|

|

市場調査レポート

商品コード

1730659

放射線検出・モニタリング・安全の世界市場:製品別、構成別、用途別、地域別 - 2030年までの予測Radiation Detection, Monitoring & Safety Market by Product (Personal Dosimeter, Monitor: Area Process, Environment, Surface: Material, Software), Detector: Gas-filled, Scintillator, Solid-state, Type (Body, Face, Hand, Apron) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 放射線検出・モニタリング・安全の世界市場:製品別、構成別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月14日

発行: MarketsandMarkets

ページ情報: 英文 361 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の放射線・検出・モニタリング・安全の市場規模は、2024年の33億8,120万米ドルから2030年には54億5,240万米ドルに達し、予測期間中のCAGRは8.3%になると予測されています。

ヘルスケアにおける放射線の利用が拡大していることに加え、原子力分野の急成長、セキュリティへの配慮の高まり、厳格な規制基準が市場拡大を後押ししています。X線、コンピュータ断層撮影(CT)、陽電子放射断層撮影(PET)、放射線治療などの画像診断が臨床診断や腫瘍治療に広く導入されているため、高度な放射線検出・モニタリングシステムの需要が高まっています。これらの技術は、患者とヘルスケア従事者の安全と保護を確保するために不可欠です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | 製品別、構成別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

放射線検出・モニタリング・安全市場は、放射線検出・モニタリング製品、材料モニター、放射性物質モニタリングソフトウェアのいくつかのセグメントに分類されます。2024年現在、放射線検出・モニタリング製品分野が世界最大の市場シェアを占めています。国際原子力機関(IAEA)、米国原子力規制委員会(NRC)、労働安全衛生管理局(OSHA)などの規制機関は、作業員の放射線被曝や環境条件の継続的なモニタリングについて厳しい規制を実施しています。原子力、製造、石油・ガス、鉱業などの産業では、自然起源放射性物質(NORM)に頻繁に遭遇します。このため、コンプライアンスを確保し、リスクを軽減するための効果的な放射線検出・モニタリングソリューションの必要性が高まっています。さらに、放射線漏れ、偶発的な被ばく、汚染事故が頻発するようになったことで、高度なリアルタイムモニタリング機能に対する需要が高まり、高度な放射線検出器に対する世界のニーズがさらに高まっています。

放射線検出・モニタリング・安全市場は、検出器、放射線防護製品、放射線安全製品の3つの主要セグメントに分類されます。2024年には、核廃棄物、汚染サイト、鉱業や石油・ガスなどの分野で一般的に見られる自然起源放射性物質(NORM)による放射線被ばくに対する懸念の高まりに後押しされ、検出器分野が世界最大の市場シェアを占めました。こうした環境要因が、高度な放射線検出器の需要を高めています。国際原子力機関(IAEA)や環境保護庁(EPA)といった機関が定める規制の枠組みは、放射線モニタリングに厳格なプロトコルを課しており、高度な検出技術の採用をさらに後押ししています。特に固体検出器やリアルタイム・モニタリング・システムの小型化や技術的進歩の動向は、様々な産業分野への導入を促進しています。このような進化により、最新の放射線検出器は必要不可欠なツールとして位置づけられ、市場情勢における優位性を確固たるものにしています。

日本、インド、中国、韓国、オーストラリア、その他の主要経済圏を含むアジア太平洋地域は、市場で大きな成長を遂げると予測されています。急速な工業化、原子力構想の進展、ヘルスケア投資の増加、放射線に関する安全保障上の懸念の高まりなどの要因によって、市場成長率は他の地域を上回っています。中国、インド、日本、韓国などの国々は、増大するエネルギー需要に対応するため、原子力インフラに大幅な投資を行ってきました。この動向は、効果的な放射線モニタリングと安全ソリューションに対する強いニーズを一貫して生み出してきました。さらに、ヘルスケア分野の拡大、特にX線、CT、PETスキャンなどの放射線に基づく画像診断技術や、がん治療のための放射線治療の利用が増加していることも、放射線検出器や放射線モニタリング装置の需要を高めています。この地域はまた、核テロや放射性物質の不正取引によるリスクの増大にも直面しています。そのため各国政府は、国境、交通の要所、防衛施設など、重要な地点における放射線検出能力を強化しなければなりません。このような成長を支えているのは、政府の好意的な政策、放射線安全に対する国民の意識の高まり、アジア太平洋市場で事業を強化する主要企業の戦略的存在です。これらの要因を総合すると、この地域は放射線検出技術の世界の急成長市場であるといえます。

当レポートでは、世界の放射線検出・モニタリング・安全市場について調査し、製品別、構成別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- 貿易分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制分析

- 技術分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 2025年の米国関税の影響- 放射線、検知、モニタリング、安全市場

- 生成AI/AI別放射線検出・モニタリング・安全市場への影響

- 投資と資金調達のシナリオ

第6章 放射線検出・モニタリング・安全市場(製品別)

- イントロダクション

- 放射線検出・モニタリング製品

- 材料モニター

- 放射線モニタリングソフトウェア

第7章 放射線検出・モニタリング製品市場(構成別)

- イントロダクション

- 検出器

- 固体検出器

- 放射線防護製品

- 放射線遮蔽製品

第8章 放射線検出・モニタリング・安全市場(用途別)

- イントロダクション

- 業界

- 安全とセキュリティ

- 診断と治療

- その他

第9章 放射線検出・モニタリング・安全市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 原子力発電インフラの開発が市場の成長を促進

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 主要参入企業が採用した戦略の概要

- 収益分析、2021年~2023年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- THERMO FISHER SCIENTIFIC INC.

- MIRION TECHNOLOGIES INC.

- FORTIVE

- AMETEK INC.

- FUJI ELECTRIC CO., LTD.

- LUDLUM MEASUREMENTS INC.

- ARKTIS RADIATION DETECTORS LTD.

- POLIMASTER EUROPE UAB

- AMRAY

- INFAB, LLC

- IBA WORLDWIDE

- その他の企業

- BERTIN TECHNOLOGIES

- RADIATION DETECTION COMPANY

- ARROW-TECH, INC.

- CENTRONIC

- S.E. INTERNATIONAL, INC.

- ATOMTEX

- NUCLEONIX SYSTEMS

- ALPHA SPECTRA, INC.

- LND, INC.

- BAR RAY PRODUCTS

- TRIVITRON HEALTHCARE

- MICRON SEMICONDUCTOR LTD.

- SCIONIX HOLLAND B.V.

- RADCOMM SYSTEMS

- XENA SHIELD

- SIMAD SRL

- BURLINGTON MEDICAL

- RADIATION PROTECTION PRODUCTS INC.

- NUCLEAR SHIELDS

第12章 付録

List of Tables

- TABLE 1 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: STUDY ASSUMPTIONS

- TABLE 2 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: RISK ANALYSIS

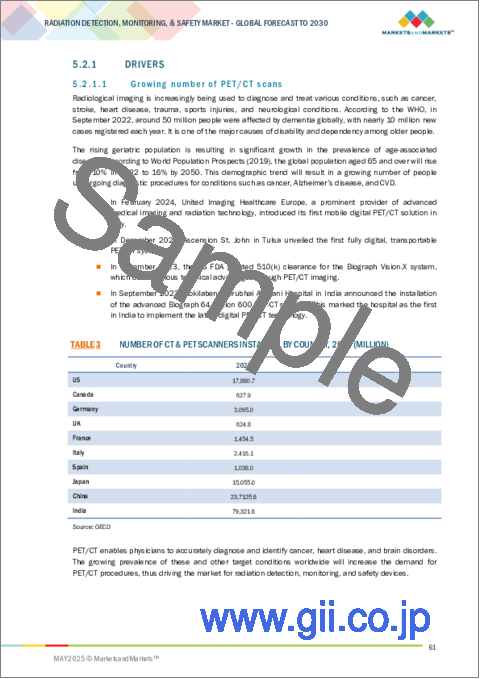

- TABLE 3 NUMBER OF CT & PET SCANNERS INSTALLED, BY COUNTRY, 2022 (MILLION)

- TABLE 4 WORLDWIDE INSTALLATION BASE OF RADIOTHERAPY EQUIPMENT, 2020 VS. 2022

- TABLE 5 MILITARY EXPENDITURE, BY REGION (2023)

- TABLE 6 HIGHEST MILITARY EXPENDITURE, BY COUNTRY (2023)

- TABLE 7 US: ELECTRIC GENERATION MIX, 2022

- TABLE 8 LIST OF REACTORS SHUT DOWN IN 2024

- TABLE 9 REACTORS PLANNED IN CHINA

- TABLE 10 AVERAGE SELLING PRICE TREND OF RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 11 AVERAGE SELLING PRICE OF RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS IN TOP APPLICATIONS, BY KEY PLAYER, 2024 (USD)

- TABLE 12 IMPORT DATA FOR HS CODE 903010 (INSTRUMENTS AND APPARATUS FOR MEASURING OR DETECTING IONIZING RADIATIONS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 903010 (INSTRUMENTS AND APPARATUS FOR MEASURING OR DETECTING IONIZING RADIATIONS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: ROLE IN ECOSYSTEM

- TABLE 15 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS

- TABLE 17 KEY BUYING CRITERIA FOR RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 24 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 25 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 26 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 27 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 28 CASE STUDY 1: DOSE ASSESSMENTS USING ENVIRONMENTAL AND PERSONAL DOSIMETERS

- TABLE 29 CASE STUDY 2: SAFETY CULTURE THROUGH RADIATION MONITORING

- TABLE 30 CASE STUDY 3: ADHERENCE TO INDIVIDUAL RADIATION MONITOR USAGE AMONG INDUSTRIAL RADIOGRAPHERS

- TABLE 31 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 32 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 33 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 34 RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 RADIATION DETECTION AND MONITORING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 EUROPE: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 LATIN AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 MIDDLE EAST & AFRICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 PERSONAL DOSIMETERS MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 43 NORTH AMERICA: PERSONAL DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 EUROPE: PERSONAL DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: PERSONAL DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 LATIN AMERICA: PERSONAL DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 MIDDLE EAST & AFRICA: PERSONAL DOSIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 PASSIVE DOSIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: PASSIVE DOSIMETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 EUROPE: PASSIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: PASSIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LATIN AMERICA: PASSIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 MIDDLE EAST & AFRICA: PASSIVE DOSIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 ACTIVE DOSIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: ACTIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 EUROPE: ACTIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: ACTIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LATIN AMERICA: ACTIVE DOSIMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 MIDDLE EAST & AFRICA: ACTIVE DOSIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 AREA PROCESS MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: AREA PROCESS MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: AREA PROCESS MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: AREA PROCESS MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 LATIN AMERICA: AREA PROCESS MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: AREA PROCESS MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

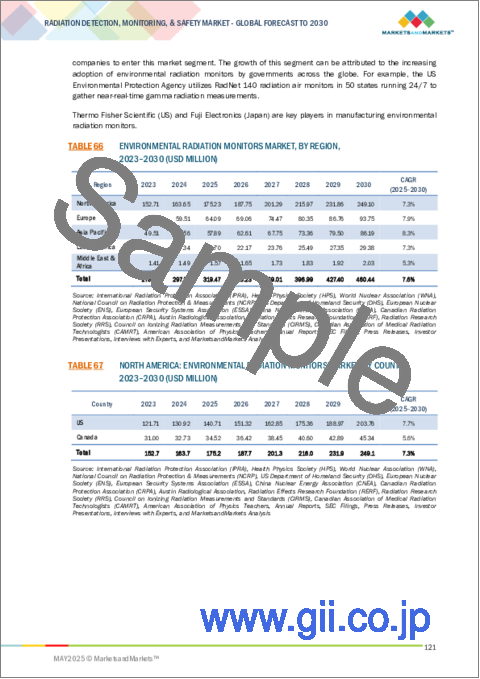

- TABLE 66 ENVIRONMENTAL RADIATION MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: ENVIRONMENTAL RADIATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 EUROPE: ENVIRONMENTAL RADIATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: ENVIRONMENTAL RADIATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 LATIN AMERICA: ENVIRONMENTAL RADIATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: ENVIRONMENTAL RADIATION MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 SURFACE CONTAMINATION MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: SURFACE CONTAMINATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: SURFACE CONTAMINATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: SURFACE CONTAMINATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 LATIN AMERICA: SURFACE CONTAMINATION MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: SURFACE CONTAMINATION MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 LATIN AMERICA: MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 RADIOACTIVE MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: RADIOACTIVE MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: RADIOACTIVE MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: RADIOACTIVE MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 LATIN AMERICA: RADIOACTIVE MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: RADIOACTIVE MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 OTHER MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: OTHER MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: OTHER MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: OTHER MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 LATIN AMERICA: OTHER MATERIAL MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: OTHER MATERIAL MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 RADIATION MONITORING SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: RADIATION MONITORING SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: RADIATION MONITORING SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: RADIATION MONITORING SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 LATIN AMERICA: RADIATION MONITORING SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: RADIATION MONITORING SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 103 RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 104 RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 107 GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 GAS-FILLED DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: GAS-FILLED DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: GAS-FILLED DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: GAS-FILLED DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 LATIN AMERICA: GAS-FILLED DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: GAS-FILLED DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 114 GEIGER-MULLER COUNTERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: GEIGER-MULLER COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: GEIGER-MULLER COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: GEIGER-MULLER COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 LATIN AMERICA: GEIGER-MULLER COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: GEIGER-MULLER COUNTERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 120 IONIZATION CHAMBERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: IONIZATION CHAMBERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: IONIZATION CHAMBERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: IONIZATION CHAMBERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: IONIZATION CHAMBERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: IONIZATION CHAMBERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 126 PROPORTIONAL COUNTERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: PROPORTIONAL COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: PROPORTIONAL COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PROPORTIONAL COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: PROPORTIONAL COUNTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: PROPORTIONAL COUNTERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 132 SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 EUROPE: SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 LATIN AMERICA: SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 139 INORGANIC SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: INORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: INORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 LATIN AMERICA: INORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: INORGANIC SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 145 RESEARCH STUDIES ON ORGANIC SCINTILLATORS

- TABLE 146 ORGANIC SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: ORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: ORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: ORGANIC SCINTILLATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ORGANIC SCINTILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 152 SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 SOLID-STATE DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 154 NORTH AMERICA: SOLID-STATE DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 EUROPE: SOLID-STATE DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SOLID-STATE DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 LATIN AMERICA: SOLID-STATE DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: SOLID-STATE DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 159 SEMICONDUCTOR DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: SEMICONDUCTOR DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 EUROPE: SEMICONDUCTOR DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SEMICONDUCTOR DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: SEMICONDUCTOR DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: SEMICONDUCTOR DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 165 DIAMOND DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: DIAMOND DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 EUROPE: DIAMOND DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DIAMOND DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: DIAMOND DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: DIAMOND DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 171 RADIATION PROTECTION PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 RADIATION PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 173 NORTH AMERICA: RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 174 EUROPE: RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: RADIATION PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 178 FULL-BODY PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: FULL-BODY PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 EUROPE: FULL-BODY PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: FULL-BODY PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: FULL-BODY PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: FULL-BODY PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 184 FACE PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: FACE PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 EUROPE: FACE PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: FACE PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: FACE PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: FACE PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 190 HAND SAFETY PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 191 NORTH AMERICA: HAND SAFETY PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 192 EUROPE: HAND SAFETY PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: HAND SAFETY PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: HAND SAFETY PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: HAND SAFETY PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 196 LEAD & LEAD-FREE APRONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: LEAD & LEAD-FREE APRONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 198 EUROPE: LEAD & LEAD-FREE APRONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: LEAD & LEAD-FREE APRONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 200 LATIN AMERICA: LEAD & LEAD-FREE APRONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: LEAD & LEAD-FREE APRONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 202 OTHER RADIATION PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 203 NORTH AMERICA: OTHER RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 204 EUROPE: OTHER RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: OTHER RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: OTHER RADIATION PROTECTION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: OTHER RADIATION PROTECTION PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 208 RADIATION SHIELDING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 210 NORTH AMERICA: LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 211 EUROPE: LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 212 ASIA PACIFIC: LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA: LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: LEAD-LINED RADIATION SHIELDING WALLS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 215 OTHER RADIATION SHIELDING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 216 NORTH AMERICA: OTHER RADIATION SHIELDING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 217 EUROPE: OTHER RADIATION SHIELDING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: OTHER RADIATION SHIELDING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 219 LATIN AMERICA: OTHER RADIATION SHIELDING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: OTHER RADIATION SHIELDING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 221 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 222 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 224 NUCLEAR POWER PLANT APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 225 INDUSTRIAL PRODUCTION OUTPUT DATA FOR MANUFACTURING INDUSTRY, BY COUNTRY, 2021-2022 (TONS)

- TABLE 226 MANUFACTURING APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 227 RADIONUCLEOTIDE APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 228 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 230 ENVIRONMENTAL APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 231 HOMELAND SECURITY & DEFENSE APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 232 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 234 HEALTHCARE APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 235 FORENSIC APPLICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 236 RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 237 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 238 NORTH AMERICA: MACROINDICATORS

- TABLE 239 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 240 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 241 NORTH AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 NORTH AMERICA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 NORTH AMERICA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 NORTH AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 245 NORTH AMERICA: DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 NORTH AMERICA: GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 NORTH AMERICA: SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 NORTH AMERICA: SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 250 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 US: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 254 US: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 US: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 US: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 CANADA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 258 CANADA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 CANADA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 CANADA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 EUROPE: MACROINDICATORS

- TABLE 262 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 263 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 264 EUROPE: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 EUROPE: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 EUROPE: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 EUROPE: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 268 EUROPE: DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 EUROPE: GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 EUROPE: SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 EUROPE: SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 273 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 GERMANY: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 277 GERMANY: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 GERMANY: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 GERMANY: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 UK: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 281 UK: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 UK: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 UK: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 FRANCE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 285 FRANCE: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 FRANCE: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 FRANCE: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 ITALY: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 289 ITALY: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 ITALY: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 ITALY: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 SPAIN: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 293 SPAIN: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 SPAIN: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 SPAIN: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 REST OF EUROPE: CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2025

- TABLE 297 REST OF EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 298 REST OF EUROPE: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 REST OF EUROPE: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 REST OF EUROPE: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 ASIA PACIFIC: MACROINDICATORS

- TABLE 302 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 303 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 304 ASIA PACIFIC: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 ASIA PACIFIC: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 ASIA PACIFIC: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 ASIA PACIFIC: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 308 ASIA PACIFIC: DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 ASIA PACIFIC: GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 ASIA PACIFIC: SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 ASIA PACIFIC: SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 313 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 CHINA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 317 CHINA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 CHINA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 CHINA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 JAPAN: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 321 JAPAN: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 JAPAN: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 JAPAN: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 INDIA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 325 INDIA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 INDIA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 INDIA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 SOUTH KOREA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 329 SOUTH KOREA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 SOUTH KOREA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 SOUTH KOREA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 AUSTRALIA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 333 AUSTRALIA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 AUSTRALIA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 AUSTRALIA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 REST OF ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 337 REST OF ASIA PACIFIC: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 338 REST OF ASIA PACIFIC: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 ((USD MILLION)

- TABLE 339 REST OF ASIA PACIFIC: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 LATIN AMERICA: MACROINDICATORS

- TABLE 341 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 342 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 343 LATIN AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 LATIN AMERICA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 LATIN AMERICA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 LATIN AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 347 LATIN AMERICA: DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 LATIN AMERICA: GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 LATIN AMERICA: SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 LATIN AMERICA: SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 352 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 355 BRAZIL: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 356 BRAZIL: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 BRAZIL: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 358 BRAZIL: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 359 MEXICO: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 360 MEXICO: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 MEXICO: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 MEXICO: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 363 REST OF LATIN AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 364 REST OF LATIN AMERICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 367 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 368 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 369 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 370 MIDDLE EAST & AFRICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 372 MIDDLE EAST & AFRICA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 MIDDLE EAST & AFRICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2023-2030 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: GAS-FILLED DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: SCINTILLATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: SOLID-STATE DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 379 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 380 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR SAFETY & SECURITY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 381 MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET FOR DIAGNOSTICS & THERAPY APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 382 GCC COUNTRIES: MACROINDICATORS

- TABLE 383 GCC COUNTRIES: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 384 GCC COUNTRIES: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 385 GCC COUNTRIES: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 GCC COUNTRIES: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 387 REST OF MIDDLE EAST & AFRICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 388 REST OF MIDDLE EAST & AFRICA: RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 389 REST OF MIDDLE EAST & AFRICA: PERSONAL DOSIMETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 390 REST OF MIDDLE EAST & AFRICA: MATERIAL MONITORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 391 OVERVIEW OF STRATEGIES DEPLOYED BY KEY RADIATION DETECTION, MONITORING, AND SAFETY MANUFACTURING COMPANIES

- TABLE 392 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DEGREE OF COMPETITION

- TABLE 393 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: REGION FOOTPRINT

- TABLE 394 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: PRODUCT FOOTPRINT

- TABLE 395 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: APPLICATION FOOTPRINT

- TABLE 396 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 397 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 398 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2025

- TABLE 399 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 400 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 401 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 402 MIRION TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 403 MIRION TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 404 MIRION TECHNOLOGIES: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 405 MIRION TECHNOLOGIES: DEALS, JANUARY 2021-APRIL 2025

- TABLE 406 MIRION TECHNOLOGIES: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 407 FORTIVE: COMPANY OVERVIEW

- TABLE 408 FORTIVE: PRODUCTS OFFERED

- TABLE 409 AMETEK INC.: COMPANY OVERVIEW

- TABLE 410 AMETEK INC.: PRODUCTS OFFERED

- TABLE 411 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 412 FUJI ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 413 LUDLUM MEASUREMENTS INC.: COMPANY OVERVIEW

- TABLE 414 LUDLUM MEASUREMENTS INC.: PRODUCTS OFFERED

- TABLE 415 LUDLUM MEASUREMENTS: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 416 ARKTIS RADIATION DETECTORS LTD.: COMPANY OVERVIEW

- TABLE 417 ARKTIS RADIATION DETECTORS LTD.: PRODUCTS OFFERED

- TABLE 418 POLIMASTER EUROPE UAB: COMPANY OVERVIEW

- TABLE 419 POLIMASTER EUROPE UAB: PRODUCTS OFFERED

- TABLE 420 AMRAY: COMPANY OVERVIEW

- TABLE 421 AMRAY: PRODUCTS OFFERED

- TABLE 422 INFAB, LLC: COMPANY OVERVIEW

- TABLE 423 INFAB, LLC: PRODUCTS OFFERED

- TABLE 424 INFAB, LLC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021- APRIL 2025

- TABLE 425 INFAB, LLC: DEALS, JANUARY 2021- APRIL 2025

- TABLE 426 IBA WORLDWIDE: COMPANY OVERVIEW

- TABLE 427 IBA WORLDWIDE: PRODUCTS OFFERED

- TABLE 428 IBA WORLDWIDE: DEALS, JANUARY 2021- APRIL 2025

List of Figures

- FIGURE 1 RADIATION DETECTION, MONITORING, AND SAFETY MARKET SEGMENTATION

- FIGURE 2 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: RESEARCH DATA

- FIGURE 3 RADIATION DETECTION, MONITORING, AND SAFETY: RESEARCH DESIGN

- FIGURE 4 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: PRIMARY SOURCES

- FIGURE 6 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 10 RADIATION DETECTION, MONITORING, AND SAFETY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- FIGURE 11 RADIATION DETECTION, MONITORING, AND SAFETY MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 12 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: TOP-DOWN APPROACH

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DATA TRIANGULATION

- FIGURE 15 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT, 2024 VS. 2030 (USD MILLION)

- FIGURE 16 RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION, 2024 VS. 2030 (USD MILLION)

- FIGURE 17 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 18 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 19 GROWING NUMBER OF PET/CT SCANS TO DRIVE MARKET

- FIGURE 20 NORTH AMERICA TO REGISTER HIGHEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 21 DIAGNOSTICS & THERAPY SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 22 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 AVERAGE SELLING PRICE TREND OF RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS, BY REGION, 2022-2024 (USD)

- FIGURE 25 AVERAGE SELLING PRICE OF RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS IN TOP APPLICATIONS, BY KEY PLAYER, 2024 (USD)

- FIGURE 26 PATENT ANALYSIS FOR RADIATION DETECTION, MONITORING, AND SAFETY MARKET, JANUARY 2013-DECEMBER 2024

- FIGURE 27 VALUE CHAIN ANALYSIS OF RADIATION DETECTION, MONITORING, AND SAFETY MARKET: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 28 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR RADIATION DETECTION, MONITORING, AND SAFETY PRODUCTS

- FIGURE 33 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: TRENDS/ DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 RADIATION DETECTION, MONITORING, AND SAFETY: INVESTMENT & FUNDING SCENARIO

- FIGURE 35 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 36 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 37 NORTH AMERICA: RADIATION DETECTION, MONITORING, AND SAFETY MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: RADIATION DETECTION, MONITORING, AND SAFETY MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF TOP PLAYERS IN RADIATION DETECTION, MONITORING, AND SAFETY MARKET, 2021-2023 (USD MILLION)

- FIGURE 40 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: COMPANY FOOTPRINT

- FIGURE 42 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 EV/EBITDA OF KEY VENDORS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 RADIATION DETECTION, MONITORING, AND SAFETY MARKET: BRAND/ PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 47 MIRION TECHNOLOGIES: COMPANY SNAPSHOT (2024)

- FIGURE 48 FORTIVE: COMPANY SNAPSHOT (2024)

- FIGURE 49 AMETEK INC.: COMPANY SNAPSHOT (2024)

- FIGURE 50 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 51 IBA WORLDWIDE: COMPANY SNAPSHOT (2024)

The global radiation, detection, monitoring & safety market is projected to reach USD 5,452.4 million by 2030 from USD 3,381.2 million in 2024, growing at a CAGR of 8.3% during the forecast period. The escalating application of radiation across healthcare, coupled with the burgeoning nuclear energy sector, heightened security considerations, and rigorous regulatory standards, is propelling market expansion. The pervasive implementation of imaging modalities such as X-rays, computed tomography (CT), positron emission tomography (PET), and radiotherapy in clinical diagnostics and oncological treatment has generated substantial demand for advanced radiation detection and monitoring systems. These technologies are essential for ensuring the safety and protection of both patients and healthcare personnel.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Product, Composition, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

By product, the radiation detection and monitoring products segment held the largest market share in 2024.

The radiation detection, monitoring & safety market is categorized into several segments: radiation detection and monitoring products, material monitors, and radioactive monitoring software. As of 2024, the radiation detection and monitoring products segment holds the largest global market share. Regulatory bodies such as the International Atomic Energy Agency (IAEA), the US Nuclear Regulatory Commission (NRC), and the Occupational Safety and Health Administration (OSHA) enforce stringent regulations for the continuous monitoring of radiation exposure among workers and environmental conditions. Industries such as nuclear power, manufacturing, oil & gas, and mining frequently encounter Naturally Occurring Radioactive Materials (NORM). This underscores the critical need for effective radiation detection and monitoring solutions to ensure compliance and mitigate risks. Moreover, the growing frequency of radiation leaks, accidental exposures, and contamination incidents has heightened the demand for advanced real-time monitoring capabilities, further driving the global need for sophisticated radiation detection instruments.

The detectors segment held the largest market share in 2024, by composition.

The radiation detection, monitoring & safety market is categorized into three primary segments: detectors, radiation protection products, and radiation safety products. In 2024, the detectors segment represented the largest global market share, driven by rising concerns over radiation exposure from nuclear waste, contaminated sites, and Naturally Occurring Radioactive Materials (NORM) commonly found in sectors such as mining and oil & gas. These environmental factors have escalated the demand for advanced radiation detectors. Regulatory frameworks established by agencies like the International Atomic Energy Agency (IAEA) and the Environmental Protection Agency (EPA) enforce strict protocols for radiation monitoring, further incentivizing the adoption of sophisticated detection technologies. The ongoing trends of miniaturization and technological advancements, particularly in solid-state detectors and real-time monitoring systems, have facilitated broader implementation across various industries. This evolution has positioned modern radiation detectors as essential tools, consolidating their dominance within the market landscape.

The Asia Pacific region is expected to register the highest growth rate in the market during the forecast period.

The Asia Pacific (APAC) region, including major economies such as Japan, India, China, South Korea, Australia, and the Rest of Asia Pacific (RoAPAC), is projected to experience significant growth in the market. The market growth rate surpasses that of other regions, driven by factors including rapid industrialization, advancements in nuclear power initiatives, increased healthcare investments, and heightened security concerns related to radiation. Countries such as China, India, Japan, and South Korea have substantially invested in nuclear energy infrastructure to meet escalating energy demands. This trend has consistently created a robust need for effective radiation monitoring and safety solutions. Furthermore, the expansion of the healthcare sector, particularly the rising utilization of radiation-based diagnostic imaging techniques (such as X-rays, CT, and PET scans) and radiation therapies for cancer treatment, has intensified the demand for radiation detectors and monitoring instruments. The region also faces increased risks from nuclear terrorism and the illicit trafficking of radioactive materials. Consequently, governments must enhance their radiation detection capabilities at critical points, including borders, transportation hubs, and defense installations. Supporting this growth are favorable government policies, a rising public awareness surrounding radiation safety, and the strategic presence of key market players intensifying their operations within the Asia Pacific market. Collectively, these factors position the region as the fastest-growing market for radiation detection technologies globally.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-- 27%, Director-level-18%, and Other Designations-55%

- By Region: North America-50%, Europe-20%, Asia Pacific-15%, Latin America-10%, and Middle East & Africa-5%

Prominent players in this market are Fortive (US), Thermo Fisher Scientific Inc. (US), Mirion Technologies Inc. (US), Fuji Electric Co., Ltd. (Japan), Ludlum Measurements, Inc. (US), and Ametek Inc.(US).

Research Coverage

- The report studies the radiation, detection, monitoring & safety market based on product, composition, application, and region.

- The report analyzes factors affecting market growth (drivers, restraints, opportunities, and challenges).

- The report evaluates the market opportunities and challenges for stakeholders and details the competitive landscape for market leaders.

- The report studies micro markets with respect to their growth trends, prospects, and contributions to the global radiation, detection, monitoring & safety market.

- The report forecasts the revenue of market segments with respect to five major regions.

Key Benefits of Buying the Report:

The report will be beneficial for the new entrants or market leaders and smaller firms in this market in evaluating their investments in the radiation, detection, monitoring & safety sector through a thorough analysis of data as solid bases for risk assessment and well-validated investment decisions. Get detailed market segmentation on the end-user and regional dimensions for customized reporting that can be used to target a specific segment. This report will also contain an exhaustive assessment covering key trends, challenges, growth catalysts, and prospects so that strategic decisions can be made with complete insight.

The report provides insights on the following pointers:

- Analysis of key drivers (growing number of PET/CT scans, increasing usage of nuclear medicine and radiation therapy), restraints (increasing use of alternatives for nuclear energy, shift in nuclear energy policies and increased nuclear phase-out), opportunities (technological advancements in radiation detection), and challenges (high cost of lead for manufacturing radiation safety products) influencing the market growth.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product & service launches in the radiation, detection, monitoring & safety market

- Market Diversification: Exhaustive information about untapped geographies, new products, recent developments, and investments in the radiation, detection, monitoring & safety market

- Market Development: Comprehensive information about lucrative markets -the report analyses radiation, detection, monitoring & safety market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Fortive (US), Thermo Fisher Scientific Inc. (US), Mirion Technologies Inc. (US), Fuji Electric Co., Ltd. (Japan), Ludlum Measurements Inc. (US), and Ametek Inc. (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKETS COVERED

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Objectives of secondary research

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 RADIATION DETECTION, MONITORING, AND SAFETY MARKET OVERVIEW

- 4.2 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- 4.3 EUROPE: RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION AND APPLICATION, 2024

- 4.4 GEOGRAPHIC SNAPSHOT OF RADIATION DETECTION, MONITORING, AND SAFETY MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number of PET/CT scans

- 5.2.1.2 Increasing usage of nuclear medicine and radiation therapy

- 5.2.1.3 Rising military expenditure for homeland security

- 5.2.1.4 Increasing safety awareness among people working in radiation-prone environments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing use of alternatives for nuclear energy

- 5.2.2.2 Shift in nuclear energy policies and increased nuclear phase-out

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in radiation detection

- 5.2.3.2 Rising focus on nuclear power in developing countries

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of lead for manufacturing radiation safety products

- 5.2.4.2 Shortage of workforce and skilled professionals in nuclear power industry

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.3.2 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 903010

- 5.7.2 EXPORT DATA FOR HS CODE 903010

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY LANDSCAPE

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China

- 5.11.2.3.2 Japan

- 5.11.2.3.3 India

- 5.11.2.4 Latin America

- 5.11.2.4.1 Brazil

- 5.11.2.4.2 Mexico

- 5.11.2.5 Middle East

- 5.11.2.6 Africa

- 5.11.2.1 North America

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Gas detectors

- 5.12.1.2 X-ray radiation detectors

- 5.12.1.3 Scintillators

- 5.12.1.4 Cyclotrons

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Multi-sensor integration technology

- 5.12.2.2 Cloud computing

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Nanotechnology in radiation detection & protection

- 5.12.1 KEY TECHNOLOGIES

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 COMPARISON OF DOSE ASSESSMENTS USING ENVIRONMENTAL AND PERSONAL DOSIMETERS IN REAL-WORLD RADIOLOGICAL AND NUCLEAR EMERGENCY SITUATIONS

- 5.13.2 LONG-TERM COMPLIANCE AND SAFETY CULTURE THROUGH RADIATION MONITORING WITH PERSONAL DOSIMETER DEVICES

- 5.13.3 ASSESSMENT OF WORKING ENVIRONMENT AND PERSONAL DOSIMETER-WEARING COMPLIANCE OF INDUSTRIAL RADIOGRAPHERS BASED ON CHROMOSOME ABERRATION FREQUENCIES

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 IMPACT OF 2025 US TARIFF-RADIATION, DETECTION, MONITORING, AND SAFETY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.17 IMPACT OF GENERATIVE AI/AI ON RADIATION DETECTION, MONITORING, AND SAFETY MARKET

- 5.18 INVESTMENT & FUNDING SCENARIO

6 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 RADIATION DETECTION & MONITORING PRODUCTS

- 6.2.1 PERSONAL DOSIMETERS

- 6.2.1.1 Passive dosimeters

- 6.2.1.1.1 Cost advantages of passive dosimeters to support market growth

- 6.2.1.2 Active dosimeters

- 6.2.1.2.1 Quick results and high-dose applications to support demand

- 6.2.1.1 Passive dosimeters

- 6.2.2 AREA PROCESS MONITORS

- 6.2.2.1 Development of technologically advanced products at lower costs to propel market

- 6.2.3 ENVIRONMENTAL RADIATION MONITORS

- 6.2.3.1 Stringent government regulations regarding radiation exposure to propel market

- 6.2.4 SURFACE CONTAMINATION MONITORS

- 6.2.4.1 Development of user-friendly, accurate, and portable radiation contamination monitors to fuel market

- 6.2.1 PERSONAL DOSIMETERS

- 6.3 MATERIAL MONITORS

- 6.3.1 RADIOACTIVE MATERIAL MONITORS

- 6.3.1.1 Increased use of radioisotopes in nuclear medicine to drive market

- 6.3.2 OTHER MATERIAL MONITORS

- 6.3.1 RADIOACTIVE MATERIAL MONITORS

- 6.4 RADIATION MONITORING SOFTWARE

- 6.4.1 NEED FOR ALERTS, TREND TRACKING, MAPPING, AND REPORT GENERATION TO DRIVE DEMAND FOR SOFTWARE

7 RADIATION DETECTION & MONITORING PRODUCTS MARKET, BY COMPOSITION

- 7.1 INTRODUCTION

- 7.2 DETECTORS

- 7.2.1 GAS-FILLED DETECTORS

- 7.2.1.1 Geiger-Muller counters

- 7.2.1.1.1 Ability to detect all types of radiation to drive market

- 7.2.1.2 Ionization chambers

- 7.2.1.2.1 Accurate measurement of high radiation doses to fuel segment

- 7.2.1.3 Proportional counters

- 7.2.1.3.1 Technological advancements to provide advantages over traditional detectors

- 7.2.1.1 Geiger-Muller counters

- 7.2.2 SCINTILLATORS

- 7.2.3 INORGANIC SCINTILLATORS

- 7.2.3.1 Inorganic scintillators to form largest and fastest-growing segment

- 7.2.4 ORGANIC SCINTILLATORS

- 7.2.4.1 Growing research activities to propel market

- 7.2.1 GAS-FILLED DETECTORS

- 7.3 SOLID-STATE DETECTORS

- 7.3.1 SEMICONDUCTOR DETECTORS

- 7.3.1.1 Technological advancements to propel market

- 7.3.2 DIAMOND DETECTORS

- 7.3.2.1 High cost of diamond detectors to hamper adoption

- 7.3.1 SEMICONDUCTOR DETECTORS

- 7.4 RADIATION PROTECTION PRODUCTS

- 7.4.1 FULL-BODY PROTECTION PRODUCTS

- 7.4.1.1 Growing volume of medical imaging procedures to increase demand

- 7.4.2 FACE PROTECTION PRODUCTS

- 7.4.2.1 Availability of lightweight eyewear to offer enhanced comfort

- 7.4.3 HAND SAFETY PRODUCTS

- 7.4.3.1 Lead-free and powder-free gloves to eliminate risk of allergies

- 7.4.4 LEAD & LEAD-FREE APRONS

- 7.4.4.1 Introduction of eco-friendly and lead-free aprons to propel market

- 7.4.5 OTHER RADIATION PROTECTION PRODUCTS

- 7.4.1 FULL-BODY PROTECTION PRODUCTS

- 7.5 RADIATION SHIELDING PRODUCTS

- 7.5.1 LEAD-LINED RADIATION SHIELDING WALLS

- 7.5.1.1 Efficient properties and relatively low prices to drive adoption

- 7.5.2 OTHER RADIATION SHIELDING PRODUCTS

- 7.5.1 LEAD-LINED RADIATION SHIELDING WALLS

8 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 INDUSTRY

- 8.2.1 NUCLEAR POWER PLANT APPLICATIONS

- 8.2.1.1 Growing adoption of nuclear energy to propel market

- 8.2.2 MANUFACTURING APPLICATIONS

- 8.2.2.1 Need for better detection and technological advancements to drive market

- 8.2.3 RADIONUCLEOTIDE APPLICATIONS

- 8.2.3.1 Rising use of nuclear medicine to drive market

- 8.2.1 NUCLEAR POWER PLANT APPLICATIONS

- 8.3 SAFETY & SECURITY

- 8.3.1 ENVIRONMENTAL APPLICATIONS

- 8.3.1.1 Need for continuous monitoring and availability of government support for environmental safety to propel market

- 8.3.2 HOMELAND SECURITY & DEFENSE

- 8.3.2.1 Rising expenditure on military and internal security to drive growth

- 8.3.1 ENVIRONMENTAL APPLICATIONS

- 8.4 DIAGNOSTICS & THERAPY

- 8.4.1 HEALTHCARE APPLICATIONS

- 8.4.1.1 Rising prevalence of cancer to drive market growth

- 8.4.2 FORENSIC APPLICATIONS

- 8.4.2.1 Growing relevance of nuclear forensics in radiation investigation to propel demand

- 8.4.1 HEALTHCARE APPLICATIONS

- 8.5 OTHER APPLICATIONS

9 RADIATION DETECTION, MONITORING, AND SAFETY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Rising prevalence of cancer to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increased awareness of radiation safety to propel market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 GERMANY

- 9.3.2.1 Growing geriatric population and rising radiography procedures to propel market

- 9.3.3 UK

- 9.3.3.1 Increasing government initiatives and support to aid market growth

- 9.3.4 FRANCE

- 9.3.4.1 Rising number of large number of CT procedures performed to drive market

- 9.3.5 ITALY

- 9.3.5.1 Well-established healthcare infrastructure to support market growth

- 9.3.6 SPAIN

- 9.3.6.1 Rising awareness and the growing need for better radiation detection and safety to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Rising prevalence of chronic diseases and healthcare expenditure to propel market

- 9.4.3 JAPAN

- 9.4.3.1 Rising awareness of radiation exposure to drive market

- 9.4.4 INDIA

- 9.4.4.1 Favorable government policies and healthcare infrastructure to support market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Favorable regulations to support market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Favorable government policies and healthcare infrastructure to support market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing geriatric population and rising need for cancer treatment to propel market

- 9.5.3 MEXICO

- 9.5.3.1 Free trade agreements and focus on reducing trade barriers to favor market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 DEVELOPMENT OF NUCLEAR POWER INFRASTRUCTURE TO FUEL MARKET GROWTH

- 9.6.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.6.3 GCC COUNTRIES

- 9.6.3.1 Growing healthcare infrastructure to fuel market growth

- 9.6.3.2 GCC Countries: Macroeconomic Outlook

- 9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.4 REVENUE ANALYSIS, 2021-2023

- 10.5 MARKET SHARE ANALYSIS, 2024

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Product footprint

- 10.6.5.4 Application footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of startups/SMEs

- 10.8 COMPANY VALUATION & FINANCIAL METRICS

- 10.8.1 FINANCIAL METRICS

- 10.8.2 COMPANY VALUATION

- 10.9 BRAND/PRODUCT COMPARISON

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES

- 10.10.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 THERMO FISHER SCIENTIFIC INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Right to win

- 11.1.1.3.2 Strategic choices made

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 MIRION TECHNOLOGIES INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices made

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 FORTIVE

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices made

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 AMETEK INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices made

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 FUJI ELECTRIC CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices made

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 LUDLUM MEASUREMENTS INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Other developments

- 11.1.7 ARKTIS RADIATION DETECTORS LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 POLIMASTER EUROPE UAB

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 AMRAY

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 INFAB, LLC

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.10.3.2 Deals

- 11.1.11 IBA WORLDWIDE

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.2.1 Deals

- 11.1.1 THERMO FISHER SCIENTIFIC INC.

- 11.2 OTHER PLAYERS

- 11.2.1 BERTIN TECHNOLOGIES

- 11.2.2 RADIATION DETECTION COMPANY

- 11.2.3 ARROW-TECH, INC.

- 11.2.4 CENTRONIC

- 11.2.5 S.E. INTERNATIONAL, INC.

- 11.2.6 ATOMTEX

- 11.2.7 NUCLEONIX SYSTEMS

- 11.2.8 ALPHA SPECTRA, INC.

- 11.2.9 LND, INC.

- 11.2.10 BAR RAY PRODUCTS

- 11.2.11 TRIVITRON HEALTHCARE

- 11.2.12 MICRON SEMICONDUCTOR LTD.

- 11.2.13 SCIONIX HOLLAND B.V.

- 11.2.14 RADCOMM SYSTEMS

- 11.2.15 XENA SHIELD

- 11.2.16 SIMAD SRL

- 11.2.17 BURLINGTON MEDICAL

- 11.2.18 RADIATION PROTECTION PRODUCTS INC.

- 11.2.19 NUCLEAR SHIELDS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS