|

市場調査レポート

商品コード

1686630

ポリオレフィン(PO):市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Polyolefin (PO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリオレフィン(PO):市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

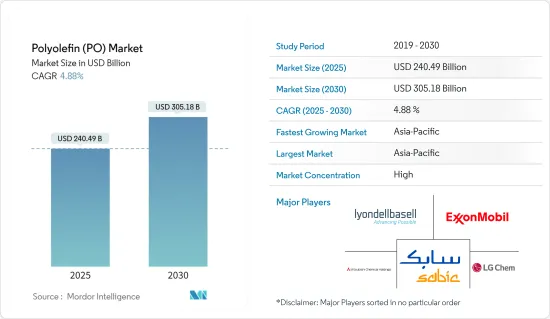

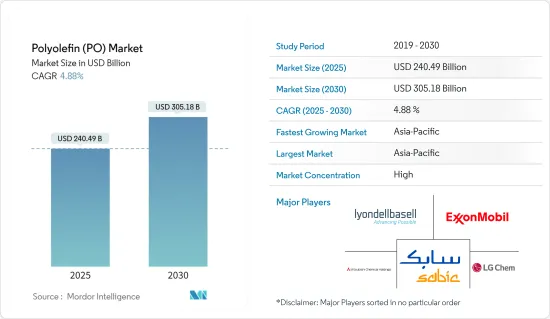

ポリオレフィン(PO)市場規模は2025年に2,404億9,000万米ドルと推定され、2030年には3,051億8,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは4.88%です。

COVID-19の蔓延は市場に深刻な影響を与え、多くのエンドユーザー産業が操業停止に追い込まれました。中国は、包装、玩具製造、建設、自動車などの産業が盛んで、ポリオレフィンの主要消費国のひとつであるため、パンデミックの間、ポリオレフィン市場に大きな支障をきたしました。しかし、2021年には各産業が製造活動を再開するため、市場も回復する可能性があります。

主なハイライト

- ポリオレフィンはその高度な特性から、エレクトロニクス、自動車、その他の産業で使用されています。このため、短期的には市場の成長が見込まれます。

- しかし、各国政府によるプラスチックに対する環境規制の高まりが市場を抑制する可能性があります。

- グリーン・ポリオレフィンへの注目の高まりは、今後数年間に新たな機会を生み出す可能性が高いです。

- アジア太平洋地域が世界市場を席巻しており、インドと中国が最大の消費国です。

ポリオレフィン(PO)市場の動向

フィルム・シート分野での需要増加が市場成長を牽引

- フィルムとシートは、輸送、包装、建設、建築産業で使用されます。

- 市場の拡大を牽引しているのは農業分野で、ポリオレフィンフィルムやシートは温室用、マルチ用、サイレージ用ストレッチフィルムなどに需要があります。また、サイレージシートやウィンドウフィルム、医療業界にも需要が見られます。

- ポリオレフィンベースの農業用フィルムはまた、霜、風、雨、害虫から野菜を守ると同時に、果物、野菜、花の成熟を早め、農家が1年に数種類の作物を栽培できるようにします。また、ポリオレフィンフィルムは蒸発を抑えるため、節水にも役立ちます。

- 一方、ポリオレフィン・シートは建築業界で使用されています。ポリエチレンシートは蒸気遅延材として機能し、スラブの下に設置されます。このシートは、劣化することなく、より長い時間滞留させることができます。その結果、建設業界からのポリオレフィン需要は拡大しています。

- アジア太平洋地域の建設業界は世界最大かつ最も急成長している業界になると予測されており、世界の建設支出の45%はこの地域のものです。今後数年間で、フィルムやシートを選ぶ人が増えると思われます。

- 2022年度のインドのポリオレフィン総生産能力は1万2,000キロトンを超えていました。ほとんどのポリオレフィンはリライアンス・インダストリーズ・リミテッドが製造しており、インドのポリオレフィン総生産能力のほぼ47%を占めています。

- こうしたことから、ポリオレフィン市場はフィルムやシートの需要増に伴い、今後数年間で成長する可能性が高いです。

アジア太平洋が市場を独占する

- ポリオレフィンの世界の主要消費国は中国であるため、アジア太平洋地域がポリオレフィン市場を独占しています。成長の原動力となっているのはeコマースの増加で、宅配ビジネスの好調がプラスチック包装の需要急増につながりました。中国の製造業は経済に大きく貢献しています。

- 中国政府は、2億5,000万人を新たなメガシティに移転させる計画など、今後10年間の大規模な建設計画を発表しました。これは、建設中の建物の特性を改善するために、建設用化学物質がさまざまな形で使用される大きなチャンスです。

- スマートフォン、有機ELテレビ、タブレット端末などの家電製品は、市場で最も速い成長を記録しています。中産階級の懐が潤えば、電子機器への需要も増え、それが同国のポリオレフィン需要を牽引する可能性があります。

- 中国では、エレクトロニクス分野は2023年末までに3,850億米ドル以上に達すると予測されています。

- 上記の要因はすべて、予測期間中にポリオレフィンの需要を増加させると予想されます。

ポリオレフィン(PO)産業の概要

ポリオレフィン市場は元来統合型です。主なプレーヤー(順不同)には、LyondellBasell Industries Holdings BV、ExxonMobil Corporation、SABIC、LG Chem、Mitsubishi Chemical Holdings Corporationなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 硬包装から軟包装への嗜好の変化

- 低コストのインテリア家具への需要の高まり

- 抑制要因

- 環境規制の高まり

- 業界バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション

- 材料タイプ

- ポリエチレン(PE)

- 高密度ポリエチレン(HDPE)

- 低密度ポリエチレン(LDPE)

- 直鎖状低密度ポリエチレン(LLDPE)

- ポリプロピレン(PP)

- ポリエチレン(PE)

- 用途

- フィルムおよびシート

- 射出成形

- ブロー成形

- 押出コーティング

- 繊維とラフィア

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- Arkema Group

- BASF SE

- Braskem

- Chevron Phillips Chemical Company

- China National Petroleum Corporation

- China Petrochemical Corporation

- Daelim

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Japan Polypropylene Corporation

- LG Chem Ltd.

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Incorporated

- Nova Chemicals Corporation

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC(Saudi Basic Industries Corporation)

- Sasol Ltd.

- Tosoh Corporation

第7章 市場機会と今後の動向

- グリーンポリオレフィンへの注目の高まり

The Polyolefin Market size is estimated at USD 240.49 billion in 2025, and is expected to reach USD 305.18 billion by 2030, at a CAGR of 4.88% during the forecast period (2025-2030).

The spread of COVID-19 severely affected the market, causing many end-user industries to shut down. During the pandemic, China hampered the polyolefins market intensively, as it is one of the major consumers of polyolefins owing to its strong industries such as packaging, toy manufacturing, construction, and automotive. However, as the industries resumed their manufacturing activities in 2021, the market studied may also recover.

Key Highlights

- Polyolefin is used in electronics, cars, and other industries because of its advanced properties. This is expected to help the market grow in the short term.

- However, growing environmental regulations on plastic imposed by various governments may restrain the market.

- The growing focus on green polyolefin is likely to create new opportunities in the coming years.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from India and China.

Polyolefin (PO) Market Trends

Increasing Demand in the Films and Sheets Segment to Drive Market Growth

- Films and sheets can be used in the transportation, packaging, construction, and building industries.

- The agricultural sector is driving the market's expansion, with demand for polyolefin films and sheets for greenhouses, mulch, and silage stretch films. The demand is also seen in silage sheets and window films, as well as in the medical industry.

- Polyolefin-based agricultural films also protect vegetables from frost, wind, rain, and pests while speeding up the ripening of fruits, vegetables, and flowers, allowing farmers to grow several crops in a year. Polyolefin films also help reduce evaporation, thus saving water.

- On the other hand, polyolefin sheets are used in the building industry. Polyethylene sheeting, which works as a vapor retarder, is installed beneath the slab. These sheets can retard for a longer time without degrading. As a result, the demand for polyolefin from the construction industry is expanding.

- The Asia-Pacific construction industry is projected to become the world's largest and fastest-growing industry, with a 45% share of global construction spending coming from the region. In the coming years, this is likely to make more people opt for films and sheets.

- In fiscal year 2022, India had a total polyolefins production capacity of over 12 thousand kilotons. Most polyolefins were made by Reliance Industries Limited, which made up almost 47% of India's total polyolefins production capacity.

- Thus, due to these factors, the polyolefin market is likely to grow in the coming years as the demand for films and sheets rises.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the dominant region in the polyolefins market, owing to China being the major consumer of polyolefins worldwide. The growth is driven by increasing e-commerce, as the strong courier business led to a spike in demand for plastic packaging. The country's manufacturing industry is one of the major contributors to its economy.

- The Chinese government announced big building plans for the next 10 years, including plans to move 250 million people to new megacities. This is a big chance for construction chemicals to be used in a variety of ways to improve building properties during construction.

- Electronic items, such as smartphones, OLED TVs, tablets, and other consumer electronics, are recording the fastest growth in the market. With more money in the pockets of the middle class, there will be more demand for electronics, which may drive the demand for polyolefins in the country.

- In China, the electronics segment was projected to reach over USD 385 billion by the end of 2023.

- All the above-mentioned factors are expected to increase the demand for polyolefins over the forecast period.

Polyolefin (PO) Industry Overview

The polyolefin market is consolidated in nature. Some of the major players (not in any particular order) include LyondellBasell Industries Holdings BV, ExxonMobil Corporation, SABIC, LG Chem, and Mitsubishi Chemical Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Shift in Preferences from Rigid Packaging to Flexible Packaging

- 4.1.2 Growing Demand for Low-Cost Interior Furnishings

- 4.2 Restraints

- 4.2.1 Growing Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyethylene (PE)

- 5.1.1.1 High Density Polyethylene (HDPE)

- 5.1.1.2 Low Density Polyethylene (LDPE)

- 5.1.1.3 Linear Low-density Polyethylene (LLDPE)

- 5.1.2 Polypropylene (PP)

- 5.1.1 Polyethylene (PE)

- 5.2 Application

- 5.2.1 Films and Sheets

- 5.2.2 Injection Molding

- 5.2.3 Blow Molding

- 5.2.4 Extrusion Coating

- 5.2.5 Fibers and Raffia

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical Company

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 Daelim

- 6.4.8 Dow

- 6.4.9 ExxonMobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Japan Polypropylene Corporation

- 6.4.12 LG Chem Ltd.

- 6.4.13 LyondellBasell Industries Holdings BV

- 6.4.14 Mitsubishi Chemical Holdings Corporation

- 6.4.15 Mitsui Chemicals Incorporated

- 6.4.16 Nova Chemicals Corporation

- 6.4.17 PetroChina Company Limited

- 6.4.18 Reliance Industries Limited

- 6.4.19 SABIC (Saudi Basic Industries Corporation)

- 6.4.20 Sasol Ltd.

- 6.4.21 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Focus on Green Polyolefin