|

市場調査レポート

商品コード

1850071

パッケージング用コーティング:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Packaging Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パッケージング用コーティング:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

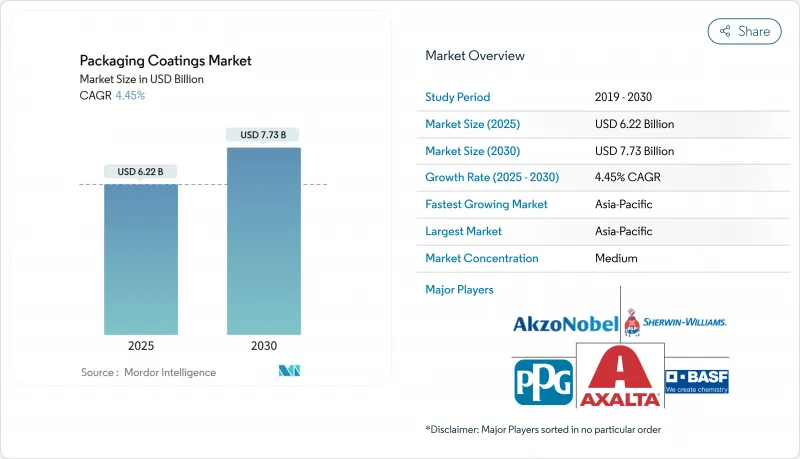

パッケージング用コーティング市場規模は2025年に62億2,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは4.45%で、2030年には77億3,000万米ドルに達すると予測されます。

成長は、世界的な食品接触規制の強化、PFASフリー・BPAフリー化学物質への急速なシフト、高級で視覚的に特徴的なパッケージに対する消費者需要の高まりによって後押しされています。

アジア太平洋地域は依然として最大かつ最も急速に拡大しており、水性、UV硬化型、非BPAエポキシ技術が、コンバーター各社が進化する顧客と法規制の基準を満たすべく競争する中でシェアを獲得しています。リジッドフォーマットが引き続き販売量を支配しているが、eコマースと軽量化に結びついたフレキシブルイノベーションが、過去のギャップを侵食しつつあります。エポキシ原料のコスト変動とサーキュラー・エコノミー・ロジスティクスのインフラ格差が、パッケージング用コーティング市場の着実な前進を妨げています。

世界のパッケージング用コーティング市場の動向と洞察

BPAフリーの缶ライニング義務化がエポキシ代替需要を促進

2025年1月発効のEU規則2024/3190により、食品接触材料中のビスフェノールAが禁止され、北米の並行措置と相まって、規格に準拠した缶内面および外面コーティングへのニーズが高まっています。メーカー各社は、シャーウィン・ウィリアムズ社のvalPure V70やアクゾ・ノーベル社のAccelshield 700など、エポキシ樹脂の性能を維持する非BPA樹脂を拡大することで対応しています。充填業者やブランドオーナーは、内張りに認められている18ヶ月の移行期間を大幅に前倒ししてこれらのシステムを認定しており、両大陸の金属製包装ライン全体で活発な採用を推進しています。

アジアのクラフト飲料ブームがUV硬化型ワニスの普及を加速

インド、中国、東南アジアの独立系ビールメーカーは、混雑した棚で缶を差別化するために、鮮やかなグラフィックと傷のない仕上げを求めています。UV硬化型オーバープリントワニスは、即時硬化、高光沢、ラインスピードの生産性向上を実現し、技術CAGRを約5.01%に押し上げています。マハラシュトラ州にあるACTEGAの新しいWESSCO UV施設は、現地での生産能力拡大がリードタイムを短縮しながらブランドスケジュールをサポートすることを示しています。

エポキシ樹脂の価格変動がマージンを圧迫

サプライチェーンの混乱、エネルギー価格の変動、原料の逼迫により、エポキシ樹脂のコストは数年来の高水準に達しています。エポキシ樹脂はパッケージング用コーティング市場の半分を支えているため、些細な価格高騰であっても、製缶業者と充填業者のコスト・パス・スルーのギャップを広げています。例えば、PPGは、収益への影響を和らげるために、原材料のヘッジと生産性向上プログラムを加速しています。

セグメント分析

2024年のパッケージング用コーティング市場シェアは、エポキシ系が51%を占め、その比類なき接着性、耐熱性、ケミカルバリア性が実証されました。エポキシに関連するパッケージング用コーティング市場規模は、サプライヤーが規制の精査とフィラー性能の閾値の両方を満たす非BPAのバリエーションを商品化するにつれて、CAGR 4.7%で成長するとみられます。Sherwin-Williams社のvalPure V70とPPG社のHobaPro 2848は、この中間経路のアプローチを例証するもので、内分泌かく乱物質の懸念を排除しながらライン効率を維持します。

アクリル樹脂とポリウレタン樹脂はそれぞれ、より低いVOCプロファイルや高い柔軟性を必要とする用途に対応しています。ポリオレフィンはフォイル蓋のヒートシールに使用され、ポリエステル・ネットワークはD&I飲料缶に耐溶剤性をもたらします。バイオ由来樹脂は、まだニッチではあるが、ブランドオーナーがセルロース、テルペン、多糖類のマトリックスをスナックフレキシブルやシングルユースカップストック用にテストしているため、2桁の伸びを記録しています。

抑制シナリオで述べたエポキシ樹脂の価格変動は、購買マネジャーに代替機会を警戒させるが、それにもかかわらず、エンドユーザーは、ラインの改造にはダウンタイムと再テストが必要なため、このクラスを完全に放棄することはめったにないです。その結果、ハイブリッド戦略が登場します。すなわち、薄いエポキシ・プライマーにアクリルまたはポリエステルのオーバーコートを塗布することで、核となる長所を維持しながら全体的なビスフェノール暴露を低減するのです。予測期間中は、全面的な置き換えよりもむしろ段階的な改良によって、厳しくなる移行制限に抵触することなくエポキシの優位性が保たれると予想されます。

水性製品は、コンバーターがより低いVOCとより簡素な許認可を追求するため、2024年には43%の売上を占める。欧州のPFAS政策が水性バリア科学にインセンティブを与えていることもあり、水性ラインのパッケージング用コーティング市場規模は着実に拡大すると予測されます。PUD#65215Aのような皮膜安定性の進歩は、乾燥曲線を短縮し、厚膜を可能にすることで、溶剤ルートに対する過去の生産性ギャップを縮める。

UV硬化技術は、インスタントキュアの経済性と最小限のオーブンインフラにより、CAGRが最も高い5.01%を記録しました。アジア太平洋の移動式缶詰製造ラインでは、UVスポットワニスユニットが採用され、クラフトビールメーカー向けの小ロットラベルが可能になり、このプラットフォームの多用途性が強調されています。溶媒を媒体とするニトロセルロースまたはエポキシ・システムは、極度の耐薬品性を必要とするレトルト食品を依然として支配しているが、カリフォルニアとEUで継続中の大気質規制により、さらなる成長は制限されています。パウダー・コーティングは、ベースこそ小さいもの、VOCゼロと優れたエッジ・カバレッジを提供することで、溶接エアゾール缶のシェアを獲得しており、パッケージング用コーティング市場内の競争を際立たせるグリーン・ケミストリーの物語を強化しています。

技術の選択は、硬化速度、エネルギー、移行限界、臭気、リサイクル性、総塗布コストなどのバランスをとりながら、ますます多角的になっています。配合者は現在、AIによる実験計画法を統合して成分マトリックスを最適化し、ラボの排出量を削減しながら市場投入までの時間を短縮しています。その結果、水性UV、エネルギー硬化型パウダー、高固形ポリエステルといったハイブリッドケミストリーのパイプラインが生まれ、技術の境界線が曖昧になりつつあるが、全体的なパッケージング用コーティング市場はライフサイクルの優位性が確認できるプラットフォームへと軸足を移していくと思われます。

地域分析

アジア太平洋地域は、2024年の売上高シェア43%、CAGR見通し4.73%でパッケージング用コーティング市場をリードしました。中国の飲料缶生産、インドのクラフトビール台頭、東南アジアのスナック輸出ブームが相まって、他の追随を許さない数量成長を実現しています。地域当局も低VOCの義務付けを急ピッチで進めており、国内企業に欧米の水性ノウハウのライセンス供与を促す一方、現地のUV樹脂合成能力に投資しています。Amcorのような多国籍企業は、急成長しているヘルスケア・サブセグメントを開拓するためにメディカル・パック工場を拡張しており、アジア太平洋地域の中心性を強めています。

北米は、一人当たりの飲料消費量が高く、マットニスのソフトタッチのような高級仕上げが広く採用されていることから、第2位にランクされています。FDAによるEUのPFAS規制との整合は、ラベル変更サイクルを加速させ、適合代替品への需要を増加させる。缶詰以外では、北米のeコマースの浸透が耐衝撃性パウチや擦り傷防止蓋のニーズを高め、パッケージング用コーティング市場の地域的範囲を拡大します。

欧州では、数量急増よりも規制による変革が進みます。2025年1月に施行されるBPA禁止措置と、間近に迫るPFAS禁止措置は、急速な技術転換を促しており、アクゾノーベル社が2025年半ばの稼働開始を予定している3,200万ユーロ規模のスペイン工場はその好例です。景気低迷により販売数量の伸びは鈍化しているものの、1トンあたりの技術付加価値は上昇しており、缶の販売数量の伸び悩み分を部分的に相殺しています。一方、中東とアフリカは、可処分所得の上昇とGCCの倉庫インフラから恩恵を受け、南米は景気変動の中で飲料セクターの回復が見られ、コーティング輸出業者にとって選択的な上昇を提供し続ける。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- BPAフリー缶ライニングの義務化により、北米と欧州でエポキシ代替品の需要が増加

- アジアにおけるクラフト飲料ブームがUV硬化型ワニスの普及を加速

- GCCのE-食料品の成長を促進、傷つきにくいキャップとクロージャーコーティング

- 欧州におけるPFASの段階的廃止により、板紙用水性バリアコーティングが推進される

- パーソナルケア業界向けエアゾール缶におけるパッケージング用コーティングの利用拡大

- 市場抑制要因

- エポキシ樹脂価格の変動が地域全体で利益率を圧迫

- リサイクルの流れが弱く、バイオバリアの導入が遅れている

- VOC排出に関する厳しい規制と環境への懸念

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- レジン別

- エポキシ

- アクリル

- ポリウレタン

- ポリオレフィン

- ポリエステル

- その他のレジン

- コーティング技術別

- 水性

- 溶剤系

- 粉

- UV硬化性

- パッケージングタイプ別

- 硬質(缶、キャップ、クロージャー)

- フレキシブル(ポーチ、フィルム、サシェ)

- 用途別

- 食品缶詰

- 飲料缶

- エアゾールとチューブ

- キャップとクロージャー

- 工業用および特殊包装

- エンドユーザー業界別

- 食品・飲料

- パーソナルケアと化粧品

- ヘルスケアと医薬品

- 工業製品

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧諸国

- トルコ

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- カタール

- アラブ首長国連邦

- ナイジェリア

- エジプト

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Akzo Nobel N.V.

- ALTANA

- artience Co., Ltd.

- Axalta Coating Systems LLC

- BASF SE

- DIC Corporation

- Dow

- H.B. Fuller Company

- Hempel A/S

- Henkel AG & Co. KGaA

- Jamestown Coating Technologies

- Jotun

- KANGNAM JEVISCO CO., LTD.

- Kansai Paint Co., Ltd.

- Michelman, Inc.

- PPG Industries Inc.

- RPM International Inc.

- Silgan Holdings Inc.

- The Sherwin-Williams Company