|

市場調査レポート

商品コード

1432659

マンモグラフィー:世界市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Global Mammography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| マンモグラフィー:世界市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

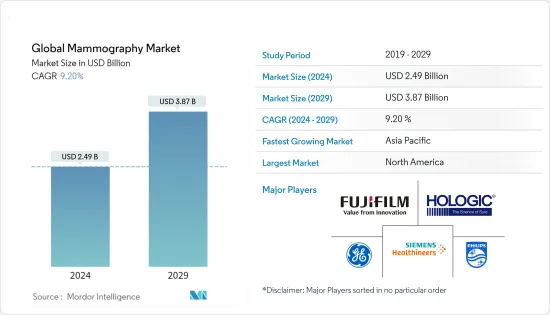

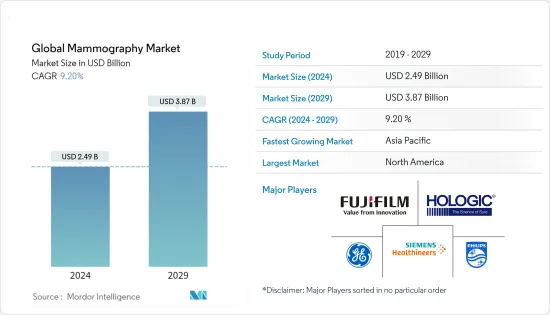

世界のマンモグラフィーの市場規模は、2024年に24億9,000万米ドルと推定され、2029年までに38億7,000万米ドルに達すると予測されており、予測期間(2024年~2029年)中に9.20%のCAGRで成長する見込みです。

COVID-19パンデミックはさまざまな市場の成長に変化をもたらし続けており、感染拡大による直接的な影響はさまざまです。当初、COVID-19の流行は、多くの病院や検査センターがロックダウンにより閉鎖されたままであり、マンモグラフィー検査の需要は短期的には抑制されると予想されているため、マンモグラフィー市場に大きな影響を与えました。たとえば、2022年6月に発行された「COVID-19感染症パンデミック施設閉鎖後のスクリーニング・マンモグラフィーの回復:施設アクセスと人種的および民族的スクリーニング格差の関連」と題された記事によると、マンモグラフィーの撮影量は2019年に減少し、2021年には61%増加しました。したがって、パンデミック後の期間でマンモグラフィー装置の需要が大幅に増加しているため、これはマンモグラフィー装置メーカーに大きな影響を与えると予想されます。

さらに、マンモグラフィー市場の成長の主な要因には、乳がんの罹患率の増加、乳房画像技術の進歩、乳がん検診キャンペーンへのさまざまな組織からの投資が含まれます。 2020年のGlobocanの報告書によると、乳がんは最も罹患率の高いがんの種類であり、罹患率は11.7%でした。同報告書によると、男女ともに5年間の有病率をみると、罹患者数がアジアで最も多く321万8,496人(41.3%)、次いで欧州で213万8,117人(27.4%)、北米で118万9,111人( 15.3%)となっています。このような乳がんの罹患率の高さは、マンモグラフィー装置が診断目的で使用される可能性があるため、マンモグラフィー装置の需要が増加すると予想される主な理由の1つです。

さらに、米国のマンモグラフィー品質基準法(MQSA)国家統計によると、米国における2021年8月までのマンモグラフィー検査件数は3,860万件に対し、2022年8月時点では約3,950万件となっています。したがって、マンモグラフィー検査の実施数の増加は、米国などの国々の市場の成長にプラスの影響を与える可能性があります。したがって、前述の要因は、調査対象の市場の成長を促進するのに役立ちます。多くの大手テクノロジー企業は、乳がんを自動的に検出できるAI(人工知能)モデルを使用しています。たとえば、2020年6月、ベルリンに本拠を置く企業Varaは、AIを活用した乳がん検査ソフトウェアのシリーズ A資金で650万ユーロを調達しました。マンモグラフィーに関連するこれらのプログラムと技術の進歩により、市場の成長が促進されると予想されます。さらに、2021年6月10月、Avva Seva trustはインドのダルワド地区で教師を対象に乳がん啓発キャンペーンとスクリーニングキャンプを1か月間開催しました。

また、2020年11月に、Hologic Inc.とRadNetは、乳房の健康における人工知能ツールの開発を進めるための提携を締結しました。この提携には、データ共有、研究開発、RadNetのHologicのマンモグラフィーシステム群の最先端の画像技術へのアップグレードが含まれる可能性があります。さらに、2020年9月に、GE HealthcareとCandelis Inc.は、Senographe Pristinaのマンモグラフィーシステムのマンモグラフィーワークフロー、画像管理、およびストレージ機能を強化するための提携を締結しました。したがって、上記の要因と市場ニーズの変化が市場の成長を促進すると予想されます。

ただし、放射線被ばくによる悪影響とマンモグラフィーに関連するリスクにより、予測期間中の市場の成長は後退すると予想されます。

マンモグラフィー市場動向

デジタルマンモグラフィーセグメントは、予測期間中に大きな市場シェアを占めると予想されます

乳がん患者は感染症にかかるリスクが高いため、多くの組織がこれらの疾患を管理するために明確な措置を講じています。 2020年9月にMedicina Clinica Journalに掲載されたDafina Petrovaらによる調査論文によると、欧州臨床腫瘍学会(ESMO)、スペイン放射線腫瘍学会(SEOR)、スペイン臨床腫瘍学会(SEOM)は、がん患者のリスクを最小限に抑えるために治療プロトコルを変更する方法に関するいくつかの推奨事項を発表しました。改善されたガイドラインは、手術を行うためのより効率的な方法を提供し、治療にプラスの影響を与えると考えられています。このような例は、デジタルマンモグラフィー市場の成長をサポートすると予想されます。デジタルマンモグラフィーの出現により、特に高濃度の乳房を検査する場合に、低コントラストの対象物の優れた描写、幅広い動的変化、および画像の診断品質の向上により、これらの新しいシステムへの移行を経験している国が増えています。

製品の発売もセグメント成長のもう1つの要因です。たとえば、2021年8月に、FUJIFILM Medical Systems USA, Inc.は、ScreenPoint Medicalの2Dおよび3Dマンモグラフィー用のFusion AIを搭載したTransparaをFDAが認可して米国で発売しました。さらに、2021年4月に、Fujifilm Europe GmbHは、Amulet Innovalityのマンモグラフィーシステムの「Harmony」バージョンをドイツで発売しました。 AMULET Innovalityは、Fujifilm独自の革新的な技術を搭載したフルフィールドデジタルマンモグラフィー(FFDM)で、非常に低い患者線量で最適な画質を実現します。したがって、新しい技術のコストは従来のシステムより6倍高いにもかかわらず、デジタルマンモグラフィーがスクリーニングの好ましい選択肢になりつつあります。

アナログシステムと比較して放射線被ばくが大幅に低くなります。これらすべての利点は、予測期間中の市場の成長に役立ちます。さらに、米国がん協会によると、2021年には約28万7,850人の女性が浸潤性乳がんと診断されました。したがって、乳がんの有病率の上昇により、デジタルマンモグラフィーの需要が高まる可能性があります。

したがって、上記の要因により、市場セグメントは予測期間中に成長を示すと予想されます。

予測期間中、北米が世界市場で大きなシェアを占める

北米はマンモグラフィー市場で大きなシェアを占めていることがわかっており、予測期間中も大きな変動はなく同様の傾向を示すと予想されます。この地域における乳がんの罹患率の上昇とより良いヘルスケアインフラの存在により、予測期間中に市場全体の成長が促進されると予想されます。

COVID-19感染症の流行により、診断の遅れや医薬品の不足などにより、市場は若干の低迷に直面すると予想されます。しかし、ロックダウンや制限が緩和されるにつれ、マンモグラフィーサービスの需要が増加する可能性があります。マンモグラフィー検査の予約をキャンセルしたり、受診を延期していた多くの女性が、現在は検査を受けることができるようになりました。米国の乳がん調査財団は、COVID-19感染症のパンデミックの初期に比べ、現在はほとんどの場所の病院や施設が十分に準備されており、安全であると述べました。したがって、診断が遅れないよう、女性には定期的に検査を受けることが奨励されています。

米国がん協会によると、2020年に推定27万6,480人の女性が新たに浸潤性乳がんと診断されました。さらに、女性の間で4万8,530例が上皮内乳がんと診断されており、乳がんの症例数は今後数年間で増加すると予想されています。

さらに、いくつかの企業が乳がん検査を支援するプログラムを立ち上げていることが判明しました。たとえば、2020年8月、Hologic Inc.はBack to Screenキャンペーンの開始を報告しました。これは、COVID-19感染症のパンデミックにより遅れていたマンモグラフィーの予約を女性に促す可能性があります。

この成長は、革新的な技術を備えた高度なマンモグラフィー装置の発売と導入の拡大によっても促進されています。たとえば、2021年10月に、FUJIFILM Canada Inc.は、ASPIRE Cristalleデジタルマンモグラフィーソリューションについてカナダ保健省の医療機器ライセンスを取得しました。また、Christie Innomedとのパートナーシップを拡大し、カナダのすべての州で製品を提供できるようになりました。

したがって、乳がんの有病率の上昇と製品の発売により、市場は予測期間中に成長すると予想されます。

マンモグラフィー業界の概要

マンモグラフィー市場は、市場に数社の大手企業が存在するため、統合された市場となっています。主要な市場プレーヤーは、技術の進歩と手術の副作用の軽減に重点を置いています。市場の主要企業には、Analogic Corporation、Canon Medical Systems Corporation、Fujifilm Corporation、GEヘルスケア、Hologic Inc.、Koninklijke Philips NV、Siemens Healthineersなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 乳がんの負担増

- 乳房画像診断分野における技術の進歩

- 乳がん検診キャンペーンへの様々な組織からの投資

- 市場抑制要因

- 放射線被曝による副作用のリスク

- 診療報酬の減少

- 業界の魅力 - ポーターのファイブフォース分析

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模:金額)

- 製品タイプ別

- デジタルシステム

- アナログシステム

- 乳房トモシンセシス

- その他の製品タイプ

- エンドユーザー別

- 病院

- 専門クリニック

- 診断センター

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Fujifilm Holdings Corporation

- GE Healthcare

- Hologic Inc.

- General Medical Merate SpA

- Koninklijke Philips NV

- Metaltronica SpA

- Konica Minolta Inc.

- Planmed Oy

- Siemens Healthineers

- Carestream Health

- Canon Medical Systems

第7章 市場機会と今後の動向

The Global Mammography Market size is estimated at USD 2.49 billion in 2024, and is expected to reach USD 3.87 billion by 2029, growing at a CAGR of 9.20% during the forecast period (2024-2029).

The COVID-19 pandemic has been continuing to transform the growth of various markets, and the immediate impact of the outbreak is varied. Initially, the COVID-19 outbreak showed a strong impact on the mammography market as many hospitals and screening centers remain closed due to lockdowns, and the demand for mammography procedures is expected to be subdued in the short term. For Instance, According to an article titled ' Screening Mammography Recovery after COVID-19 pandemic facility closures: Associations of facility access and Racial and Ethnic Screening disparities' published in June 2022, mammography volumes decreased in 2019 and then increased by 61% in 2021. Thus, this is expected to have a significant impact on mammography device manufacturers, as their demand has increased significantly in post pandemic period.

Moreover, the major factors responsible for the growth of the mammography market include the growing prevalence of breast cancer, technological advancements in breast imaging, and investment from various organizations in breast cancer screening campaigns. According to a Globocan report in 2020, breast cancer was the most prevalent type of cancer, with a prevalence rate of 11.7%. According to the same report, the five-year prevalence rate for both sexes showed that Asia had the highest number of people affected at 3,218,496 (41.3%), followed by Europe at 2,138,117 (27.4%) and North America with 1.189,111 people (15.3%). Such high prevalence rates of breast cancer are one of the main reasons the demand for mammography devices is expected to increase, as they may be used for diagnostic purposes.

Furthermore, according to the Mammography Quality Standards Act (MQSA) National Statistics of the United States, as of August 2022, about 39.5 million mammography procedures as compared to 38.6 million mammography procedures by August 2021 in the United States. Therefore, the increasing number of mammography tests performed is likely to have a positive impact on the growth of the market in countries, like the United States. Hence, the aforesaid factors help in driving the growth of the market studied. Many major tech companies are using AI (artificial intelligence) models that can automatically detect breast cancer. For instance, in June 2020, Vara, a Berlin-based company raised EUR 6.5 million in Series A funding for AI-powered breast cancer screening software. These programs and technological advancements associated with mammograms are expected to boost the market growth. Additionally, In June October 2021 Avva Seva trust held a month-long breast cancer awareness campaign and screening camp for teachers in Dharwad district, India.

Also, in November 2020, Hologic Inc. and RadNet entered into a collaboration to advance the development of artificial intelligence tools in breast health. The collaboration may include data sharing, R&D, and an upgrade of RadNet's fleet of Hologic mammography systems to state-of-the-art imaging technology. Furthermore, in September 2020, GE Healthcare and Candelis Inc. entered into a collaboration to enhance mammography workflow, image management, and storage capabilities for the Senographe Pristina Mammography System. Thus, the above-mentioned factors, coupled with the changing market needs, are expected to drive market growth.

However, adverse effects from radiation exposure and risks associated with mammography are expected to pull back the market growth over the forecast period.

Mammography Market Trends

The Digital Mammography Segment is Expected to Account for the Large Market Share During the Forecast Period

As breast cancer patients are at higher risk of acquiring the infection, many organizations took definite measures to manage these diseases. According to a research article by Dafina Petrova et al., published in Medicina Clinica Journal in September 2020, the European Society for Medical Oncology (ESMO), the Spanish Society of Radiation Oncology (SEOR), and the Spanish Society of Medical Oncology (SEOM) have published some recommendations on how to modify treatment protocols to minimize risks in cancer patients. The improved guidelines would provide more efficient methods to perform surgeries which would have a positive impact on the treatments. Such instances are expected to support the growth of the digital mammography market. With the advent of digital mammography, an increasing number of countries are experiencing shifts toward these newer systems, due to their superior depiction of low-contrast objects, wider dynamic change, and improved diagnostic quality of images, especially when examining denser breasts.

Product launches are another factor for segmental growth. For instance, in August 2021, FUJIFILM Medical Systems U.S.A., Inc. launched ScreenPoint Medical's, FDA cleared Transpara powered by Fusion AI for 2D and 3D mammography in the United States. Additionally, In April 2021, Fujifilm Europe GmbH launched the 'Harmony' version of its Amulet Innovality mammography system in Germany. AMULET Innovality is a Full Field Digital Mammography (FFDM) equipped with Fujifilm's unique and innovative technologies that achieve optimum image quality at a very low patient dose. Thus, digital mammography is becoming the preferred choice of screening, even though the cost of the new technology is six times higher than the conventional systems.

Radiation exposure is significantly lower as compared to analog systems. All these advantages aid in the growth of the market over the forecast period. Moreover, as per the American Cancer Society, in 2021, about 287,850 cases of invasive breast cancer were diagnosed in women. Thus, the rising prevalence of breast cancer is likely to boost the demand for digital mammography.

Thus, owing to the abovementioned factors, the market segment is expected to show growth over the forecast period.

North America Accounts for the Large Share in the Global Market Over the Forecast Period

North America is found to hold a major share of the mammography market, and it is expected to show a similar trend over the forecast period, without significant fluctuations. The rising prevalence of breast cancer and the presence of better healthcare infrastructure in the region are expected to drive the overall growth of the market over the forecast period.

Due to the outbreak of COVID-19, the market is expected to face a slight setback owing to the delay in diagnosis, drug shortages, and others. However, as lockdowns and restrictions are getting relaxed, there may be an increase in demand for mammography services. Many women who had canceled their appointments or had their visits for mammography services postponed are now able to get their tests done. The Breast Cancer Research Foundation in the United States has stated that hospitals and facilities in most places are well prepared and safe now as compared to the initial days of the COVID-19 pandemic. Thus, it has been encouraging women to get their scheduled scans done so that diagnosis is not delayed.

According to the American Cancer Society, in 2020, an estimated 276,480 new cases of invasive breast cancer have been diagnosed among women. Additionally, 48,530 cases of in situ breast carcinoma have been diagnosed among women, and the number of breast cancer cases is expected to increase in the coming years.

Furthermore, several companies are found launching programs to support breast cancer tests. For example, in August 2020, Hologic Inc. reported the Back to Screen campaign launch, which may encourage women to schedule their delayed mammograms due to the COVID-19 pandemic.

The growth is also being fueled by the launch and growing adoption of advanced mammography devices with innovative technologies. For instance, in October 2021, FUJIFILM Canada Inc. received a Health Canada medical device license for its ASPIRE Cristalle digital mammography solution. It also expanded its partnership with Christie Innomed to offer the product across every province in Canada.

Thus, owing to the rising prevalence of breast cancer and product launches, the market is expected to experience growth over the forecast period.

Mammography Industry Overview

The mammography market is a consolidated one, owing to the presence of a few major players in the market. The major market players are focusing on technological advancements and reducing the side effects of the procedures. Some of the major players in the market are Analogic Corporation, Canon Medical Systems Corporation, Fujifilm Corporation, GE Healthcare, Hologic Inc., Koninklijke Philips NV, and Siemens Healthineers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Breast Cancer

- 4.2.2 Technological Advancements in the Field of Breast Imaging

- 4.2.3 Investment from Various Organizations in Breast Cancer Screening Campaigns

- 4.3 Market Restraints

- 4.3.1 Risk of Adverse Effects from Radiation Exposure

- 4.3.2 Reduction in Reimbursement

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD Million)

- 5.1 By Product Type

- 5.1.1 Digital Systems

- 5.1.2 Analog Systems

- 5.1.3 Breast Tomosynthesis

- 5.1.4 Other Product Types

- 5.2 By End Users

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Diagnostic Centers

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujifilm Holdings Corporation

- 6.1.2 GE Healthcare

- 6.1.3 Hologic Inc.

- 6.1.4 General Medical Merate SpA

- 6.1.5 Koninklijke Philips NV

- 6.1.6 Metaltronica SpA

- 6.1.7 Konica Minolta Inc.

- 6.1.8 Planmed Oy

- 6.1.9 Siemens Healthineers

- 6.1.10 Carestream Health

- 6.1.11 Canon Medical Systems