|

市場調査レポート

商品コード

1524089

フリート管理ソリューション:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フリート管理ソリューション:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年07月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

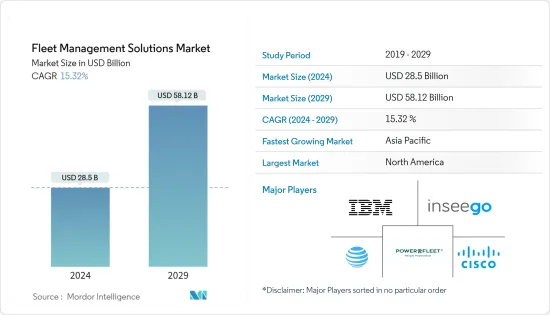

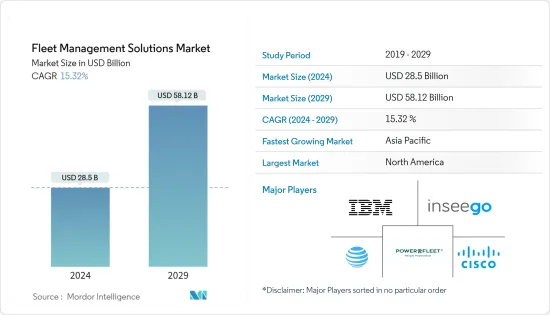

フリート管理ソリューション市場規模は2024年に285億米ドルと推定され、2029年には581億2,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは15.32%で成長する見込みです。

*フリート管理ソフトウェアは、自動車保有台数に依存する企業にとって不可欠なツールとなっており、生産性の向上を通じて業務を変革しています。手作業のプロセスや断片的なシステムに端を発する従来の手法には、不正確なデータ、可視性の低さ、資源の無駄遣いといった欠点があった。しかし、費用対効果の高い戦術とリアルタイム分析への要求から、新しいソリューションへのニーズが高まっています。

*企業が求めている機能には、遠隔地での作業や生産性の監視、車両データのリアルタイム追跡などがあり、ビジネスチャンスの創出につながると期待されています。自律走行車の導入は、車両管理ソリューションがルートや配送スケジュールを効果的に調整する上で重要な要素になりつつあることから、市場の成長に寄与する可能性が高いです。

*フリート管理システム市場は、主にソフトウェア、ハードウェア、接続ソリューション、ネットワークインフラで構成され、フリートオペレーターに効果的なモニタリングとレポーティングを提供します。このソリューションは、コストとリソースの支出を削減すると同時に、車両が確立された基準に準拠していることを確認することを可能にすることで、車両運行会社に利益をもたらします。市場ベンダーは、有益性のないサービスを排除することで、フリート効率を高めることに主眼を置いています。

*貨物・ロジスティクス向けソフトウェア開発の第二の大きな動向は、自動化の急速な導入であり、フリート管理ソリューションはこのアプローチを急速に採用しています。この市場は、モノのインターネット、コネクテッドトラック、コンテナといった新しい技術から大きな牽引力を得ています。車両をインターネットに接続することで、効率的なビジネスの機会もさらに生まれると思われます。

*5Gの導入は、情報伝達のスピードを上げ、車両が遅延を減らして生産性を上げることを可能にするため、車両管理にも多大な影響を与えると思われます。モバイル車両管理アプリケーションを使用する組織は、5Gの使用を可能にします。通信範囲の拡大と即時通知のイントロダクションより、運行管理者とその乗務員は互いに連絡を取り合い、生産性を向上させることができます。

*フリート管理ソリューションは、限られた機能で初期費用が高く、管理システムの機能によって月あたりの資産あたりのコストが異なります。最終的に、各ソリューションの正確な価格は、追跡する車両の数、ベンダーが提供するサポートの質、一般的に総費用にバンドルされているベンダーのライセンス料とメンテナンス料の価格など、さまざまな要因に依存する独自のものです。

*COVID-19の蔓延により、アイドリング状態の車両が大量に発生し、他のタイプの車両を管理するために設計されたベンダーが提供する車両管理ソリューションが最も大きな打撃を受けています。これは、世界の封鎖、出張制限、在宅勤務の文化によるものです。企業が在宅勤務政策を拡大し続け、人々がライドヘイリングサービスの利用を避けるようになるにつれ、この動向は続いています。

フリート管理ソリューション市場の動向

資産管理セグメントが大きなシェアを占める見込み

*資産管理システム・ソリューションは、(FAST)への直接接続を維持し、重複データベースを排除して、資産および保守管理と財務の間の接続を作成することができます。これは、データの可用性と効果的な調査のおかげで、費用便益分析の見直しが行われるように、各活動に対する資産の影響の監視を実施することができます。

*製造業やオフィス環境における急速なデジタル化が進む現在の市場シナリオにおいて、資産管理とトラッキングソリューションは、より高い業務効率を確保するためにさらに重要になってきています。最近のモノのインターネット(Internet of Things)技術の動向により、経済的で効率的な資産追跡装置を購入できるようになったエンドユーザーもいます。資産追跡システムの売上は、標準的な従来の資産追跡システムと比較して、最小限の電力とインフラを使用する最新の広域および短距離モノのインターネット機器によって牽引されています。

*全地球測位システム(GPS)は自動車に広く使用されていますが、その用途は限定されていません。GPSは屋外の正確な位置を追跡するのに役立ちます。予備的なアプリケーションとして、車両追跡システムは、輸送や物流のビジネスが車両や 促進要因を含むすべての資産を追跡するのを助けるように設計されています。

*資産フリート管理のためのアプリケーションは、特定の車や 促進要因の利用情報を収集し、ポジションモニタリング、インパクトレポート、車両アクセスコントロール、コンプライアンスチェックリストのような機能をフリート管理システムに追加する可能性があります。マテリアルハンドリングトラックは単なるリフトトラックであることを超えて進化しました。それは現在、運転者のコックピットと同様に、管理者のデータソースとみなされています。伝統的なベースリフトトラックの提供は、運転者のセキュリティと生産性をサポートする機能、および施設管理のための車両と運転者のパフォーマンスに関するデータ主導の実用的洞察のような、幅広い先進技術的選択で強化することができます。

*産業用モノのインターネットでは、資産の追跡が今後10年間で大幅に増加すると予測されており、位置認識は相互接続されたデバイスの重要な要素になります。モノのインターネットの資産監視のための新しいソリューションは、低消費電力無線周波数チップ技術の開発と、低消費電力広域ネットワーク(LPWAN)およびブルートゥースLBLEビーコンの採用により出現しました。RFID技術を使って資産トラッカーが実装されれば、産業オートメーション、サプライチェーン、ロジスティクス、農業、建設、鉱業、関連市場など、いくつかの分野での需要が増加すると予想されます。

北米が最大市場を記録する見込み

- 製造、輸送、物流などの産業部門が強く存在することから、北米は資産管理にとって重要な市場です。また、同地域の市場成長は、政府の取り組みや、さまざまなエンドユーザー部門に適用される規制によって支えられています。

- 国内の消費者がより迅速な配送を採用する傾向が強まっていることから、連合輸送業者と荷送人は時間的制約のないサプライチェーンを維持しなければならないです。ラスト・マイルをめぐる輸送業者間の競合により、従来のフリートや新興企業から、消費者の自宅に直接小包を届ける効率的な方法へのシフトが進んでいます。さらに、この国では、最後のホリデーショッピングシーズンという、フリートオーナーの運転効率に大きな影響を与える要因があります。

- フリート管理ソリューションの採用は、5Gフリート管理に関するこの国の重要な促進要因と考えられています。フリートは5Gの主な機能を使って遅延を短縮し、生産性を向上させることができるはずです。カバレッジの改善と生産性の向上により、フリート管理アプリケーションのユーザーは5Gによるより良い通信から恩恵を受けることができます。

- ベンダーから見ると、車両リース会社は国内の顧客にフリート管理ソリューションを提供し始めています。また、これらの企業の大半は、地理的プレゼンスを構築するために協力やパートナーシップを利用しています。例えばカナダでは、車両追跡や電子伐採から車両メンテナンスやアイドリング・トラッキングまで、HOS247が包括的なエンド・ツー・エンドの車両管理システムを提供しています。HOS247の電子記録装置は、違反を減らし、連邦規則を遵守する企業を支援するために作られています。同社は、彼らの顧客ケアで一流のサポートを提供することに専念しています。同社のハードウェアの品質とソフトウェアのユーザーフレンドリーな設計のため、 促進要因は楽に自分のログを管理し、資金や罰則から離れて滞在することができます。

車両管理ソリューション業界の概要

車両管理ソリューション市場は、グローバルプレーヤーと中小企業の両方が存在するため、非常に断片化されています。さらに、車両管理データの増加により、企業はクラウド技術に関心を持つようになっています。i.D.のようないくつかの重要なプレーヤーがこの市場を独占しています。Systems、Cisco Systems Inc.、IBM Corporation、AT&T Inc.、Ctrack(Inseego Corp.)市場のプレーヤーは、製品ラインナップを強化し、持続可能な競争優位性を獲得するために、提携や買収などの戦略を採用しています。

2023年7月、Charles Jackson and Co.は、InseegoAIを搭載したA.I.フリートカメラソリューションを、安全性と保険の改善をターゲットとし、衝突を減らし安全性を向上させるために、その専門家による運搬業務に拡大しました。ライブトラッキング、インシデントアラート、 促進要因の状態監視を組み合わせることで、責任ある運転を促し、衝突を減らすことができます。事故が発生した場合、 促進要因の安全を確保し、保険請求プロセスを管理するために対応することができます。また、ビデオとサポートデータを使用して、効果的な調査を迅速に行うことができます。個別または匿名化された映像は、 促進要因へのフィードバックとトレーニング戦略をサポートします。

2023年3月、パワーフリート社はフリートインテリジェンスプラットフォームであるUnityに、安全・セキュリティデータを活用したアプリケーションを発表しました。Unityは、あらゆるIoTデバイスやサードパーティのビジネスシステムからデータを取り込み、コンパイルし、エンリッチします。Powerfleetの新しく強化されたデータ科学主導のソリューションにより、企業は、1つの包括的で高度に集中したダッシュボードとレポーティングの下で、現実世界の安全性とセキュリティインシデントからの可視性と洞察を改善することができます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 自動車のチップ不足と川下への影響

第6章 テレマティクス(車両ハードウェア)の概要

第7章 市場力学

- 市場促進要因

- フリートオペレーションの合理化の再重要視

- 幅広いレポーティングと分析サービスの利用可能性

- 手頃な価格のハードウェアと接続性の向上

- 市場抑制要因

- 小規模フリートオーナーの認識不足

- COVID-19による輸送業界の不確実性

第8章 市場セグメンテーション

- 展開モデル別

- オンプレミス

- オンデマンド

- ハイブリッド

- ソリューション別

- 資産管理

- 情報管理

- ドライバー管理

- 安全・コンプライアンス管理

- リスク管理

- オペレーション管理

- その他

- エンドユーザー別

- 輸送

- エネルギー

- 建設

- 製造

- その他

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

- 北米

第9章 競合情勢

- 企業プロファイル

- Cisco Systems Inc.

- AT&T Inc.

- Ctrack(Inseego Corp.)

- I.D. Systems

- IBM Corporation

- Astrata Group

- Mix Telematics Limited

- Omnitracs LLC

- Tomtom NV

- Trimble Navigation Limited

- Verizon Communications Inc.

- Wheels Inc.

- Tenna LLC

- Samsara Network Inc.

- KeepTrucking Inc.

- Fleet Complete Inc.

- Odoo SA

- Fleetable(Affable Web Solutions Company)

- Octo Group SpA

- Geotab Inc.

- Rarestep Inc.(FLEETIO)

- Switch Board Inc.

- Azuga holdings Inc.

- Chevin Fleet Solutions

- One Step GPS LLC

- Transflo

- Go Fleet Inc.

- Advance Tracking Technologies Inc.

- Donlen Corporation By Hertz Holdings

第10章 市場の展望

The Fleet Management Solutions Market size is estimated at USD 28.5 billion in 2024, and is expected to reach USD 58.12 billion by 2029, growing at a CAGR of 15.32% during the forecast period (2024-2029).

* Fleet management software has become a vital tool for businesses that depend on car fleets, transforming operations through increased productivity. Traditional methods, which originated in manual processes and fragmented systems, have drawbacks, including imprecise data, poor visibility, and wasteful resource use. However, the need for new solutions has increased due to the demand for cost-effective tactics and real-time analytics.

* Some of the features businesses are looking for, which they expect will create opportunities, include monitoring tasks and productivity in a remote environment, along with real-time tracking of fleet data. Introducing autonomous vehicles will likely contribute to market growth as fleet management solutions are becoming a key factor in effectively coordinating routes and delivery schedules.

* The Fleet Management System market mainly comprises software, hardware, connectivity solutions, and network infrastructure to provide fleet operators with effective monitoring and reporting. The solution will benefit fleet operators by reducing costs and resource expenditures while making it possible to ensure that the fleet is complying with established standards. Market vendors' primary focus has been increasing fleet efficiency by eliminating services that offer no appreciable benefit.

* The second significant trend behind software development for freight and logistics is the rapid adoption of automation, where fleet management solutions rapidly adopt this approach. The market is gaining considerable traction from new technologies such as the Internet of Things, connected trucks, and containers. Connecting vehicles to the Internet would also create further opportunities for efficient business.

* 5G deployment will also immensely affect fleet management, as it increases the speed of information transfer and allows fleets to reduce delays and gain productivity. Organizations using a mobile fleet management application will make the use of 5 G possible. The increased coverage and the introduction of immediate notifications enable fleet managers and their crews to remain in touch with each other and increase productivity.

* Fleet management solutions have high initial costs with limited functionality, and the cost per asset per month varies according to the management system's features. Ultimately, the exact price of each solution is unique and dependent on various factors, such as the number of vehicles tracked, the quality of support offered by the vendor, and the price of the vendor's licensing and maintenance fees, which are typically bundled into the total cost.

* The spread of COVID-19 resulted in high levels of idled vehicles, and fleet management solutions offered by vendors designed to manage other types of fleets have been hit hardest. This is due to a global lockdown, travel restrictions, and the culture of working from home. The trend stays in place as firms continue to expand work-from-home policies and people avoid using ride-hailing services.

Fleet Management Solutions Market Trends

Asset Management Segment Expected to Hold Significant Share

* Asset management systems and solutions allow for the creation of connections between property and maintenance management and financial by maintaining a direct connection to the (FAST), eliminating duplicate databases, and maintaining a This allows for the monitoring of an asset's effect on each activity to be carried out so that a review of cost-benefit analysis may take place, thanks to data availability and effective research.

* In the present market scenario for rapid digitalization in manufacturing and office environments, asset management and tracking solutions have become even more important to ensure a higher efficiency of operations. Several end users have benefited from recent developments in the Internet of Things technologies, enabling them to purchase economical and efficient asset-tracking equipment. The sales of asset tracker systems are driven by modern wide area and short-range Internet of Things equipment, which use minimal power and infrastructure compared with standard traditional Asset Tracker Systems.

* Global positioning systems (GPS) are widely used in vehicles, but their application is not limited. Organizations have also reported using them to monitor employees-GPS aids in tracking precise outdoor locations. As a preliminary application, the vehicle tracking system is designed to help businesses in transport or logistics keep track of all their assets, including vehicles and drivers.

* Applications for asset fleet management may gather utilization information on specific cars and drivers, assisting managers in finding ways to boost output features like position monitoring, impact reporting, vehicle access control, and compliance checklists are additional possible additions to fleet management systems. The material handling truck has evolved beyond being a simple lift truck. It is now regarded as the manager's data source as well as the operator's cockpit. Traditional base lift truck offerings can be enhanced with a wide range of advanced technological choices, such as capabilities to support operator security and productivity, as well as data-driven, actionable insight into vehicle and operator performance for facility management.

* In the Industrial Internet of Things, asset tracking is projected to increase significantly in the coming decade, and location awareness will become a key element for interconnected devices. New solutions for asset monitoring of the Internet of Things have emerged due to developments in low-power radio frequency chip technology and the adoption of Low Power Wide Area Networks, LPWAN, and Bluetooth LBLE beacons. Demand in several sectors, such as industry automation, supply chains, logistics, agriculture, construction, mining, and related markets, is anticipated to increase when asset trackers are implemented using RFID technology.

North America is Expected to Register the Largest Market

- Given the strong presence of industry sectors such as manufacturing, transportation, and logistics, North America is an important market for asset management. In addition, market growth in the region is supported by government initiatives and regulations applicable to different end-user sectors.

- Allied carriers and shippers must keep a time-definite supply chain in place, given the increasing adoption of more rapid delivery by consumers at home. The competition between carriers for the last mile has resulted in a shift to efficient methods of delivering small packages directly into consumers' homes from traditional fleets and start-ups. In addition, there is a significant factor influencing the driving efficiency of fleet owners in this country: the last holiday shopping season.

- Adopting fleet management solutions is considered a critical driving factor in this country regarding 5G fleet management. Fleets should be able to shorten delays and improve productivity using 5G's main features. Due to improved coverage and higher productivity, users of fleet management applications can benefit from better communication with 5G.

- In vendor terms, vehicle leasing companies have started offering fleet management solutions to clients in the country. In addition, most of those companies have been using cooperation and partnerships to build their geographic presence. For instance, in Canada, from vehicle tracking and electronic logging to vehicle maintenance and idle tracking, HOS247 provides a comprehensive end to end fleet management system. The electronic logging device from HOS247 is made to reduce infractions and assist companies in adhering to federal rules. The company is dedicated to offering first rate support with their customer care. Because of the quality of the company's hardware and the user-friendly design of the software, drivers can effortlessly manage their logs and stay away from funds and penalties.

Fleet Management Solutions Industry Overview

The fleet management solutions market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Furthermore, companies have become interested in cloud technologies due to growing fleet management data. Several important players, such as I.D., dominate this market. Systems, Cisco Systems Inc., IBM Corporation, AT&T Inc., Ctrack (Inseego Corp.), and others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2023, Charles Jackson and Co. expand its A.I. fleet camera solution with an InseegoAI-powered fleet dashcam solution to its specialist haulage operation to target safety and insurance improvements and to reduce collisions and improve safety, where the combination of live tracking, incident alerting, and driver status monitoring will help us encourage responsible driving and reduce crashes. If an incident does occur, we will be able to respond to ensure driver welfare and manage the insurance claims process, as well as use video and supporting data to undertake an effective investigation quickly. Individual or anonymized footage will support our targeted driver feedback and training strategy.

In March 2023, Powerfleet Inc. launched its safety and security data-powered application to Unity, its fleet intelligence platform. Unity ingests, compiles, and enriches data from any IoT device or third-party business system. Mixed fleets, over the road or in the warehouse or distribution center, now have a single source of truth to revolutionize the safety of assets, vehicles, and, most importantly, its people; with Powerfleet's new and enhanced data-science-driven solution, businesses have improved visibility and insights from real-world safety and security incidents under one comprehensive and highly focused set of dashboards and reporting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 IMPACT OF CHIP SHORTAGE IN AUTOMOTIVE AND DOWNSTREAM EFFECTS

6 TELEMATICS (FLEET HARDWARE) OVERVIEW

7 MARKET DYNAMICS

- 7.1 Market Drivers

- 7.1.1 Renewed Emphasis on Streamlining Fleet Operations

- 7.1.2 Availability of a Wider Range of Reporting and Analytics Services

- 7.1.3 Affordable Hardware and Access to Greater Connectivity

- 7.2 Market Restraints

- 7.2.1 Lack of Awareness among Smaller Fleet Owners

- 7.2.2 Uncertainties in transport industry due to COVID-19

8 MARKET SEGMENTATION

- 8.1 By Deployment Model

- 8.1.1 On-Premise

- 8.1.2 On-Demand

- 8.1.3 Hybrid

- 8.2 By Solution

- 8.2.1 Asset Management

- 8.2.2 Information Management

- 8.2.3 Driver Management

- 8.2.4 Safety and Compliance Management

- 8.2.5 Risk Management

- 8.2.6 Operations Management

- 8.2.7 Other Solutions

- 8.3 By End User

- 8.3.1 Transportation

- 8.3.2 Energy

- 8.3.3 Construction

- 8.3.4 Manufacturing

- 8.3.5 Other End-Users

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 France

- 8.4.2.4 Rest of Europe

- 8.4.3 Asia Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia Pacific

- 8.4.4 Latin America

- 8.4.4.1 Brazil

- 8.4.4.2 Argentina

- 8.4.4.3 Rest of South America

- 8.4.5 Middle East and Africa

- 8.4.5.1 United Arab Emirates

- 8.4.5.2 Saudi Arabia

- 8.4.5.3 South Africa

- 8.4.5.4 Rest of Middle East and Africa

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Cisco Systems Inc.

- 9.1.2 AT&T Inc.

- 9.1.3 Ctrack (Inseego Corp. )

- 9.1.4 I.D. Systems

- 9.1.5 IBM Corporation

- 9.1.6 Astrata Group

- 9.1.7 Mix Telematics Limited

- 9.1.8 Omnitracs LLC

- 9.1.9 Tomtom NV

- 9.1.10 Trimble Navigation Limited

- 9.1.11 Verizon Communications Inc.

- 9.1.12 Wheels Inc.

- 9.1.13 Tenna LLC

- 9.1.14 Samsara Network Inc.

- 9.1.15 KeepTrucking Inc.

- 9.1.16 Fleet Complete Inc.

- 9.1.17 Odoo SA

- 9.1.18 Fleetable (Affable Web Solutions Company)

- 9.1.19 Octo Group SpA

- 9.1.20 Geotab Inc.

- 9.1.21 Rarestep Inc. (FLEETIO)

- 9.1.22 Switch Board Inc.

- 9.1.23 Azuga holdings Inc.

- 9.1.24 Chevin Fleet Solutions

- 9.1.25 One Step GPS LLC

- 9.1.26 Transflo

- 9.1.27 Go Fleet Inc.

- 9.1.28 Advance Tracking Technologies Inc.

- 9.1.29 Donlen Corporation By Hertz Holdings