|

市場調査レポート

商品コード

1644279

ラテンアメリカのビール缶:市場シェア分析、産業動向、成長予測(2025~2030年)Latin America Beer Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ラテンアメリカのビール缶:市場シェア分析、産業動向、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 70 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

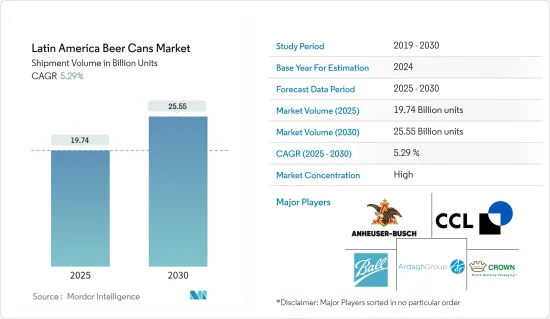

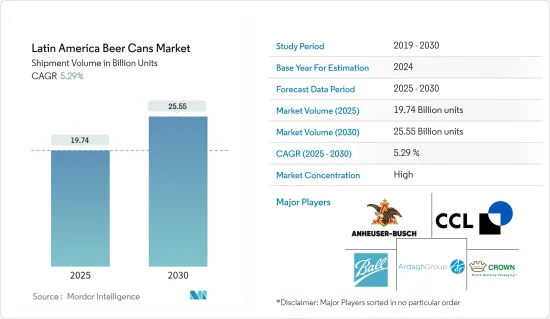

ラテンアメリカのビール缶市場規模(出荷数量ベース)は、2025年の197億4,000万個から2030年には255億5,000万個に拡大し、予測期間(2025~2030年)のCAGRは5.29%と予測されます。

ビール缶産業は、主にビールの多様な味と風味に対する顧客の嗜好の変化により、著しい成長を遂げています。軽量で耐久性に優れたアルミ缶は、輸送のしやすさでガラス瓶に勝る。ラテンアメリカ近代的な都市部の消費者は、野外活動、パーティー、集会などでの利便性に惹かれて、アルミ缶を好みます。

主要ハイライト

- 環境対策による持続可能性の採用が市場を牽引すると予想されます。缶は、ビーチ、プール、公園、キャンプ場、球場、ゴルフ場、ボートなど、通常ボトルの持ち込みが禁止されている多くの場所で許可されています。缶は100%リサイクル可能で、ボトルよりもはるかに軽く、空でも充填済みでも輸送に必要な燃料が少なくて済むという利点もあります。空の12オンスボトルの重さが約7オンスであるのに対し、空の缶の重さはわずか約半オンスです。

- ブラジル政府は地ビール製造の促進に大きな役割を果たしています。例えば、2024年6月、ブラジル最大の麦芽製造施設、マルタリア・カンポス・ジェライス(Maltaria Campos Gerais)が落成しました。ポンタ・グロッサとカランベイの間、PR-151に位置するこの先進的な工場は、国内の麦芽需要の約20%に対応する態勢を整えています。24万トンの年間生産能力を誇るこの施設は、ブラジルの醸造部門に大きな影響を与える準備が整っています。

- さらに、メキシコでは環境への関心が高まっており、ビール会社はプラスチックフリーの缶を採用せざるを得なくなっています。メキシコのビール醸造、流通、販売における重要な参入企業であるGrupo Modeloは、最近、WestRockとGrupo Gondiと共同で、サステイナブル包装イニシアチブに約400万米ドルを割り当てました。同社の繊維ベースのCanCollar Eco製品は、キンタナ・ロー州を皮切りに、メキシコでプラスチック製リングを撲滅する予定であり、これにより年間1,200万個のプラスチック製リングがなくなります。

- しかし、消費者のワイン志向は、ワインや酒類製品の値ごろ感が増しているため、市場に影響を与える可能性があります。このシフトは今後も続くと予想され、より多くの消費者がこれらの商品にシフトしていくと考えられます。例えば、Jefferies & Companyによると、ブラジルのアルコール飲料市場は2027年に約1,210億米ドルになり、米国のアルコール市場の半分以下を占めると予想されています。

- さらに、現在進行中のロシア・ウクライナ紛争は、調査対象市場の成長に大きな影響を与えています。世界有数のアルミニウム生産国であるロシアは、その金属輸出を標的とした経済制裁により、生産量の途絶に直面しています。これは、ラテンアメリカのビール缶製造に必要な原料の入手可能性に影響を及ぼしています。

ラテンアメリカのビール缶市場動向

アルミ缶がブラジルで大きなシェアを占める

- アルミ缶は高いリサイクル性を誇り、リサイクルプロセスで消費されるエネルギーは、新規のアルミ生産よりも大幅に少ないです。ブラジルやメキシコなどのラテンアメリカ諸国は、強固なリサイクルシステムを確立しており、アルミの環境適合性を高めています。これは環境意識の高い消費者の共感を呼び、世界の持続可能性の動向とシームレスに合致します。

- さらに、アルミ缶は軽量で持ち運びが容易であり、ガラス瓶よりも耐久性に優れています。その結果、消費者は、特に野外活動、パーティー、集会などの際に、利便性を求めて缶に引き寄せられる傾向が強まっています。この持ち運びやすさが、ラテンアメリカ現代的な都市層にとって缶飲料を特に魅力的なものにしています。外出先での消費動向の高まりとともに、缶飲料の需要は急増しています。さらに、アルミ缶は、ラテンアメリカ文化に欠かせない公共スペース、イベント、フェスティバルでの使い勝手の良さからも選ばれています。

- ラテンアメリカ主要飲料企業は、サステイナブルプラクティスを取り入れています。アルミ缶を選択することで、これらの企業は企業の社会的責任(CSR)目標を推進し、二酸化炭素排出量の最小化に取り組んでいます。さらに、Crown Holdings, Inc.のブラジル子会社であるCROWN Embalagens S.A.は、ブラジルに6番目の飲料缶工場を有しています。その2ライン工場では、複数のサイズの2ピースアルミ缶を生産しており、年間生産能力は24億缶です。

- 都市部の人口が増加し、ライフスタイルがよりテンポの速いものになるにつれ、缶ビールはその手軽さからますます好まれるようになっています。所得水準が上がるにつれて、消費者はより便利で高級な包装オプションを求めるようになります。ブラジルの缶ビール需要は、飲料セクターの高級化傾向と一致し、さらに拍車がかかっています。世界銀行によると、2023年のブラジルの国民1人当たり総所得は約9,070米ドルで、前年の8,240米ドルから増加しています。

大幅な市場成長が期待されるブラジル

- ブラジルは人口が多く、ビール消費文化が根付いています。ビールは、社交の場、お祭り、カーニバルやサッカーの試合のような重要なイベントなどで目立つ主食飲料です。このようなビールへの安定した需要が、包装の必要性を高め、缶が市場のかなりの部分を占めています。Banco do Nordesteによると、ブラジルのビール消費量は、前年の108億リットルから2024年には113億リットルに達すると予測されています。

- また、ブラジルのアルミリサイクル率は世界でもトップクラスで、90%以上がリサイクルされています。このようにリサイクルシステムが確立されているため、アルミ缶は消費者や企業にアピールする環境に優しい選択肢となっています。

- 消費量の増加に伴い、ビールメーカーはブラジルでの生産を増やしています。その結果、この地域の市場ベンダー向けの製造工場プロジェクトが増加しています。例えば、ハイネケンは2023年3月、ブラジル北東部にある2つの醸造所の生産能力を増強するため、15億BRL(3億米ドル)の投資を発表しました。この戦略的な動きは、特にハイネケン、アムステル、デバッサなどのプレミアムビールやシングルモルト・ブランドの需要増に対応するためのものです。

- 過去10年間、ブラジルのクラフトビール市場は大きな成長を遂げてきました。クラフトビールメーカーは、従来のガラス瓶よりもアルミ缶を好むようになっています。缶はビールの鮮度保持に優れ、光と酸素からより効果的に遮断されます。その結果、この急成長するクラフトビール醸造シーンが缶ビールの需要を押し上げています。

ラテンアメリカのビール缶産業概要

ラテンアメリカのビール缶市場は統合されています。市場全体に貢献する缶の生産で高い市場シェアを持つ有力企業はほとんどなく、Ball Corporation、CCL Container Inc、Crown Holdings, Inc.などがその例です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- 主要マクロ経済動向の市場への影響

第5章 市場力学

- 市場促進要因

- 環境問題への関心の高まり

- 地ビール生産の増加

- 市場課題

- 消費者のワイン志向

第6章 市場セグメンテーション

- 包装タイプ別

- アルミ缶

- スチール/錫缶

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- コロンビア

- その他のラテンアメリカ諸国

第7章 ベンダー市場シェア

第8章 競合情勢

- 企業プロファイル

- Ball Corporation

- Crown Holdings, Inc.

- Anheuser-Busch Packaging Group Inc.

- CCL Container Inc.

- Ardagh Group

第9章 投資分析

第10章 投資分析市場の将来

The Latin America Beer Cans Market size in terms of shipment volume is expected to grow from 19.74 billion units in 2025 to 25.55 billion units by 2030, at a CAGR of 5.29% during the forecast period (2025-2030).

The beer cans industry has seen significant growth, driven primarily by changing customer preferences for diverse tastes and flavours in beer. Lightweight and durable, aluminium cans outshine glass bottles in transport ease. Modern urban consumers in Latin America gravitate towards these cans, drawn by their convenience for outdoor activities, parties, and gatherings.

Key Highlights

- The adoption of sustainability with environmental measures is expected to drive the market. Cans are permitted in many places where bottles are typically not allowed, such as beaches, pools, parks, campgrounds, ballparks, golf courses, boats, etc. Cans are 100-percent recyclable with other benefits such as much lighter than bottles, and requiring less fuel to ship them, whether empty or filled, is an added advantage. An empty 12-ounce bottle weighs about 7 ounces, whereas an empty can weighs only about a half-ounce.

- Brazil's government plays a significant role in boosting local beer manufacturing. For instance, in June 2024, Brazil inaugurated its largest malt production facility, Maltaria Campos Gerais. Situated on PR-151, between Ponta Grossa and Carambei, this advanced plant is primed to cater to roughly 20% of the nation's malt requirements. Boasting a robust annual production capacity of 240,000 tons, the facility stands ready to make a substantial impact on Brazil's brewing sector.

- Further, the growing environmental concern in Mexico is forcing beer companies to adopt plastic-free cans. Grupo Modelo, a significant player in Mexico's beer brewing, distribution, and sales, has recently allocated approximately USD 4 million towards a sustainable packaging initiative in collaboration with WestRock and Grupo Gondi. Their fibre-based CanCollar Eco product is set to eradicate plastic rings in Mexico, commencing in Quintana Roo, thereby eliminating 12 million plastic rings yearly.

- However, consumers' preference for wine might challenge the market due to the increasing affordability of wine and liquor products. This shift is expected to continue, making more consumers shift towards these commodities. For instance, according to Jefferies & Company, the Brazilian alcoholic beverage market is expected to be around USD 121 billion in 2027, accounting for less than half of the US alcohol market.

- Moreover, the ongoing Russia-Ukraine conflict has significantly influenced the growth of the studied market. As a leading global aluminium producer, Russia's output has faced disruptions due to economic sanctions targeting its metal exports. This affects the availability of raw materials needed for manufacturing beer cans in Latin America.

Latin America Beer Cans Market Trends

Aluminium Can to Hold a Significant Share in Brazil

- Aluminium cans boast high recyclability, with recycling processes consuming notably less energy than new aluminium production. Countries in Latin America, such as Brazil and Mexico, have established robust recycling systems, enhancing aluminium's eco-friendliness. This resonates with environmentally conscious consumers and aligns seamlessly with global sustainability trends.

- Moreover, aluminium cans are lightweight, easily transportable, and more durable than glass bottles. As a result, consumers are increasingly gravitating towards cans for convenience, particularly during outdoor activities, parties, and gatherings. This portability makes cans especially attractive to the contemporary urban demographic in Latin America. With a rising trend in on-the-go consumption, the demand for canned beverages is surging. Furthermore, aluminium cans are chosen for their user-friendliness in public spaces, events, and festivals, which are integral to Latin American culture.

- Leading beverage companies across Latin America are embracing sustainable practices. By choosing aluminium cans, these organizations advance their corporate social responsibility (CSR) objectives and work towards minimizing their carbon footprint, further propelling the demand for this packaging format. In addition, CROWN Embalagens S.A., a Brazilian subsidiary of Crown Holdings, Inc., has its sixth beverage can plant in Brazil. Its two-line facility produces two-piece aluminium cans in multiple sizes and has an annual capacity of 2.4 billion cans.

- As urban populations grow and lifestyles become more fast-paced, canned beer is increasingly preferred for its ease of use. As income levels rise, consumers seek more convenient and premium packaging options. This has further fueled the demand for beer cans in Brazil, aligning with the beverage sector's premiumization trend. According to the World Bank, in 2023, Brazil's national gross income per capita amounted to around USD 9,070, an increase from 8,240 dollars per person in the previous year.

Brazil is Expected to Witness a Significant Market Growth

- Brazil's large population boasts a deep-rooted culture of beer consumption. Beer is a staple beverage, prominently featured in social settings, festivals, and significant events such as Carnival and football matches. This consistent demand for beer, in turn, fuels the need for packaging, with cans capturing a substantial portion of the market. According to Banco do Nordeste, beer consumption in Brazil was forecast to reach nearly 11.3 billion litres by 2024, up from the estimated 10.8 million a year earlier.

- In addition, Brazil has one of the highest aluminium recycling rates in the world, recycling over 90% of its aluminium. This well-established recycling system makes aluminium cans an environmentally friendly option that appeals to consumers and businesses.

- Owing to increased consumption, beer manufacturers are increasing production in Brazil. The result is the growing number of manufacturing plant projects for the region's market vendors. For instance, in March 2023, Heineken unveiled a BRL 1.5 billion (USD 300 million) investment to boost production capacity in two of its breweries in Northeast Brazil. This strategic move is set to cater to the rising demand, especially for premium beers and single-malt brands, including Heineken, Amstel, and Devassa.

- Over the past decade, Brazil's craft beer market has experienced significant growth. Craft brewers are increasingly favouring aluminium cans over traditional glass bottles. Cans offer superior preservation of beer freshness, shielding it more effectively from light and oxygen. As a result, this burgeoning craft brewing scene is driving up the demand for beer cans.

Latin America Beer Cans Industry Overview

The Latin America beer cans market is consolidated. Few prominent players have potentially high market share in can production that caters to the overall market, which includes Ball Corporation , CCL Container Inc, Crown Holdings, Inc., etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Concern

- 5.1.2 Increasing Local Beer Production

- 5.2 Market Challenges

- 5.2.1 Preference of Consumers For Wine

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Aluminium Can

- 6.1.2 Steel/Tin Can

- 6.2 By Country

- 6.2.1 Brazil

- 6.2.2 Mexico

- 6.2.3 Argentina

- 6.2.4 Colombia

- 6.2.5 Rest of Latin America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Ball Corporation

- 8.1.2 Crown Holdings, Inc.

- 8.1.3 Anheuser-Busch Packaging Group Inc.

- 8.1.4 CCL Container Inc.

- 8.1.5 Ardagh Group