|

市場調査レポート

商品コード

1536875

ホットメルト接着剤:市場シェア分析、産業動向・統計、成長予測(2024~2029年)Hot-melt Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ホットメルト接着剤:市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年08月14日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

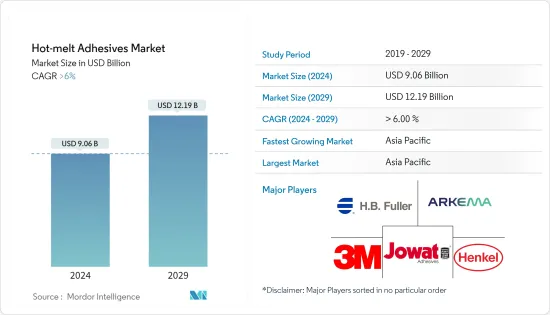

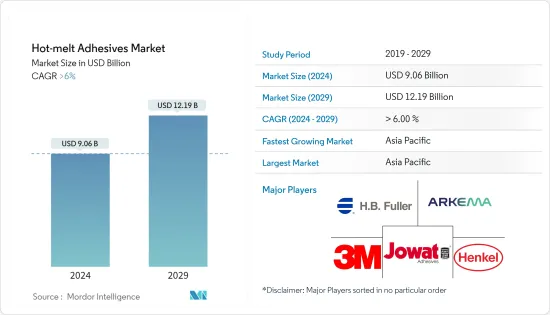

世界のホットメルト接着剤の市場規模は、2024年に90億6,000万米ドルに達し、2024~2029年の予測期間中にCAGR 6%以上で成長し、2029年には121億9,000万米ドルに達すると予測されています。

COVID-19はホットメルト接着剤市場を阻害しました。自動車製造、建設、不織布衛生製品など、ホットメルト接着剤の様々な最終用途産業は、政府による規制、消費者需要の減少、サプライチェーンの混乱により、生産の減速や停止を経験しました。閉鎖措置や規制の緩和により、多くの産業が操業を再開し、ホットメルト接着剤の需要増につながっています。

*包装産業からのホットメルト接着剤需要の増加、建設部門からの需要の増加、不織布衛生製品におけるホットメルト接着剤の採用増加が市場を牽引すると予想されます。

*しかし、原材料価格の変動がホットメルト接着剤市場の成長を妨げると予想されます。

*自動車製造の拡大と建設技術の進歩は、今後の期間に機会を提供すると予想されます。

*インド、日本、中国などの経済が急成長しているため、アジア太平洋は今後数年間で支配的な市場になると予想されます。

ホットメルト接着剤市場の動向

紙、板紙、包装分野が市場を独占する

*包装産業はホットメルト接着剤の最大消費者の一つです。これらの接着剤は、ケースやカートンのシール、トレイの成形、ラベリング、ラミネートなどの用途で、板紙、段ボール、プラスチックフィルム、箔などの包装材料の接着に広く使用されています。産業のホットメルト接着剤の大規模な使用は、大きな需要と市場の優位性を牽引しています。

*包装分野におけるホットメルト接着剤の需要は、食品消費の増加と様々な用途により増加しています。例えば、インドでは、包装は最も急速に成長している産業の一つです。このセクターは過去数年にわたり着実な成長を遂げており、特に輸出セクターでは急拡大が見込まれています。

*例えばインドでは、インド製紙工業協会(IPMA)が報告したデータによると、2023年4月~12月までの紙の輸入量は37%増の147万トンとなっています。

*さらに、ドイツ連邦統計局が2023年3月に発表した推計によると、2022年、ドイツの包装産業の収益の約46%は紙製包装によるものでした。ほぼ34%はプラスチック包装です。

*さらに、ドイツ連邦統計局が2023年に発表した推計によると、ドイツの包装産業は約350億ユーロ(379億4,000万米ドル)の収益を上げました。これは、前年度の296億ユーロ(320億9,000万米ドル)に比べて増加しました。

*食品・飲料部門は包装の主要消費者のひとつです。世界中の増加傾向に対応するため、ベーカリー部門が成長しており、これが包装製品の売上を牽引しています。

*このように、上記のような要因から、紙・板紙・包装産業のホットメルト接着剤需要が伸びると予想されます。

アジア太平洋が市場を独占する

*アジア太平洋では、特に新興経済諸国において急速な工業化、都市化、インフラ整備が進んでいます。こうした成長は、建築、包装、自動車、その他の産業におけるホットメルト接着剤の需要を促進しています。

*アジア太平洋の政府や民間セクターは、交通、公共事業、住宅や商業施設の建設など、様々なインフラプロジェクトに投資しています。ホットメルト接着剤は、羽目板、床材の施工、断熱材の接着、屋根の葺き替えなど、さまざまな建設用途で使用されており、同地域の建設産業における需要を牽引しています。

*Indian Brand Equity Foundationによると、インフラへの設備投資は2023~2024年の予算で33%増の約1,220億米ドルに達し、GDPの3%を占めます。

*さらに、民間投資を誘致するため、インド政府は、特に道路・高速道路、空港、ビジネスパーク、高等教育・技能開発部門について、多くの方法を開発しています。非公開会社およびベンチャーキャピタルは、2023年5月までにインド企業に35億米ドルを投資し、71件の取引を行いました。

*中国は2008年以降、紙製包装材と板紙の生産量が最も多い国となっています。中国紙業協会の調査によると、2023年の中国の紙・板紙製造企業の総数は2,500社、全国の紙・板紙生産量は1億2,965万トンで、前年比4.35%増となっています。

*このように、上記の要因は予測期間中、同地域のホットメルト接着剤市場を牽引すると予想されます。

ホットメルト接着剤産業の概要

世界のホットメルト接着剤市場は細分化されています。同市場の主要企業(順不同)には、3M、Jowat SE、Henkel Corporation、Arkema、H.B. Fullerなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 包装産業からの需要増加

- 建設産業からの需要増加

- その他の促進要因

- 抑制要因

- 原材料価格の変動

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(市場規模:金額)

- 樹脂タイプ

- エチレン酢酸ビニル

- スチレン系ブロック共重合体

- 熱可塑性ポリウレタン

- その他の樹脂タイプ

- エンドユーザー産業

- 建築・建設

- 紙・板紙・包装

- 木工・建具

- 自動車・運輸

- フットウェア・皮革

- ヘルスケア

- 電気・電子機器

- その他のエンドユーザー産業

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- ASEAN諸国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- トルコ

- スペイン

- ロシア

- 北欧

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- ナイジェリア

- エジプト

- カタール

- アラブ首長国連邦

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- 3M

- Alfa International

- Arkema

- Ashland

- AVERY DENNISON CORPORATION

- Beardow Adams

- Dow

- DRYTAC

- Franklin International

- H.B. Fuller Company

- Henkel Corporation

- Hexcel Corporation

- Huntsman International LLC

- Jowat SE

- Mactac

- Master Bond Inc.

- Paramelt RMC B.V.

- Pidilite Industries Limited

- Sika AG

第7章 市場機会と今後の動向

- 自動車製造の拡大

- 建設技術の進歩

The Hot-melt Adhesives Market size is estimated at USD 9.06 billion in 2024, and is expected to reach USD 12.19 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

COVID-19 hampered the hot melt adhesive market. Various end-use industries for hot melt adhesives, such as automotive manufacturing, construction, and nonwoven hygiene products, experienced slowdowns or shutdowns in production due to government-mandated restrictions, reduced consumer demand, and supply chain disruptions. With the easing of lockdown measures and restrictions, many industries have resumed operations, leading to increased demand for hot melt adhesives.

* Increasing demand for hot melt adhesives from the packaging industry, rising demand from the construction sector, and increased adoption of hot melt adhesives in nonwoven hygiene products are expected to drive the market.

* However, volatility in raw material prices is expected to hamper the growth of the hot melt adhesive market.

* Expansion in automotive manufacturing and the advancements in construction technologies are expected to provide opportunities in the upcoming period.

* Due to rapidly growing economies like India, Japan, and China, Asia-Pacific is expected to emerge as a dominant market in the coming years.

Hot Melt Adhesives Market Trends

Paper, Board, and Packaging Segment to Dominate the Market

* The packaging industry is one of the largest consumers of hot melt adhesives. These adhesives are widely used for bonding packaging materials such as paperboard, corrugated cardboard, plastic films, and foils in applications such as case and carton sealing, tray forming, labeling, and lamination. The industry's large-scale use of hot melt adhesives drives significant demand and market dominance.

* The demand for hot melt adhesives in the packaging sector is increasing due to increased food consumption and various applications. For instance, in India, packaging is one of the fastest-growing industries. The sector has witnessed steady growth over the past several years and is expected to expand rapidly, particularly in the export sector.

* For instance, in India, paper imports rose by 37% to 1.47 million tonnes from April to December 2023, according to data reported by The Indian Paper Manufacturers Association (IPMA).

* Further, according to the estimate published by the Statistisches Bundesamt in March 2023, in 2022, around 46 percent of the packaging industry revenue in Germany was generated by paper packaging. Almost 34 percent was made up of plastic packaging.

* Moreover, according to the estimate published by the Statistisches Bundesamt in 2023, the German packaging industry generated around EUR 35 billion (USD 37.94 billion) in revenue. This was an increase compared to the previous year at EUR 29.6 billion (USD 32.09 billion).

* The food and beverage sector is one of the major consumers of packaging. In order to cope with the increasing trend around the world, the bakery sector is growing, and this is driving sales of packaging products.

* Thus, the factors mentioned above are expected to grow the demand for hot melt adhesives from the paper, board, and packaging industries.

Asia-Pacific to Dominate the Market

* Asia-Pacific is experiencing rapid industrialization, urbanization, and infrastructure development, particularly in emerging economies in the region. This growth fuels the demand for hot melt adhesives in construction, packaging, automotive, and other industries, as these adhesives are essential for bonding materials and components in manufacturing and construction processes.

* Governments and private sectors in the Asia Pacific are investing in various infrastructure projects such as transportation, utilities, and residential and commercial construction. Hot melt adhesives are used in various construction applications, including paneling, flooring installation, insulation bonding, and roofing, driving the demand for these adhesives in the region's construction industry.

* According to the Indian Brand Equity Foundation, the capital investment in infrastructure is set to increase by 33%, amounting to about USD 122 billion, for the budget of 2023-24, and this accounts for 3% of GDP.

* Further, in order to attract private investment, the government of India has developed a number of ways, particularly for roads and highways, airports, business parks, and higher education and skills development sectors. Private Equity and Venture Capital Firms invested USD 3.5 billion in Indian companies between May 2023 with 71 deals.

* China has been the most extensive paper packaging and paperboard producer since 2008. According to a survey conducted by the China Paper Association, in 2023, the total number of paper and paperboard manufacturing enterprises in China stood at 2,500, with a nationwide paper and paperboard output of 129.65 Million tons, a 4.35% increase from the previous year.

* Thus, the above factors are expected to drive the hot-melt adhesives market in the region during the forecast period.

Hot-melt Adhesives Industry Overview

The global hot-melt adhesives market is fragmented in nature. Some of the major players in the market (not in any particular order) include 3M, Jowat SE, Henkel Corporation, Arkema, and H.B. Fuller, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Packaging Industry

- 4.1.2 Rising Demand from Construction Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Ethylene Vinyl Acetate

- 5.1.2 Styrenic Block Co-polymers

- 5.1.3 Thermoplastic Polyurethane

- 5.1.4 Other Resin Types (Polyolefin, polyamide)

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Paper, Board, and Packaging

- 5.2.3 Woodworking and Joinery

- 5.2.4 Automotive and Transportation

- 5.2.5 Footwear and Leather

- 5.2.6 Healthcare

- 5.2.7 Electrical and Electronic Appliances

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Spain

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Alfa International

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 AVERY DENNISON CORPORATION

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DRYTAC

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel Corporation

- 6.4.12 Hexcel Corporation

- 6.4.13 Huntsman International LLC

- 6.4.14 Jowat SE

- 6.4.15 Mactac

- 6.4.16 Master Bond Inc.

- 6.4.17 Paramelt RMC B.V.

- 6.4.18 Pidilite Industries Limited

- 6.4.19 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Automotive Manufacturing

- 7.2 Advancements in Construction Technologies