|

市場調査レポート

商品コード

1851528

化粧品包装:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 化粧品包装:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月01日

発行: Mordor Intelligence

ページ情報: 英文 104 Pages

納期: 2~3営業日

|

概要

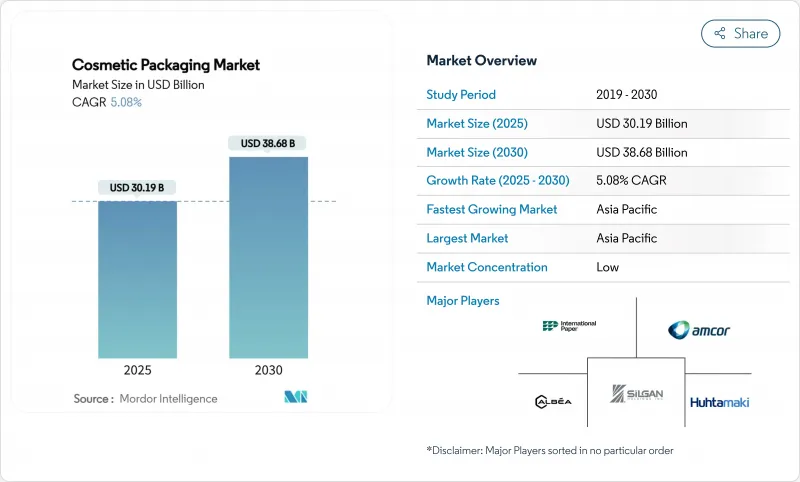

化粧品包装の市場規模は、2025年に301億9,000万米ドルに達し、2030年には386億8,000万米ドルに増加すると予測されています。

これは、2025年2月に施行される欧州連合(EU)の包装・容器包装廃棄物規制への各ブランドの対応を反映したもので、同規制はリサイクル可能性と拡大生産者責任の遵守を義務付けています。ブランドは、地政学的緊張や中国・欧州での生産削減によって上昇するポリエチレンテレフタレートコストに対抗するため、リサイクル素材の使用や軽量設計を加速させています。アジア太平洋地域は、洗練された消費者ルーチンと強力なeコマース・ロジスティックスに後押しされ、引き続き成長エンジンとなっています。中国のシートマスクの成功と韓国と日本のプレミアム化は、この地域の影響力を象徴しています。プラスチックのコスト・リーダーシップが維持される一方で、ガラスは高級感、詰め替え可能性、サーキュラー・エコノミーの魅力で前進しています。一方、AmcorとBerry Globalの84億3,000万米ドルの合併に代表される企業統合は、持続可能な包装の展開を加速させるために、規模と研究開発を束ねるものです。

世界の化粧品包装市場の動向と洞察

プレミアムおよびマステージ美容製品の消費拡大

手触りの良い仕上げ、重厚なガラス、華麗なクロージャーがブランドストーリーテリングを形成し、高級志向が主流チャネルに移行。ロレアルは2025年の「ワールド・リフィル・デー」に向けて、詰め替え用の選択肢を5年間で17倍に増やしたが、これはプレミアムという位置づけを薄めるものではありません。エスティローダーは、すでにポートフォリオの71%をサステナブル・フォーマットで供給しており、環境面での進歩と高級イメージの共存が可能であることを裏付けています。そのため、サプライヤーは、プレステージの処方に耐える高清浄度のガラス製ポンプや単一素材のポンプを優先しています。このチャンスは、隣接販売を保証し、より高い利幅をもたらす詰め替えキットにも広がっています。ラグジュアリーブランドが環境性能を採用することで、化粧品包装市場のすべての層の水準が高まる。

eコマースに適した軽量フォーマットへのシフト

オンライン販売では、破損しにくさと寸法・重量の節約が決め手となります。フレキシブルパウチがCAGR7.67%で成長するのは、平らな状態で出荷でき、ボイドフィルを削減でき、運賃を削減できるからです。KISS Cosmetics社は、480,000ft2の施設をインテリジェントなカートピッキングとA-Frameディスペンサーで自動化し、均一で軽量なパックを好むフルフィルメントの経済性を実証しました。包装ロボットへの投資は、2032年までに75億米ドルに達すると予測されており、複数のSKUの流れをスムーズにする自動化の役割を強調しています。小売店の棚ではなく、宅配便ネットワークに最適化されたブランドは、より速いサイクルタイムと低排出量を確保し、世界の化粧品包装市場をロジスティクスの不安定性から強化しています。

世界的なリサイクル樹脂価格の乱高下

欧州のPETは、反ダンピング規則によって供給が逼迫し、コンバーター各社がスポット市場での入札合戦を余儀なくされたため、2024年には1トン当たり1,130~1,170ユーロで推移しました。ポリエチレンとポリプロピレンは、原料コストの上昇に伴い、2025年初頭にポンド当たり5セントと4セント上昇しました。リサイクル率50%を誓約しているブランドは、こうしてマージンショックを吸収するか、あるいはオンサイト洗浄プラントなどの垂直統合によってヘッジします。高品質の食品用PCRはプレミアムがつくため、入手可能性リスクは設計の自由度を制約し、化粧品包装市場におけるバージン樹脂からの代替を遅らせる可能性があります。

セグメント分析

2024年の化粧品包装市場シェアは、コスト効率、透明性、ラインスピード適合性によりプラスチックが64.58%を占めました。ポリエチレンテレフタレートはパーソナルケアボトルに、ポリプロピレンはポンプのステムやクロージャーに、低密度ポリエチレンはフレキシブルチューブに使われています。しかし、ガラスは2030年までCAGR 8.67%で先行します。これは、高級ブランドが重厚感、耐傷性、無限のリサイクル性を切望しているからです。プレミアムシフトは、総パック数がプラスチックより少なくても、ガラスの化粧品包装市場規模を二桁の収益スライスに引き上げます。エスティ・ローダーがストラテジック・マテリアルズ社と取り組んでいるようなガラス・リサイクルへの取り組みは、カレットの品質と炉の歩留まりを向上させ、環境への批判を和らげている[2]。メタライズド・アルミニウムとスチールは、バリア性能と触感の清涼感が棚にインパクトを与えるフレグランスやギフト用には、依然としてニッチです。ファイバーベースのボードは、トランジットシッパーやギフトセットでエスカレートし、プラスチック税の負担を増やすことなくeコマースのクッションニーズに応えています。

第二世代の素材は、カテゴリー間の境界線を曖昧にします。かつてはチューブに見られた多層PETアルミラミネートは、リサイクルの流れに適合する単層EVOHバリアPETへと移行しています。ポリ乳酸のようなバイオ由来樹脂は、限定ラベル用に試用されているが、耐熱性や充填ラインの摩擦との戦いがあり、規模が制限されています。このようなハードルに対処するサプライヤーが早期に契約を獲得したことは、持続可能性のパフォーマンスが今や化粧品包装市場全体のベンダー選定基準を形成していることを反映しています。一方、詰め替え用ステーションと連携したリターナブル・ガラス・プログラムは、ガラスをより主流な品揃えに引き込むために、プレミアムな信用と低環境負荷の野心がどのように融合しているかを例証しています。

ボトルとジャーは2024年に44.56%の売上を達成し、充填速度の速さと買い物客の親しみやすさに支えられています。広口ジャーは引き続きフェイスクリームの中心であり、首の細いペットボトルはシャンプーやミセル水を支配しています。しかし、サシェとスタンドアップパウチはCAGR 7.67%という高い伸びを示し、1回分のグラム数を削減し、宅配便の投函時に破損しにくくなっています。ライトサイズ技術により、ブランドは1ヶ月に1本から、1封筒に5つの平たい小袋に切り替えることができ、貨物排出強度を下げることができます。チューブやスティックは、持ち運びに便利な日焼け止め、固形美容液、カラーバームの動向に対応し、トラベルサイズ規制や漏れゼロの期待に応えます。折りたたみ式カートンは、ガラス瓶やブースターバイアルを収納し、ソフトタッチのニスや箔押しでブランド・ナラティブを伝えながら、高級感を演出するのに好まれています。

輸送箱も進化します。段ボールのサプライヤーは、ボイドフィル(空隙充填物)をトリミングするアルゴリズム製函を導入し、リアルタイムの注文寸法に合わせて板紙を裁断するPacksizeマシンに支えられています。消費者の箱開け体験はオムニチャネル体験を差別化し、デジタル・ロイヤルティ特典の引き金となるQR印刷のインサートを促します。フレキシブルパックのバリアコーティングは、酸化ケイ素や酸化アルミニウムにアップグレードされ、香りの保持を確保し、リサイクル性を損なうことなく酸素透過を低減します。このような進歩により、フレキシブル・フォーマットによる化粧品包装市場規模が拡大し、リジッド容器のみからマス・プレミアムの美学が再定義されます。

化粧品包装市場は、素材タイプ(プラスチック、ガラス、金属、紙・板紙)、製品タイプ(ボトル・ジャー、チューブ・スティック、折りたたみカートン、段ボール箱、その他)、ディスペンサー機構(ポンプ式、スポイト・ピペット、スプレー・ミスト、その他)、化粧品タイプ(ヘアケア、カラー化粧品、スキンケア、その他)、地域別に分類されています。市場規模および予測は金額(米ドル)で提供されます。

地域別分析

アジア太平洋地域は2024年の化粧品包装市場売上高の42.89%を占め、可処分所得の増加、先進的なK-ビューティレジメン、モバイルコマースの高い普及率に後押しされ、2030年までCAGR 7.45%で成長します。中国におけるシートマスクの優位性は、シングルユースでありながら洗練されたパック形態に対する現地の意欲を物語っており、同地域はミニマムでありながら機能的なパウチの温床となっています。日本と韓国は、エアレスクッションコンパクトやスリムツイストバームなど、デザインのヒントを世界に輸出しており、この地域のコンバーターに先行者利益をもたらしています。

北米は、プレミアムスキンケアの採用と急速なeコマースにより、確固たる価値を保持しています。美容専門小売店では詰め替え用ステーションの試験運用が開始され、ガラスカートリッジサプライヤーは新たなサービス契約を獲得しています。自動化対応により、ロボットに優しい段ボールやライナーレスラベルが広く受け入れられます。州レベルのプラスチック削減法案が、軽量単一素材のシフトを急がせ、リサイクル・コンテントPETや繊維代替に投資を振り向けさせる。こうした動きにより、成熟したカテゴリーが浸透しているにもかかわらず、化粧品包装市場は活況を呈しています。

欧州は、世界に波及する規制の枠組みを形成しています。フランスでは、PPWRの施行とエコ貢献料の高騰により、包装のリサイクル可能性の閾値が明確になり、分解設計への投資が加速しています。フランスとイタリアの高級香水クラスターは、スクラッチ低減のための高度なホットエンドコーティングなど、ガラスの技術革新を支持しています。一方、中欧と東欧では、地元ブランドと輸出生産の両方に対応するため、ボトルの成型能力の拡張が行われています。世界各地域が材料戦略や技術移転率に影響を与え、化粧品包装市場の需要促進要因となっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- プレミアムおよびマステージ美容製品の消費拡大

- eコマースに適した軽量フォーマットへのシフト

- プレステージ・チャネルにおける詰め替え/再利用可能なデリバリー・システムの台頭

- 偽造品を抑制する認証対応スマートパッケージング

- カーボンラベル対応パックに対するブランド需要

- 3PLフルフィルメントにおけるロボット対応二次パックの急速な採用

- 市場抑制要因

- 世界の再生樹脂価格の高騰

- 使い捨てプラスチックに対する規制上限

- 新規バイオ材料の充填ライン非適合性

- 埋立地容量の縮小が拡大生産者責任料金を促進する

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 材料タイプ別

- プラスチック

- ポリエチレンテレフタレート(PET)

- ポリプロピレン

- ポリエチレン(PE)

- その他のプラスチック

- ガラス

- 金属

- 紙・板紙

- プラスチック

- 製品タイプ別

- ボトルとジャー

- チューブ&スティック

- 折りたたみカートン

- 段ボール箱

- フレキシブル小袋・パウチ

- その他の製品タイプ

- ディスペンシングメカニズム別

- ポンプベース

- スポイト/ピペット

- スプレー/ミスト

- スティック/ツイストアップ

- ジャー/スクープ

- 化粧品タイプ別

- スキンケア

- フェイシャルケア

- ボディケア

- ヘアケア

- カラー化粧品

- 香水とフレグランス

- その他の化粧品タイプ

- スキンケア

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- ケニア

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Albea SA

- AptarGroup Inc.

- Amcor Group GmbH

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Quadpack Industries SA

- Libo Cosmetics Co. Ltd

- Gerresheimer AG

- Ball Corporation

- Verescence France SA

- SKS Bottle & Packaging Inc.

- Altium Packaging

- Cosmopak Ltd

- Raepak Ltd

- Rieke Corporation

- Essel Propack Ltd

- Huhtamaki Oyj

- Alpla Werke Alwin Lehner GmbH

- RPC M&H Plastics

- HCP Packaging Co. Ltd