|

|

市場調査レポート

商品コード

1444166

農業用トラクター:市場シェア分析、業界動向と統計、成長予測(2024-2029年)Agricultural Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 農業用トラクター:市場シェア分析、業界動向と統計、成長予測(2024-2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 133 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

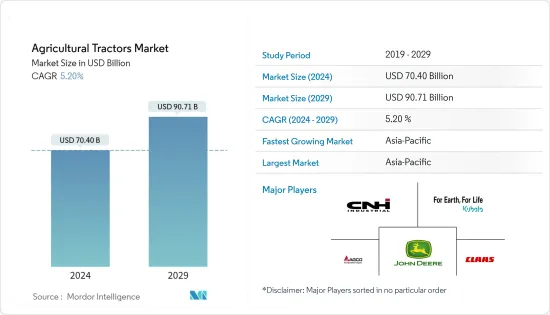

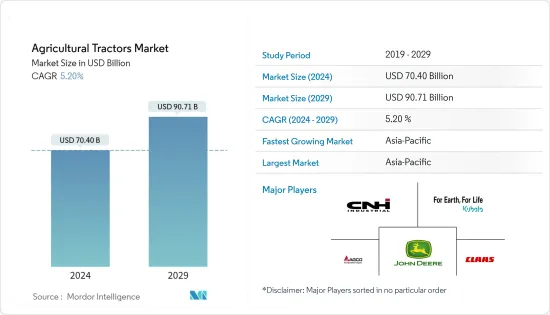

農業用トラクター市場規模は、2024年に704億米ドルと推定され、2029年までに907億1,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.20%のCAGRで成長します。

主なハイライト

- トラクターは、耕す、耕す、田植えなどの農業作業を行うために使用される農業機械です。肥料の散布、藪の伐採、その他の活動にも使用されます。都市化と都市部への人々の移住により、人件費は大幅に上昇しています。農場の労働力のコストは生産コストに直接比例します。機械化により労働者の賃金が削減される可能性があります。労働賃金の上昇と農業労働力の不足により、機械化率が上昇しています。

- さらに、高収量を得るための農業機械化に対する政府の補助金の増額も、トラクター台数の増加につながっています。さらに、技術の進歩は機械化の増加にも対応しており、農業機械化の利点について農家の間で意識が高まっています。

- 多くの企業が新しい農業用トラクターをリリースしており、より迅速な製品の発売と進歩により市場を独占することができています。いくつかの主要な市場プレーヤーは、最先端の機器を生産し、市場での強力な地位を維持するために研究開発に資金を費やしています。この要因が市場でのトラクターの販売を促進します。たとえば、2020年にDeere &Companyは、8Rホイールトラクター、8RT 2トラックトラクター、業界初の固定フレーム4トラックトラクターを含む新しい8ファミリートラクターラインナップを発売しました。これらの新しいトラクターには最新の精密農業技術が搭載されており、お客様は作業に最適な機械構成、オプション、馬力を選択できます。一方で、特殊な最新のトラクターを操作するための適切な熟練労働者の不足が、トラクター市場の抑制要因となる可能性があります。

農業用トラクターの市場動向

途上国市場における農業機械化の増加

- 精密農業と、生産量を増やすための農業技術の採用の増加により、トラクターの需要が高まっています。農業機器は、高精度測位システム(GPSやGNSS、自動ステアリングシステム、ジオマッピング、センサー、リモートセンシングなど)や統合電子通信などのテクノロジーを使用して、機械の操作から優れた結果を生み出すことができます。たとえば、Deere &Companyは、トラクターやその他のアイテムなどの農業機械にPrecision AGテクノロジーを提供しています。同社は、表示システム、播種と植栽、収穫のための受信機、圃場準備および耕耘機器を提供しています。このようなアイテムの発売は、農業用トラクター市場の成長に大きな影響を与えます。

- 農業機械の使用を広範囲に促進する農業研修プログラムの増加も、トラクター業界を後押ししています。エンジン容積が1,500CC以下のため、占有スペースが少なく、よりフレキシブルに使用できるトラクタです。カスタマイズが容易なため、実験がしやすくなり、その結果、メーカーは高出力のコンポーネントやテクノロジーに移行する前に、この分野の新しいコンポーネントやテクノロジーを積極的に試してみようとします。低馬力トラクターは、河川流域などの柔らかい土壌条件でうまく機能します。 40馬力未満のトラクターは主に園芸に使用されます。新興諸国では、農家の可処分所得が低く、人件費が高いため、低馬力トラクターの需要が高くなります。農家は、農地のサイズが小さいため、農業用にカスタマイズされた小型のトラクターを好みます。さらに、小型トラクターによる燃料消費量の削減は、小規模で限界のある農家に力を与えるのに役立ちます。インドのような新興諸国の政府は、機器の購入に補助金を出したり、フロントエンド代理店を通じて一括購入をサポートしたりすることで、農業の機械化を推進しています。

- さらに、新興諸国からの需要の増加により、市場の主要企業は新製品を革新しています。たとえば、TAFEは2021年 2月に新しいDYNATRACKシリーズを発売しました。これは、ダイナミックなパフォーマンス、洗練された技術、比類のない実用性、多用途性を提供する、単一の強力なトラクターに設計された先進的なトラクターです。これらの要因は、予測期間中に市場を牽引する可能性があります。

アジア太平洋が市場を独占

- アジア太平洋では、トラクターの販売台数で中国、日本、インドがトップとなっています。中国の農業活動の約60%は機械化されています。中国国家統計局のデータによると、大型および中型のトラクターは徐々に小型トラクターに置き換わっています。 2020年末時点で、国内には大型および中型のトラクターが440万台ありました。政府は「中国製造2025」キャンペーンに農業機械を含めました。このプログラムにより、中国はほとんどの農機具を国内で生産できるようになり、中国でのトラクターの売り上げが増加すると期待されています。

- インドのほとんどの人々は農業に依存しています。インドブランドエクイティ財団によると、インドの総人口の58%が農民です。したがって、インドにはトラクターの大きな市場が存在します。インドの農業部門では、動物の力や人間の力の使用が大幅に減少しています。代わりに、トラクターやディーゼルエンジンなどの化石燃料で動く車両が使用されており、その結果、伝統的な農業プロセスからより機械化されたプロセスへの移行が生じています。

- インド政府は機械化レベルを高めるため、各種設備への補助金の支給やフロントエンド代理店による大量購入の支援など「バランスの取れた農業機械化」を推進しており、インドのトラクター市場の強化が期待されています。例えば、インド政府は、トラクターの購入に対する融資兼補助金など、農業機械に対してさまざまな制度を提供しています。さらに、NABARDの基準によれば、8エーカーの土地を持つ農家は、9年間、金利12.5%でトラクターのローンを組むことができます。したがって、この地域の政府によるプログラムの実施と、全土でのトラクターの使用量の増加が、予測期間中に市場を牽引すると予想されます。

農業用トラクター業界の概要

農業用トラクター市場は統合されており、大手企業が大きな市場シェアを占めています。 Deere and Company、Kubota Corporation、CNH Industrial NV、AGCO Corporation、CLAAS KGaA mbHが市場の主要企業です。新製品の発売、提携、買収は、世界市場の大手企業が採用する主要な戦略です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替製品による脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 馬力別

- 40馬力未満

- 40馬力~99馬力

- 100馬力~150馬力

- 151馬力~200馬力

- 201馬力~270馬力

- 271馬力~350馬力

- 350馬力超

- タイプ別

- 果樹園用トラクター

- 条植え作物用トラクター

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- ポーランド

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Claas KGaA mbH

- Deere &Company

- Mahindra &Mahindra Ltd

- CNH Industrial NV

- Kubota Corporation

- AGCO Corporation(Massey Ferguson Limited)

- Tractors and Farm Equipment Ltd

- Iseki &Co. Ltd

- Yanmar Holdings Co. Ltd

第7章 市場機会と将来の動向

The Agricultural Tractors Market size is estimated at USD 70.40 billion in 2024, and is expected to reach USD 90.71 billion by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Tractors are agriculture equipment that is used to perform farming operations such as plowing, tilling, and planting. They are also used for spreading fertilizers, clearing bushes, and other activities. The cost of labor has been increasing at significantly high rates due to the urbanization and migration of people to urban areas. The cost of farm labor is directly proportional to the cost of production. Mechanization can reduce labor wages. The increasing labor wages and the lack of farm labor have led to increasing rates of mechanization.

- Furthermore, the increased government support to raise farm mechanization for obtaining high yield by providing subsidies is helping to increase the number of tractors. Moreover, technological advancements are also catering to the increased mechanization and raising awareness among farmers about the benefits of farm mechanization.

- Numerous businesses have been releasing new agricultural tractors, allowing them to dominate the market with speedier product launches and advancements. Several major market players are spending on research and development in order to produce cutting-edge equipment and retain a strong market position. This factor drives the sales of tractors in the market. For instance, in 2020, Deere & Company launched a new 8 Family Tractor line-up that included 8R wheel tractors, 8RT two-track tractors, and the industry's first fixed-frame four-track tractors. These new tractors come equipped with the latest precision agriculture technology and allow customers to choose the machine configuration, options, and horsepower to best fit their operation. On the other hand, the lack of properly skilled labor for operating specialized and modern tractors may become a restraining factor for the tractor market.

Agricultural Tractors Market Trends

Increasing Farm Mechanization in Developing Markets

- Precision farming and the increasing adoption of farm technology to boost production are driving up demand for tractors. Agricultural equipment can use technology like high-precision positioning systems (such as GPS and GNSS, automated steering systems, geo-mapping, sensors, and remote sensing) and integrated electronic communication to produce superior results from machine operations. For instance, Deere & Company provides Precision AG technology for farm machinery like tractors and other items. The company provides display systems, receivers for seeding and planting, harvesting, and field preparation and tillage equipment. The launch of such items has a substantial impact on the growth of the agricultural tractor market.

- The increasing number of farm training programs promoting the use of agricultural machinery on a wide scale is also driving the tractor industry. With an engine volume of not more than 1,500 CC, these tractors occupy less space and can be used with greater flexibility. Ease of customization makes them more amenable to experimentation, and consequentially, manufacturers are willing to try new components and technologies in this segment before moving on to high-powered ones. Low-horsepower tractors work well in soft soil conditions, such as river basins. The lesser than 40 HP tractors are mainly used for horticulture. In developing countries, the demand for lower HP tractors is high due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps empower small and marginal farmers. Governments in developing countries like India promote farm mechanization by subsidizing equipment purchases and supporting bulk buying through front-end agencies.

- Furthermore, due to the increasing demand from developing countries, the major players in the market are innovating new products. For instance, in February 2021, TAFE launched a new DYNATRACK Series, which is an advanced range of tractors that offer dynamic performance, sophisticated technology, unmatched utility, and versatility, engineered into a single powerful tractor. These factors are likely to drive the market during the forecast period.

Asia-Pacific Dominating the Market

- In the Asia-Pacific, China, Japan, and India lead in terms of the number of tractors sold. Around 60% of China's farm activities are mechanized. According to data from the National Bureau of Statistics of China, large and medium-sized tractors are gradually being replaced by small tractors. At the end of 2020, there were 4.4 million large- and medium-sized tractors in the country. The government included agricultural machinery in its 'Made in China 2025' campaign. The program is expected to help the country produce most of its farm equipment domestically, which is expected to increase the sales of tractors in China.

- Most people in India are agriculture-dependent. According to the Indian Brand Equity Foundation, 58% of the total population in India are farmers. Thus, there is a great market for tractors in India. The agriculture sector in India has witnessed a substantial decline in the use of animal and human power in the agriculture sector. Fossil fuel-operated vehicles, such as tractors and diesel engines, are being used instead, which has resulted in a shift from the traditional agriculture process to a more mechanized process.

- In order to increase the mechanization level, the Indian government is promoting 'Balanced Farm Mechanization' by providing subsidies on various equipment and supporting bulk buying through front-end agencies, which is expected to strengthen the tractors market in India. For instance, the government of India offers various schemes for agricultural equipment, such as loan-cum-subsidy for the purchase of tractors. In addition, as per NABARD norms, any farmer with eight acres of land can take a tractor loan for a period of nine years with a 12.5% rate of interest. Thus, the implementation of programs by governments in the region, along with the increasing tractor usage across, is expected to drive the market during the forecast period.

Agricultural Tractors Industry Overview

The agricultural tractor market is consolidated, with major players occupying a significant market share. Deere and Company, Kubota Corporation, CNH Industrial NV, AGCO Corporation, and CLAAS KGaA mbH are the major players in the market. New product launches, partnerships, and acquisitions are the major strategies being adopted by the leading companies in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat from Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Horse Power

- 5.1.1 Lesser than 40 HP

- 5.1.2 40 HP to 99 HP

- 5.1.3 100 HP to 150 HP

- 5.1.4 151 HP to 200 HP

- 5.1.5 201 HP to 270 HP

- 5.1.6 271 HP to 350 HP

- 5.1.7 Greater than 350 HP

- 5.2 By Type

- 5.2.1 Orchard Tractors

- 5.2.2 Row-crop Tractors

- 5.2.3 Other Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Poland

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Claas KGaA mbH

- 6.3.2 Deere & Company

- 6.3.3 Mahindra & Mahindra Ltd

- 6.3.4 CNH Industrial NV

- 6.3.5 Kubota Corporation

- 6.3.6 AGCO Corporation (Massey Ferguson Limited)

- 6.3.7 Tractors and Farm Equipment Ltd

- 6.3.8 Iseki & Co. Ltd

- 6.3.9 Yanmar Holdings Co. Ltd