|

市場調査レポート

商品コード

1639409

MEMS自動車用センサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)MEMS Automobile Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MEMS自動車用センサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

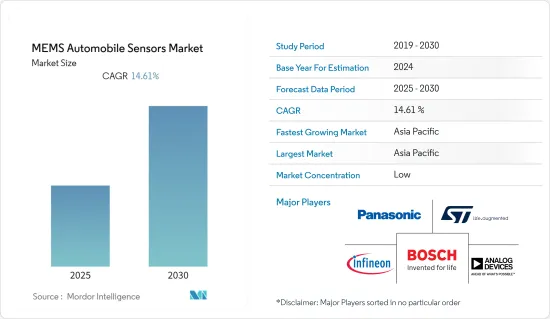

MEMS自動車用センサー市場は予測期間中にCAGR 14.61%を記録する見込みです。

主なハイライト

- MEMSセンサーは自動車に不可欠な部品となっています。加速度計のような自動車で使用される最初のバージョンから、このセンサー技術は大きく進化し、自動車アプリケーションの最も顕著な技術ドライバーとなっています。ほとんどの先進的な自動車では、これらの繊細なセンサーが自動車システムに正確なデータを継続的に供給し、それに基づいて、接続された電気制御ユニットがリアルタイムで必要なアクションを引き起こします。

- 自動車の安全性とセキュリティに対する需要の高まりは、市場の成長に重要な役割を果たす主な要因のひとつです。世界保健機関(WHO)によると、年間150万人以上が交通事故で死亡し、約5,000万人が負傷しています。MEMSセンサーは自動車の安全性向上に重要な役割を果たすため、こうした動向はマーケット成長のカタリストとして機能します。

- さらに、電動化と自動化は自動車産業における2つの重要な動向です。業界における電気自動車(EV)の出現は、圧力センサーと磁気センサーの需要と流通に劇的な影響を与えています。長期的にはさらに需要が増加すると予想されます。電気自動車の販売台数の増加は、センサーの需要を増加させています。さらに、自動車システムにおけるRADAR、LIDAR、画像処理など、さまざまな位置決めや高価値のセンシングモジュールの統合が進んでいるため、予測期間中に大きなビジネスチャンスが生まれると予想されます。

- また、政府の厳しい規制により、自動車メーカーは主要な自動車市場の新車にタイヤ空気圧モニタリングシステム(TPMS)やエレクトロニック・スタビリティ・コントロール(ESC)などの安全システムを搭載することが義務付けられており、MEMSセンサの実装に新たな使用事例が生まれています。また、さまざまなメーカーが市場のチャンスをつかむために、いくつかの製品イノベーションを行っています。例えば、TDKはCES 2021で、車載グレードの6軸ASIL-B MEMS IMUであるSmart Automotive IAM-20685を発表しました。

- MEMSデバイスは、比較的単純な構造のものから、集積されたマイクロエレクトロニクスの制御下で複数の可動素子を持つ非常に複雑なものまでさまざまです。そのため、業界は複雑な製造工程でさまざまな課題に直面しています。さらに、これらのセンサーは温度によるドリフトが大きいことが多く、これが市場の成長をさらに妨げる課題となっています。

- さらに、COVID-19の大流行により、自動車需要が減速し、自動車部品のサプライチェーンにも影響が及んでいます。短期・中期的には、自動車メーカーが目先の資金需要に研究予算を振り向けたため、パンデミックは自律走行などの先端技術開発を遅らせた。しかし、状況が改善し、自動車産業が勢いを増していることから、予測期間中に十分な成長機会がもたらされると期待されます。

MEMS自動車用センサー市場動向

エアバッグ展開センサが大きく成長

- MEMSセンサは、自動車の安全機能を向上させる上で重要な役割を果たしています。自律走行の進化に伴い、エアバッグ展開のような安全ベースのアプリケーション向けにMEMSセンサの需要は倍増すると予想されます。事故レベルを低減するため、各国政府は厳しい規制を策定しており、自動車ベンダーはエアバッグ展開システムに最新のMEMSベースセンサを実装するよう求められています。

- エアバッグ制御用のクラッシュセンシングは、慣性MEMSセンサの最大の自動車用途分野の1つです。このアプリケーションでは、加速度計が自動車の加速度を連続的に測定します。あらかじめ設定されたパラメータがしきい値を超えると、エアバッグが作動します。その結果、エアバッグシステムの信頼性が向上し、価格も低下したため、自動車への搭載がほぼ一般的になっています。

- 交通事故の増加率を考慮し、各国政府はエアバッグの使用を促進する厳しい規制を設けています。インドでは、エアバッグを最低2個搭載する規則が施行されました。政府は、自動車メーカーに対し、ボディスタイルやセグメントに関係なく、すべてのバリエーションに6個のエアバッグを標準装備するよう提案しました。こうした動向は、市場にさらなる成長機会をもたらすと期待されています。

- ここ数年、特に新興諸国では高級車の販売が大きく伸びています。これらの車には通常、より多くのエアバッグが搭載されているため、販売台数の伸びは市場の成長にプラスの影響を与えると予想されます。例えば、高級車ブランドの代表格であるBMWは最近、世界で252万台の自動車を販売しました。さらに、電気自動車やハイブリッド車に対する需要の高まりも、これらの自動車には通常、高度な安全性と快適性が備わっているため、市場の成長にプラスの影響を与えると予想されます。

アジア太平洋地域が最速の成長率を示す

- 中国、インド、日本などの経済圏で自動車産業が急成長していることから、アジア太平洋地域はMEMS自動車用センサー市場で最も高い成長率を示すと予想されています。例えば、OICAによると、昨年の自動車生産台数は約2,600万台で、中国が世界トップの自動車メーカーでした。年間自動車生産台数では、中国に米国、日本、インドが続いた。

- 中国では、自律走行とADASの標準化が加速しています。例えば、昨年、中国政府は3つの新しい国家安全基準(電気自動車安全要件、電気自動車トラクション・バッテリー安全要件、電気バス安全要件)を発表しました。これらの必須基準は、バッテリーの早期故障検出メカニズムの実装を含め、バッテリーパックと車両に対する安全要件を提示しています。

- 同様の動向は、アジア太平洋地域の他の国々でも採用されつつあります。例えば、インド道路交通高速道路省(MoRTH)は今年6月、自動車メーカーに高度な安全機能を提供するよう奨励し、同国で生産される自動車の「輸出価値」を高めるため、乗用車を対象とした安全性評価制度「バーラト・ニューカー・アセスメント・プログラム(BNCAP)」の導入を提案しました。

- さらに、日本や韓国などの国々では、自律走行車の開発が急速に進んでいます。例えば、韓国政府は完全な自律走行の追求を計画しており、2035年までに国産車の半数を完全自律走行車にしたいと考えています。これらの自動車は手動による介入を最小限にとどめる必要があるため、センサーはその運用を成功させる上で重要な役割を果たします。したがって、自律走行車産業の成長により、MEMSセンサの需要がさらに高まると予想されます。

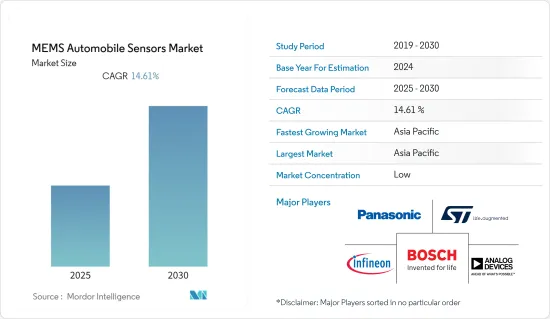

MEMS自動車用センサー業界の概要

MEMS自動車用センサー市場は細分化されており、STMicroelectronics NV、Panasonic Corporation、Robert Bosch GmbH、Analog Devices Inc.、Infineon Technologies AGなど、多くの世界的・地域的プレーヤーで構成されています。これらのプレーヤーは、世界中の顧客基盤の拡大に注力しています。これらの企業は、予測期間中に競争優位性を獲得するために、新しいソリューションの導入、戦略的提携、その他の有機的・無機的成長戦略への研究開発投資に注力しています。

2022年10月、中国の車載グレードMEMS LiDARソリューションの大手プロバイダーであるZvisionとエヌビディアは協業契約を締結し、Zvisionは同プラットフォームの主要LiDARセンサーパートナーの1社としてエヌビディア・ジェットソンのエコシステムに参加しました。この契約を通じて、ZvisionはNVIDIAの本格的なソフトウェアツールチェーンとリードAIチップハードウェアを活用し、さまざまなソリッドステートLiDARベースの自律走行センサーとシステムを開発する計画です。

STマイクロエレクトロニクスは2021年4月、高性能車載アプリケーション向けの次世代MEMS加速度計、AIS2IH 3軸リニア加速度計を発表しました。これらの加速度計は、テレマティクス、盗難防止、インフォテインメント、ビークルナビゲーション、傾斜/傾き測定などの非安全自動車アプリケーションに、分解能、機械的堅牢性、温度安定性の向上をもたらします。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 技術スナップショット

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- 乗客の安全性とセキュリティに関する規制、およびコンプライアンス重視の高まり

- 顧客に好まれる自動化機能と性能向上の増加

- 市場抑制要因

- インターフェース設計の考慮によるMEMSセンサーの実装コストの増加

第6章 市場セグメンテーション

- タイプ別

- タイヤ空気圧センサー

- エンジンオイルセンサ

- 燃焼センサー

- 燃料噴射・燃料ポンプセンサー

- エアバッグ展開センサー

- ジャイロスコープ

- 燃料レール圧力センサー

- その他のタイプ

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋地域

- 世界のその他の地域

- 北米

第7章 競合情勢

- 企業プロファイル

- Analog Devices Inc.

- Delphi Automotive PLC

- Denso Corporation

- General Electric Co.

- Freescale Semiconductors Ltd

- Infineon Technologies AG

- Sensata Technologies Inc.

- SiMicroelectronics NV

- Panasonic Corporation

- Liqid Inc.

- Robert Bosch GmbH

第8章 投資分析

第9章 市場機会と今後の動向

The MEMS Automobile Sensors Market is expected to register a CAGR of 14.61% during the forecast period.

Key Highlights

- MEMS sensors have become an indispensable part of vehicles. From the first versions used in motor vehicles, such as the accelerometer, this sensor technology has evolved significantly to become the most prominent technology driver for automotive applications. In most advanced vehicles, these delicate sensors continuously supply the automotive system with precise data, based on which the connected electric control units trigger necessary actions in real-time.

- The growing demand for safety and security in automobiles is one of the main factors that play a vital role in the market's growth. According to the World Health Organization, more than 1.5 million people are killed in road accidents yearly, and about 50 million people get injured. As MEMS sensors play a critical role in improving the safety features of vehicles, such trends act as catalysts for the growth of the market.

- Moreover, electrification and automation are two significant trends in the automotive industry. The emergence of electric vehicles (EVs) in the industry has dramatically impacted the demand for and distribution of pressure and magnetic sensors. It is expected to increase the demand in the long-term further. Increasing sales of electric cars are thereby increasing the demand for sensors. Furthermore, the increasing integration of various positioning and high-value sensing modules, such as RADAR, LIDAR, and imaging in automotive systems, is expected to create significant opportunities during the forecast period.

- In addition, strict government regulations encourage automotive manufacturers to include mandated safety systems, such as tire pressure monitoring systems (TPMS) and electronic stability control (ESC), in new vehicles in major automotive markets, creating new use cases for implementing MEMS sensors. Various manufacturers are also making several product innovations to grab the market's opportunities. For instance, at CES 2021, TDK announced Smart Automotive IAM-20685, an automotive grade 6-axis ASIL-B MEMS IMU.

- MEMS devices vary from a relatively simple structure to highly complex ones with multiple moving elements under the control of integrated microelectronics. Hence, the industry faces various challenges during the complex manufacturing process. Additionally, these sensors often have a more significant drift over temperature, which further challenges the growth of the market.

- Additionally, due to the COVID-19 pandemic, the demand for automotive slowed down, along with the effect on the supply chain of automotive parts. Over the short to medium term, the pandemic delayed the development of advanced technologies, such as autonomous driving, as automakers divert research budgets to fund immediate cash requirements. However, with the condition improving and the automotive sector gaining momentum, the industry is expected to offer ample growth opportunities during the forecast period.

Automobile MEMS Sensors Market Trends

Airbag Deployment Sensors to Witness a Significant Growth

- MEMS sensors play a vital role in improving the safety features of vehicles. With the evolution of autonomous driving, the demand for these sensors is expected to increase multiple-fold for safety-based applications, such as airbag deployment. To reduce accident levels, governments are framing stringent regulations, pushing automotive vendors to implement the latest MEMS-based sensors in airbag deployment systems, creating growth opportunities for the market.

- Crash sensing for airbag control is among the largest automotive application areas of inertial MEMS sensors. In this application, an accelerometer continuously measures the acceleration of the car. When the preset parameter goes beyond the threshold, the airbags are fired. The resulting increase in reliability and reduction in the price of the airbag system is further bringing about its near-universal inclusion in cars.

- Considering the growing rate of road accidents, governments across various countries are framing stringent regulations that promote the use of airbags. A minimum two airbag rule came into effect in India. The government proposed that automobile manufacturers include six airbags as standard across all variants, regardless of the body style or segment. Such trends are expected to create more growth opportunities in the market.

- The past years have witnessed significant growth in the sale of luxury vehicles, especially in developing countries. As these cars usually contain more airbags, the sales growth is expected to impact the growth of the market positively. For instance, recently, BMW, one of the leading luxury car brands, sold 2.52 million units of cars globally. Furthermore, the increasing demand for electric and hybrid vehicles is also expected to positively impact the growth of the market as these vehicles usually come with advanced safety and comfort features.

Asia-Pacific to Exhibit the Fastest Growth Rate

- Due to the rapidly growing automotive industry in economies such as China, India, and Japan, the Asia-Pacific is expected to exhibit the highest growth rate in the automotive MEMS sensors market. For instance, according to OICA, last year, China was the leading automobile manufacturer globally, with a production volume of about 26 million vehicles. China was followed by the United States, Japan, and India in annual vehicle production volume.

- The standardization of autonomous driving and ADAS is accelerating in China. For instance, last year, the Chinese government issued three new national safety standards (Electric Vehicle Safety Requirements, Electrical Vehicle Traction Battery Safety Requirements, and Electric Bus Safety Requirements). These mandatory standards put forward safety requirements for the battery pack and vehicle, including the implementation of early battery failure detection mechanisms.

- A similar trend is being adopted by other countries of the Asia-Pacific region, considering the growing number of road accident cases. For instance, to encourage automobile manufacturers to provide advanced safety features and boost the "export worthiness" of vehicles produced in the country, the Indian Ministry of Road Transport and Highways (MoRTH) proposed to introduce a safety rating system, Bharat New Car Assessment Program (BNCAP), for passenger cars, in June this year.

- Furthermore, countries such as Japan and South Korea are progressing fast to develop autonomous vehicles. For instance, the South Korean government plans to pursue full autonomy and wants half of its domestically-built cars to be fully autonomous by 2035. As these vehicles need minimal manual intervention, sensors play a crucial role in their successful operation. Hence, the growth of the autonomous vehicle industry is expected to drive the demand for MEMS sensors further.

Automobile MEMS Sensors Industry Overview

The MEMS automobile sensors market is fragmented in nature and consists of many global and regional players, such as, STMicroelectronics NV, Panasonic Corporation, Robert Bosch GmbH, Analog Devices Inc., and Infineon Technologies AG. These players focus on expanding their customer base across the globe. They focus on the research and development investment in introducing new solutions, strategic alliances, and other organic and inorganic growth strategies to earn a competitive edge over the forecast period.

In October 2022, Zvision, a leading provider of automotive-grade MEMS LiDAR solutions in China, and NVIDIA signed a collaborative agreement whereby Zvision joined the NVIDIA Jetson ecosystem as one of the platform's key LiDAR sensor partners. Through this agreement, Zvision plans to leverage NVIDIA's full-fledged software toolchains and lead AI chip hardware to develop a range of solid-state LiDAR-based autonomous driving sensors and systems.

In April 2021, STMicroelectronics unveiled AIS2IH three-axis linear accelerometer, a next-generation MEMS accelerometer for high-performance automotive applications. These accelerometers bring enhanced resolution, mechanical robustness, and temperature stability to non-safety automotive applications, including telematics, anti-theft, infotainment, vehicle navigation, and tilt/inclination measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Passenger Safety and Security Regulations, and Increased Focus on Compliance

- 5.1.2 Increased Automation Features and Performance Improvements Preferred by Customers

- 5.2 Market Restraints

- 5.2.1 Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Tire Pressure Sensors

- 6.1.2 Engine Oil Sensors

- 6.1.3 Combustion Sensors

- 6.1.4 Fuel Injection and Fuel Pump Sensors

- 6.1.5 Air Bag Deployment Sensors

- 6.1.6 Gyroscopes

- 6.1.7 Fuel Rail Pressure Sensors

- 6.1.8 Other Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Delphi Automotive PLC

- 7.1.3 Denso Corporation

- 7.1.4 General Electric Co.

- 7.1.5 Freescale Semiconductors Ltd

- 7.1.6 Infineon Technologies AG

- 7.1.7 Sensata Technologies Inc.

- 7.1.8 SiMicroelectronics NV

- 7.1.9 Panasonic Corporation

- 7.1.10 Liqid Inc.

- 7.1.11 Robert Bosch GmbH