|

市場調査レポート

商品コード

1443940

金属仕上げ:市場シェア分析、業界動向と統計、成長予測(2024-2029)Metal Finishing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 金属仕上げ:市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

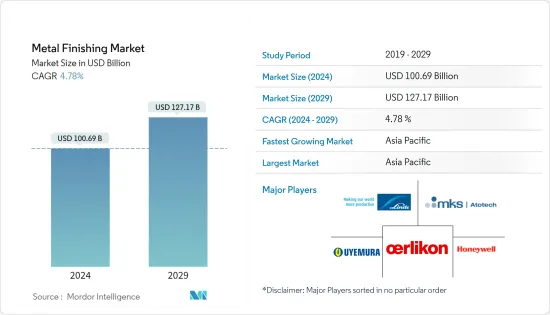

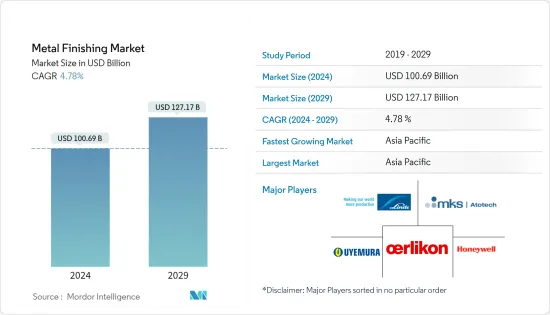

金属仕上げ市場の規模は、2024年に1,006億9,000万米ドルと推定され、2029年までに1,271億7,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.78%のCAGRで成長します。

COVID-19のパンデミックは市場に悪影響を及ぼしました。ロックダウンや制限措置により製造施設や工場が停止したためです。サプライチェーンと輸送の混乱により、さらに市場に障害が生じました。しかし、業界は2021年に回復を見せ、調査対象市場の需要が回復しました。

主なハイライト

- 短期的には、耐久性、耐摩耗性、長持ちする金属製品に対する需要の増加が、市場の成長を促進する要因の一部です。

- 一方、一部の金属仕上げ用化学薬品に対する環境規制や、金属のプラスチックへの代替の増加は、市場の成長を妨げると予想されます。

- ただし、従来の溶剤系技術から新しい技術への移行は、予測期間中に市場機会を提供する可能性があります。

- アジア太平洋は、自動車、建設、エレクトロニクス、ハードウェアなどのエンドユーザー産業からの旺盛な需要により、世界市場を独占しました。

金属仕上げ市場の動向

自動車部門が市場を独占

- 金属仕上げ市場の需要は自動車産業が独占していました。金属仕上げは、車両の金属部品に保護層を設けるために使用される最も一般的な方法の1つです。

- 金属仕上げは、エンジン、その他のボンネット下の部品、パワーステアリングシステム、ブレーキ部品およびシステム、空調部品およびシステム、シャーシハードウェア、空調部品、燃料システムなどの車両部品に使用されます。

- 金属仕上げには、塗料やセラミックの塗布も含まれます。多くの大小の自動車部品では、接触面が滑らかで応力が軽減され、バリや欠陥がないことが求められます。これにより、自動車エンジンは摩擦と熱が少ない表面を実現し、より多くの馬力を生成し、全体的なパフォーマンスが向上します。

- 米国は世界の主要な自動車産業の1つであり、国の国内総生産(GDP)全体に少なくとも3%貢献しています。同国は2022年に乗用車と商用車を含む自動車を1,006万台近く生産し、2021年と比較して10%増加しました。したがって、国内の自動車生産の増加は、自動車に対する上振れ需要を生み出すと予想されます。金属仕上げ市場。

- インドネシアでは、自動車排出ガス、自動車の安全性の向上、自動車の運転支援システム、小売およびeコマース分野での急速に成長する物流に関する規制の強化により、小型商用車の需要が大幅に増加しています。たとえば、OICAによると、2022年に国内で小型商用車は約1,60,171台生産され、2021年と比較して1%増加しました。これにより、金属仕上げ市場に需要が上向きになると予想されます。この国の小型商用車市場。

- さらに、フィリピンでは、eコマースによる商品の需要の増加により、物流における小型商用車の使用が促進されており、国内の小型商用車市場の成長への道が開かれています。多くのeコマースおよび物流企業がこの国で成長しており、小型商用車市場の成長をさらに促進しています。たとえば、2022年の国内の小型商用車生産台数は50,560台に達し、2021年と比較して68%増加しました。

- さらに、マレーシアにおける移動制限令の緩和により、多くの経済セクターが国内での事業再開を許可されたため、景況感の改善につながり、商用車を含む新車の生産に貢献しました。ビジネスを運営するために必要です。たとえば、2022年のマレーシアの小型商用車生産台数は52,085台で、2021年と比較して48%増加しました。したがって、これは同国の小型商用車からの金属仕上げの需要を下支えすると予想されます。

- 金属仕上げ市場は、より技術的に開発された自動車の登場により、長期的に成長する可能性があります。

アジア太平洋地域が市場を独占

- アジア太平洋地域では、自動車産業への投資と生産の増加、電気・電子機器の生産の増加、重機の需要の急増が、金属仕上げ市場を牽引する主な要因の一部となっています。多国籍企業がこの地域の産業部門を牽引しています。

- 中国は金属仕上げ市場においてアジア太平洋で最大の市場シェアを保持しています。国内の投資と建設活動の増加により、金属仕上げ市場の需要は予測期間を通じて増加すると予想されます。中国は過去数年間、世界のインフラへの主要な投資国の一つであり、多大な貢献をしています。例えば、中国国家統計局(NBS)によると、2022年の中国の建設工事の生産額は27兆6,300億元(4兆1,085億8,100万米ドル)に達し、2021年と比較して6.6%増加しました。

- さらに、中国は、国内の乗用車生産に寄与するその他の要因の中でも、物流とサプライチェーンの改善、企業活動の増加、国内の豊富な消費促進策により、最大の乗用車生産国の一つでもあります。例えば、OICAによると、2022年の中国の乗用車生産台数は23,836,083台で、2021年と比較して11%増加しました。したがって、国内の乗用車生産の増加により、金属仕上げ市場の需要は上向きです。

- インドでは、自動車の排ガス、自動車の安全性の向上、自動車の運転支援システム、小売およびeコマース分野での急速に成長する物流に関する規制の強化により、新型の先進的な小型商用車(LCV)の需要が大幅に増加しています。例えば、OICAによると、2022年のインドの小型商用車生産台数は61万7,398台に達し、2021年と比較して27%増加し、2020年と比較して60%回復したことが示されています。

- さらに、インドにおける自動車産業への投資の増加と進歩により、卑金属の消費量が増加すると予想されます。たとえば、タタモーターズは2022年4月、今後5年間で乗用車事業に30億8,000万米ドルを投資する計画を発表しました。したがって、自動車生産と自動車産業への投資の増加により、国内の自動車および輸送産業からの金属仕上げ市場への需要が増加すると予想されます。

- 銅、錫、ニッケル、アルミニウムは、エレクトロニクス業界でよく使用される金属です。アジア地域は世界最大の電気・電子機器生産国であり、中国、日本、韓国、シンガポール、マレーシアなどが世界を支配しています。

- JEITA(電子情報技術協会)によると、日本では、2022年 12月の家庭用電化製品の国内出荷額が1,252億円(9億6,404万米ドル)に達しました。一方、3月は2022年の家庭用電化製品の出荷額で最も好調な月で、約1,255億円(9億6,635万米ドル)になりましたが、5月が最も低調で、金額は864億円(6億6,528万米ドル)まで下がりました。したがって、同国からの家電出荷の増加により、金属仕上げ市場の需要が増加すると予想されます。したがって、この地域へのこのような好ましい動向と投資により、アジア太平洋が世界市場を独占すると予想されます。

金属仕上げ業界の概要

金属仕上げ市場は非常に細分化されています。この市場の主要企業(順不同)には、OC Oerlikon Management AG、MKS Atotech、Linde plc、C. Uyemura、Honeywell International Inc.などが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- アフリカにおける自動車生産の増加

- 耐久性、耐摩耗性、長持ちする金属製品に対する要求の高まり

- その他の 促進要因

- 抑制要因

- 一部の化学物質に対する環境規制

- 金属からプラスチックへの代替の増加

- 業界のバリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替製品やサービスの脅威

- 競合の程度

第5章 市場セグメンテーション

- タイプ

- 無機金属仕上げ

- クラッディング

- 前処理・表面処理

- 消耗品と予備品

- 電気めっき

- 亜鉛メッキ

- 無電解めっき

- 化成皮膜

- 溶射粉体塗装

- 陽極酸化処理

- 電解研磨

- 有機金属仕上げ

- ハイブリッド金属仕上げ

- 無機金属仕上げ

- 用途

- 自動車

- 家電製品

- ハードウェア

- 航空宇宙

- 重機

- エレクトロニクス

- 工事

- その他の用途

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- サウジアラビア

- 南アフリカ

- その他中東およびアフリカ

- アジア太平洋

第6章 競合情勢

- 合併と買収、合弁事業、コラボレーション、および契約

- 市場シェア(%)**/ランキング分析

- 有力企業が採用した戦略

- 企業プロファイル

- AE Aubin Company

- ALMCOGROUP

- Auromex Co., Ltd.

- C. Uyemura Co., Ltd.

- DuPont

- Grind Master

- Guyson Corporation

- Honeywell International Inc.

- Linde plc

- MKS|Atotech

- OC Oerlikon Management AG

- OTEC Precision Finish, Inc.

- Plating Equipment Ltd

- POSCO

- Quaker Chemical Corporation

- sequa gGmbH

- TIB Chemicals AG

第7章 市場機会と将来の動向

- 従来の溶剤系技術から新しい技術への移行

- その他の機会

The Metal Finishing Market size is estimated at USD 100.69 billion in 2024, and is expected to reach USD 127.17 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

.

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, the increasing demand for durable, wear-resistant, and long-lasting metal products are some of the factors driving the market's growth.

- On the other hand, the environmental restrictions on some metal finishing chemicals and increasing metal replacement with plastics are expected to hinder the market's growth.

- However, the shift from traditional solvent-borne technologies to newer technologies will likely provide market opportunities during the forecast period.

- Asia-Pacific dominated the global market, with robust demand from end-user industries such as automotive, construction, electronics, and hardware.

Metal Finishing Market Trends

Automotive Segment to Dominate the Market

- The automotive industry dominated the demand for the metal finishing market. Metal finishing is one of the most common methods used to provide a protective layer on the metal components of vehicles.

- Metal finishing is used in vehicle parts such as engines, other under-the-hood components, power steering systems, brake parts and systems, air conditioning components and systems, chassis hardware, climate control components, and fuel systems.

- Metal finishing also includes the application of paints or ceramics. Many small and large automobile parts require their contact surfaces to be smooth, stress-relieved, and without burrs or defects. This enables the automotive engines to achieve a surface with less friction and heat, generating more horsepower and overall better performance.

- The United States is one of the major automotive industries in the world, contributing at least 3% to the country's overall gross domestic product (GDP). The country produced close to 10.06 million units of automobiles, including passenger and commercial vehicles, in 2022, which showed an increase of 10% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to create an upside demand for the metal finishing market.

- In Indonesia, the increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have significantly driven the demand for light commercial vehicles. For instance, according to OICA, in 2022, around 1,60,171 units of light commercial vehicles were produced in the country, which showed an increase of 1% compared to 2021. This is expected to create an upside demand for the metal finishing market from the country's light commercial vehicle market.

- Moreover, in the Philippines, the increased demand for goods through e-commerce is pushing the use of light commercial vehicles in logistics, paving the way for light commercial vehicle market growth in the country. Many e-commerce and logistics companies are growing in the country, further boosting the light commercial vehicle market's growth. For instance, in 2022, light commercial vehicle production in the country amounted to 50,560 units, which shows an increase of 68% compared to 2021.

- Furthermore, due to the relaxation of movement control orders in Malaysia, many economic sectors were allowed to re-open businesses in the country, which helped to improve business confidence and contributed to the production of new vehicles, including commercial vehicles, which are much-needed for running businesses. For instance, in 2022, light commercial vehicle production in Malaysia amounted to 52,085 units, which shows an increase an 48% compared to 2021. Therefore, this is expected to support the demand for metal finishing from the country's light commercial vehicles.

- The metal finishing market has the potential for growth in the long term with the emergence of more technologically developed cars.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, the increasing investments and production in the automotive industry, rising production of electricals and electronics, and surging demand for heavy equipment are some of the major factors driving the market for metal finishing. Multinational companies drive the industrial sector in this region.

- China holds the largest Asia-Pacific market share for the metal finishing market. The demand for the metal finishing market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, China is also one of the largest producers of passenger cars due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car production in the country. For instance, according to OICA, in 2022, passenger car production in China amounted to 2,38,36,083 units, which showed an increase of 11% compared to 2021. Therefore, increasing the production of passenger cars in the country is expected to create an upside demand for the metal finishing market.

- In India, increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, according to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, showing an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India are expected to increase the consumption of base metals. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. Therefore, increasing automobile production and investment in the automobile industry is expected to have an upside demand for the metal finishing market from the country's automotive and transportation industry.

- Copper, tin, nickel, and aluminum are common metals the electronics industry uses. The Asian region is the largest producer of electrical and electronics globally, with countries such as China, Japan, South Korea, Singapore, and Malaysia dominating globally.

- In Japan, according to JEITA (Japan Electronics and Information Technology Association), domestic shipments of consumer electronics in Japan reached a value of JPY 125.2 billion (USD 964.04 million) in December 2022. While March was the strongest month for consumer electronics shipments during 2022, with around JPY 125.5 billion (USD 966.35 million), May was the weakest, with the value falling to JPY 86.4 billion (USD 665.28 million). Therefore, increasing consumer electronics shipments from the country is expected to increase demand for the metal finishing market.

- Hence, with such favorable trends and investments in the region, Asia-Pacific is expected to dominate the global market.

Metal Finishing Industry Overview

The Metal Finishing market is highly fragmented. The major players in this market (not in a particular order) include OC Oerlikon Management AG, MKS Atotech, Linde plc, C. Uyemura Co., Ltd, and Honeywell International Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Automotive Production in Africa

- 4.1.2 Increasing Requirement for Durable, Wear-resistant, and Long-lasting Metal Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Restrictions on Some Chemicals

- 4.2.2 Increasing Replacement of Metal with Plastics

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Type

- 5.1.1 Inorganic Metal Finishing

- 5.1.1.1 Cladding

- 5.1.1.2 Pretreatment/Surface Preparation

- 5.1.1.3 Consumables and Spares

- 5.1.1.4 Electroplating

- 5.1.1.5 Galvanization

- 5.1.1.6 Electro-less Plating

- 5.1.1.7 Conversion Coatings

- 5.1.1.8 Thermal Spray Powder Coating

- 5.1.1.9 Anodizing

- 5.1.1.10 Electro-polishing

- 5.1.2 Organic Metal Finishing

- 5.1.3 Hybrid Metal Finishing

- 5.1.1 Inorganic Metal Finishing

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Appliances

- 5.2.3 Hardware

- 5.2.4 Aerospace

- 5.2.5 Heavy Equipment

- 5.2.6 Electronics

- 5.2.7 Construction

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A.E. Aubin Company

- 6.4.2 ALMCOGROUP

- 6.4.3 Auromex Co., Ltd.

- 6.4.4 C. Uyemura Co., Ltd.

- 6.4.5 DuPont

- 6.4.6 Grind Master

- 6.4.7 Guyson Corporation

- 6.4.8 Honeywell International Inc.

- 6.4.9 Linde plc

- 6.4.10 MKS | Atotech

- 6.4.11 OC Oerlikon Management AG

- 6.4.12 OTEC Precision Finish, Inc.

- 6.4.13 Plating Equipment Ltd

- 6.4.14 POSCO

- 6.4.15 Quaker Chemical Corporation

- 6.4.16 sequa gGmbH

- 6.4.17 TIB Chemicals AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift from Traditional Solvent-borne Technologies to Newer Technologies

- 7.2 Other Opportunities