|

市場調査レポート

商品コード

1550239

ピンベースアクセスコントロール:市場シェア分析、産業動向、成長予測(2024年~2029年)Pin-based Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ピンベースアクセスコントロール:市場シェア分析、産業動向、成長予測(2024年~2029年) |

|

出版日: 2024年09月02日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

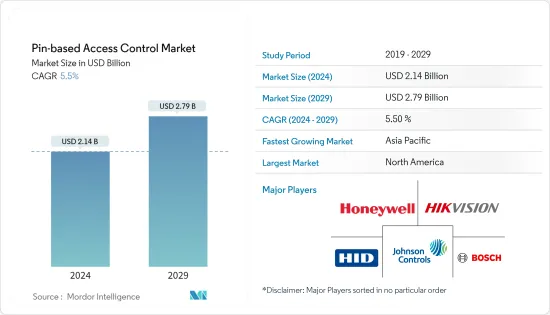

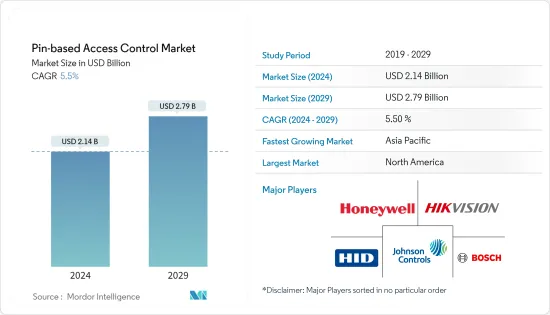

ピンベースアクセスコントロール市場規模は2024年に21億4,000万米ドルと推定され、2029年には27億9,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは5.5%で成長します。

主なハイライト

- ピンベースアクセスコントロールシステムは、商業オフィス、企業、住宅への入退室管理に欠かせないものとなっています。これらのシステムは、テナントやスタッフにとって物件のセキュリティを強化するものであり、資格証明書を使って素早く入館できる一方、無許可の人物の入館を拒否することができます。プライバシーやセキュリティに対する懸念が高まり、重要なデータや情報の盗難が増加していることが、市場の成長に寄与しています。

- ここ数年、世界中で強盗や犯罪の件数が増加しています。このため、人や資産、プロセスの安全性に対する懸念が高まり、インフラへの深刻な被害や多数の人命が失われる事態を招いています。

- 刑事司法評議会(CCJ)によると、2020年夏から急増し始めた犯罪である自動車盗難は、2023年まで増加傾向を維持し、米国では2022年と比べて報告件数が29%増加しました。米国の各都市における住宅窃盗の発生率は、2023年には2019年比で26%減少したのに対し、2022年からは3%減少し、1,052件の減少を記録しました。住宅侵入盗は2022年の同時期と比べ、2023年前半は4%、後半は1%減少しました。犯罪率の減少に役立つ技術は数多くあります。そのひとつが、ピンを使った入退室管理です。

- さらに、ピンベースアクセスコントロールは簡単に拡張できるため、余分なコストをかけずにデータを保護したい中小企業に適しています。いくつかのピンベースアクセスコントロールシステムは、特定のエリアに誰がアクセスしたかを時間と共に追跡することができます。これらのシステムは既存のインフラと互換性があることが多く、古いセキュリティシステムに統合するのに便利な選択肢となっています。

- バイオメトリクス認証は、安全な本人確認プロセスを提供するため、さまざまな業界で急速に増加しています。この技術は、顔認識、指紋スキャン、音声認識、網膜認識などの身体的特徴を使用してユーザーを認証します。トランザクションテクノロジーの採用が加速しているため、厳格な本人確認が必要となっており、従来のピンベースアクセスコントロールよりも消費者に好まれるバイオメトリクスアクセスコントロールの需要が高まっており、市場の成長を妨げています。

- インフレ率の上昇が商品やサービスの価格を押し上げており、特に入退室管理システムのコストが上昇しています。こうしたコスト上昇は消費者と企業の購買力を低下させ、結果的に市場の成長を妨げています。さらに、現在進行中のロシアとウクライナの紛争は、特に入退室管理システムに不可欠な電子部品や原材料の領域で、世界のサプライチェーンを大きく混乱させています。その結果、メーカーは生産の遅れとコストの上昇に直面しています。

ピンベースアクセスコントロール市場動向

大企業セグメントが市場で大きなシェアを占める見込み

- ピンベースアクセスコントロールシステムは、商業ビル、オフィス、企業などの大企業の入退室管理に適した方法となっています。ピンベースアクセスコントロールシステムは、機密情報が保管されているITルームへの物理的なアクセスを制限するために構築することができます。ピンベースアクセスコントロールシステムの市場は、安全意識の高まり、高レベルの入退室管理システムに対する需要の高まり、商業組織における入退室管理デバイスの採用などにより成長が見込まれています。

- 米国は、複数の大手市場企業の存在により、入退室管理システムの早期導入国となっています。米国では、金融センターや銀行、企業、ホテル、モール、小売店などの大企業がピンベースアクセスコントロールシステムを採用しています。さらに、いくつかのオフィスでは、従業員がIT施設に入り、割り当てられたシステムを使用するために、ピンベースアクセスコントロールを使用することを義務付けています。

- 技術の進歩に伴い、組織は盗難を防止し、機密データのセキュリティを高めるためにスマートドアロックを導入しています。バイオメトリクス技術を搭載したスマートドアロックの需要が増加しているため、主要ベンダーは新製品の発売と製品ポートフォリオの拡充に注力しています。例えば、2024年3月、TCLは最先端のスマートドアロックであるK9G Plusを発表しました。このロックは、正確な顔認識のためのデュアルカメラや3D構造化光などの先進技術を備えています。さらに、広々とした4.5インチの内側タッチスクリーンと、大容量で長持ちするバッテリーを搭載しています。このデバイスは、顔認証、指紋スキャン、パスワード入力、カード・スイピング、キー挿入、NFC技術など、さまざまなロック解除方法を提供します。

- さらに、キーパッド付きの業務用ドアロックシステムは高度なセキュリティを提供し、物理的なアクセス・キーの必要性を排除するため、複数の不動産所有者や上級管理職は、許可された担当者のみがスペースにアクセスできるようにするため、PINコードを随時交互に使用しています。このような需要は、世界中の大企業でもピンベースアクセスコントロールシステムに大きな関心をもたらすと思われます。

- 2023年11月、AWSは大企業の物理的スペースとデジタル資産のセキュリティを強化するために設計された、新しい手のひらベースのIDサービスを発表しました。この革新的なサービスは、個人情報の保護を優先しつつ、ユーザーの利便性を高めながら運用コストを削減することを目的としています。このサービスで採用されている最先端の手のひら認識技術は、高度な人工知能と機械学習を活用して固有の手のひら署名を生成し、バッジ、従業員ID、暗証番号などのさまざまな身分証明書にリンクさせることができます。

アジア太平洋地域が著しい成長を遂げる見込み

- アジア太平洋地域は、予測期間中に最も急成長する地域となる見込みです。この成長は、中国やインドのような国々でアクセス制御システムの需要が増加していることに起因しています。中国は、建設部門の拡大、多くの製造業、犯罪率の増加により市場を独占しています。また、中国にはDahuaやHikvisionといった主要なピンベースアクセスコントロールベンダーが存在します。

- 産業化の進展により、資産やデータの安全確保に対する需要が高まっています。この地域では都市化が進んでおり、セキュリティ上の懸念から住宅地や商業地での入退室管理の必要性が高まっています。技術の進歩とデジタル化は、組織全体のソリューション需要を促進しています。さらに、スマートフォンやモバイル・コンピューティング・デバイスの累積的な普及が、アジア太平洋地域におけるピンベースアクセスコントロールの採用を促進すると予想されます。

- インドでは、ホテル、政府機関、企業オフィス、住宅、小売店などさまざまな分野でピンベースのアクセス制御システムが増加しています。デジタル・インディアやメイク・イン・インディアといったインド政府のプログラムの下、複数の主な企業がインドのスマートホーム要件に沿ったデバイスを開発しています。

- さらに、インドでは盗難や強盗が増加しており、スマート・ドアロックの需要を牽引しています。2023年11月にGodrej Locksが委託した「Live Safe, Live Free」と題する報告書によると、ムンバイ、デリー、コルカタ、ボパール、バンガロールの5大都市では、回答者の3分の2以上が自宅の安全確保にスマートロックを採用していることが明らかになった。これらの都市は、国家犯罪記録局のデータで浮き彫りになった脆弱性に基づいて選ばれました。

- 技術の進歩に伴い、オーストラリアの人々は、安全で便利な出入管理ソリューションとして、デジタルドアロックにますます注目しています。スマートホームテクノロジーの人気が高まるにつれ、スマートドアロックは住宅地に不可欠なものとなっています。費用対効果の高さが、オーストラリアでピンベースのドアロックの人気が高まる要因となっています。この地域の他の国々でも、財産やデータを保護する必要性から、ピンベースアクセスコントロールシステムが採用されています。

ピンベースアクセスコントロール産業概要

ピンベースアクセスコントロール市場は細分化され、競争が激しく、複数の企業で構成されています。同市場に参入している企業は、新製品の投入、事業の拡大、戦略的M&A、提携、協力関係の締結などにより、市場での存在感を高めようと絶えず努力しています。主な企業には、Johnson Controls、HID Global Corporation、Hangzhou Hikvision Digital Technology、Thales Groupなどがあります。

- 2024年2月:Hikvisionは、プロフェッショナル向け入退室管理ソリューションの最新製品ラインを発表し、入退室管理における顕著な進歩を示します。これらの技術革新は、強化されたウェブ管理、さまざまな認証方法、特殊なアクセスアプリケーション、および統合されたセキュリティソリューションを含みます。今回のリリースで注目すべき製品には、バンダルプルーフデザインで知られるDS-K1T805および502シリーズがあり、PINコード、指紋、モバイル認証情報など、さまざまな認証オプションを提供しています。

- 2023年12月SALTOは、DBolt Touchスマートデッドボルトを発表しました。DBolt Touchは、集合住宅の機械式デッドボルト錠を強化する優れたソリューションです。DBolt Touchは、後付けオプションと高度なスマートロック機能を提供します。様々なアクセスコントロール方法で、シームレスで便利なキーレス体験をお約束します。さらに、DBolt Touchスマートキーパッドリーダーは、居住者や訪問者がPINベースエントリーシステムを使って敷地にアクセスすることを可能にします。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19パンデミックの後遺症とその他のマクロ経済要因が市場に与える影響

第5章 市場力学

- 市場促進要因

- プライバシーとセキュリティへの関心の高まり

- 市場の課題

- 生体認証の統合

- 暗証番号の容易なハッキング

第6章 市場セグメンテーション

- コンポーネント別

- ハードウェア

- ソフトウェア

- 組織規模別

- 中小企業

- 大企業

- エンドユーザー産業別

- 銀行・金融サービス

- 政府サービス

- 小売

- IT・通信

- ヘルスケア

- 電力・公益事業

- 住宅産業

- その他エンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Johnson Controls

- Honeywell International Inc.

- Bosch Security and Safety Systems

- HID Global Corporation

- Hangzhou Hikvision Digital Technology Co. Ltd

- Axis Communications AB

- Avigilon Corporation

- Napco Security Technologies Inc.

- Thales Group

- Dormakaba Group

- Dahua Technology Co. Ltd

- Anviz Global Inc.

第8章 投資分析

第9章 市場の将来

The Pin-based Access Control Market size is estimated at USD 2.14 billion in 2024, and is expected to reach USD 2.79 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

Key Highlights

- Pin-based access control systems have become crucial to managing access to commercial offices, businesses, and residential buildings. These systems offer enhanced property security for tenants and staff, who can quickly enter with credentials while denying access to unauthorized individuals. The increasing privacy and security concerns and the increasing theft of crucial data and information contribute to the market's growth.

- The number of burglaries and crimes has increased across the world in the past few years. This has heightened concerns about the safety of people, assets, and processes, resulting in severe damage to infrastructure and the loss of multiple lives.

- According to the Council on Criminal Justice (CCJ), motor vehicle theft, a crime that began surging in the summer of 2020, maintained its upward trend through 2023, with a 29% increase in reported thefts compared to 2022 in the United States. Whereas residential burglary rates across cities in the United States were 26% lower in 2023 than in 2019, they saw a 3% decline from 2022, marking a reduction of 1,052 incidents. Residential burglary dropped by 4% in the first half of 2023 and 1% in the latter half compared to the same periods in 2022. There are many technologies that can help in decreasing the crime rate. One of them is pin-based access control.

- Furthermore, pin-based access controls are easily scalable, making them suitable for SMEs who want to secure their data without having to spend extra money. Several pin-based access control systems can track who accessed a particular area along with time. These systems are often compatible with the existing infrastructure, making them a convenient choice to integrate into older security systems.

- Biometric authentication is rapidly increasing across various industries because of the provision of secure identity verification processes. This technology uses physical characteristics like facial recognition, fingerprint scan, voice recognition, and retina recognition to authenticate the user. The necessity for strict identity verification due to the accelerating adoption of transactional technologies is increasing the demand for biometrics access controls, which are preferred by consumers over the traditional pin-based access control, hindering the growth of the market.

- Rising inflation rates are driving up the prices of goods and services, notably increasing the cost of access control systems. These heightened costs are eroding purchasing power for both consumers and businesses, consequently hampering the market's growth. Moreover, the ongoing conflict between Russia and Ukraine is severely disrupting the global supply chain, especially in the realm of electronic components and raw materials essential for access control systems. As a result, manufacturers are facing production delays and escalating costs.

Pin-based Access Control Market Trends

The Large Enterprises Segment is Expected to Hold a Significant Share in the Market

- Pin-based access control systems have become the preferred way to manage access to large enterprises such as commercial buildings, offices, and businesses. Pin-based access control systems can be built to restrict physical access to IT rooms where sensitive information is stored. The market for pin-based access control systems is expected to grow due to increasing safety consciousness, the growing demand for high-level access control systems, and the adoption of access control devices in commercial organizations.

- The United States is an early adopter of access control systems owing to the presence of several larger market players. Large enterprises, such as financial centers and banks, enterprises, hotels, malls, and retail stores, have adopted pin-based access control systems in the United States. Furthermore, several offices have made it mandatory for their employees to use pin-based access control to enter the IT premises and use the systems assigned to them.

- With advancements in technology, organizations are implementing smart door locks to prevent theft and to increase the security of sensitive data. Due to the increasing demand for smart door locks with biometric technology, key vendors are focusing on new product launches and expansion of their product portfolio. For instance, in March 2024, TCL unveiled the K9G Plus, a cutting-edge smart door lock. This lock features advanced technology, including dual cameras and 3D structured light for precise facial recognition. Additionally, it has a spacious 4.5-inch inner touchscreen and a high-capacity, long-lasting battery. The device offers a range of unlocking methods, such as facial recognition, fingerprint scanning, password entry, card swiping, key insertion, and NFC technology.

- Moreover, as commercial door lock systems with keypads provide advanced security and eliminate the requirement for physical access keys, several property owners and senior management professionals alternate the PIN code from time to time to ensure that only authorized personnel can access the space. Such demand will also bring huge interest in pin-based access control systems in large enterprises globally.

- In November 2023, AWS unveiled a new palm-based identity service designed to enhance the security of physical spaces and digital assets for large enterprises. This innovative service aims to reduce operational costs while offering added convenience for users, all the while prioritizing the protection of personal data. The cutting-edge palm recognition technology employed by this service leverages advanced artificial intelligence and machine learning to generate a unique palm signature that can be linked to various identification credentials such as badges, employee IDs, and PINs.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is expected to be the fastest-growing region during the forecast period. The growth is attributed to the increasing demand for access control systems across countries like China and India. China dominates the market due to its expanding construction sector, many manufacturing industries, and a growing crime rate. In addition, China is home to major pin-based access control key vendors, such as Dahua and Hikvision.

- The growing industrialization leads to a high demand for securing assets and data. Urbanization in the region is driving the need for access controls in residential and commercial areas owing to security concerns. Technological advancements and digitalization drive the demand for solutions across organizations. Furthermore, the cumulative adoption of smartphones and mobile computing devices is expected to drive the adoption of pin-based access control across Asia-Pacific.

- India is witnessing an increase in pin-based access control systems in various sectors, including hotels, government institutions, corporate offices, residential buildings, and retail stores, primarily due to the rapidly growing security concerns and increasing crime rates. Several key players are developing devices as per the Indian smart home requirements under the Government of India programs, such as Digital India and Make in India.

- Further, growing theft and robberies in India drive the demand for smart door locks. A November 2023 report titled 'Live Safe, Live Free,' commissioned by Godrej Locks, revealed that more than two-thirds of respondents in five major cities, namely Mumbai, Delhi, Kolkata, Bhopal, and Bangalore, already employ smart locks to secure their homes. These cities were chosen based on their vulnerability, as highlighted in the National Crime Record Bureau's data.

- As technology advances, Australians increasingly turn to digital door locks as a secure and convenient solution for access control. With the growing popularity of smart home technologies, smart door locks have become essential to residential areas. The cost-effectiveness factor has contributed to the growing popularity of pin-based door locks in Australia. Other countries in the region also adopt pin-based access control systems, driven by the need to protect the property and data.

Pin-based Access Control Industry Overview

The pin-based access control market is fragmented, highly competitive, and consists of several players. Companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players are Johnson Controls, HID Global Corporation, Hangzhou Hikvision Digital Technology Co. Ltd, and Thales Group.

- February 2024: Hikvision introduced its latest line of professional access control solutions, marking a notable advancement in access management. These innovations encompass enhanced web management, a range of authentication methods, specialized access applications, and integrated security solutions. Notable products in this release include the DS-K1T805 and 502 series, known for their vandal-proof design, and they offer a variety of authentication options, including PIN codes, fingerprints, and mobile credentials.

- December 2023: SALTO introduced the DBolt Touch smart deadbolt, which provides an excellent solution for enhancing mechanical deadbolt locks in multi-family residential settings. The DBolt Touch offers a retrofit option and advanced smart locking capabilities. With a variety of access control methods, it ensures a seamless and convenient keyless experience. Additionally, the DBolt Touch smart keypad reader allows residents and visitors to access the property using a PIN-based entry system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 The Impact of Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Privacy and Security Concerns

- 5.2 Market Challenges

- 5.2.1 Integration of Biometrics

- 5.2.2 Easy Hacking of PINs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Banking and Financial Services

- 6.3.2 Government Services

- 6.3.3 Retail

- 6.3.4 IT and Telecommunications

- 6.3.5 Healthcare

- 6.3.6 Power and Utilities

- 6.3.7 Residential

- 6.3.8 Other End-user Industries

- 6.4 By Region

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls

- 7.1.2 Honeywell International Inc.

- 7.1.3 Bosch Security and Safety Systems

- 7.1.4 HID Global Corporation

- 7.1.5 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.6 Axis Communications AB

- 7.1.7 Avigilon Corporation

- 7.1.8 Napco Security Technologies Inc.

- 7.1.9 Thales Group

- 7.1.10 Dormakaba Group

- 7.1.11 Dahua Technology Co. Ltd

- 7.1.12 Anviz Global Inc.