|

市場調査レポート

商品コード

1403896

市販(OTC)鎮痛薬-市場シェア分析、産業動向と統計、2024~2029年の成長予測Over-the-counter (OTC) Analgesics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 市販(OTC)鎮痛薬-市場シェア分析、産業動向と統計、2024~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 130 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

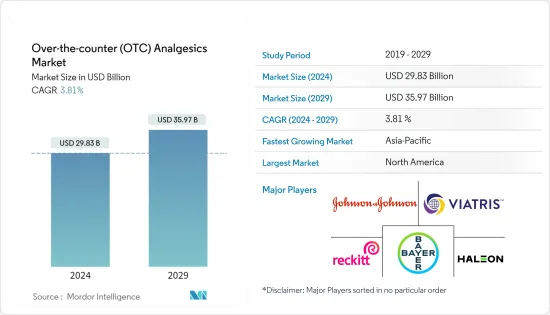

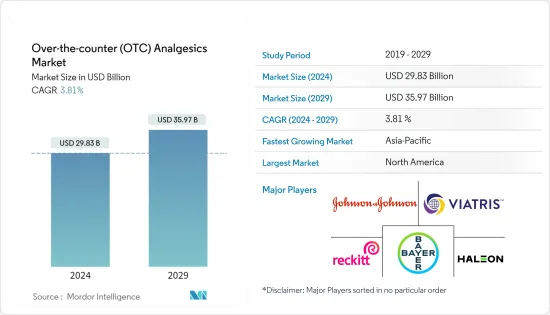

市販(OTC)鎮痛薬市場規模は2024年に298億3,000万米ドルと推定され、2029年には359億7,000万米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは3.81%で成長する見込みです。

COVID-19パンデミックはOTC市場に世界的に影響を与えました。パンデミックは、個人の健康への関心の高まりにより、これらの医薬品の販売にかなりの影響を及ぼし、市場にプラスの影響を与えました。風邪薬や咳止めのOTC医薬品の需要はすでに高く、栄養補助食品は主にCOVID-19パンデミックの影響で、より高い成長率が見込まれていました。例えば、2022年5月にAnnals of Medicine and Surgery Journalが発表した論文によると、COVID-19の流行時に最もよく使用された市販(OTC)医薬品は解熱剤(アセトアミノフェン、イブプロフェン)、抗ヒスタミン剤(セチリジン、ロラタジン)、咳止め(デキストロメトルファン)、ビタミンB、C、D、亜鉛などでした。この論文はまた、ナイジェリア、バングラデシュ、ペルー、トーゴといった低所得国でのCOVID-19パンデミック時の自己投薬の有病率は、発熱、咳、風邪、鼻づまり、疲労といった様々な症状に対して34%から84%と幅があり、非常に高いと考えられたことも報告しています。このように、パンデミックはOTC鎮痛薬の需要を急増させました。しかし、現在のシナリオでは、痛みを和らげたり熱を下げたりするために市販(OTC)医薬品を使用することが、予測期間中に調査した市場の成長を促進すると予想されます。

市場の成長を後押しする主要要因としては、局所鎮痛薬に対する需要の増加、高齢者人口の増加、様々な疾患の有病率の上昇、OTC鎮痛薬のコスト効率などが挙げられます。2022年11月にBioMed Central(BMC)ジャーナルに掲載された論文によると、慢性疼痛は世界の約20%の人に共通する疾患です。2020年の中国疼痛健康指数(CPHI)が最も高かったのは北京だった。上位5省は、北京市(67.64ポイント)、上海市(67.04ポイント)、浙江省(65.74ポイント)、山東省(61.16ポイント)、天津市(59.99ポイント)だった。このように、慢性疼痛が世界的に拡大していることがわかる。その結果、OTC鎮痛剤の需要は予測期間中に伸びると予想されます。

高齢者は慢性疼痛になりやすいため、疼痛緩和ソリューションの需要は高齢者人口の増加により増加しています。高齢者人口の継続的な増加は、いくつかの高齢者問題を引き起こし、そのために患者は病院に行くことを控え、自宅で薬や治療を受けることを好みます。例えば、2022年3月にFrontiers in Human Neuroscienceに掲載された論文では、高齢者人口における臓器機能障害やその他の慢性疾患が、慢性疼痛に大きくつながる可能性があると報告されています。従って、このような要因から、市場における基礎的市販(OTC)鎮痛薬製品の重要性が高まり、採用が進んでいます。これらの医薬品は高齢の患者集団に長年服用されてきたため、市販(OTC)需要は市場で常に高い水準を維持しています。

さらに、フランスでは妊婦のセルフメディケーションの普及率が高いです。国立生物工学情報センター(NCBI)が2021年1月に発表した調査論文によると、世界的にOTC鎮痛薬の母親による消費は非常に多く、急激に増加しています。このように、セルフメディケーションの普及率の上昇は、市場全体の成長を促進すると予想されます。

さらに、NCBIが2022年11月に発表した別の論文によると、インドにおけるセルフメディケーションの全体的な平均有病率は53.57%でした。同出典によると、セルフメディケーションを実践する主要理由は薬に対する意識の高さにあるようで、その実践は中流以下の家庭の個人により多く見られ、有病率は26.31%でした。さらに、セルフメディケーション(SM)の主要理由は軽度の病気であり、中でも頭痛が最も多く報告されました。

このように、局所鎮痛薬に対する需要の増加、高齢者人口の増加、様々な疾患の有病率の上昇、市販(OTC)鎮痛薬の費用対効果などから、市場は予測期間中に高い成長を遂げることが予想されます。しかし、薬物耐性、依存、中毒、乱用は、予測期間中の市場の成長を鈍化させると予想されます。

市販薬(OTC)鎮痛薬市場の動向

予測期間中、非ステロイド性抗炎症薬(NSAIDs)セグメントが市場で主要シェアを占める見込み

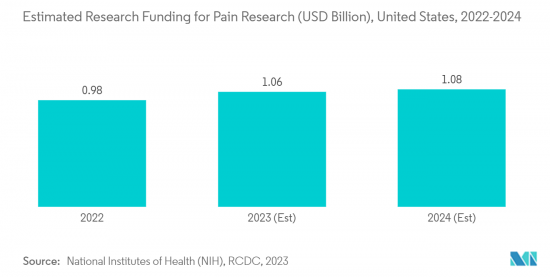

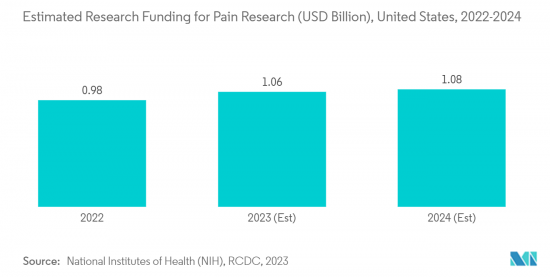

NSAIDsは、シクロオキシゲナーゼ(COX)と呼ばれる酵素を阻害することにより、痛みや炎症を抑える働きをします。COXを阻害することで、NSAIDsは痛みや炎症を予防・軽減します。一般用医薬品のNSAIDsは、クリームやジェルなどの外用薬と、経口薬があります。しかし、錠剤よりも外用薬の方が安全可能性があります。非ステロイド性抗炎症薬(NSAIDs)セグメントは、広く入手可能であること、慢性疼痛と炎症症例の負担が増加していること、疼痛とその管理に関する研究資金が増加していることから、市場で大きなシェアを占めると予想されます。

NSAIDsは、関節リウマチや脊椎関節炎などの慢性炎症性疾患の治療にも広く使用されています。NSAIDsは安価で、関節リウマチに特徴的な慢性疼痛、炎症、腫脹の管理に役立つため、他の薬剤よりも好まれています。したがって、これらの炎症性疾患の高い負担は、OTC NSAIDsの需要を増加させ、市場の成長を促進すると予想されます。例えば、2022年11月に米国リウマチ学会(American College of Rheumatology)が発表した研究報告によると、カイロプラクティック・クリニックの治療を受けている慢性腰痛患者の約12%が未診断の腋窩脊椎関節炎(axSpA)を患っており、その中でも非放射線性のaxSpAが最も一般的な病型でした。これは、慢性腰痛患者の負担が大きく、市販(OTC)鎮痛薬の必要性が高まっていることを示しています。このため、市場は大きく成長すると予想されます。

さらに、非ステロイド性抗炎症薬の新たな承認と発売により、これらの製品の市場での入手可能性が高まり、市場が大きく成長する可能性が高いです。例えば、2023年3月、Perrigo Company PLCは、複数の疼痛関連症状に対するアセトアミノフェンとイブプロフェン錠剤の略式新薬承認申請(ANDA)について、米国食品医薬品局(FDA)から最終承認を取得しました。このような新たな承認や上市はNSAIDsの入手可能性を高め、予測期間中の市場の成長を後押しするとみられます。

北米は予測期間中に大幅な成長が見込まれる

北米は、筋骨格系疾患やスポーツ関連傷害の有病率の増加、症状緩和のためのセルフメディケーションの普及、OTC医薬品の承認・上市の増加といった要因から、市場に大きな影響を与えると予想されます。これらの要因は、同地域の市場成長を促進すると予想されます。

例えば、全米高校スポーツ関連傷害サーベイランス・スタディが2022年8月に発表した報告書によると、米国では2021/22年度に4,998件の傷害が報告され、傷害発生率は20競技の選手1,000人当たりの傷害発生件数は2.02件でした。また、男子レスリング競技の傷害発生率は、2020/2021年度の1,000人当たり3.2件から、2021/22年度には1,000人当たり5.5件に増加しています。これはスポーツに関連した傷害が増加していることを示しており、疼痛管理のためのOTC鎮痛剤の需要が増加すると考えられます。これは調査期間中、市場に大きな影響を与えると予想されます。

さらに、規制当局による製品承認は、新しく効果的な市販製品の利用可能性を高め、これが調査対象市場の成長を促進すると予想されます。例えば、2022年4月、Genexaは、史上初のクリーンな成人用アセトアミノフェン鎮痛剤を発売しました。同様に、2022年8月、Haleonは、信頼できる2つの鎮痛剤を便利な1錠にまとめたAdvil PLUSアセトアミノフェンをカナダ人に発売しました。この製品は、カナダ全土の薬局、食料品店、小売店で市販されており、オンラインでも購入できます。こうした製品の発売は、消費者向け医薬品業界全体を活性化させる先進的なアプローチです。その結果、この地域全体で市場が大きく成長することが期待されます。

市販薬(OTC)鎮痛薬業界概要

市場は、多国籍企業だけでなく地元企業も多数存在するため、かなり競争が激しいです。同市場で事業を展開する企業は、より大きな市場シェアを獲得するため、新製品の発売、地域拡大、提携、協力など様々な戦略を採用しています。市場の主要企業としては、Bayer AG、Boehringer Ingelheim International GmbH、Johnson &Johnson、Reckitt Benckiser Group PLC、Sanofi SA、Sun Pharmaceutical Industries Ltdなどが挙げられます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 局所鎮痛薬に対する需要の増加

- 筋骨格系疾患の有病率増加に伴う高齢者人口の増加

- OTC鎮痛薬のコスト効率性

- 市場抑制要因

- 薬物耐性、依存、中毒、乱用

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模-100万米ドル)

- 医薬品の種類

- アセトアミノフェン

- 非ステロイド性抗炎症薬(NSAIDs)

- サリチル酸塩

- その他の鎮痛薬

- 流通経路

- 病院薬局

- 小売薬局

- オンライン薬局

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Bayer AG

- Boehringer Ingelheim International GmbH

- Johnson & Johnson

- Haleon PLC

- Endo International PLC

- Reckitt Benckiser Group PLC

- Sanofi SA

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Dr. Reddy's Laboratories Ltd

- Novartis AG

第7章 市場機会と今後の動向

The Over-the-counter Analgesics Market size is estimated at USD 29.83 billion in 2024, and is expected to reach USD 35.97 billion by 2029, growing at a CAGR of 3.81% during the forecast period (2024-2029).

The COVID-19 pandemic affected the OTC market globally. The pandemic had a positive impact on the market, as it considerably influenced the sales of these drugs due to the increased focus on personal health. The demand for cold and cough OTC drugs was already high, and dietary supplements were expected to have a higher growth rate, mainly due to the COVID-19 pandemic. For instance, an article published by the Annals of Medicine and Surgery Journal in May 2022 reported that the most common OTC drugs used during the COVID-19 pandemic were antipyretics (acetaminophen, ibuprofen), antihistamines (cetirizine, loratadine), a cough suppressant (dextromethorphan), vitamins B, C, D, zinc, etc. The article also reported that the prevalence of self-medication during the COVID-19 pandemic in lower-income countries like Nigeria, Bangladesh, Peru, and Togo varied from 34% to 84% for various symptoms like fever, cough, cold, nasal congestion, and fatigue, which was considered very high. Thus, the pandemic surged the demand for OTC analgesics. However, in the current scenario, the use of OTC drugs for relieving pain or lowering a fever is expected to drive the growth of the market studied over the forecast period.

The major factors boosting the growth of the market include the increasing demand for topical analgesics, the growth of the geriatric population, the rising prevalence of various diseases, and the cost-efficiency of OTC analgesic drugs. An article published in the BioMed Central (BMC) Journal in November 2022 reported that chronic pain is a common disease for about 20% of people worldwide. The highest China Pain Health Index (CPHI) in 2020 was in Beijing. The top five provinces were Beijing (67.64 points), Shanghai (67.04 points), Zhejiang (65.74 points), Shandong (61.16 points), and Tianjin (59.99 points). Thus, such instances show that chronic pain is growing globally. As a result, the demand for OTC analgesics is expected to grow over the forecast period.

The demand for pain relief solutions is increasing due to the growing elderly population, as aged people are more prone to chronic pain. The continuous growth of the geriatric population leads to several old age problems, for which patients refrain from going to hospitals and prefer to get medications and treatment at home. For instance, an article published by Frontiers in Human Neuroscience in March 2022 reported that organ dysfunction and other chronic diseases in the geraitric population could significantly lead to chronic pain. Thus, such factors lead to the growing importance and adoption of basic analgesic OTC products in the market. These drugs have been taken for years by the elderly patient population, which keeps the OTC demand consistently high in the market.

Additionally, there is a high prevalence of self-medication among pregnant women in France. According to the research article published by the National Center for Biotechnology Information (NCBI) in January 2021, there is a very high prevalence of maternal consumption of OTC analgesics globally, which is increasing sharply. Thus, the rising prevalence of self-medication is expected to propel the overall market growth.

In addition, another article published by NCBI in November 2022 reported that the overall mean prevalence of self-medication practices in India was 53.57%. The same source stated that the awareness of the medication seems to be a major reason to practice self-medication, and the practice was noticed more among individuals from middle-lower class families, with a prevalence rate of 26.31%. Furthermore, minor ailments were the primary reason for self-medication (SM), among which headache was the most commonly reported.

Thus, due to the increasing demand for topical analgesics, the growth of the geriatric population, the rising prevalence of various diseases, and the cost efficiency of OTC analgesic drugs, the market is expected to witness high growth over the forecast period. However, drug tolerance, dependence, addiction, and abuse are expected to slow down the growth of the market over the forecast period.

Over-the-counter (OTC) Analgesics Market Trends

Nonsteroidal Anti-inflammatory Drugs (NSAIDs) Segment is Expected to Have the Major Share in the Market over the Forecast Period

NSAIDs work to reduce pain and inflammation by inhibiting enzymes called cyclooxygenases (COX). By inhibiting COX, NSAIDs help prevent and/or reduce pain and inflammation. OTC NSAIDs are available as creams and gels for topical use, and a few are available as oral formulations. However, topical use may be safer than the pill form. The NSAIDs segment is expected to have a significant share in the market due to its widespread availability, the rising burden of chronic pain and inflammation cases, and increasing research funding for pain and its management.

NSAIDs are also used broadly for the treatment of chronic inflammatory disorders such as rheumatoid arthritis and spondyloarthritis. They are preferred over other drugs because they are inexpensive, and they help manage chronic pain, inflammation, and swelling that are characteristic of rheumatoid arthritis. Hence, the high burden of these inflammatory diseases increases the demand for OTC NSAIDs, which is anticipated to propel the market's growth. For instance, according to the study report published by the American College of Rheumatology in November 2022, approximately 12% of patients with chronic back pain in the care of chiropractic clinics had undiagnosed axial spondyloarthritis (axSpA), in which non-radiographic axSpA was the most common form of the disease. This shows the high burden of patients with chronic back pain, which increases the need for OTC analgesics. This is expected to have significant growth in the market.

Furthermore, the new approvals and launches of NSAIDs increase the availability of these products in the market, which is likely to haave significant growth in the market. For instance, in March 2023, Perrigo Company PLC received the final approval from the United States Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for acetaminophen and ibuprofen tablets for multiple pain-related symptoms. These kinds of new approvals and launches increase the availability of NSAIDs, which is expected to boost the market's growth over the forecast period.

North America is Expected to Witness Significant Growth over the Forecast Period

North America is expected to have a significant impact on the market owing to factors such growing prevalence of musculoskeletal diseases and sports-related injuries, coupled with the adoption of self-medication to relieve the symptoms and an increase in approval and launch of OTC drugs. These factors are expected to drive the growth of the market in the region.

For instance, according to the report published by the National High School Sports-Related Injury Surveillance Study in August 2022, 4,998 injuries were reported in the academic year 2021/22 in the United States, with an injury incidence of 2.02 injuries per 1,000 athletes exposures in 20 sports. In addition, there was an increase in the rate of boys' wrestling competition injuries from 3.2 per 1,000 athlete exposures in 2020/2021 to 5.5 per 1,000 athlete exposures in the 2021/22 academic year. This shows the increasing number of sport-related injuries, which is likely to increase the demand for OTC analgesics for pain management. This is expected to have a significant impact on the market over the study period.

Furthermore, product approvals by the regulatory authority increase the availability of new and effective OTC products, which is expected to drive the growth of the market studied. For instance, in April 2022, Genexa launched the first-ever clean acetaminophen pain relief product for adults. Similarly, in August 2022, Haleon introduced Advil PLUS acetaminophen to Canadians, combining two trusted pain relievers into one convenient tablet. It is available over the counter at pharmacies, grocery stores, and retailers across Canada and online. These product launches offer a forward-thinking approach that catalyzes the entire consumer pharmaceutical industry. This is expected to result in significant growth of the market throughout the region.

Over-the-counter (OTC) Analgesics Industry Overview

The market is fairly competitive due to the presence of a large number of multinational as well as local market players. Companies operating in the market are adopting various strategies, such as new product launches, regional expansion, partnerships, and collaborations, to gain larger market shares. Some of the key players in the market are Bayer AG, Boehringer Ingelheim International GmbH, Johnson & Johnson, Reckitt Benckiser Group PLC, Sanofi SA, and Sun Pharmaceutical Industries Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Topical Analgesics

- 4.2.2 Growing Geriatric Population along with Increasing Prevalence of Musculoskeletal Diseases

- 4.2.3 Cost Efficiency of OTC Analgesic Drugs

- 4.3 Market Restraints

- 4.3.1 Drug Tolerance, Dependence, Addiction, and Abuse

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Type of Drug

- 5.1.1 Acetaminophen

- 5.1.2 Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- 5.1.3 Salicylates

- 5.1.4 Other Analgesics

- 5.2 Distribution Channel

- 5.2.1 Hospital Pharmacies

- 5.2.2 Retail Pharmacies

- 5.2.3 Online Pharmacies

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bayer AG

- 6.1.2 Boehringer Ingelheim International GmbH

- 6.1.3 Johnson & Johnson

- 6.1.4 Haleon PLC

- 6.1.5 Endo International PLC

- 6.1.6 Reckitt Benckiser Group PLC

- 6.1.7 Sanofi SA

- 6.1.8 Sun Pharmaceutical Industries Ltd

- 6.1.9 Teva Pharmaceutical Industries Ltd

- 6.1.10 Viatris Inc.

- 6.1.11 Dr. Reddy's Laboratories Ltd

- 6.1.12 Novartis AG