|

市場調査レポート

商品コード

1432810

麻酔薬市場:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)Global Anesthesia Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 麻酔薬市場:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

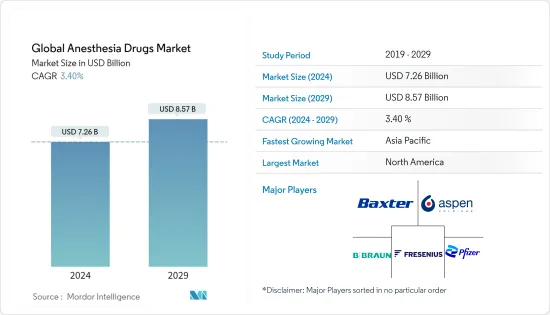

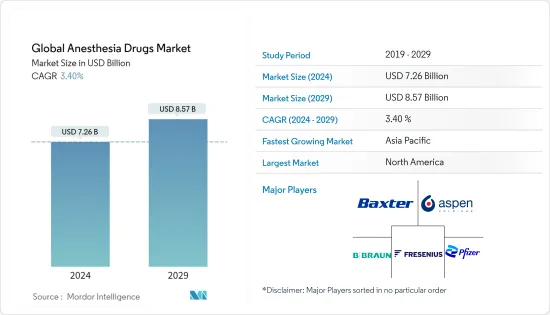

世界の麻酔薬市場規模は2024年に72億6,000万米ドルと推定され、2029年には85億7,000万米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは3.40%で成長する見込みです。

パンデミック(世界的大流行)状況の出現により、2020年には麻酔薬の需要が若干減少し、手術の延期や中止が生じました。2020年5月にBritish Journal of Surgeryに掲載された研究によると、COVID-19による病院サービスの中断がピークとなる12週間を基準にすると、世界中で約2,840万件の選択的手術がキャンセルまたは延期されたと推定されます。しかし、活動が再開されるにつれて、延期されていたすべての選択的手術が完了し、麻酔薬の消費量が増加しています。

この市場の成長を推進している主な要因は、手術件数の増加と新しい麻酔薬の承認です。米国形成外科学会によると、2020年には米国で美容外科手術が230万件、美容低侵襲手術が1,320万件、再建手術が680万件行われ、2019年比で3%増加しました。これは、手術件数の増加を示しており、最終的には麻酔薬の需要増につながります。

さらに、2020年7月に国立生物工学情報センター(NCBI)に掲載された論文「Trauma of Major Surgery」によると、世界全体では毎年3億1,000万件もの大手術が行われています。同様に、2021年7月に発表された「Incidence and Cumulative Risk of Major Surgery in Older Persons in the United States(米国における高齢者の大手術の発生率と累積リスク)」と題された論文によると、米国では、高齢者100人につき年間9件近くの大手術が行われ、メディケア受給者の7人に1人以上が5年間に大手術を受けており、これは500万人近くのユニークな高齢者に相当します。

さらに、新規局所麻酔薬の開発と承認は、市場プレーヤーにとって新たな収益源となることが証明されつつあります。例えば、2021年2月、ペインパスは、慢性疼痛患者をターゲットとし、筋肉を外部から麻痺させる初のカンナビジオール(CBD)/リドカイン製品ラインを発売しました。2021年12月、ヒクマ・ファーマシューティカルズPLC(ヒクマ)は、米国の関連会社であるヒクマ・ファーマシューティカルズ米国社を通じてブピバカイン塩酸塩注射液USPを発売しました。同社は0.25%、0.5%、0.75%を10mLと30mLの用量で上市しました。さらに、PAION AGは2021年6月、バイファボ(レミマゾラムベシル酸塩)の成人における手続き鎮静の承認を英国医薬品・ヘルスケア製品規制庁(MHRA)から取得しました。

このように、手術件数の増加や製品の上市など、前述のすべての要因が予測期間中の市場を押し上げます。

麻酔薬市場の動向

全身麻酔薬セグメントではプロポフォールセグメントが急成長の見込み

プロポフォールは、手術で最も一般的に使用される全身麻酔薬のひとつであり、ICUにおける重症患者(COVID-19を含む)の鎮静薬としても使用されます。手技的鎮静の開始および維持、全身麻酔などに使用されます。2020年6月、米国食品医薬品局は、フレゼニウス・プロポーベン2%乳剤を、機械的人工呼吸を必要とするCOVID-19患者(16歳以上)の鎮静維持に使用することを承認しました。

プロポフォールは麻酔の導入維持や難治性てんかん状態の管理にも使用されます。この薬は長い間、麻酔を必要とする様々な種類の外科手術に使用されてきました。プロポフォール注射薬を製造している企業は、Neon Laboratories Limited、Bharat Serums and Vaccines Limited、Fresenius Kabiです。

さらに、2021年5月にBritish Journal of anesthesiology誌に発表された「COVID-19パンデミック時のイングランドとウェールズにおける外科活動:全国的観察コホート研究」と題する研究によると、2020年にイングランドとウェールズで実施された外科手術の総数は3,102,674件でした。したがって、緊急手術の発生件数の増加、薬剤の広範な使用、短時間作用性、世界の外科手術件数の増加が、市場の成長を促進する主な要因となっています。

前述の要因の結果、プロポフォール分野は予測期間中に健全な成長を遂げると予想されます。

北米が市場を独占し、予測期間中も同様の動向となる見込み

北米は現在、麻酔薬市場を独占しており、今後数年間はその牙城を守り続けると予想されます。米国は世界最大の地域市場です。COVID-19の出現により、米国は重要な麻酔薬、特にデクスメデトミジン、ミダゾラム、プロポフォール、神経筋遮断薬の深刻な不足に直面しました。その結果、多くの企業が麻酔薬の生産を強化しています。例えば、2020年5月、ヒグマ製薬は米国で新製品「プロポフォール注射用乳剤」を発表しました。

さらに、この市場を牽引しているのは、手術件数の増加、慢性疾患が増加する高齢化人口の増加、麻酔技術の進歩です。米国形成外科学会(ASPS)によると、2020年には、10~29歳で約76万8000件の美容整形手術が行われ、40~54歳では610万件の美容整形手術が行われました。これらの統計は、この地域で外科手術が絶えず増加しており、最終的に麻酔薬の需要を牽引していることを示しています。一般手術における麻酔薬の使用は、市場の成長に大きく貢献すると予想されます。

さらに、同国では新しい麻酔薬が開発されており、これが市場成長を促進すると期待されています。例えば、2020年6月、MedovaとNew York School of Regional Anesthesia(NYSORA)は、米国でSAFIRA(SAFer Injection for Regional Anesthesia)を導入するためのパートナーシップを締結しました。また、2020年1月、米国でランネット社製コカイン塩酸塩(HCI;NUMBRINO)点鼻液4%(40mg/mL)の麻酔薬としての新薬承認申請が米国食品医薬品局(FDA)より承認されました。さらに、2021年12月、ヒクマ・ファーマシューティカルズPLC(ヒクマ社)は、米国の関連会社ヒクマ・ファーマシューティカルズUSA社を通じてブピバカイン塩酸塩注射液USPを発売しました。同社は0.25%、0.5%、0.75%を10ミリリットルと30ミリリットルの用量で発売しました。同様に2020年4月、Blue-Zone Technologies Ltd.はカナダ保健省から全身麻酔に使用される麻酔薬デスフルランUSPの承認を取得しました。

こうした発展は、麻酔薬を使用する手術件数の増加と相まって、同地域の市場成長を後押しすると予想されます。

麻酔薬業界の概要

麻酔薬市場は競争が激しく、複数の大手企業が参入しています。市場シェアの面では、現在、少数の大手企業が市場を独占しています。しかし、医薬品の承認件数の増加に伴い、中堅・中小企業はより低価格で新成分を投入することで市場での存在感を高めています。バクスター、アボット・ラボラトリーズ、アスペン、フレゼニウスSE、ロシュ、B.ブラウン・メルサンゲンAGといった企業が麻酔薬市場で大きなシェアを占めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 手術件数の増加

- 麻酔薬の新規承認

- 新薬のコスト削減

- 市場抑制要因

- 全身麻酔薬の副作用

- 熟練麻酔医の不足

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 薬剤タイプ別

- 全身麻酔薬

- プロポフォール

- セボフルラン

- デスフルラン

- デクスメデトミジン

- レミフェンタニル

- ミダゾラム

- その他の全身麻酔薬

- 局所麻酔薬

- ブピバカイン

- ロピバカイン

- リドカイン

- クロロプロカイン

- プリロカイン

- ベンゾカイン

- その他の局所麻酔薬

- 全身麻酔薬

- 投与経路別

- 吸入

- 注射

- その他の投与経路

- 用途別

- 一般外科

- 形成外科

- 美容外科

- 歯科手術

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- AbbVie Inc.

- Apsen Pharmacare Holdings Limited

- Baxter International Inc.

- B. Braun Melsungen AG

- Fresenius SE & Co. KGaA

- Pfizer Inc.

- Teva Pharmaceutical Industries Limited

- Dr. Reddy's Laboratories

- Abbott Laboratories Inc.

- Novartis AG

- Eisai Inc.

第7章 市場機会と今後の動向

The Global Anesthesia Drugs Market size is estimated at USD 7.26 billion in 2024, and is expected to reach USD 8.57 billion by 2029, growing at a CAGR of 3.40% during the forecast period (2024-2029).

Due to the emergence of the pandemic situation, demand for anesthesia drugs decreased slightly in 2020, resulting in surgeries being postponed or canceled. According to a study published in the British Journal of Surgery in May 2020, around 28.4 million elective surgeries worldwide were estimated to be canceled or postponed, based on 12 weeks of peak disruption to hospital services due to COVID-19. However, as activities resume, all of the elective surgeries that had been postponed are now being completed, increasing anesthesia drug consumption.

The primary factors propelling the growth of this market are the rising number of surgeries and new anesthesia drug approvals. According to the American Society of Plastic Surgeons, in 2020, 2.3 million cosmetic surgical procedures, 13.2 million cosmetic minimally invasive procedures, and 6.8 million reconstructive procedures were performed in the United States 2020, representing a 3% increase over 2019. This indicates the rising number of surgeries, which ultimately results in the rising demand for anesthesia drugs.

Moreover, according to the article 'Trauma of Major Surgery' published in the National Center for Biotechnology Information (NCBI) in July 2020, globally, a staggering 310 million major surgeries are performed each year. Similarly, according to the article titled 'Incidence and Cumulative Risk of Major Surgery in Older Persons in the United States published in July 2021, in the United States, Nearly nine major surgeries were performed annually for every 100 older persons, and more than 1 in 7 Medicare beneficiaries underwent a major surgery over five years, representing nearly 5 million unique older people.

Furthermore, the development and approvals of novel local anesthesia drugs are proving to be a new revenue-generating resource for market players. For instance, in February 2021, PainPass launched the first Cannabidiol (CBD)/lidocaine product line targeting those with chronic pain and for numbing muscles externally. In December 2021, Hikma Pharmaceuticals PLC (Hikma), has launched Bupivacaine HCl Injection, USP through its United States affiliate, Hikma Pharmaceuticals United States Inc. The company has launched 0.25%, 0.5% and 0.75% in 10mL and 30mL doses. Moreover, in June 2021, PAION AG received United Kingdom Medicines & Healthcare products Regulatory Agency (MHRA) approval for Byfavo (remimazolam besylate) in adults for procedural sedation.

Thus, all aforementioned factors, such as the increasing number of surgical procedures and product launches, boost the market over the forecast period.

Anesthesia Drugs Market Trends

The Propofol Segment is Expected to Show the Fastest Growth in the General Anesthesia Drugs Segment

Propofol is one of the most commonly used general anesthetics in surgeries and is used as a sedative for critical care (including those with COVID-19) in the ICU. It is used for the initiation and maintenance of procedural sedation, general anesthesia, etc. In June 2020, the United States Food & Drug Administration approved the use of Fresenius Propoven 2% emulsion to maintain sedation in COVID-19 patients (16 years and above) requiring mechanical ventilation.

Propofol is also used for the induction maintenance of anesthesia and the management of refractory status epilepticus. The drug has been used for a long time for various types of surgical procedures that require anesthesia. The companies that manufacture propofol injections are Neon Laboratories Limited, Bharat Serums and Vaccines Limited, and Fresenius Kabi.

Furthermore, as per the study published in the British Journal of anesthesiology in May 2021, titled "Surgical activity in England and Wales during the COVID-19 pandemic: a nationwide observational cohort study", the total number of surgical procedures carried out in England and Wales in 2020 was 3,102,674. Hence, the increasing incidences of emergency surgeries, extensive usage of the drug, short-acting characteristics, and a rising number of surgical procedures worldwide are the major factors propelling the growth of the market.

As a result of the aforementioned factors, the propofol segment is expected to experience healthy growth during the forecast period.

North America Dominates the Market and is Expected to Follow the Same Trend Over the Forecast Period

North America currently dominates the anesthesia drugs market and is expected to continue its stronghold for a few more years. The United States is the largest regional market in the world. With the emergence of COVID-19, the United States faced heavy shortages of vital anesthesia drugs, particularly dexmedetomidine, midazolam, propofol, and neuromuscular blocking agents. As a result, many companies are ramping up their production of anesthesia drugs. For instance, in May 2020, Hikma Pharmaceutical introduced a new product, "Propofol Injectable Emulsion," in the United States.

Furthermore, this market is driven by the increasing number of surgeries, rising aging population with increasing chronic conditions, and advancements in anesthesia technologies. according to the American Society of Plastic Surgeons (ASPS), in 2020, about 768,000 total cosmetic procedures were performed in people aged 10-29 years, and 6.1 million total cosmetic procedures were performed among the age group of 40-54-year-olds. These statistics indicate that surgical procedures are constantly increasing in the region, ultimately driving the demand for anesthesia drugs. The application of anesthetics in general surgeries is expected to contribute significantly to the growth of the market.

Moreover, new anesthesia drugs are being developed in the country, which is expected to propel market growth. For instance, in June 2020, Medova and the New York School of Regional Anesthesia (NYSORA) entered a partnership to introduce SAFIRA (SAFer Injection for Regional Anesthesia) in the United States. Also, in January 2020, the Food & Drug Administration approved the new drug application for cocaine hydrochloride (HCI; NUMBRINO) nasal solution 4% (40 mg/mL), manufactured by Lannett Company, for anesthetic use in the United States. Moreover, in December 2021, Hikma Pharmaceuticals PLC (Hikma) launched Bupivacaine HCl Injection USP through its United States affiliate Hikma Pharmaceuticals USA Inc. The company launched 0.25%, 0.5%, and 0.75% in 10 milliliter and 30 milliliter doses. Similarly, in April 2020, Blue-Zone Technologies Ltd received approval from Health Canada for desflurane, USP, an anesthetic drug used for general anesthesia.

Such developments coupled with growth in the number of surgeries using anesthesia drugs are anticipated to bolster market growth in the region.

Anesthesia Drugs Industry Overview

The anesthesia drugs market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with rising drug approvals, mid-size to smaller companies are expanding their market presence by introducing new ingredients at fewer prices. Companies like Baxter, Abbott Laboratories, Aspen, Fresenius SE, Roche, and B. Braun Melsungen AG hold substantial market shares in the anesthesia drugs market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Surgeries

- 4.2.2 New Approvals of Anesthesia Drugs

- 4.2.3 Reduction in the Cost of Newly Invented Drugs

- 4.3 Market Restraints

- 4.3.1 Side Effects of General Anesthetics

- 4.3.2 Lack of Skilled Anesthetics

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Drug Type

- 5.1.1 General Anesthesia Drugs

- 5.1.1.1 Propofol

- 5.1.1.2 Sevoflurane

- 5.1.1.3 Desflurane

- 5.1.1.4 Dexmedetomidine

- 5.1.1.5 Remifentanil

- 5.1.1.6 Midazolam

- 5.1.1.7 Other General Anesthesia Drugs

- 5.1.2 Local Anesthesia Drugs

- 5.1.2.1 Bupivacaine

- 5.1.2.2 Ropivacaine

- 5.1.2.3 Lidocaine

- 5.1.2.4 Chloroprocaine

- 5.1.2.5 Prilocaine

- 5.1.2.6 Benzocaine

- 5.1.2.7 Other Local Anesthesia Drugs

- 5.1.1 General Anesthesia Drugs

- 5.2 By Route of Administration

- 5.2.1 Inhalation

- 5.2.2 Injection

- 5.2.3 Other Routes of Administration

- 5.3 By Application

- 5.3.1 General Surgery

- 5.3.2 Plastic Surgery

- 5.3.3 Cosmetic Surgery

- 5.3.4 Dental Surgery

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AbbVie Inc.

- 6.1.2 Apsen Pharmacare Holdings Limited

- 6.1.3 Baxter International Inc.

- 6.1.4 B. Braun Melsungen AG

- 6.1.5 Fresenius SE & Co. KGaA

- 6.1.6 Pfizer Inc.

- 6.1.7 Teva Pharmaceutical Industries Limited

- 6.1.8 Dr. Reddy's Laboratories

- 6.1.9 Abbott Laboratories Inc.

- 6.1.10 Novartis AG

- 6.1.11 Eisai Inc.