|

市場調査レポート

商品コード

1907233

毛髪再生サービス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Hair Restoration Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 毛髪再生サービス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 112 Pages

納期: 2~3営業日

|

概要

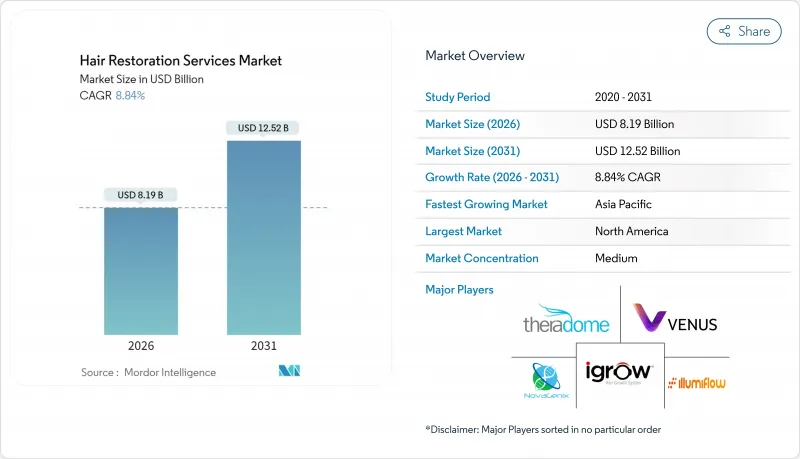

毛髪再生サービス市場は、2025年の75億3,000万米ドルから2026年には81億9,000万米ドルへ成長し、2026年から2031年にかけてCAGR8.84%で推移し、2031年までに125億2,000万米ドルに達すると予測されています。

この成長の勢いは、ペラージュ・ファーマシューティカルズのPP405などの再生医療化合物の臨床的成功、44マイクロン解像度を備えたARTAS iXiロボットのような次世代デバイス、そして永続的で自信を高める結果を認識する潜在患者の層の拡大によって推進されています。社会的受容の拡大、インフルエンサーによる認知度向上、柔軟な支払いプランにより、26~35歳の成人における初回施術が加速しています。一方、FoLixフラクショナルレーザー治療などのデバイス補助療法は、手術を望まない、あるいは適さない消費者へのケアを拡大しています。医療観光、特にトルコやインドへの需要が並行して増加し、コスト障壁の低下と施術件数の増加をもたらしています。一方、頭皮冷却システムに対するFDAのクラスII規制に見られるような支援的な規制は、脱毛症が生活の質に関わる問題として制度的に認識されていることを示しています。

世界の毛髪再生サービス市場の動向と洞察

世界的に増加する脱毛症および毛髪喪失障害の負担

男性型脱毛症は現在、世界中の成人の最大50%に影響を及ぼしており、世代を超えてジヒドロテストステロン(DHT)感受性が高まるにつれ、その有病率は上昇しています。2024年には世界中で70万件以上の毛髪再生処置が実施され、2016年比16%増加しており、アンメットニーズを浮き彫りにしています。26~35歳の若年患者層が早期に治療を開始する傾向にあり、生涯にわたる施術需要の増加と維持療法の順守率向上につながっています。自己免疫関連脱毛症や化学療法による脱毛症の調査拡大により、従来の男性型脱毛症以外の患者層も対象となりつつあります。高所得国における高齢化に伴い、認知度向上、費用対効果、アクセス性の向上により、需要は急激な上昇傾向を維持しています。

可処分所得の増加と美容整形への支出意欲

米国、ドイツ、中国、湾岸協力会議(GCC)諸国の経済圏では、可処分所得の増加に伴い、ヘルスケア費用が美容整形サービスに振り向けられています。初めて植毛手術を受ける患者の平均年齢は現在26~35歳であり、この年齢では手術がより簡単で、時間の経過とともに優れた密度を得ることができます。消費者調査によると、77%の決定はキャリアや人間関係を動機としており、豊かな髪は社会的資本と同等であると見なされています。分割払いプラン、無利子のクリニックローン、後払いアプリにより、中所得層にも手頃な価格帯が広がっています。元サッカー選手ウェイン・ブリッジ氏が7,000ポンド(約100万円)の施術を受けたという有名人の事例は、その効果を裏付け、施術費用を一般的なものと認識させる役割を果たしています。

高額な施術費用と限定的な保険適用範囲

先進地域における4,000~1万5,000米ドルの手術費用は依然として高額であり、民間保険会社は植毛を任意手術と分類するため、患者は自己負担を余儀なくされます。新興市場では一人当たり所得が施術費用を下回るため、認知度が高まる中でも格差はより顕著です。分割払いプランや第三者信用機関による融資が価格への抵抗感を和らげますが、多くの見込み患者は治療を遅らせ、毛包の微小化リスクを高めています。医療ツーリズムは費用格差を縮めますが、移動費が加わることで域内患者にとって節約効果が相殺される場合があります。一方、低出力レーザーキャップなどの機器ベースの治療法が1,000米ドル未満で市場に参入し、価格に敏感な消費者向けの入り口を提供すると同時に、外科的治療チャネルから一定の需要を奪っています。

セグメント分析

頭皮手術は2025年時点で毛髪再生サービス市場の87.02%を占めており、男性型脱毛症の有病率の高さと確立された外科的プロトコルを反映しています。ソーシャルメディアの美容基準に後押しされた眉毛再生は、10.22%のCAGRで拡大し、従来の男性層を超えたクリニック収益の多様化が予測されます。ひげ施術は、より豊かな顔の美学を求めるミレニアル世代にニッチな魅力を持ちますが、まつ毛や体毛の施術は、ドナー毛の不足と手術の複雑さにより依然として限定的です。アフリカ系毛質向けに設計されたロボット直接毛髪移植(DHI)技術は、これまで十分にサービスが行き届いていなかった層を開拓し、早期導入クリニックの競合優位性を高めます。女性患者の認知度向上と先進的なマイクロパンチツールの普及により、ダウンタイムと瘢痕が軽減され、頭皮手術の中核的地位が強化されると同時に、高利益率の顔面サービスポートフォリオが拡大します。

二次的影響は調達とマーケティングに及びます。眉毛やひげの潜在顧客向けにキャンペーンを調整するクリニックは、中核となる頭皮需要を損なうことなく追加施術を確保し、毛髪再生サービス市場全体の収益を押し上げます。一方、機器メーカーは繊細な顔面領域での外傷を最小限に抑えるため、パンチ径と植毛ペンの最適化を進めています。規制当局は頭皮以外の施術向け認証プロセスを適応させ、解剖学的差異があるにもかかわらず標準化された安全性を確保しています。その結果、移植部位の多様化により、提供者は頭皮需要の周期的な変動の影響を緩和できると同時に、毛髪再生サービス市場の総潜在規模を拡大しています。

地域別分析

2025年時点で北米は毛髪再生サービス市場の40.05%を占め首位を維持。高所得層とAI支援ロボット技術の早期導入が牽引要因です。米国ではボズリーなどのクリニックがフラクショナルレーザーやエクソソーム追加治療へ多角化し、患者1人あたりの収益拡大を図っています。カナダでは医療機器承認プロセスが有利なため、他国では利用できない新技術を求める越境患者の流入が促進されています。保険適用範囲の不足は残るもの、第三者金融や雇用主の健康手当が費用障壁を緩和しています。

欧州は成熟しつつも革新的な市場です。ドイツではPRP(多血小板血漿)や医療機器の施術者に専門資格を義務付け、品質向上と提供者数の抑制を図っています。患者流動は双方向で発生しております:コスト意識の高いドイツ人は低価格FUE施術のためイスタンブールへ渡航し、湾岸地域住民は移植+フィラー併用パッケージを求めてベルリンへ飛来します。スマイルヘアクリニックの2025年ハンブルク進出は、欧州におけるプレミアム需要への確信を示しております。EUの広告基準監視により透明性ある施術結果の主張が保証され、毛髪再生サービス市場への信頼が強化されております。

アジア太平洋地域はCAGR9.44%と予測される成長エンジンです。中国には3,000以上の移植提供者が存在しますが、消費者が個人経営の施設よりもブランドネットワークを好む傾向から、統合圧力が高まり品質が向上しています。インドは英語による遠隔診療と米国価格の4分の1という価格設定を活かし、手頃な価格を求める西洋人を惹きつけています。トルコは地理的には欧州に位置しますが、アジア太平洋地域、中東・アフリカ、米国のお客様に等しくサービスを提供しており、地理的な境界を越えた展開を示しています。イスタンブールとラゴスで導入されたアフリカ系ヘアに最適化されたロボット技術は、サービスの包摂性を広げ、医療観光としての地位を強化しています。タイと韓国の政府機関は現在、美容観光ビザの発行を推進しており、毛髪再生を国家の医療輸出戦略に正式に組み込んでいます。これらの要因が相まって、毛髪再生サービス市場は従来の西洋圏の枠を超えて拡大しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 世界的に増加する脱毛症および脱毛障害の負担

- 可処分所得の増加と美容施術への支出意欲の高まり

- 外科的および非外科的毛髪再生技術における継続的な技術進歩

- 専門的な植毛クリニックおよびフランチャイズチェーンの拡大

- 費用対効果の高い施術を求める美容目的の海外渡航(コスメティック・ツーリズム)の受容拡大

- ソーシャルメディアマーケティングとインフルエンサー推薦の拡大

- 市場抑制要因

- 高額な施術費用と限定的な保険適用範囲

- 熟練した植毛外科医の不足

- 術後のリスクと成功率のばらつき

- 低侵襲な美容代替手段の普及

- 規制情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 対象領域別

- 頭皮

- ひげ/口ひげ

- 眉毛

- まつげ

- その他の身体部位

- 治療別

- 外科手術技術

- FUE(単一毛包抽出法)

- FUT (毛包単位植毛)

- ダイレクトヘアインプランテーション(DHI)

- ロボットFUE

- 非外科的/補助療法

- 低出力レーザー療法(LLLT)

- 多血小板血漿(PRP)

- 幹細胞・エクソソーム療法

- 外用剤および注射剤用アジュバント

- 外科手術技術

- エンドユーザー別

- 専門ヘアクリニック

- 総合病院

- 外来手術センター

- メディカルスパ・ウェルネスセンター

- その他のエンドユーザー

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Aderans Co., Ltd.(HairClub)

- Bosley Inc.

- Venus Concept Inc.

- Bernstein Medical-Center for Hair Restoration

- The Cole Clinic

- Elite Hair Restoration

- Hairline International Hair & Skin Clinic

- Apira Sciences Inc.(iGrow)

- Lexington Intl. LLC(HairMax)

- Illumiflow

- National Hair Centers

- NovaGenix

- Theradome Inc.

- Restoration Robotics Inc.(ARTAS)

- Neograft Solutions

- Follica Inc.

- Advanced Hair Studio

- DHI Global Medical Group

- Eugenix Hair Sciences

- Sisram Medical(Alma Lasers)

- Solta Medical(Bausch Health)