|

市場調査レポート

商品コード

1907216

放射線検出・監視・安全性:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Radiation Detection, Monitoring, And Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 放射線検出・監視・安全性:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 143 Pages

納期: 2~3営業日

|

概要

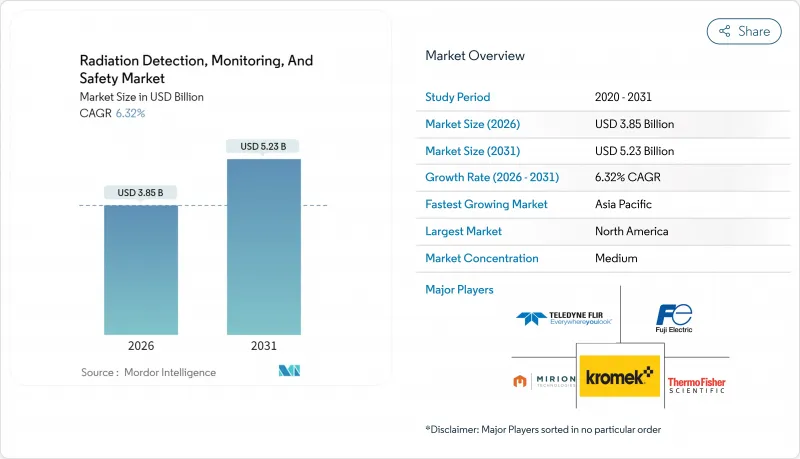

放射線検出・監視・安全性市場の規模は、2026年には38億5,000万米ドルと推定され、2025年の36億2,000万米ドルから成長が見込まれます。

2031年の予測では52億3,000万米ドルに達し、2026年から2031年にかけてCAGR6.32%で拡大する見通しです。

この成長軌道を支える要因として、核医学検査の拡大、環境監視の継続的実施を義務付ける規制要件、半導体ベース検出器性能の急速な進歩が挙げられます。また、国境管理、緊急対応要員、重要インフラ分野におけるセキュリティ懸念の高まりが需要を後押しする一方、老朽化した原子炉群の廃止措置に伴う監視システムの導入需要も増加しています。放射線検出・監視・安全性市場は、民生医療投資と国家安全保障支出を結びつけるデュアルユースの価値提案により、強靭な収益基盤を構築しています。北米の電力会社、欧州の原子力廃止プログラム、アジア太平洋地域の原子力発電所建設が相まって、旧式検出プラットフォームの更新サイクルを加速させています。デジタル接続性、予測分析、クラウドネイティブアーキテクチャが現在、プレミアム製品の差別化要因となっており、アフターマーケット向けソフトウェア収益と継続的なサービス契約を支えています。

世界の放射線検出・監視・安全性市場の動向と洞察

がんおよび慢性疾患の発生率上昇

2050年までに世界のがん患者数は3,500万件に達すると予測され、精密線量測定システムの潜在市場が拡大しています。放射線治療部門では、線量率の高周波変動を捕捉する半導体検出器を好んで採用し、サブミリ秒単位のビームモニタリング精度を要求しています。適応治療計画プラットフォームはデータ生成量を増加させ、臨床医は分割照射線量を調整するためリアルタイムフィードバックループへの依存度を高めています。このため医療システムでは、多チャンネル線量検証ラック、冗長化されたフィールドキャリブレーター、クラウド型線量登録ソフトウェアへの予算配分が進んでおり、放射線検出・監視・安全性市場を拡大するエコシステムが形成されています。ベンダー戦略は、リニアック稼働率を向上させるモジュラー型検出器ヘッドとAI支援品質保証ダッシュボードに注力しています。

拡大する核医学および放射線治療手技

核医学検査は2024年に前年比12%増加し、アクチニウム225やルテチウム177などの治療診断用同位体が牽引しました。放射性医薬品ハブでは、空気中アルファ粒子モニター、ホットセル用ガンマ線スペクトロメータ、施設LIMSデータベースと自動同期する個人用線量計が必須です。患者集団に近い場所に配置された分散型サイクロトロンネットワークは、遮蔽キャビネット、除染ポータル、リークテストキットの調達拠点を増加させます。米国FDA 21 CFR Part 361に基づく標準化は、同位体固有の校正プロトコルを義務付け、検出器再校正サービスプロバイダーにとって継続的な外部委託機会を確保します。これらの動向は平均販売価格(ASP)を引き上げ、アフターマーケット収益の見通しを拡大します。

厳格な複数管轄区域にわたるコンプライアンス負担

検出器OEMメーカーは、FDA 510(k)申請書類の承認取得、IEC 60601-2-45性能指標の達成、CEマーキング適合性の取得が求められます。それぞれに個別の生体適合性試験、EMC試験、放射線パターン試験が必要です。文書作成作業だけでも研究開発予算を膨らませ、小規模なイノベーター企業はライセンシングやニッチな学術市場へ方向転換せざるを得ません。並行する認証プロセスは、一度導入された機器が複数国に展開されると、機敏なファームウェア更新を妨げ、機能展開を遅らせます。その結果、設計採用サイクルが4年を超える長期化を招き、放射線検出・監視・安全性市場における新技術投資の正味現在価値(NPV)を希薄化させるとともに、短期的な収益拡大を抑制する結果となっております。

セグメント分析

検知・監視システムは2025年収益の50.74%を占め、放射線量状態の継続的検証が必要な病院・公益事業・防衛機関の調達予算を支えています。放射線検出・監視・安全性市場規模において、検知プラットフォームは予防的メンテナンス間隔を推奨する予測分析モジュールと共に成長が見込まれます。鉛入り防護服、除染ブース、自動遮蔽ドアを含む安全装備は、ISO 2919防護装置規格の調和化に支えられ、7.55%のCAGRで従来の基準を上回る成長を見せています。リアルタイムγ線プローブと電動遮蔽カーテンを統合したソリューションは、警報から遮蔽までの時間を短縮し、ALARA(合理的に達成可能な限り低い線量)準拠性を向上させます。ベンダーはクロスセリングの相乗効果を活用しています。病院がシンチレーションプローブを発注する際には、バッジ線量計のサブスクリプションを追加することが多く、原子炉オペレーターは周辺ポータルとシェルターインプレイス換気システムをセットで導入します。規制義務が調達緊急性を高めるため価格弾力性は限定的であり、放射線検出・監視・安全性産業全体で高価格帯SKUの安定した販売が維持されています。

クラウドダッシュボードの機能拡張、地理タグ付き警報可視化、役割ベースアクセス、自動コンプライアンス報告書生成により、検知機器は単なる汎用品の域を超えています。SaaSオーバーレイは大幅な粗利益率をもたらし、ハードウェア単体の利益率を上回るため、ハードウェア非依存型エコシステムを促進します。その結果、チャネルパートナーはNaI(Tl)、CZT、中性子モジュールを単一の監視HMIで統合するマルチプロトコルゲートウェイの在庫を好みます。リアルタイム分析により誤検知発生率がさらに低減され、高コストな避難インシデントが削減されます。こうした付加価値ソリューションは、放射線検出・監視・安全性市場全体における検知ソリューションのリーダーシップを強化します。

地域別分析

北米は2025年においても30.05%の収益シェアを維持し、既存の原子力発電所群、広範な国土安全保障インフラ、早期導入型医療システムを反映しています。米国国立研究所はCZT検出器の小型化に向けた研究開発助成金を投入しており、カナダのNRCan枠組みは研究用原子炉における環境監視システムの更新を助成しています。メキシコにおける放射性医薬品輸出の拡大は、同位体生産用ホットセル監視装置の需要増加に寄与しています。ANSI N42に基づく越境標準化は機器の相互運用性を高め、地域放射線検出・監視・安全性市場における規模の経済を強化しています。

アジア太平洋地域は8.05%のCAGRで最速の成長軌道を記録しており、これは中国が2060年までに150基の原子炉を稼働させる計画に支えられています。北京の「中国製造2025」政策に組み込まれた現地化義務は、CZTウエハーの合弁製造工場を促進し、輸入関税の削減とサプライチェーン脆弱性の軽減を図っています。日本の福島第一原子力発電所事故後の規制体制では、原子炉施設周辺20kmに及ぶガンマ線防護網の設置が資金援助されています。一方、インド原子力省は、地方都市のがん治療病棟向けに低コストの放射線測定器への資金提供を行っています。韓国では18MeVサイクロトロンネットワークの拡大により、対象となる病院数がさらに増加し、アジア太平洋地域が放射線検出・監視・安全性市場における世界の成長エンジンとしての地位を強化しています。

欧州では、ドイツ、ベルギー、スペインにおける廃止措置プロジェクトが、空気中アルファ線モニターや廃棄物ドラム分析システムへの専門的な需要を生み出し、バランスの取れた成長を示しています。フランスは、原子力発電の割合を高く維持しつつ、ASNの厳しい地震リスク基準を満たす必要がある寿命延長アップグレードに注力しています。欧州原子力共同体(Euratom)条約は調達仕様を標準化し、複数年度予算サイクルを活用した越境大量契約を可能にしております。中東欧諸国では、旧ソ連時代の研究用原子炉を近代化するにあたり、トレーニングサービスをセットにしたターンキー方式の検知システムを求めております。

中東およびアフリカ地域は、まだ発展途上ではありますが、戦略的港湾へ中性子貨物スキャナーを導入し、サイクロトロンベースの放射性医薬品研究所を稼働させており、新興地域における放射線検出・監視・安全性市場の中期的な成長を予感させます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- がんおよび慢性疾患の発生率上昇

- 核医学および放射線治療手技の拡大

- リアルタイム環境モニタリングに対する規制推進

- 小型化およびIoT対応線量計

- 無人航空機(UAV)を用いた広域放射線マッピング

- 世界の老朽化原子炉の廃止措置

- 市場抑制要因

- 複数の管轄区域における厳格なコンプライアンス負担

- 認定放射線安全管理者の不足

- 分光級検出器の高額な設備投資

- ヘリウム3及びシンチレータ結晶のサプライチェーン変動性

- 業界バリューチェーン分析

- マクロ経済要因が市場に与える影響

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 検出と監視

- 安全性

- 検出器技術別

- ガス充填型(ガイガー・ミュラー計数管、比例計数管、イオン化室)

- シンチレーション(NaI(Tl)、CsI、LaBr3、プラスチック)

- 半導体(HPGe、CZT、SiPM)

- 個人用線量計(TLD、OSL、電子式)

- エンドユーザー業界別

- 医療・ヘルスケア

- エネルギー・電力(原子力、従来型)

- 国土安全保障・防衛

- 産業分野(石油・ガス、鉱業、製造業)

- 研究機関・学術研究所

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Teledyne FLIR LLC

- Fuji Electric Co., Ltd.

- Unfors RaySafe AB

- Arktis Radiation Detectors Ltd.

- Kromek Group plc

- Berthold Technologies GmbH & Co. KG

- Alpha-Spectra, Inc.

- Radiation Detection Company

- Centronic Ltd.

- Burlington Medical LLC

- Amray Group Ltd.

- Atomtex SPE

- Polimaster Ltd.

- Smiths Detection Group Ltd.

- Ludlum Measurements, Inc.

- Hitachi-Aloka Medical, Ltd.

- General Atomics Electronic Systems

- Else Nuclear s.r.l.

- Silena Group s.r.l.