|

市場調査レポート

商品コード

1851514

燃料電池:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 燃料電池:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月05日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

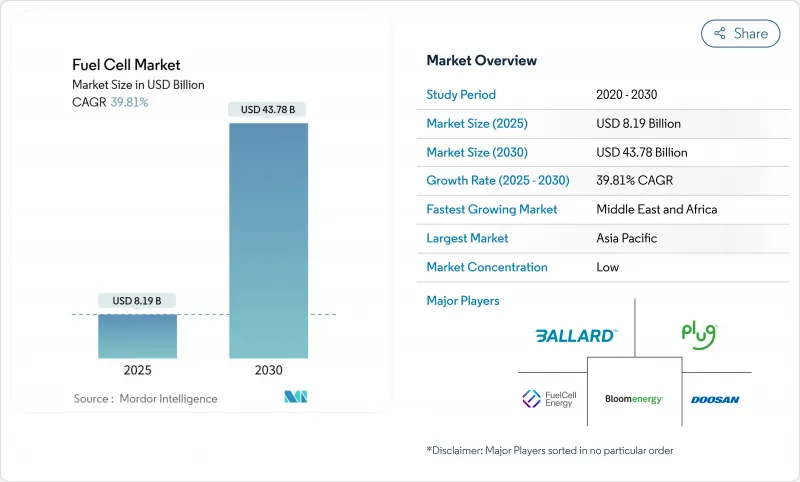

燃料電池市場規模は2025年に81億9,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは39.81%で、2030年には437億8,000万米ドルに達すると予測されます。

拡大の背景には、輸送、データセンター、ユーティリティ・スケールのアプリケーションからの需要の急増があり、それぞれがよりクリーンなエネルギー政策の義務化の恩恵を受けています。グリーン水素とブルー水素のコスト低下、アジア太平洋における水素補給コリドーの急速な展開、大型トラックメーカーによる投資の加速が、商業的な道筋を広げています。技術革新の勢いは、据置型負荷に対応する固体酸化物燃料電池へとシフトしているが、一方で固体高分子型燃料電池は自動車、バス、フォークリフトの主流であり続けています。白金族金属と水素インフラのギャップをめぐるサプライチェーンリスクが当面の成長を抑制する一方で、海運事業者と公益事業者の関心の高まりが燃料電池市場の対応可能な裾野をさらに広げています。

世界の燃料電池市場の動向と洞察

グリーン&ブルー水素製造コストの低下

米国のクリーン水素製造税額控除(最大3米ドル/kg)やEU再生可能エネルギー指令の産業向け再生可能水素割当量42%といった政策インセンティブが、投資パイプラインを下支えしています。2020年から2024年の間に最終投資決定に至るプロジェクトが7倍に急増するのは、資本フローの深化を反映しています。水素燃料は通常、燃料電池の総所有コストの半分近くを占めるため、安価な分子は直接的に普及を拡大します。燃料電池市場の開拓者は、2USD/kg以下の水素が長距離輸送車両においてディーゼルと同等になるきっかけになると予測しています。

アジア太平洋におけるFCEVへの自動車メーカーのコミットメント

トヨタ、現代自動車、ホンダは、今後2年間で4万5,000台のFCEVの供給契約を含む、水素モビリティのための数十億米ドル規模のロードマップを約束しました。中国は、2035年までに100万台の燃料電池車と2,000基のステーションを目標に掲げており、韓国は水素トラックを国家スマートグリッド計画に結びつけています。自動車メーカー各社は、生産スケジュールの調整、エネルギー企業との合弁事業、ステーションの共同投資によって、スケールアップのスケジュールを短縮しています。これらの需要シグナルは、スタック・サプライヤー、コンプレッサー・メーカー、燃料補給インテグレーターを通じて、燃料電池市場に連鎖します。

JP&KR以外の水素燃料補給インフラの希少性

日本と韓国の成熟した回廊以外では、ネットワークの密度は依然として不十分です。ドイツは、欧州をリードする約170の公共水素ステーションを有するが、そのカバー率は地域トラック輸送ルートのニーズにはまだ及ばないです。米国では、まとまった建設計画を提供しているのはカリフォルニア州だけであり、1kg当たり12~15米ドルのポンプ価格がフリート全体の展開を妨げています。インフラ整備の遅れがフリート転換を遅らせ、早期導入企業の投資回収期間を引き延ばし、燃料電池市場の全体量を減少させています。

セグメント分析

車両セグメントは2024年の世界売上高の80.9%を占め、燃料電池市場において中心的な役割を担っていることが確認されました。商用トラック、市バス、小型車は、高速燃料補給と長距離走行を実現するPEMFCアーキテクチャに依存しています。最近、235台の水素トラックが卸売され、欧州の燃料電池バスの大量注文と相まって、需要曲線が成熟しつつあることを示しています。水素の価格が下がり、メンテナンスの節約になるにつれて、ディーゼル車に対する総コストの差は縮まっています。

データセンター、通信タワー、病院向けの据置型が残り19.1%のシェアを占め、急成長を遂げています。ハイパースケールの事業者は、ディーゼル発電機を置き換える数メガワットの設備を試験的に導入しています。このような早い段階での勝利は、2030年以降、稼働時間と排ガス規制が証明されるにつれて、燃料電池市場がモバイル用と据置型の間でより均等にバランスすることを示唆しています。

PEMFCは、乗用車とマテリアルハンドリングフリートによって支えられ、2024年には70.4%のシェアを維持します。作動温度が低いため、頻繁な始動・停止に適しており、都市部での稼働率が高まる。スタック寿命の改善と膜リサイクル・プログラムにより、PEMFCの経済性はさらに向上します。

しかし、SOFCは2030年までのCAGRが51.1%と予測され、最も急速に成長しています。60%近い電気効率と柔軟な燃料投入により、公益事業やデータセンターの顧客は、今日はパイプライン・ガスで、明日は水素で稼働できるようになります。ブルーム・エナジーの数メガワット規模の受注は、この変遷を裏付けています。その結果、SOFCシステムの燃料電池市場規模は、ベースロードの代替とマイクログリッド・アプリケーションの混合を反映して、2035年までに200億米ドルを超えると予想されます。アルカリ、リン酸、溶融炭酸塩燃料電池は特定の産業ニッチに対応し、技術スペクトルを完成させる。

燃料電池市場レポートは、用途別(車両用、非車両用)、技術別(高分子電解質膜燃料電池、固体酸化物燃料電池、アルカリ性燃料電池、その他)、燃料タイプ別(水素、天然ガス、アンモニア、その他)、エンドユーザー産業別(運輸、公益事業、商業・産業、その他)、地域別(北米、欧州、アジア太平洋、南米、中東・アフリカ)に分類されています。

地域分析

アジア太平洋地域は、2024年の燃料電池市場で57.8%のシェアを占めています。日本の戦略的ロードマップは燃料電池自動車と住宅用マイクロCHPユニットに補助金を出し、韓国は水素とスマートシティ構想をセットにしています。中国は、2035年までに100万台のFCEVと2,000基のステーションを目標に掲げており、これは他国では例を見ない規模です。地方政府は電解槽に資金を供給し、通行料を免除して車両の運営コストを削減しています。定評ある自動車グループは、トラック、SUV、フォークリフトに燃料電池を組み込み、地域のサプライヤーに部品需要を固定化しています。

北米は、米国の政策的追い風を受けて第2位となりました。クリーン水素製造税控除と7つの地域水素ハブは、電解、貯蔵、川下プロジェクトに向けて数十億米ドルを動員します。カリフォルニア州の先進クリーン・トラック規制は、中型および大型フリートにおける初期の需要を支え、カナダの各州は水素バスを支援しています。テキサス州、イリノイ州、バージニア州のデータセンター事業者は、送電網の信頼性を高めるために数メガワットのSOFCプラントを契約し、この地域の燃料電池市場に厚みを加えています。

欧州は、Fit-for-55気候変動対策パッケージを活用して、トラック、鉄道、海運における燃料電池の採用を促進します。最新のCO2基準では、2040年までに大型車の排出ガスを90%削減することが求められており、水素推進は信頼できる道筋となっています。ドイツの170を超える公共ステーションは、大陸をリードしています。欧州水素銀行(European Hydrogen Bank)と革新基金(Innovation Fund)は、入札参加者に助成金を提供し、電解槽とスタックプラントのスケールアップのリスクを軽減します。スペインからフランスまでの国境を越えたパイプラインのアップグレードは、将来のグリーン水素の流れのためのインフラを整備します。

中東・アフリカは、CAGR予測41.2%と最も速い成長見通しを示しています。豊富な太陽光資源と風力資源により、競争力のあるグリーン水素の輸出拠点が形成されます。エジプト、アラブ首長国連邦、サウジアラビアはそれぞれ、輸送顧客向けのアンモニア生産に関連した数ギガワットの電解槽パークを計画しています。既存の天然ガス・パイプラインと港湾インフラは、水素混合燃料への転換を可能にするプラットフォームを提供します。アフリカの経済は、弱電網を安定させ、ディーゼル発電機を置き換えるローカル燃料電池マイクログリッドに注目しており、新たな需要の波を予兆しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 最近の動向

- 市場促進要因

- グリーン&ブルー水素発電のコスト低下

- アジア太平洋におけるFCEVへの自動車メーカーのコミットメント

- 大型車輸送における政府のゼロエミッション義務(NAとEU)

- データセンターにおける長時間バックアップ電源の需要

- 海洋脱炭素化目標により加速する燃料電池

- 企業の敷地内分散型発電へのネット・ゼロ投資

- 市場抑制要因

- JP&KR以外の水素充填インフラの希少性

- PGMとニッケルの価格変動が積み上げコストを押し上げる

- 海上高硫黄環境におけるSOFCの性能劣化

- 米国の建築基準法における認証のギャップが据置型設置を遅らせる

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 用途別

- 車両(乗用車、バス&コーチ、トラック、マテリアルハンドリング機器、鉄道、船舶)

- 非車両(据置型電力、ポータブル電力、マイクロコンバインド・ヒート&パワー)

- 技術別

- 高分子電解質膜燃料電池(PEMFC)

- 固体酸化物燃料電池(SOFC)

- アルカリ性燃料電池(AFC)

- その他[リン酸燃料電池(PAFC)、溶融炭酸燃料電池(MCFC)、ダイレクトメタノール燃料電池(DMFC)]。

- 燃料の種類別

- 水素

- 天然ガス/メタン

- アンモニア

- その他(メタノール、バイオガス)

- エンドユーザー業界別

- 輸送機関

- ユーティリティ

- 商業・産業用

- その他(防衛、住宅)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- 北欧諸国

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的な動き(M&A、パートナーシップ、PPA)

- 市場シェア分析(主要企業の市場ランク/シェア)

- 企業プロファイル

- Ballard Power Systems Inc.

- Plug Power Inc.

- FuelCell Energy Inc.

- Bloom Energy Corporation

- Doosan Fuel Cell Co., Ltd.

- Cummins Inc.(Hydrogenics)

- Toshiba Energy Systems & Solutions Corp.

- Panasonic Corporation

- Horizon Fuel Cell Technologies Pte. Ltd.

- Intelligent Energy Ltd.

- Nuvera Fuel Cells, LLC

- SFC Energy AG

- Mitsubishi Power Ltd.

- Hyundai Mobis Co., Ltd.

- Toyota Motor Corporation

- Nikola Corporation

- Ceres Power Holdings plc

- Ballard Motive Solutions Ltd.

- PowerCell Sweden AB

- AFC Energy plc

- Advent Technologies Holdings Inc.

- Gencell Ltd.

- Proton Motor Power Systems plc