|

市場調査レポート

商品コード

1907337

ポリメチルメタクリレート(PMMA):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Polymethyl Methacrylate (PMMA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリメチルメタクリレート(PMMA):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

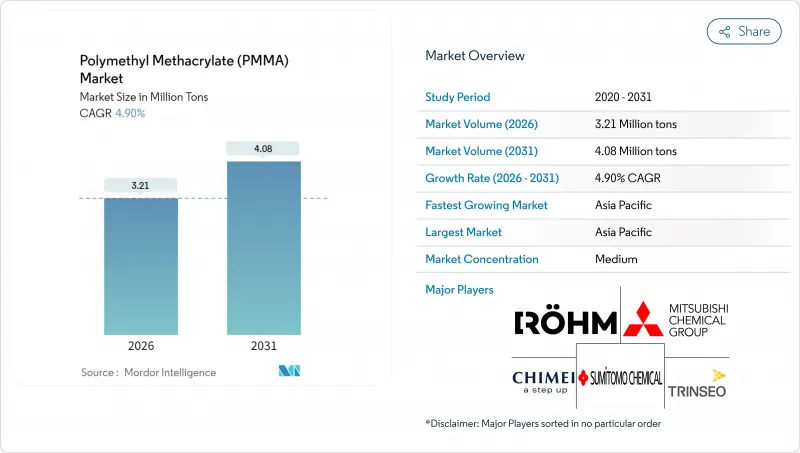

ポリメチルメタクリレート(PMMA)市場の規模は、2026年に321万トンに達すると予測されております。

これは2025年の306万トンから成長した数値であり、2031年には408万トンに達する見込みです。2026年から2031年にかけては、CAGR4.90%で成長を続けると予測されております。

自動車の軽量化、建築用ガラス、LEDディスプレイからの堅調な需要が成長を支えており、メタクリル酸メチル(MMA)原料コストの変動が続く中でも成長を維持しています。PMMAの光学透明性、紫外線安定性、そして加工の容易さは、競合ポリマーとの差別化要因となり、多くの主要用途において代替圧力から生産量を保護しています。地域的な過剰生産能力(特に中国)が価格競争力を維持する一方、画期的な化学的リサイクルパイロットプロジェクトが循環型生産モデルへの道を開いています。生産者は、PMMA市場における防御戦略として、垂直統合と特殊グレードの開発を優先しています。

世界のポリメチルメタクリレート(PMMA)市場の動向と洞察

自動車の軽量化と照明需要

電気自動車メーカーは、パノラミックサンルーフ、テールランプカバー、センサーハウジングにPMMAを指定しています。このポリマーはガラスよりも50%軽量でありながら、高い光学品質を提供するためです。適応型LEDシステムへの技術移行により、精密なビームパターンを形成するローム社の光管理グレードへの需要が高まっています。さらに、低複屈折性を必要とする自動運転車用LiDARレンズからも需要が生まれています。新たな耐衝撃性ポリカーボネート(PC)共重合体が登場したにもかかわらず、コストと紫外線耐久性がわずかな強度の向上を上回る分野では、PMMA市場の回復力が持続しています。

建築グレージング・ファサードへの採用

スマートビルの外装には、センサーや発熱体を内蔵したPMMAシートが組み込まれ、採光・結露管理・セルフクリーニング機能を実現しています。PMMAは可視光透過率92~93%(PCは86~89%)を達成し、欧州建築基準における省エネルギー性能評価の要件を満たします。PMMAパネルへのデジタル印刷技術により、複合材料を使用せずに複雑なファサードデザインが可能となり、施工時間の短縮が図られています。高層プロジェクトにおける防火規制は依然として普及を制限していますが、長期保証と耐紫外線性により、透明性と美観が重視される分野ではPMMAの競争力を維持しています。

MMA原料価格の変動性

MMA価格の変動は石油化学原料の動向を反映し、エネルギー集約型プロセスにより増幅されます。トリネオ社は2025年3月、プロピレンコスト急騰を受け欧州向けPMMA価格を250ユーロ/トン引き上げ、コンバーターの利益率を圧迫しました。欧州などの輸入依存地域は、バイオベースまたは再生MMAが商業規模で普及するまで影響を受け続ける見込みです。アセトン工程を後方統合したアジアの生産者はコスト優位性を獲得し、世界の価格格差を拡大させています。

セグメント分析

シート製品は2025年にPMMA市場シェアの38.19%を占め、2031年までCAGR5.36%で拡大が見込まれます。これにより、このカテゴリーにおける米ドル建て売上高の成長は、PMMA市場全体の規模に比例した伸びを示す見通しです。薄肉押出ラインでは、自動車用サンルーフの荷重要件を満たす高い機械的安定性が実現され、自動車メーカーは安全マージンを損なうことなく軽量化が可能となりました。鋳造アクリルシートは、光学欠陥を最小限に抑える厳密な厚み公差により、特にLEDエッジライトパネルにおいてプレミアムな位置付けを維持しております。

ビーズおよびペレットは、射出成形レンズ、家電ノブ、医療部品の主力原料として続きます。配合段階で衝撃改質剤や紫外線吸収剤を組み込むケースが増加しており、屋外看板では透明性を多少犠牲にしながらも耐久性を高めています。レーザー彫刻用に設計された顆粒は、トロフィーや贈答品分野において新たな収益源を開拓しています。シートカテゴリーほどの成長は見られませんが、樹脂コンパウンドは短納期のカスタマイズ製品を幅広く支えることで、PMMA市場における安定した需要を支えています。

PMMA市場レポートは、製品形態(シート、ビーズ・ペレット、樹脂コンパウンド、グラニュール)、エンドユーザー産業(自動車、建築・建設、電気・電子、航空宇宙、産業機械・設備、その他)、地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)別に分類されています。市場予測は、数量(トン)および金額(米ドル)で提供されます。

地域別分析

アジア太平洋地域は、中国の巨大なコンバーター基盤とインドのインフラ整備を背景に、2025年のPMMA市場シェアの50.30%を占めました。しかしながら、中国の過剰生産能力が利益率を圧迫し、国内メーカーは特殊用途向け輸出へシフトするとともに、新規生産能力の抑制を促しています。インドは11億米ドルを投じ、MMA-PMMA統合プラントを建設し、輸入依存度の削減と2027年までの地域シェア獲得を目指しています。日本と韓国は、エレクトロニクスや光学分野に関連する高付加価値ニッチ市場を基盤としており、汎用品グレードで見られる価格下落の影響を緩和しています。

北米は成熟市場ながら収益性の高い領域であり、持続可能性の特性がプレミアム価格を牽引しています。LG化学が2025年にバイオアクリル酸の生産を開始することで、北米のコンバーターは化粧品包装向けに再生可能原料含有PMMA製品を提供可能となります。航空宇宙産業の回復と電気自動車への投資が基盤需要を支えており、輸入シートとの競合にもかかわらず需要は堅調です。

欧州は循環型経済に注力しており、ドイツとオランダにおける化学的リサイクルのパイロット事業は政策支援を受け、リサイクル含有率基準を満たす初期商業ロットを生産しています。しかしながら、輸入MMA原料への依存度の高さから、欧州のPMMAメーカーはエネルギー価格変動によるコスト急騰の影響を受けやすい状況です。南米および中東市場は規模こそ小さいもの、インフラ大型プロジェクトで透明性のある防音壁や大型看板が求められることから、将来性が期待されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 自動車業界における軽量化と照明需要

- 建築用ガラス及びファサードの採用状況

- LED看板・ディスプレイ産業の拡大

- 医療・歯科分野におけるPMMA使用量の増加

- PMMA化学リサイクルの経済性における画期的な進展

- 市場抑制要因

- MMA原料価格の変動性

- ポリカーボネートおよびガラスによる代替品の脅威

- 厳格な使い捨てプラスチック規制

- バリューチェーン分析

- ポーターのファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 輸出入動向

- 価格動向

- 規制情勢

- 最終用途セクター動向

- 航空宇宙(航空宇宙部品生産収益)

- 自動車(自動車生産)

- 建築・建設(新築床エリア)

- 電気・電子機器(電気・電子機器生産収益)

- 包装(プラスチック包装数量)

第5章 市場規模と成長予測

- 製品形態別

- シート

- ビーズおよびペレット

- 樹脂コンパウンドおよび顆粒

- エンドユーザー業界別

- 自動車

- 建築・建設

- 電気・電子機器

- 航空宇宙

- 産業用機械・設備

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- マレーシア

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- ナイジェリア

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- Asahi Kasei Corporation

- CHIMEI

- Kuraray Co., Ltd.

- LOTTE MCC Corp.

- Lucite International Alpha B.V.

- LX MMA(LX Group)

- Mitsubishi Chemical Corporation

- Rohm GmbH

- Sanors

- Sumitomo Chemical Co., Ltd.

- Suzhou Double Elephant Optical Materials Co., Ltd.

- Trinseo

- Wanhua