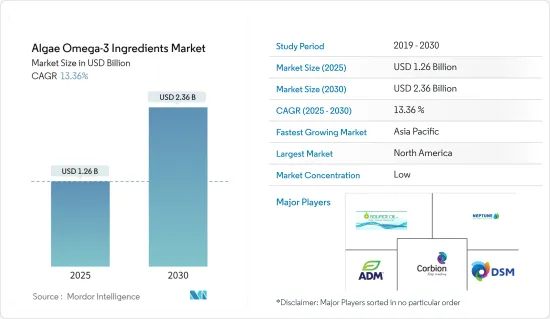

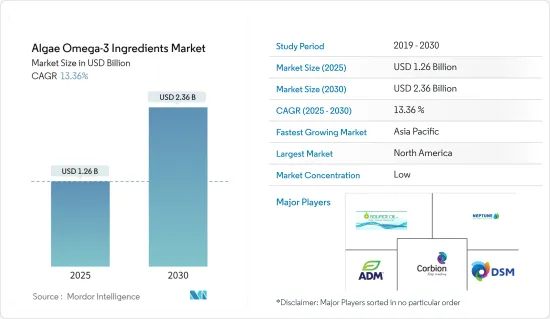

藻類オメガ3成分市場規模は、2025年に12億6,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは13.36%で、2030年には23億6,000万米ドルに達すると予測されます。

主なハイライト

- オメガ3系オイルは必須脂肪酸であり、心臓血管、目、脳の健康など幅広い健康効果があります。具体的には、オメガ3脂肪酸には主に3種類あり、アルファーリノレン酸(ALA)、エイコサペンタエン酸(EPA)、ドコサヘキサエン酸(DHA)です。オメガ3製品は、サプリメントの形で摂取されるほか、機能性食品、乳児用調製粉乳など、多くの食品に含まれる重要な成分でもあります。

- 藻類油は、菜食主義者や長鎖オメガ3脂肪酸(EPAとDHA)の供給源を求める人々の間で人気を集めています。また、ポリ塩化ビフェニルなどの汚染物質の心配もないです。

- 世界的に、藻類のオメガ3成分は注目されつつあり、消費者の日々の食生活の一部となりつつあります。この変化の主な理由は、生活習慣病の有病率の上昇と、予防ヘルスケアに取り組む人々の増加です。

- COVID-19の影響は、健康志向の製品、特に栄養補助食品のメーカーにチャンスをもたらす結果となりました。それぞれの市場は、これらの製品が免疫力の維持に役立ち、致命的なウイルスと闘うのに効率的であるという消費者の認識の高まりに促されています。これは、順番に藻類オメガ3を含む関連成分の需要を急増させる。

藻類オメガ3成分市場動向

乳児用製剤におけるEPA/DHAベースの藻類オメガ3需要の増加

新興国市場における乳児用調製粉乳の需要増が市場を牽引しています。中国は出生率が高いため、乳児用調製粉乳の世界最大の消費国です。DHAとEPAは乳児の脳の開発と免疫力の強化に不可欠です。DHAは、さまざまな規制やWHOの勧告において、乳児用調製粉乳製品に配合するための法的系統が確立されています。乳児用調製粉乳は、中国における藻類オメガ3消費者製品の主要市場シェアを占めています。

ノルウェーの研究によると、オメガ3は子供の脳に良い影響を与え、子供の問題解決能力を高めるといいます。最近の調査研究によると、乳児用調製粉乳や母乳にDHAを大量に摂取すると、身長が伸びるなど、早産児の成長にプラスの効果があるといいます。中国のように、成人人口と乳幼児人口の両方が増加傾向にある国では、乳児用栄養剤やベビーフードの需要が絶えず増加しています。オメガ3を強化した乳児用栄養剤の需要は、多忙なライフスタイルで食事の準備に時間をかけられない親たちから高まっています。

北米が最大の市場シェアを占める

北米の米国は、世界の藻類オメガ3成分市場で最大のシェアを占めています。これは、オメガ3サプリメントや強化食品の消費の増加、オメガ3の健康効果に関する意識の高まりによるものです。また、主要企業の国内進出や配合を強化した製品の頻繁な発売が、この地域の市場成長をさらに後押ししています。

米国では、ドコサヘキサエン酸(DHA)は乳児栄養に使用される主要成分です。同国で乳児用調製粉乳を提供するほぼすべてのブランドが、調製粉乳のコスト増につながる成分としてDHAを使用しており、これが同国の藻類オメガ3成分市場の成長を後押ししています。例えば、米国のEnfamil社はEnfagrow A+Stage 4 Nutritional Milk Powderを提供しており、DHAを他の必須プレバイオティクスや微量栄養素とともに配合しています。

藻類オメガ3成分産業概要

Koninklijke DSM N.V.、Corbion、BASF、Polaris S.A.、Neptune Wellness Solutions Inc.などの主要企業は、様々な地域で地元のプレーヤーとの競争に直面しているので、世界の藻類オメガ3成分市場は断片化されています。パートナーシップが最も一般的な戦略であることに変わりはないです。ADM、Koninklijke DSM N.V.、Neptune Wellness Solutions Inc.などの主要企業は、様々な地域で生産能力と消費者基盤を拡大するため、提携や合弁事業に注力しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の成果 と前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ別

- エイコサペンタン酸(EPA)

- ドコサヘキサエン酸(DHA)

- EPA/DHA

- 用途別

- 飲食品

- 栄養補助食品

- 医薬品

- 動物栄養

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- スペイン

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 主要企業の戦略

- Market Positioning Analysis

- 企業プロファイル

- Archer Daniels Midland Company

- Koninklijke DSM N.V.

- Corbion N.V.

- Neptune Wellness Solutions

- Source Omega LLC

- POLARIS

- BASF SE

- Novotech Nutraceuticals Inc.

第7章 市場機会と今後の動向

第8章 COVID-19の市場への影響

The Algae Omega-3 Ingredients Market size is estimated at USD 1.26 billion in 2025, and is expected to reach USD 2.36 billion by 2030, at a CAGR of 13.36% during the forecast period (2025-2030).

Key Highlights

- Omega-3 oils are essential fatty acids that have a broad range of health benefits, including cardiovascular, eye, and brain health. More specifically, omega-3 fatty acids are of three main types, alphalinolenic acid (ALA), eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA). Omega-3 products are consumed in the form of supplements and are also an important ingredient in a number of food products including, functional foods, infant formulae and others.

- Algal oil is gaining popularity among vegans and other people who want a source of long-chain omega-3 fatty acids (EPA and DHA). It does not pose the risk of contamination with pollutants, such as polychlorinated biphenyls.

- Globally, algae omega-3 ingredients are gaining prominence and becoming a part of the consumer's daily diet. The key reasons for this change have been the increased prevalence of lifestyle diseases and people taking preventive healthcare measures.

- The impact of the COVID-19 resulted in the generation of opportunities for manufacturers of health-oriented products, especially dietary supplements. The respective market has been prompted with the increase in consumer perception of these products to be helpful in maintaining immunity and its efficiency in fighting with the deadly virus. This in turn surges the demand for associated ingredients including algae omega-3.

Algae Omega-3 Ingredients Market Trends

Increasing Demand for EPA/DHA-Based Algae Omega-3 in Infant Formulations

The market studied is being dominantly driven by the increasing demand for infant formula products in developing regions. China is the world's largest consumer of infant formula products, due to the high birth rate in the country. DHA and EPA are essential for infant brain development and immunity strength. DHA has well-established legal strains for incorporation into infant formula products in different regulations and WHO recommendations. Infant formula holds the major market share for algae omega-3 consumer products in China.

According to a Norwegian study, omega-3 demonstrates a positive effect on a child's brain and enhances a child's problem-solving abilities. According to recent research studies, high doses of DHA in baby formula or breast milk can have a positive effect on the growth of pre-term infants, such as an increase in height. In countries, such as China, where both the adult population and infant population are on the rise, the demand for infant nutrition and baby food is constantly increasing. The demand for infant nutrition fortified with omega-3 is increasing from the parents who have busy lifestyles and less time to prepare meals.

North America Holds the Largest Market Share

United States in North America accounts for the largest share in the global algae omega 3 ingredient market. This is due to the increased consumption of Omega 3 supplements, fortified foods and rising awareness regarding the health benefits of Omega 3. Also, domestic expansion of the leading companies and frequent launches of products with enhanced formulations have further fueled the market growth in the region.

In the United States, docosahexaenoic acid (DHA) is a major ingredient that is being used in infant nutrition. Almost all the brands offering infant nutrition formula in the country uses DHA as an ingredient that adds to the cost of formula, which is augmenting the growth of algae omega-3 ingredients market in the country. For instance, Enfamil, a US-based company offers Enfagrow A+ Stage 4 Nutritional Milk Powder, which consists of DHA, along with other essential prebiotics and micronutrients.

Algae Omega-3 Ingredients Industry Overview

The global algae omega-3 ingredients market is fragmented, as key players, like Koninklijke DSM N.V, Corbion, BASF, Polaris S.A., and Neptune Wellness Solutions Inc. are facing competition from local players across various regions. Partnerships remained the most common strategy. Key players, like ADM, Koninklijke DSM N.V, and Neptune Wellness Solutions Inc. are focusing on partnerships and joint ventures to increase their production capabilities and consumer base across various regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Eicosapentanoic Acid (EPA)

- 5.1.2 Docosahexaenoic Acid (DHA)

- 5.1.3 EPA/DHA

- 5.2 By Application

- 5.2.1 Food and Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Pharmaceuticals

- 5.2.4 Animal Nutrition

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Koninklijke DSM N.V.

- 6.3.3 Corbion N.V.

- 6.3.4 Neptune Wellness Solutions

- 6.3.5 Source Omega LLC

- 6.3.6 POLARIS

- 6.3.7 BASF SE

- 6.3.8 Novotech Nutraceuticals Inc.