|

市場調査レポート

商品コード

1907269

塗料およびコーティング:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 塗料およびコーティング:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

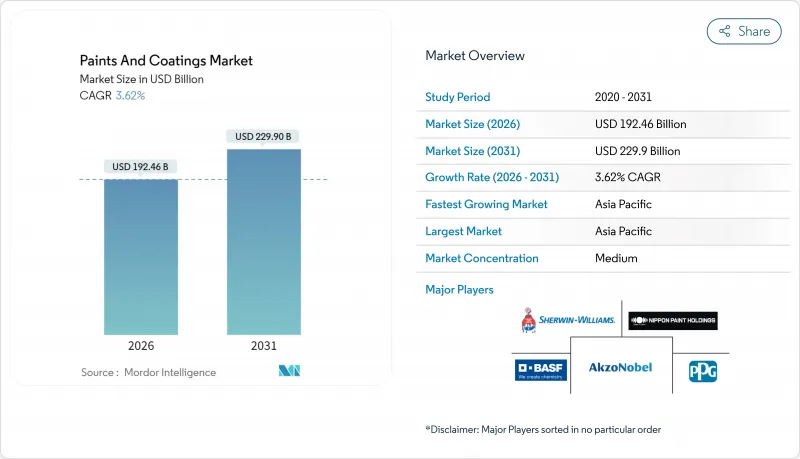

塗料およびコーティング市場規模は2026年に1,924億6,000万米ドルと予測され、2025年の1,857億4,000万米ドルから成長を遂げます。

2031年までの見通しでは2,299億米ドルに達し、2026年から2031年にかけてCAGR3.62%で拡大する見込みです。

住宅建設、インフラ整備、持続可能な製品革新からの安定した需要が、原材料コストの急激な変動や環境規制の強化にもかかわらず、この緩やかな拡大を支えています。アジア太平洋地域は、構造的な優位性、急速な都市化、大規模な資本プロジェクト、拡大する工業生産を併せ持ち、これら全体が成熟経済圏よりも著しく速いペースで地域の消費を牽引しています。技術面では、低VOC水性化学薬品への移行が依然として最も影響力のある動向であり、政府の排出規制上限や顧客の環境配慮仕様への嗜好によって強化されています。同時に、メーカー各社は、労働力不足の緩和と市場投入までの時間短縮を図るため、カラーマッチング、工場スケジューリング、品質管理のワークフローをデジタル化しています。世界の塗料およびコーティング業界では、上位12社のサプライヤーが、よりスリムなポートフォリオの構築と規模の経済の実現を目的とした買収や事業売却を推進しており、競合が激化しています。

世界の塗料およびコーティング市場における動向と洞察

世界の住宅建設活動の急増

北米の「インフラ投資・雇用法」などの立法により、道路・橋梁・公益事業へ資本が集中し、新規・改修資産双方の保護・装飾用塗料需要が拡大しています。並行して、アジア太平洋地域の各国政府は手頃な価格の住宅プログラムを優先し続け、新規住宅着工と内装塗り替えサイクルを促進しています。複数の経済圏における歴史的な低水準の住宅ローン金利は、リフォーム予算を復活させ、グリーンビルディングクレジットの対象となるプレミアムなゼロVOC壁用塗料への需要増加をもたらしています。サプライヤーは、塗布速度を犠牲にすることなく厳しい室内空気基準を満たす速乾性水性塗料ラインで対応しています。これらの要因が相まって、予測期間中の塗料およびコーティング業界の安定した販売数量基盤を強化しています。

自動車生産台数の拡大

軽自動車の生産台数は2024年に回復し、2026年までにパンデミック前の成長軌道に復帰すると予測されています。中国、インド、東南アジアが増加する生産能力の大部分を占める見込みです。現代のボディショップでは、サイクルタイムとVOC排出量の削減を目的に、水性ベースコートと低温焼付クリアコートの採用が増加しており、OEMラインと補修塗装ラインの技術収束が進んでいます。樹脂調合メーカー、塗装ブースメーカー、自動車メーカー間の戦略的提携により、塗装単位あたりのエネルギー消費量を低減する統合コーティングプラットフォームの導入が加速しています。この継続的な生産拡大は産業用塗料消費を大幅に押し上げ、塗料およびコーティング市場の動向を後押ししています。

厳格な世界のVOC規制

カリフォルニア州南海岸大気質管理地区では、規則1113の規制強化が定期的に実施され、非適合製品の再配合または市場撤退を余儀なくされ、中小サプライヤーの研究開発コストが増加しています。欧州では、CLP規則改正により内分泌かく乱物質の表示が追加され、生産者は原材料ポートフォリオの見直しと安全データシートの更新を義務付けられます。中国では統一建築基準案により、プライマーやシーラーなどの補助材料にもVOC制限が拡大され、規制対応の複雑化が予想されます。これらの規制は総合的に塗料およびコーティング業界の利益率を圧迫し、迅速な製品開発パイプラインの重要性を高めています。

セグメント分析

アクリル系化学製品は2025年に塗料およびコーティング業界の35.78%を占め、2031年までCAGR3.98%を維持すると予測されています。これは、建築用および軽工業用ニーズを満たす、実証済みの耐候性、色保持性、低VOC特性を基盤としています。配合技術者は、耐擦洗性と防汚性を高める架橋構造の改良を継続しており、DIYユーザーやプロの塗装業者にとってメンテナンス間隔の延長を実現しています。成長の原動力は新興市場の都市化にあり、アクリルエマルション塗料は新築住宅の内装市場で主流を占めています。メーカーは地域ごとの反応装置容量を拡大し、リードタイムの短縮と色調ラインナップの現地化を進めており、この戦略が溶剤系競合他社に対する競争力強化につながっています。

樹脂市場は、多国籍企業が収益性の高いアクリル系分散プラットフォームへポートフォリオを集中させることで、徐々に統合が進んでいます。アルキド樹脂は金属・木材用塗料でニッチな存在感を維持していますが、大豆油価格の変動による利益率の圧迫に直面しています。エポキシ樹脂の需要は重整備用途で安定していますが、2025年に達成された価格安定は構造的な上昇ではなく、生産能力の均衡を反映したものです。ポリウレタンおよびポリエステル系樹脂は、それぞれ耐摩耗性床材と粉体塗料という特殊な性能分野を占めていますが、アクリル系のような広範な需要量には至っていません。全体として、塗料およびコーティング市場全体において、アクリル系樹脂が調合メーカーの成長戦略の基盤であり続けるでしょう。

塗料およびコーティング市場レポートは、樹脂別(アクリル、アルキド、ポリウレタン、エポキシなど)、技術別(水性、溶剤系、粉体塗装、UV硬化塗装)、エンドユーザー産業(建築、自動車、木材、保護コーティングなど)、地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)別に分析されています。市場予測は金額ベース(米ドル)で提供されます。

地域別分析

アジア太平洋地域は2025年に全世界売上高の46.21%を占め、2031年まで堅調な4.91%のCAGRを維持する見込みです。同地域の塗料およびコーティング市場規模は、継続的なメガシティ開発、産業の回帰、持続的な公共インフラ投資の拡大により恩恵を受けており、これらが相まって保護・装飾用塗料の需要を増加させています。

北米地域は、連邦政府資金による交通回廊整備と、安定した住宅ローン金利に後押しされた住宅改修サイクルの加速により支えられています。ESG(環境・社会・ガバナンス)基準に沿った資産への需要が高まる中、認証済み低排出型内装塗料の採用が加速し、水性塗料メーカーが塗料およびコーティング業界でシェア拡大の機会を得ています。欧州では、主要経済圏が住宅不足やEUグリーンディール関連のエネルギー改修計画に取り組む中、緩やかな回復が見られます。ただし、改正CLP規制による表示枠組みの強化がサプライチェーン全体にコスト増をもたらしています。

南米ではブラジルを中心に選択的な成長が見込まれます。シャーウィン・ウィリアムズによるBASFの装飾部門買収により、店舗網が即座に拡大し、請負業者がブランド塗料に容易にアクセスできるようになりました。中東・アフリカ地域は、メガプロジェクトや資源主導型インフラを基盤とした初期段階の成長が見込まれますが、政治リスクや資金調達の制約により、アジア太平洋地域と比較すると需要量は限定的です。過酷な砂漠や沿岸気候が、資本資産を保護する高性能ポリシロキサンおよびフッ素樹脂トップコートの仕様を後押ししています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 世界の住宅建設活動の急増

- 拡大する自動車生産台数

- アジア太平洋地域における都市人口の急激な増加

- グリーンビルディング(低VOC)に対する政府の優遇措置

- AI駆動型カラーマッチングプラットフォームの台頭

- 市場抑制要因

- 世界の厳格なVOC規制

- 二酸化チタン原料価格の変動性

- 水性システムの乾燥・硬化時間の延長

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 樹脂

- アクリル

- アルキド樹脂

- ポリウレタン

- エポキシ樹脂

- ポリエステル

- その他の樹脂タイプ

- 技術

- 水性

- 溶剤系

- 粉体塗装

- UV硬化型コーティング

- エンドユーザー産業

- 建築

- 自動車

- 木材

- 保護コーティング

- 一般産業

- 輸送機関

- 包装

- 地域

- アジア太平洋地域

- 中国(台湾を含む)

- インド

- 日本

- インドネシア

- オーストラリアおよびニュージーランド

- 韓国

- タイ

- マレーシア

- フィリピン

- バングラデシュ

- ベトナム

- シンガポール

- スリランカ

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ベネルクス

- ロシア

- トルコ

- スイス

- スカンジナビア諸国

- ポーランド

- ポルトガル

- スペイン

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- その他南米

- 中東

- サウジアラビア

- カタール

- アラブ首長国連邦

- クウェート

- エジプト

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- アルジェリア

- モロッコ

- その他アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- Akzo Nobel N.V.

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Russian Paints Company

- SK Kaken Co. Ltd

- The Sherwin-Williams Company