|

市場調査レポート

商品コード

1849843

ウェアラブル医療機器:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Wearable Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ウェアラブル医療機器:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月23日

発行: Mordor Intelligence

ページ情報: 英文 130 Pages

納期: 2~3営業日

|

概要

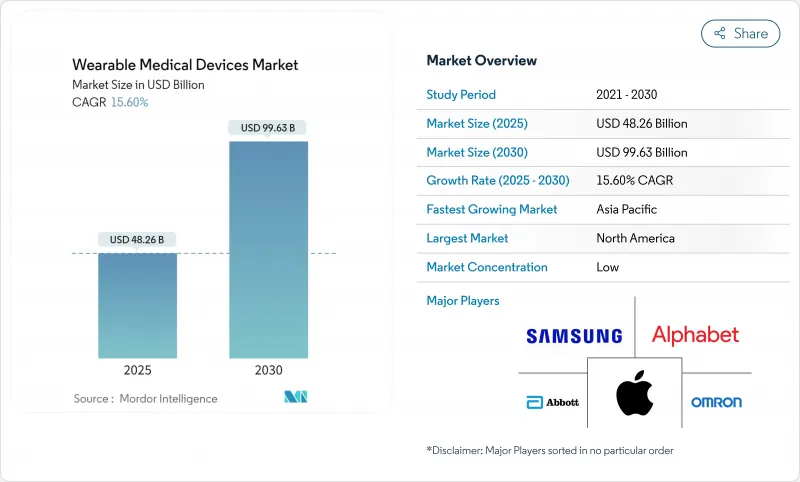

ウェアラブル医療機器市場規模は2025年に482億6,000万米ドルと推定・予測され、2030年には996億3,000万米ドルに達すると予測され、予測期間中のCAGRは15.60%です。

規制機関がコネクテッド・ダイアグノスティクスのためのファスト・トラック・パスウェイを構築し、臨床意思決定支援の中でウェアラブル・データを認識するメディケア償還が拡大するにつれて、成長は加速します。バイオセンサー、バッテリーの小型化、クラウドの相互運用性における絶え間ない技術革新が臨床採用を強化し、Apple HealthKitのような消費者向けハイテクエコシステムがユーザーエンゲージメントを拡大します。伝統的な医療技術企業とソフトウェア・リーダーとの戦略的パートナーシップは、新たな介入可能な製品ラインを開拓し、アジア太平洋の製造クラスターは、より広い地域への展開を可能にする製造コストの低減をサポートします。サイバーセキュリティの義務付けや、コンシューマーグレードの精度に対する医師の懐疑的な見方が勢いを削いでいるが、より明確な規制ガイダンスと支払者の受け入れにより、パイロットプロジェクトは広範な病院プログラムへと移行し続けています。

世界のウェアラブル医療機器市場の動向と洞察

慢性疾患の蔓延と在宅ヘルスケア需要の増加

人口の高齢化とバリュー・ベース・ケアの償還により、予定外の入院を減らすために継続的モニタリングに依存する慢性疾患プログラムが加速しています。アボット社のFreestyle Libreのような市販の持続血糖モニターは、糖尿病患者の自己管理を可能にすると同時に、臨床医にリアルタイムの動向データを提供します。各国政府は、24時間のバイタル測定に有効なバイオセンサーを必要とする「在宅病院」モデルを推進しており、ウェアラブル医療機器市場はコスト抑制に不可欠な市場となっています。早期の異常警告は治療結果を改善し、救急部門の利用率を低下させる。高齢者人口が最も急速に増加しているアジア太平洋地域では、転倒検知パッチや心臓リズム・パッチに対する需要が旺盛です。こうした構造的な力が、予測CAGRの約3.5ポイントの長期的な上昇を支えています。

疾患特異的モニタリングのためのAI搭載バイオセンサーの採用増加

フレキシブル・エレクトロニクスに組み込まれたAIは、ウェアラブルを一般的なウェルネス・トラッカーから、FDAが承認したアルゴリズムで98%の不整脈検出感度を実現する診断プラットフォームへとシフトさせる。Nanowear社のSimpleSense-BPは、テキスタイル基板上で数十種類のバイオマーカーを捕捉し、臨床レベルの血圧測定値を提供します。香港大学のエッジコンピューティング・デザインは、データをローカルに処理し、プライバシーを保護し、クラウドの待ち時間を削減します。機械学習が光電式血圧計を改良し、SpO2と血圧を臨床に近い精度に。予測分析は、症状発現の数時間前に増悪のフラグを立て、ケアパラダイムをリアクティブからプロアクティブに移行させる。これらの機能は、医師の信頼性を高め、循環器科と神経科のユニット全体の調達に拍車をかけます。

サイバーセキュリティとデータプライバシー・コンプライアンスコスト

ヘルスケアはランサムウェアの標的として最も狙われている分野のひとつであり、規制当局が要件を強化するよう促しています。FDAは現在、市販前申請におけるソフトウェア部品表の開示とライフサイクルパッチプランを義務付けており、複雑なウェアラブル製品の開発費が100万米ドルも増加します。EUのGDPR規則では、明示的な同意と忘れる権利のプロトコルが要求され、ベンダーは暗号化、鍵管理、監査証跡への投資を余儀なくされています。小規模なイノベーターは、技術的に機敏ではあるが、エンタープライズ・グレードのセキュリティ・ベンチマークを満たす際に、資本的制約にしばしば遭遇します。認証の遅れは商品化を遅らせ、競合の地位を低下させる可能性があります。

セグメント分析

診断・モニタリング機器は、2024年のウェアラブル医療機器市場規模の63.78%を占め、保険償還可能な慢性期医療パスウェイを満たす心拍数、血圧、持続グルコースモニターの普及に支えられました。このセグメントのリーダーシップは、成熟したセンサー精度と幅広い規制クリアランスを反映しています。バイタルサインパッチは依然として循環器病棟で好まれており、夜間オキシメトリーウェアラブルは睡眠時無呼吸スクリーニングをサポートしています。クローズドループ型グルコースシステムは、CMSが適用範囲を拡大した後に力強い支持を受け、内分泌科全体で継続的な成長を支えています。

治療用ウェアラブルは、パッシブパッチからアクティブドラッグデリバリーや神経モジュレーションデバイスへとフォームファクターが進化するにつれて、現在は小さいもの、予測CAGR 15.93%で進歩しています。AIガイド付き運動ライブラリを備えた温熱療法パッドは、理学療法と消費者の利便性の融合を示しています。Epiminder社のMinderのような植え込み型EEGモニターは、発作の継続的な追跡を臨床環境の外にも拡大し、市場が介入へとシフトしていることを示します。これらのブレークスルーは、アルゴリズムが投与量や刺激強度をリアルタイムで個別化するにつれて、治療薬のウェアラブル医療機器市場規模が2030年まで顕著に拡大することを裏付けています。

18~60歳の成人は2024年のウェアラブル医療機器市場シェアの61.45%を占め、労働人口集団における慢性疾患発生率と雇用者のウェルネスインセンティブがその原動力となっています。デバイスは、ライフスタイルに関する洞察とFDA認可の測定基準とのバランスをとり、予防医療と臨床モニタリングの両方を満たします。高齢者は、簡素化されたユーザー・インターフェースや、天然素材にモーション・センサーを組み込んだ転倒検知スマートウェアを受け入れており、技術に疎いユーザーのコンプライアンスを高めています。

小児科での採用は少ないもの、予測CAGRは16.46%です。12歳以上の小児を対象とした、薬剤を使用しない鼻づまり治療器Sonu BandのFDA認可は、小児に特化したデザインに対する規制当局の寛容さを例証するものです。保護者は、スマートフォンにアラートを送信し、通院回数を減らす非侵襲的なバイタルパッチキットを高く評価しています。ゲーム・スタイルのフィードバックとカラフルなフォーム・ファクターは若年ユーザーを魅了し、学校の遠隔医療パイロット試験は初期の成功を示しています。これらを総合すると、若年層に焦点を当てたイノベーションは、従来医療技術が十分なサービスを提供してこなかったセグメントにおいて、市場セグメンテーションの市場規模を拡大しています。

地域分析

北米は2024年に世界売上高の34.57%を創出したが、これは商業化を早める強固な償還制度と合理化されたFDAの経路によるものです。CMSが承認した遠隔患者モニタリングコードの普及は、病院が退院時に認証されたセンサーを配布することを促し、プライマリケアネットワークへのさらなる浸透を促進します。米国の大手ハイテク企業は、サードパーティのアプリケーションで機器の機能を拡張する活気ある開発者エコシステムを育成しています。カナダは州の遠隔医療義務化を通じて同様のモデルを拡大し、メキシコは国境を越えたサプライチェーンを活用して認証済みデバイスを低コストで利用できるようにしています。

欧州はCAGR 15.32%で勢いを維持し、患者の信頼を高めるGDPRに沿ったプライバシー保証に支えられています。ドイツのDiGAプログラムは、法定保険を通じて、心臓リズムパッチを含むデジタル治療薬を償還します。フランスでは、デバイスの注文を自動化する全国的な電子処方サービスが採用され、イタリアでは、高齢者介護施設に転倒検知ウェアラブルを統合するための官民パートナーシップを試験的に導入しています。医療機器規制の市販後調査義務によりベンダーの説明責任が高まり、CEマーク製品の評価がウェアラブル医療機器市場全体で高まる。

アジア太平洋はCAGR 16.42%で最も急成長する地域と予測されます。中国の医療機器セクターは、2025年までに2,100億米ドルの市場規模になると予測されています。日本の保健省の指針は、予備的トリアージにスマートウォッチ由来の心電図データを推奨しており、韓国はバイオヘルスケア2030計画の下、スマート衣料工場に補助金を出しています。インドのデジタルヘルス・ミッションは、農村部の診療所におけるBluetooth対応バイタル測定デバイスを推進し、アクセシビリティを向上させる。地域の契約製造業者はグローバル・ブランドに製品を供給し、アジア太平洋地域の生産規模とコスト・リーダーシップへの影響力をウェアラブル医療機器市場内で強化しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 慢性疾患の罹患率の上昇と在宅医療の需要

- 疾患特異的モニタリングのためのAI対応バイオセンサーの採用増加

- 遠隔患者モニタリングプログラムへの償還増加

- 消費者テクノロジーエコシステムとの統合によりユーザーエンゲージメントを向上

- バッテリー技術の小型化によりフォームファクターの制約が低減

- デジタル治療薬とコネクテッドデバイスのための規制の迅速化

- 市場抑制要因

- サイバーセキュリティとデータプライバシーのコンプライアンスコスト

- 相互運用性を妨げる断片化されたデバイスデータ標準

- 消費者向けデータの正確性に対する医師の信頼度が低い

- バッテリー寿命と電子廃棄物の懸念

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- デバイスタイプ別

- 診断および監視デバイス

- バイタルサインモニタリングデバイス

- 睡眠モニタリングデバイス

- 持続血糖モニター

- 血圧モニター

- その他の診断およびモニタリング装置

- 治療機器

- 疼痛管理デバイス

- リハビリテーション機器

- 呼吸療法機器

- インスリン送達デバイス

- その他の治療機器

- 診断および監視デバイス

- 年齢層別

- 18歳未満

- 18~60歳

- 60歳以上

- 流通チャネル別

- オンライン

- オフライン

- 用途別

- スポーツとフィットネス

- 遠隔患者モニタリング

- 在宅ヘルスケア

- エンドユーザー別

- 消費者

- 病院とクリニック

- 長期ケアセンター

- 外来手術センター

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- Competitive Benchmarking

- 市場シェア分析

- 企業プロファイル

- Abbott Laboratories

- AIQ Smart Clothing Inc.

- Alphabet Inc.

- Apple Inc.

- Biobeat Technologies Ltd.

- Dexcom Inc.

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- imec

- Intelesens Ltd.

- Koninklijke Philips N.V.

- Lifesense Group

- Masimo Corporation

- Medtronic plc

- MINTTI Health

- Omron Corporation

- ResMed Inc.

- Samsung Electronics Co., Ltd.

- Withings SA

- Xiaomi Corporation