|

市場調査レポート

商品コード

1850154

整形外科用デバイス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Orthopedic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 整形外科用デバイス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月27日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

概要

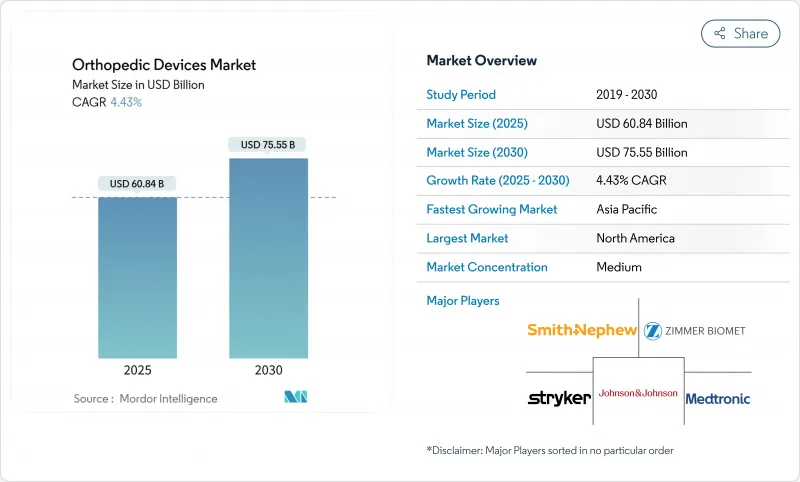

整形外科用デバイス市場の2025年の市場規模は608億4,000万米ドル、2030年には755億5,000万米ドルに達すると予測され、CAGRは4.43%で推移します。

需要の成熟化、償還政策の厳格化、バリューベース購買への軸足を反映して、成長曲線は急速ではなく着実です。人口の高齢化を背景に関節再建術は拡大を続け、AIを活用した手術計画やロボットガイダンスによって臨床の精度が向上し、回復までの期間が短縮されます。メーカーはまた、従来の金属の限界を克服するため、3Dプリンターや生体吸収性インプラントに投資しており、患者に特化したソリューションのパイプラインを支えています。同時に、整形外科用デバイス市場は、複雑な承認経路や外科医の診療報酬削減によるプレッシャーを感じており、人口動態が良好であるにもかかわらず、加速を抑制する要因となっています。

世界の整形外科用デバイス市場の動向と洞察

高齢化が変形性関節置換術を促進

米国における人工股関節置換術は2030年までに63万5,000件、人工膝関節置換術は128万件に達すると予測されており、長寿化によって需要が大型関節インプラントにシフトすることを示しています。コロンビアでは2050年までに3万9,270件の下肢人工関節置換術が行われ、ドイツでは2040年までに人工膝関節全置換術が55%増加すると予測されています。また、若く活動的な人々は、より早期の手術を選択し、インプラントの耐用年数を延ばし、高価な材料の使用に拍車をかけています。したがって医療システムは、手術能力を拡大し、リハビリテーション・ネットワークを強化し、手術の急増を効率的に管理するために転帰追跡を標準化しなければならないです。

3Dプリンターと生体吸収性インプラントの技術的進歩

積層造形は現在、オッセオインテグレーションを早め、手術時間を短縮する、患者にマッチした形状を提供します。2024年に最初のPEEK製頭蓋インプラントがFDAの認可を受けたことで、3Dプリンターで製造されたポリマーが荷重を支える適応症で規制当局に受け入れられることが証明されました。アラバマ州にある工業規模のプリンターは、すでに廃棄物を最小限に抑えながら脊椎ケージを製造することができ、コスト競争力を示しています。生体吸収性器具は、永久的なハードウェアが不要なスポーツや外傷の症例に対応するもので、生物学的治癒を促す血小板を豊富に含む血漿システムの最近のFDA認可によって、その能力が強化されました。このような技術革新は、サプライヤーを差別化し、再置換の負担を長期的に軽減する再生経路を開くものです。

厳しい複数地域の規制承認

2024年に完全施行される欧州の医療機器規制では、エビデンスの閾値が引き上げられ、審査サイクルが延長されたため、製品の上市が遅れ、開発予算が膨らみました。新しいコーティングガイダンスや変更管理計画を含むFDAの並行した変更により、特に抗菌剤や表面修飾インプラントの文書化レイヤーが追加されました。企業は現在、多施設臨床試験を実施し、市販後調査システムを維持しなければならないが、これは中小のイノベーターのリソースを圧迫し、技術の普及を遅らせる可能性があります。

セグメント分析

関節再建インプラントは、2024年の整形外科用デバイス市場シェアの37.16%を占め、股関節置換術と膝関節置換術の数量がこの先10年間も増加し続けることが見込まれます。メーカーは、長持ちするポリエチレン製ライナー、多孔性チタン製足場、臨床医に荷重データを伝えるスマートセンサーに注力しています。整形生物工学は、規模は小さいもの、CAGR5.86%で最も急成長しているグループであり、軟骨修復マトリックスと成長因子強化移植片がその推進力となっています。この傾向は、CARTIHEAL AGILI-Cが4年後の人工膝関節全置換術への移行を87%減少させたことからも明らかです。

スポーツ医学器具と関節鏡は、予防的修理を求める若年層から恩恵を受け、脊椎器具は回復を短縮する低侵襲技術から利益を吸収しています。外傷用器具は、安定した事故率のおかげで回復力を維持しています。そのため、ベンダーは幅広い開発品目を管理し、大量生産が可能な再建用主力インプラントと特殊な生物学的製剤のバランスを取りながら、整形外科用デバイス市場のコモディティ化したセグメントにおける償還の絞り込みをヘッジしています。

2024年の整形外科用デバイス市場規模の42.84%をチタンとその合金が占めており、これは強度対重量の優位性と実証済みの生体適合性のおかげです。しかし、供給チェーンの不安定性により、チタンのコストは精製グレードによって1ポンド当たり6~30米ドルの幅があるため、代替品の探求が推進されています。生体吸収性ポリマーと複合材料はCAGR 6.58%で最も急速に成長し、スポーツ外傷や小児の骨折で珍重される、治癒が完了すると溶解する一時的な固定を提供します。

PEEKは、アーチファクトのない画像診断が可能で、骨との弾性率の適合性にも優れているため、脊椎ケージの分野で確固たる地位を築いています。世界中で1,500万個以上のPEEK製医療機器が埋め込まれています。ニオブやジルコニウムを含む先進的なβチタン合金は、応力遮蔽を制限するために弾性率のミスマッチを減少させ、マグネシウムベースの再吸収物は試験を通じて前進しています。これらのシフトは、永久的な金属製ハードウェアから徐々に移行していることを示しており、整形外科用デバイス市場は、より再生可能でライフサイクルを重視した治療法へと位置づけられています。

整形外科用デバイス市場は、デバイスタイプ別(関節再建インプラント、外傷固定デバイス、その他)、素材別(チタンおよびチタン合金、ステンレススチール、その他)、用途別(股関節整形外科手術、膝関節整形外科手術、その他)、エンドユーザー別(病院、整形外科および専門クリニック、その他)、地域別(北米、欧州、アジア太平洋、その他)に分類されています。

地域別分析

北米は、2024年の整形外科用デバイス市場収益の44.62%を占めました。保険適用が堅調で、ロボット工学の早期導入がプレミアムインプラントの普及を加速させたためです。CMSは2025年に人工関節置換術に新たな患者報告アウトカム指標を導入し、償還を機能改善と関連付け、サプライヤーをエビデンスに基づく価格設定へと誘導しています。一方、この地域ではASCの整備が進んでおり、今後10年間で整形外科の外来患者数は21%増加する見込みで、ベンダーはコスト対価値の提案をより鮮明にする必要に迫られています。

CAGR7.23%で成長するアジア太平洋地域は、中間所得層の増加、手術用ロボットへの政府投資、変性脊椎疾患の罹患率の急上昇から利益を得ています。中国だけで、2025年までに2,100億米ドルの医療機器市場を目標としており、地域の生産拠点がチタンやPEEKを供給し、リードタイムを短縮して輸入関税を削減しています。地元企業は多国籍企業と製品を共同開発し、技術移転を急ぎ、小柄な患者向けに機能をカスタマイズしています。

欧州では、医療機器規制のハードルが承認サイクルを延長しているにもかかわらず、着実な拡大が見られます。ドイツでは、人工膝関節全置換術の罹患率が2040年までに55%上昇すると予測しており、病院がインプラントベンダーを統合する中でも、耐久性のあるベースライン需要が創出されます。中東アフリカと南米は、まだ発展途上ではあるが魅力的な市場です。湾岸諸国の整形外科ツーリズムが高度急性期手術の件数を押し上げ、ブラジルのマクロ経済回復が外傷とスポーツ医学の在庫のための資本予算を確保します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高齢化が関節変形手術の増加を促進

- 大関節再建手術の増加

- 3Dプリントおよび生体吸収性インプラントの技術進歩

- 整形外科的外傷および事故発生率の上昇

- AI主導の手術計画とロボット工学が手術結果を改善

- 価値に基づくケアがモジュール式のコスト効率の高いインプラントを促進

- 市場抑制要因

- 厳格な複数地域の規制承認

- 不利な償還と熟練外科医の不足

- チタンおよびPEEK材料のサプライチェーンの不安定性

- 外来患者への移行が入院患者のインプラントマージンを侵食する

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- デバイスタイプ別

- 関節再建インプラント

- 外傷固定デバイス

- 脊椎手術用デバイス

- 頭蓋顎顔面デバイス

- スポーツ医学および関節鏡検査デバイス

- オーソバイオロジクス

- その他の整形外科用デバイス

- 材料別

- チタンおよびチタン合金

- ステンレス鋼

- 高分子生体材料

- 生体吸収性および複合材料

- その他

- 用途別

- 股関節整形外科手術

- 膝の整形外科手術

- 脊椎整形外科手術

- 外傷の固定

- その他の用途

- エンドユーザー別

- 病院

- 整形外科・専門クリニック

- 外来手術センター(ASC)

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- DePuy Synthes(Johnson & Johnson)

- Zimmer Biomet Holdings Inc.

- Stryker Corporation

- Smith & Nephew plc

- Medtronic plc

- Enovis Corporation(DJO)

- B. Braun SE

- Arthrex Inc.

- Globus Medical Inc.

- NuVasive Inc.

- ATEC Spine Inc.

- Ossur hf.(Embla Medical hf.)

- CTL Amedica

- CONMED Corporation

- MicroPort Orthopedics

- SeaSpine Orthopedics Corporation(Orthofix Medical Inc.)

- Integra LifeSciences

- Exactech Inc.