|

|

市場調査レポート

商品コード

1403745

自動車用ヘッドアップディスプレイ-市場シェア分析、産業動向・統計、2024~2029年成長予測Automotive Head-up Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用ヘッドアップディスプレイ-市場シェア分析、産業動向・統計、2024~2029年成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 80 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

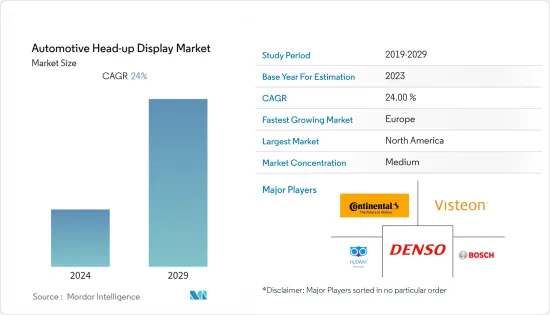

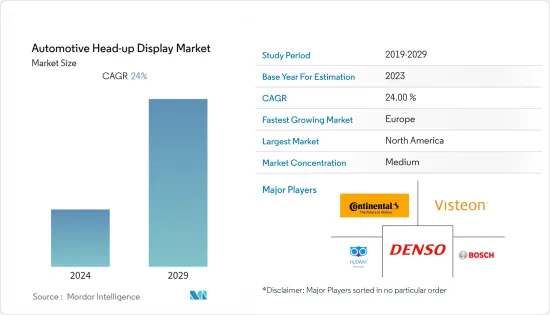

自動車用ヘッドアップディスプレイ市場は、2024年に約14億5,000万米ドルを記録し、2029年には49億9,000万米ドル以上に達すると予測され、予測期間中のCAGRは約24%です。

主要ハイライト

- COVID-19パンデミックは、世界各国の政府による規制により製造活動が停止し、サプライチェーンが混乱したため、2020年の市場にマイナスの影響を与えました。しかし、パンデミック後、経済活動が回復するにつれて、米国、中国、インドなどの主要国で自動車の生産と販売が顕著に伸びたため、需要は勢いを増し始めました。

- ヘッドアップディスプレイを含む高度な安全機能を備えたハイエンドの高級車や中型車の需要は、スマートフォンやナビゲーションシステムの利用の著しい伸びと相まって、市場の需要を高めると予想されます。さらに、安全性に関する厳しい政府規制のイントロダクション、ヘッドアップディスプレイの継続的な低価格化、技術の進歩、自動車生産の有機的成長は、予測期間中の市場の成長をさらに押し上げると思われます。

- 自動車メーカーとヘッドアップディスプレイ市場参入企業は、現在のヘッドアップディスプレイシステムの改良に取り組んでいます。現在のヘッドアップディスプレイは、フロントガラスに警告やエラーメッセージを表示できるGPS(地理的測位システム)を備えています。政府による厳格な安全規制の実施と高級車の販売増が相まって、高級車へのヘッドアップディスプレイの採用は、市場の参入企業に有利な機会を提供するために、ドライバーと乗客の安全システムの一部として増加傾向にあります。

- 予測期間中、北米地域が市場を独占し、次いで欧州、アジア太平洋が続くと予想されます。高級車への消費支出の増加と安全重視の高まりが、これらの地域における自動車用ヘッドアップディスプレイの成長をサポートすると予想されます。

自動車用ヘッドアップディスプレイ市場動向

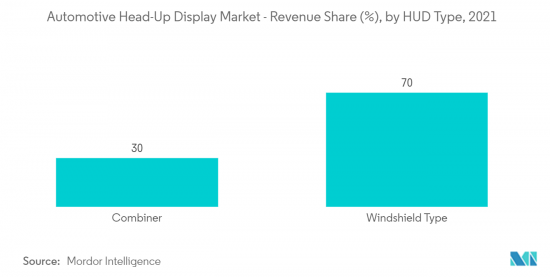

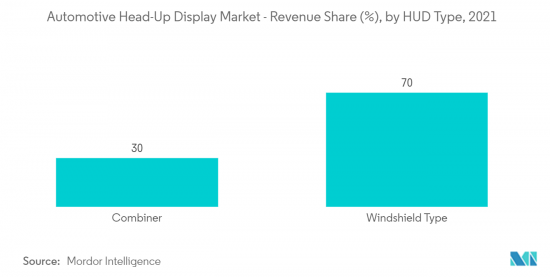

フロントガラス用ヘッドアップディスプレイの採用率が高まり、市場で大きなシェアを占める

- 自動車メーカーとヘッドアップディスプレイサプライヤーは、自動車向けのより良いシステムの開発に継続的に取り組んでいます。これらのヘッドアップディスプレイは、数年前のようなかさばるナビゲーションから進化しています。これらのシステムは現在、コンパスの方向、警告メッセージ、ラジオ情報などをフロントガラスに表示することができます。

- 液晶ディスプレイ(LCD)や発光ダイオード(LED)のような先進技術を活用することで、フロントガラスに明るく鮮やかな画像を表示できる利点があります。一貫した技術の進歩により、製造コストも低く抑えられています。例えば

- 2022年7月、旧Tohoku Pioneer Corporation Yonezawa Plant(山形県米沢市)のSOARは、有機EL(エレクトロルミネッセンス)ディスプレイの新たな需要を開拓します。車載用ヘッドアップディスプレイや小型モビリティ、スマートウォッチなどの新分野へのアプローチを強化します。

- 電気機械システムをベースとしたマイクロミラーベースのデバイスを含む新しい投影技術が市場に登場し、より多くの色を使用した明るいディスプレイの作成を支援します。ディスプレイシステム市場の成長を促進すると予想される要因は、低コストと革新的なディスプレイ技術です。

- ヘッドアップディスプレイは、以前は主に高級車に搭載されていたが、現在ではOEMメーカーが考え、エコノミー車にも標準搭載するようになっています。2022年、日本のメーカーであるMaruti Suzukiは、インド市場で大型フロントガラスヘッドアップディスプレイを搭載したBalenoのアップデートを発表しました。

- Continental AGはアダプティブ・クルーズ・コントロールを提供しており、ARベースのヘッドアップディスプレイを使用して前方の速度や距離を表示・監視しています。ディスプレイ上の三日月型のアイコンは、先行車が近づきすぎると色が変わり、途切れることのないフィードバックを提供します。ディスプレイパネルは、自動車のドライバーアシスタントシステムの利用拡大において重要な役割を果たします。

予測期間中、米国が市場を独占する見込み

- 自動車の安全性において米国が突出していることから、北米は自動車用ヘッドアップディスプレイ市場のシナリオにおいて欧州に次ぐ主要地域の一つとなっています。同国の自動車産業は着実に変貌を遂げており、特に乗用車セグメントでは安全システムの市場浸透と大量導入が進んでいます。ピックアップトラックのような商用車も、ドライバーの視認性を向上させ、夜間の事故を減らすために、これらのシステムを採用し始めています。例えば

- 2021年8月、カナダのBlackberry Limited(Blackberry)は、Nobo AutoがブラックベリーQNX Neutrinoリアルタイム・オペレーティング・システム(RTOS)とQNXハイパーバイザーをベースにしたスマート・コックピット・ドメイン・コントローラの生産を開始したと発表しました。このドメインコントローラは、Great Wall MotorのSUV「Haval H6S」に搭載される予定です。Haval H6Sには、Nobo AutoのDCC(デジタル・コックピット・コントローラー)プラットフォームが採用されます。

- NHTSAの調査によると、米国で起きている事故の約80%はドライバーの注意散漫が原因です。自動車業界で起きている急速な技術開発により、ヘッドアップディスプレイはドライバーが車両情報だけでなく、周辺の環境情報も見るのに役立っています。ドライバーは、電話の着信、走行速度、ナビゲーション、先行車がブレーキを踏んでいるときの衝突の危険性など、さまざまな通知を受けることができます。

- フォードやGMなどの自動車メーカーは、消費者に充実した運転体験を提供するため、インフォテインメント・システムを車両に内蔵するようになってきています。このような先進システムに対する需要の高まりは、車載エンターテインメントや車両情報システムと複雑に統合されたヘッドアップディスプレイシステムの需要増につながると予想されます。

- スマートフォンやタブレット端末と車載エンターテインメントや情報システムとの統合が進むなど、自動車におけるコネクティビティの動向は、先進運転支援システムの需要増加を後押ししています。現在、メーカーは歩行者を検知できるヘッドアップディスプレイの開発に注力しています。

- 2021年12月、カルマ・オートモーティブとWayRayは、革新的で新しい形態の拡大現実(AR)ヘッドアップディスプレイ技術を将来のカルマの車両に統合するための協業を発表しました。WayRayの真の拡大現実(True AR)と深層現実(Deep Reality)ディスプレイ技術は、任意の距離と複数の深度平面上の仮想画像の生成を可能にします。画像は、赤緑青(RGB)レーザービームを画像生成ユニット(PGU)を通してホログラフィック光学素子(HOE)に投影することで生成されます。

- このような運転支援システムの市場の促進要因の成長により、ヘッドアップディスプレイシステムの需要が増加し、提供される情報の監視プロセスが容易になると予想されます。

自動車用ヘッドアップディスプレイ産業概要

自動車用ヘッドアップディスプレイ市場は、世界参入企業といくつかの地域参入企業がいるため、適度に統合されています。これらの企業は、製品ポートフォリオを管理し、新製品を開発し、世界数カ国に拠点を拡大することで優位性を獲得しています。著名なメーカーは、収益を最大化し、経済的な中型車にヘッドアップディスプレイを提供するために、先進的なヘッドアップディスプレイシステムの開発のための研究開発活動に投資しています。

2021年1月、Panasonic Automotiveは、車線の端、道路上の物体、ドライバーにとって重要なその他の情報を表示できる最新の拡大現実ヘッドアップディスプレイを発表しました。ヘッドアップディスプレイはAIで動作し、ドライバーと情報を共有します。この新しいヘッドアップディスプレイは、障害物が車両なのか、歩行者なのか、ゴミ箱なのかを自ら判断することができます。

2020年9月、DigiLensはあらゆる自動車のダッシュボードに対応する超小型のCrystalClear(TM)AR ヘッドアップディスプレイを発表しました。CrystalClear(TM)AR ヘッドアップディスプレイの視野角は約15° x 5°で、ホログラフィック支援ナビゲーションのゲートウェイをあらゆる自動車に開くと期待されています。

これら以外にも、いくつかの主要OEM企業が市場に積極的に参入しており、このような発展は市場に強い好影響を与えると思われます。例えば

2021年6月、現代自動車は、ダッシュボードに設置され、ドライバーに向かって角度をつけた光学ガラスを特徴とする、視界を確保しにくいヘッドアップディスプレイを発表しました。

2021年、Audiは最新の現実(AR)ヘッドアップディスプレイを電気自動車アウディQ4 e-tronに導入すると発表しました。生成された仮想画像は、ドライバーの約10メートル前方の空間に浮かんでいるように見えます。同社は、オーバーレイされた画像は、混乱することなく、迅速なペースで情報を伝達するのに役立つとしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

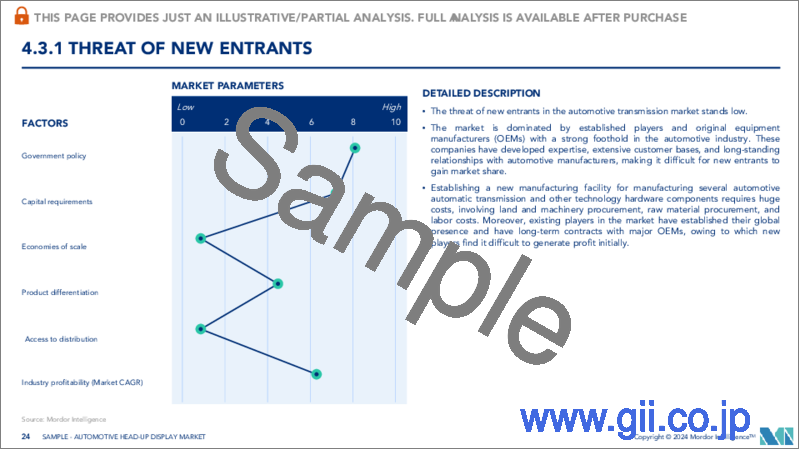

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模(単位:米ドル))

- ヘッドアップディスプレイタイプ

- フロントガラス

- コンバイナー

- 車種

- 乗用車

- 商用車

- 地域

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 世界のその他の中東・アフリカ

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Nippon Seiki Co. Ltd

- Continental AG

- Yazaki Corporation

- DENSO Corporation

- Robert Bosch GmbH

- Visteon Corporation

- Panasonic Corporation

- Pioneer Corporation

- ヘッドアップディスプレイWAY LLC

第7章 市場機会と今後の動向

The automotive head-up display (HUD) market registered about USD 1.45 billion in 2024 and is expected to reach over USD 4.99 billion by 2029, registering a CAGR of around 24% during the forecast period.

Key Highlights

- The COVID-19 pandemic had a negative impact on the market in 2020 due to a halt in manufacturing activities and supply chain disruptions due to restrictions imposed by governments worldwide. However, post-pandemic, as economic activities restored, the demand started gaining momentum owing to notable growth in production and sales of vehicles across major countries like the United States, China, India, and others.

- The demand for high-end luxury and mid-size cars with advanced safety features, including head-up displays, coupled with significant growth in the use of smartphones and navigation systems, is anticipated to enhance demand in the market. Further, the introduction of stringent government regulations regarding safety, continuous reduction in the price of head-up displays, advancement in technology, and organic growth in automobile production will further boost the growth of the market during the forecast period.

- Automobile manufacturers and HUD market players are working towards improving the present head-up display system. Present HUDs are equipped with a geological positioning system (GPS) that can display warning and error messages on the windshield. Implementation of strict safety regulations by the government coupled with increasing sales of luxury cars, the adoption of HUD in luxury vehicles is on the rise as a part of the driver and passenger safety systems to offer lucrative opportunities for players in the market.

- North American region is expected to dominate the market studied during the forecast period, followed by Europe and Asia-Pacific region. Increased consumer spending on luxury cars and a growing emphasis on safety are expected to support the growth of automotive HUDs in these regions.

Automotive Head-up Display (HUD) Market Trends

Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market

- Automobile manufacturers and HUD suppliers have been continually working on developing better systems for cars. These HUDs have evolved beyond the bulky navigation that was available a few years ago. These systems are now capable of displaying compass directions, warning messages, radio information, etc., on the windshield.

- Utilizing advanced technologies, like liquid crystal display (LCD) and light-emitting diodes (LED), delivers the advantage of displaying bright, vibrant images on the windshield. The consistent technological advancements have evolved them to be less expensive to manufacture. For instance,

- In July 2022, SOAR, formerly Tohoku Pioneer Corporation Yonezawa Plant (Yonezawa City, Yamagata Prefecture), will cultivate a new demand for organic electroluminescent displays (ELDs). The company will strengthen its approach to automotive head-up displays (HUDs), compact mobility vehicles, and new fields such as smartwatches.

- New projection technologies, including micro mirror-based devices based on electromechanical systems, are coming into the market, which will aid in creating brighter displays with the usage of more colors. The factors that are expected to drive the growth of the display systems market are the low cost and innovative display technologies.

- Head-up displays were earlier available majorly in luxury cars, but now, OEMs have been thinking and making them standard even in economy cars. In 2022, Japanese manufacturer Maruti Suzuki launched an updated Baleno with the large windshield HUD in the Indian market.

- Continental AG offers Adaptive Cruise Control, which uses AR-based HUD to display and monitor the speed and distance ahead of the cars. A crescent-shaped icon on the display changes its color to provide uninterrupted feedback when the vehicle ahead gets too close. The display panel plays a critical role in the augmented usage of the driver assistant systems in the vehicle.

United States is Expected to Dominate the Market During the Forecast Period

- The prominence of the United States in automotive safety makes North America one of the leading geographies in the automotive HUD market scenario after Europe. With a steady transformation in the country's automotive industry, there is considerable market penetration and mass adoption of safety systems, especially in the passenger vehicle segment. Commercial vehicles, like pick-up trucks, have also started adopting these systems to improve the driver's visibility and reduce accidents at night. For instance,

- In August 2021, Blackberry Limited (BlackBerry) of Canada announced that Nobo Auto has begun production of a smart cockpit domain controller based on the BlackBerry QNX Neutrino real-time operating system (RTOS) and QNX Hypervisor. The domain controller will be installed on Great Wall Motor's Haval H6S SUV. The Haval H6S will use Nobo Auto's DCC (Digital Cockpit Controller) platform.

- According to a study conducted by the NHTSA, about 80% of the accidents happening in the United States are caused due to driver distraction. With the rapid technological developments happening in the automotive industry, HUDs have helped drivers view not only vehicle information but also the nearby environment information. Drivers can be alerted with several notifications, such as a phone call, driving speed, navigation, and imminent collision when the vehicle ahead is braking, etc.

- Automobile manufacturers, such as Ford and GM, are increasingly equipping their vehicles with built-in infotainment systems to provide consumers with enhanced driving experiences. The increasing demand for these advanced systems is expected to result in an increased demand for HUD systems, which are intricately integrated with in-vehicle entertainment and vehicle information systems.

- The growing trend of connectivity in vehicles, with the increased integration of smartphones and tablets with in-vehicle entertainment and information systems, helps drive increased demand for advanced driving-assisted systems. Currently, manufacturers are focusing on developing HUDs that can detect pedestrians. For instance,

- In December 2021, Karma Automotive and WayRay announced a collaboration to integrate an innovative, new form of Augmented Reality (AR) Head-Up Display (HUD) technology in a fleet of future Karma vehicles. The WayRay True Augmented Reality (True AR) and Deep Reality Display technology enable the generation of virtual images at any distance and on multiple depth planes. Images are generated by projecting a red-green-blue (RGB) laser beam through a Picture Generating Unit (PGU) onto a Holographic Optical Element (HOE).

- The growth of the market for these driver-assisted systems is expected to increase the demand for HUD systems, thus easing the process for monitoring the information provided.

Automotive Head-up Display (HUD) Industry Overview

The automotive HUD market is moderately consolidated as the market accommodates global players and several regional players. These companies have managed to gain an advantage by managing their product portfolio, developing new products, and expanding their footprint across several countries across the world. Prominent manufacturers are investing in research and development activities for the development of advanced HUD systems to maximize revenue and provide the HUD in economic and midsize vehicles.

In January 2021, Panasonic Automotive launched its latest augmented-reality HUD capable of displaying lane edges, objects on the road, and other information important to drivers. The HUD runs in AI and shares information with the driver. The new HUD can determine by itself whether the barrier is a vehicle, pedestrian, or trash can.

In September 2020, DigiLens unveiled its Ultra-Compact CrystalClear™ AR HUD, compatible with any auto dashboard. The CrystalClear™ AR HUD has around 15° x 5° field-of-view and is expected to open the gateway for holographic-assisted navigation to any vehicle.

Besides these, several key OEMS are also participating actively in the market, and such developments are likely to have a strong positive impact on the market. For instance,

In June 2021, Hyundai Motor Company introduced a less head-up display (HUD) that features optical glass installed in the dashboard and angled toward the driver, which ensures better vision.

In 2021, Audi announced the introduction of its latest reality (AR) heads-up-display (HUD) in the Audi Q4 e-tron electric vehicle. The generated virtual image will appear to float in space about ten meters ahead of the driver. The company claims that the overlaid image will assist in conveying information at a rapid pace and without confusion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 HUD Type

- 5.1.1 Windshield

- 5.1.2 Combiner

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Nippon Seiki Co. Ltd

- 6.2.2 Continental AG

- 6.2.3 Yazaki Corporation

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 Visteon Corporation

- 6.2.7 Panasonic Corporation

- 6.2.8 Pioneer Corporation

- 6.2.9 HUDWAY LLC