|

市場調査レポート

商品コード

1685844

ガスセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ガスセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 155 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

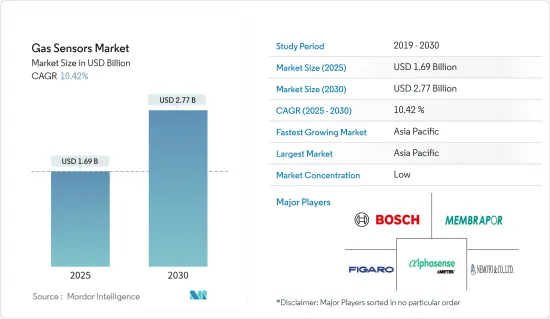

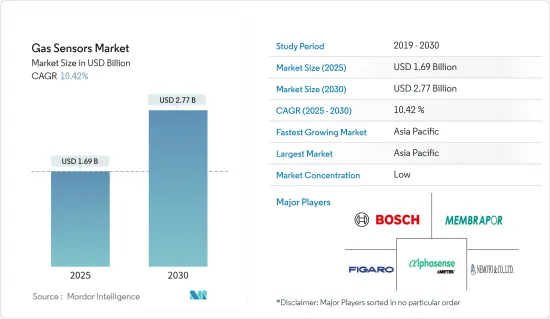

ガスセンサーの市場規模は2025年に16億9,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは10.42%で、2030年には27億7,000万米ドルに達すると予測されます。

主なハイライト

- スマートシティでは、ガスセンサーは、気象観測所、公共エリア、ビルオートメーションシステム内の空気品質チェックなど、環境モニタリングに応用されています。このような広範な採用が、予測期間を通じて市場の成長を促進すると予想されます。

- さらに、暖房、換気、空調(HVAC)システムは建物に不可欠であり、環境を監視し、ガス濃度を調整します。この2つの機能が大きな需要を喚起し、市場の成長をさらに後押ししています。

- ガス検知は世界の石油・ガスセクターで最も重要です。この業界の海洋掘削や探査活動では、危険ガス、可燃性ガス、有毒ガスが発生します。少量であれば良性のガスもあるが、高濃度になると酸素を奪い、窒息などの深刻なリスクにつながります。石油生産量の増加が予測される中、ガス・センサーの需要も増加しています。これらのセンサーは、設備、パイプライン、貯蔵タンクからのガス漏れを迅速に特定するために極めて重要です。

- 有毒ガスや危険ガスに関連する職場での危険に対する意識の高まりが、特に石油・ガス、化学、石油化学、金属、鉱業などの分野でのガスセンサーの採用を後押ししています。潜在的なリスクを考慮すると、化学産業ではガス濃度が安全限度を超えた場合に緊急システムを作動させるためにガスセンサーに頼ることが多いです。

- ガス・センサーの製造コストは、主に技術の進歩により上昇しています。多くのセンサーは現在、微小電気機械システム(MEMS)やナノテクなどの最先端技術を組み込んでいるが、これらは性能を向上させる一方で、製造工程を複雑化させ、コストを上昇させています。こうした高度なセンサー技術の開発には、研究開発への多額の投資が必要となり、コスト構造をさらに悪化させる。既存メーカーはこうした変化に適応しているが、新規参入メーカーや中堅メーカーは大きなハードルに直面しています。

- ガスセンサー市場は、ロシア・ウクライナ紛争とそれに続く景気減速により、顕著な混乱に直面しました。インフレと金利の上昇は個人消費を抑制し、ガスセンサー需要を減退させました。米国と中国の貿易摩擦は世界のサプライチェーンの混乱を悪化させました。特に、米国が中国への半導体製造装置の輸出を厳しく規制したことで、中国の家電や自動車部門の生産が妨げられました。

ガスセンサー市場動向

一酸化炭素(CO)セグメントが大きな市場シェアを占める

- 一酸化炭素(CO)は中毒を引き起こす可能性があり、予測できない罹患率や死亡率の主要因となるため、大きな脅威となっています。このため、この危険なガスを検出するための最適な材料と技術を特定することが非常に重要です。金属酸化物半導体(MOS)センサーは、特にマイクロまたはナノ薄膜形式での応用で注目を集めています。

- 一酸化炭素は本質的に有毒であるが、工業や冶金作業では重要な可燃性で環境に優しいエネルギー源として役立っています。一酸化炭素は酸化還元反応において極めて重要な役割を果たし、金属の精製を助ける。特に一酸化炭素は可燃性が高く、爆発しやすいです。潜在的な危険性を考慮すると、一酸化炭素センサーの採用は増加傾向にあります。この動向は、特に労働者の安全を重視する政府の規制がますます厳しくなっていることによって、さらに後押しされています。

- 一酸化炭素検知器は、無色・無臭・無味のこのガスを検知する能力により、様々な産業で不可欠なものとなっています。このようなセンサーは、一酸化炭素中毒を回避する上で極めて重要です。一酸化炭素中毒は、放っておくと、意識喪失、発作、あるいは死といった深刻な結果を招く可能性があります。米国だけでも、このサイレント・キラーは年間2万件以上の救急外来を受診させ、多くの国で最も一般的な致死的中毒となっています。

- 一酸化炭素(CO)は、体内の臓器や組織への酸素の供給を阻害することで、健康に害を及ぼす可能性があります。心臓病を患っている人は、CO濃度が低くてもリスクが高まり、胸痛、運動能力の低下などの症状を経験し、繰り返し暴露されることで心血管系の合併症を引き起こす可能性があります。道路を走る自動車の増加により、大量のCOが発生するため、環境中のガスを分析・検出するガスセンサーに対する大きな需要が生じています。CO(一酸化炭素)ガスセンサーは、家庭や自動車から産業環境に至るまで、様々な環境で一酸化炭素を識別するために設計されたガス検知機器の重要なコンポーネントです。

- 環境保護庁によると、米国では2023年に、山火事によるものを除いて約4,230万トンの一酸化炭素(CO)が排出されます。このようなCO排出量の増加は、セグメント成長の新たな市場機会を生み出します。

アジア太平洋が大きな成長を遂げる見込み

- CO2に次いで、メタンは地球温暖化に大きく影響する温室効果ガスです。中国は化石燃料活動によるメタン排出量がトップクラスであり、メタン排出量の抑制を迫られています。

- 生態環境部(Ministry of Ecology and Environment)によって最近発表された中国のメタン計画では、その取り組みが概説されているにもかかわらず、メタン排出量の抑制が迫られています。メタン排出の抑制には、不十分なデータ収集、税制上の規制基準、継続的な技術的・経営的ハードルなどがあります。

- 地政学的対立によるエネルギー価格の上昇により、水素のような代替エネルギー源への関心が高まっています。水素は、産業用および住宅用の一次エネルギー源となる可能性があります。医療業界は、カプノグラフィや呼気分析器などの機器にガスセンサーが搭載され、堅調に推移すると予測されます。

- ガスセンサーは、水素漏れを検知し、水素の安全な製造、貯蔵、利用を確保するために極めて重要です。日本はクリーンなエネルギー源として水素に多額の投資を行っており、自動車や発電用の水素燃料電池の開発に取り組んでいます。ガスセンサーは、水素漏れを検知し、水素の安全な生産、貯蔵、利用を確保するために極めて重要です。

- 例えば、日本で最も著名な発電会社であるJERAは、2035年までにアンモニアと水素燃料供給に60億米ドル以上を投資する意向です。同社が最も注力するのは、ブルー水素とグリーン水素です。ブルー水素は天然ガスから製造され、二酸化炭素を排出するが、これを回収・貯蔵することで温室効果ガスへの影響を最小限に抑えます。一方、グリーン水素は、水の電気分解を利用した太陽エネルギーと風力エネルギーの再生可能資源から製造されます。

ガスセンサー業界の概要

ガスセンサー市場は、多くのプレーヤーが存在するため断片化されています。様々なタイプのガスセンサーを提供する企業は、技術的な製品差別化を図っています。そのため、市場シェアを獲得するために競合他社との価格競争戦略を採用しています。主なプレーヤーには、Membrapor AG、AlphaSense Inc.、根本産業、Figaro Engineering Inc.、Robert Bosch GmbHなどがあります。

2023年10月-フィガロ・エンジニアリングは、ドイツのノイスにフィガロ・欧州事務所を開設したと発表。この戦略的な動きは、顧客と現地の販売代理店に専任の技術サポートを提供することで、欧州におけるFigaroの存在感を高めることを目的としています。このオフィスは、的を絞ったマーケティング活動の先頭に立つことが期待され、欧州市場での足場を拡大するというFigaroのコミットメントを強調するものです。

2023年10月-MEMBRAPOR AGは、NO2/CA-2センサーを強化し、その感度をほぼ2倍に高めました。この改良により、ppbレンジの低濃度を検出できるようになりました。このセンサーは、電気化学NO2センサーで一般的なO3交差感度を効果的に緩和する、確立された触媒O3フィルターを備えています。NO2/CA-20センサーを導入し、測定能力を最大20ppmの範囲に拡張しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

第5章 市場力学

- 市場促進要因

- 政府規制に対応するための自動車用ガスセンサー需要の増加

- 主要産業における労働災害に対する意識の高まり

- 市場の課題

- コスト上昇と製品差別化の欠如

第6章 市場セグメンテーション

- タイプ別

- 酸素

- 一酸化炭素(CO)

- 二酸化炭素(CO2)

- 窒素酸化物

- 炭化水素

- その他のタイプ

- 技術別

- 電気化学式

- 光イオン化検出器(PID)

- 固体/金属酸化物半導体

- 触媒式

- 赤外線

- 半導体

- 用途別

- 医療

- ビルオートメーション

- 産業

- 飲食品

- 自動車

- 輸送・物流

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- アジア

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 北米

第7章 競合情勢

- 企業プロファイル

- Figaro Engineering Inc.

- Membrapor AG

- AlphaSense Inc.

- Nemoto & Co. Ltd

- Robert Bosch GmbH

- Delphi Technologies

- SGX Sensortech Ltd(Amphenol Corporation)

- Zhengzhou Winsen Electronics Technology Co., Ltd.

- Niterra Co. Ltd.(NGK-NTK)

- Senseair(Asahi Kesai)

- Drgerwerk AG & Co. KGaA

第8章 投資分析

第9章 市場機会と将来の成長

The Gas Sensors Market size is estimated at USD 1.69 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 10.42% during the forecast period (2025-2030).

Key Highlights

- In smart cities, gas sensors find applications in environmental monitoring, including air quality checks at weather stations, public areas, and within building automation systems. This widespread adoption is expected to drive the market's growth through the forecast period.

- Additionally, heating, ventilation, and air conditioning (HVAC) systems are integral to buildings, monitoring environments and regulating gas concentrations. This dual functionality has spurred significant demand, further fueling market growth.

- Gas detection is paramount in the global oil and gas sector. This industry's offshore drilling and exploration activities produce a spectrum of hazardous, flammable, and toxic gases. While some gases are benign in small quantities, they can deplete oxygen in high concentrations, leading to severe risks like suffocation. As oil production is projected to rise, so is the demand for gas sensors. These sensors are crucial for swiftly identifying gas leaks from equipment, pipelines, and storage tanks.

- Increasing awareness of workplace hazards related to toxic and hazardous gases is propelling the adoption of gas sensors, especially in sectors like oil and gas, chemicals, petrochemicals, metals, and mining. Given the potential risks, chemical industries often rely on gas sensors to trigger emergency systems when gas concentrations exceed safe limits.

- Production costs for gas sensors have increased, primarily due to technological advancements. Many sensors now incorporate cutting-edge technologies like microelectromechanical systems (MEMS) or nanotech, which, while enhancing performance, also complicate the fabrication process, thereby increasing costs. Developing these advanced sensor technologies necessitates substantial investments in research and development, further adding to the cost structure. While established players have adapted to these changes, newcomers and mid-tier manufacturers face significant hurdles.

- The gas sensors market faced notable disruptions due to the Russia-Ukraine conflict and subsequent economic slowdown. Rising inflation and interest rates curtailed consumer spending, dampening the demand for gas sensors. The trade tensions between the United States and China exacerbated global supply chain disruptions. Notably, the United States' stringent controls on semiconductor manufacturing equipment exports to China have hampered production in China's consumer electronics and automotive sectors.

Gas Sensors Market Trends

Carbon Monoxide (CO) Segment to Hold Significant Market Share

- Carbon monoxide (CO) poses a significant threat as it can cause intoxication, a leading factor in unpredictable morbidity and mortality, which is often linked to inhalation injuries from combustion. This underscores the critical need to identify optimal materials and technologies for detecting this hazardous gas. Metal oxide semiconductor (MOS) sensors have garnered attention, especially for their application in micro- or nano-thin film formats.

- While carbon monoxide is inherently toxic, it serves as a crucial, combustible, and eco-friendly energy source in industrial and metallurgical operations. It plays a pivotal role in redox reactions, aiding in metal purification. Notably, carbon monoxide is both highly flammable and prone to explosions. Given the potential dangers, the adoption of carbon monoxide sensors is on the rise. This trend is further propelled by increasingly stringent government regulations, particularly those emphasizing worker safety.

- Carbon monoxide detectors are indispensable in various industries, primarily for their ability to detect this colorless, odorless, and tasteless gas, which is otherwise imperceptible to human senses. Such sensors are pivotal in averting carbon monoxide poisoning, a condition that, when left unchecked, can lead to severe consequences, including loss of consciousness, seizures, or even death. In the United States alone, this silent killer prompts over 20,000 emergency room visits annually and stands as the most common fatal poisoning in many nations.

- Carbon monoxide (CO) can harm health by impeding oxygen delivery to the body's organs and tissues. Individuals with heart disease face heightened risks even at lower CO levels, experiencing symptoms like chest pain, reduced exercise capacity, and potentially additional cardiovascular complications with repeated exposure. The growing number of vehicles on the road generates a huge amount of CO, which creates a significant demand for gas sensors to analyze and detect gases in the environment. CO (Carbon Monoxide) gas sensors are crucial components in gas detection equipment, designed to identify carbon monoxide in various settings, from homes and automotive to industrial environments.

- According to the Environmental Protection Agency, the United States saw emissions of around 42.3 million tons of carbon monoxide (CO) in 2023, excluding those from wildfires. Such increased CO emissions create new market opportunities for segment growth.

Asia-Pacific Expected to Witness Major Growth

- After CO2, methane is the second most impactful greenhouse gas, significantly contributing to global warming. China is one of the top methane emitters from fossil fuel activities, and the nation is under pressure to rein in its methane output.

- Despite efforts outlined in China's recent methane plan issued by the Ministry of Ecology and Environment. These include inadequate data collection, tax regulatory standards, and ongoing technical and managerial hurdles in controlling methane emissions.

- The increase in energy prices due to geopolitical conflicts has caused a growing interest in alternative energy sources like Hydrogen. Hydrogen can potentially be a primary energy source for industrial and residential uses. The medical industry is projected to stay steady, with gas sensors in devices like capnography and breath analyzers.

- Gas sensors are crucial for detecting hydrogen leaks and ensuring Hydrogen's safe production, storage, and utilization. Japan invests heavily in Hydrogen as a clean energy source, with initiatives to develop hydrogen fuel cells for vehicles and power generation. Gas sensors are crucial for detecting hydrogen leaks, ensuring the safe production, storage, and utilization

- For instance, Japan's most prominent power generation company, JERA, intends to invest over USD 6 billion in ammonia and hydrogen fuel supplies by 2035. The company's primary focus will be on blue and green Hydrogen. Blue Hydrogen is generated from natural gas, which produces carbon emissions that are then captured and stored to minimize its greenhouse gas impact. In contrast, green Hydrogen is produced through water electrolysis-powered solar and wind energy renewable resources.

Gas Sensors Industry Overview

The gas sensors market is fragmented because of the presence of many players. The companies offering various types of gas sensors have technological product differentiation. Hence, they are adopting competitive pricing strategies to gain market share. Some of the key players include Membrapor AG, AlphaSense Inc., Nemoto & Co. Ltd, Figaro Engineering Inc., and Robert Bosch GmbH

October 2023-Figaro Engineering announced the opening of the Figaro Europe Office in Neuss, Germany. This strategic move aimed to bolster Figaro's presence in Europe by offering dedicated technical support to customers and local distributors. The office was expected to spearhead targeted marketing initiatives, underscoring Figaro's commitment to expanding its foothold in the European market.

October 2023 - MEMBRAPOR AG enhanced its NO2/CA-2 sensor, boosting its sensitivity to nearly double its capability. This advancement enabled the sensor to detect lower concentrations in the ppb range. The sensor features its established catalytic O3 filter, effectively mitigating the common O3 cross-sensitivity in electrochemical NO2 sensors. It introduced the NO2/CA-20 sensor, extending its measurement capabilities to ranges of up to 20 ppm.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Gas Sensors in Automobiles for Compliance with Governmental Regulations

- 5.1.2 Growing Awareness on Occupational Hazards across Major Industries

- 5.2 Market Challenges

- 5.2.1 Rising Costs and Lack of Product Differentiation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Oxygen

- 6.1.2 Carbon Monoxide (CO)

- 6.1.3 Carbon Dioxide (CO2)

- 6.1.4 Nitrogen Oxide

- 6.1.5 Hydrocarbon

- 6.1.6 Other Types

- 6.2 By Technology

- 6.2.1 Electrochemical

- 6.2.2 Photoionization Detectors (PID)

- 6.2.3 Solid State/Metal Oxide Semiconductor

- 6.2.4 Catalytic

- 6.2.5 Infrared

- 6.2.6 Semiconductor

- 6.3 By Application

- 6.3.1 Medical

- 6.3.2 Building Automation

- 6.3.3 Industrial

- 6.3.4 Food and Beverages

- 6.3.5 Automotive

- 6.3.6 Transportation and Logistics

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Figaro Engineering Inc.

- 7.1.2 Membrapor AG

- 7.1.3 AlphaSense Inc.

- 7.1.4 Nemoto & Co. Ltd

- 7.1.5 Robert Bosch GmbH

- 7.1.6 Delphi Technologies

- 7.1.7 SGX Sensortech Ltd (Amphenol Corporation)

- 7.1.8 Zhengzhou Winsen Electronics Technology Co., Ltd.

- 7.1.9 Niterra Co. Ltd. (NGK-NTK)

- 7.1.10 Senseair (Asahi Kesai)

- 7.1.11 Drgerwerk AG & Co. KGaA