|

市場調査レポート

商品コード

1851027

サービスとしてのネットワーク:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Network As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| サービスとしてのネットワーク:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月24日

発行: Mordor Intelligence

ページ情報: 英文 194 Pages

納期: 2~3営業日

|

概要

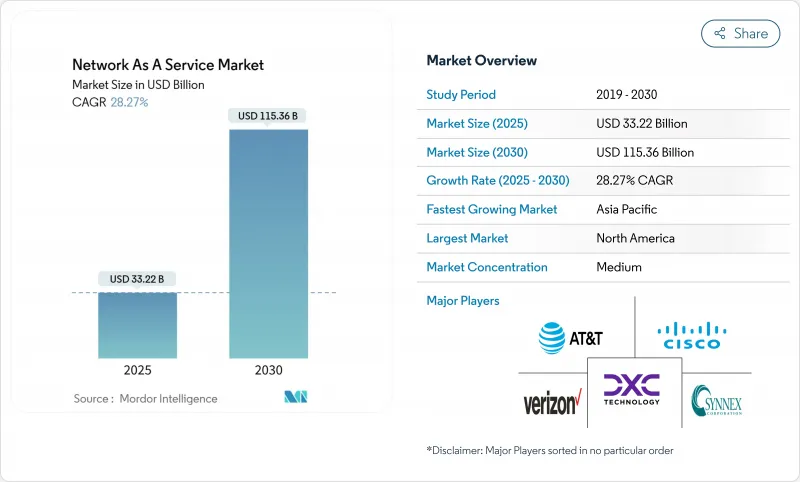

サービスとしてのネットワーク市場規模は、2025年に332億2,000万米ドル、2030年には1,153億6,000万米ドルに達すると予測され、期間中のCAGRは28.3%を記録します。

この拡大は、資本集約的なハードウェア所有から、運用予算と俊敏性のニーズを一致させる消費ベースのサービスモデルへの企業の決定的なシフトを反映しています。クラウドファーストの変革ロードマップ、SD-WANとSASEの急速な展開、平均修復時間を5分未満に短縮するAI主導のネットワーク保証エンジンによって、力強い勢いが生まれています。北米は堅調な企業のデジタル化と成熟したマネージドサービス・エコシステムによって優位性を維持しており、アジア太平洋は大規模な近代化プログラムと厳格なデータ主権義務に支えられて急成長を遂げています。レガシー機器ベンダーがサービス・ポートフォリオを中心に再配置し、通信キャリアがプライベート5Gスライシングを収益化するにつれ、競合の激しさは増しています。同時に、データレジデンシー規制、ベンダーの囲い込み懸念、IFRS第16号/ASC第842号の複雑な会計処理などが、短期的な採用の見通しを弱めています。

世界のサービスとしてのネットワーク市場動向と洞察

企業の「クラウドファースト」ネットワーク変革ロードマップ

企業がレガシー・ハードウェアを廃止し、インテント・ベースの自動化と統合セキュリティを実現するクラウドネイティブなソフトウェア定義プラットフォームを採用することで、近代化プログラムはインフラ消費を再定義しています。シスコによると、技術担当役員の91%は、AIとIoTワークロードを支えるためにネットワーキング予算を増額しており、統合NaaSフレームワークが迅速なイノベーションを実現するための望ましい道筋として浮上しています。単一の運用モデルの下で接続性、セキュリティ、可観測性を緊密に結合することで、迅速なプロビジョニング、ダウンタイムの短縮、マルチクラウドエステート間での一貫したポリシー適用が可能になります。その結果、ネットワーキングを減価償却する資産ではなく、弾力的なユーティリティに変えることで、俊敏性がサービスとしてのネットワーク市場を強化します。

サブスクリプション予算へのCapExからOpExへのシフト

IFRS第16号と会計基準編纂書第842号により、企業は貸借対照表上でリースを認識する必要があり、従来のハードウェア調達の経済性が複雑化します。消費ベースのネットワーキングは、企業が大規模な資本配分を回避し、キャッシュフロープロファイルを平準化し、更新サイクルを短縮するのに役立ち、CFO主導の変革イニシアティブの導入を促進します。また、毎月の支出を予測できるため、テクノロジー・ライフサイクルが加速した場合の財務リスクも軽減され、サブスクリプション・モデルは中堅市場の採用企業にとって特に魅力的です。

根強いデータ主権と居住コンプライアンス障壁

欧州データ法や中国のサイバーセキュリティ法などの地域的な義務付けは、現地での処理を要求し、国境を越えた移転制限を課しています。このような枠組みはグローバルなサービスの統一を複雑にし、プロバイダーは断片的なフットプリントの展開を余儀なくされるため、スケールメリットが希薄になり、調達サイクルが長くなり、規制分野におけるサービスとしてのネットワーク市場の成長が鈍化します。

セグメント分析

WAN-as-a-Serviceのサービスとしてのネットワーク市場規模は、2024年に151億米ドルに達し、売上高の45.5%を占めました。企業は、ハイブリッドワークやクラウドの導入をサポートする、弾力性のあるアプリケーション対応接続を優先しています。一方、Campus-Switch-as-a-Serviceは、2030年までCAGR 29.8%で拡大すると予測されており、これは高度な電力管理とRF最適化を必要とするWi-Fi 7の展開が後押ししています。

ベンダーは、スイッチング、アクセスポイント、保証ソフトウェアをサブスクリプション契約にバンドルすることで、中規模キャンパスにおける調達のハードルを下げています。将来的には、LAN-as-a-Serviceとデータセンター相互接続サービスが、キャンパス、WAN、クラウドのファブリックを統合契約することでシェアを拡大すると予想されます。単一プラットフォーム運用の推進により、サービスタイプの多様化がサービスとしてのネットワーク市場拡大の最前線に位置づけられると思われます。

仮想CPEは、2024年に42.8%のシェアを占める。これは、企業がハードウェアルータをホワイトボックス機器にホストされるソフトウェアイメージに置き換えるためです。接続性と脅威防御を融合させたSASEフレームワークへの信頼の高まりを反映し、統合ネットワークセキュリティ・アズ・ア・サービスはCAGR 29.3%と最も強い軌道を示します。

帯域幅オンデマンドとマネージドVPNは、季節的なワークロードに対応した動的な容量拡張と、低帯域幅サイトへのセキュアな接続を可能にする補完的な存在であり続ける。2030年までには、統合セキュリティが仮想CPEを追い越すと予想されます。この動向はサービスとしてのネットワーク市場規模の着実な拡大を支えており、コンプライアンス、DDoS防御、観測可能性を単一のSLAに組み込んだ多機能サービス層への支出を促しています。

地域分析

洗練されたクラウドエコシステム、SASEの早期導入、既存ベンダー内の機能を統合する活発な情勢を反映して、2024年には北米が35.4%のシェアを占める。HPEが計画しているジュニパーネットワークスの140億米ドル規模の買収は、ネットワーキングの収益貢献の倍増を意図しており、シスコの優位に課題するプラットフォームプレイを示唆しています。連邦および州のデータ・プライバシー規則が、社内にコンプライアンス・リソースを持たない企業によるマネージド・サービスの導入にさらに拍車をかける。

アジア太平洋地域は、2030年までのCAGRが28.9%に達する見込みです。これは、各国政府がデジタルインフラ構築に資金を提供し、通信事業者が産業キャンパス向けにプライベート5Gスライシングを商用化するためです。中国のデータローカライゼーション義務化は主権クラウドのNaaSモデルを促進し、インドの生産連動インセンティブ・プログラムは工場のデジタル化を刺激し、この地域の需要を後押ししています。

欧州では、厳しい規制にもかかわらず、依然としてビジネスチャンスが豊富です。来るべきデジタル・オペレーショナル・レジリエンス法(Digital Operational Resilience Act)は、銀行や保険会社を、監査対応レポートを組み込んだマネージド・コネクティビティへと向かわせる。サービス・プロバイダーは、GDPR、データ・アクト・ポータビリティ、新たなサイバー・レジリエンス・ベンチマークを満たすようにサービスを調整し、着実な普及を促しています。ラテンアメリカ、中東・アフリカはまだ始まったばかりだが、クラウドサービスの可用性が高まり、エネルギー価格の変動が予測可能なOpEx消費モデルへの意欲を高めるにつれて、牽引力を増しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 企業の「クラウドファースト」ネットワーク変革ロードマップ

- CapExからOpExへのサブスクリプション予算編成のシフト

- マネージドWANの刷新を加速するSD-WANとSASEの融合

- Wi-Fi 7の電力スパイクに対抗するキャンパスLANのNaaS需要

- AIによるネットワーク保証でMTTRを5分以下に短縮

- CSPが"as-a-service "で販売するプライベート5Gネットワークスライシング

- 市場抑制要因

- 根強いデータ主権と居住コンプライアンス障壁

- 独自のライフサイクル・プラットフォームをめぐるベンダーロックインの懸念

- IFRS第16号/ASC第842号の複雑なリース会計規則

- NaaSのTCOに影響を与えるエッジサイトの電力コスト変動

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済動向が市場に与える影響の評価

第5章 市場規模と成長予測

- タイプ別

- サービスとしてのLAN

- WANサービス

- キャンパス・スイッチ・アズ・ア・サービス

- データセンター・インターコネクト・アズ・ア・サービス

- 用途別

- バーチャルCPE(vCPE)

- オンデマンド帯域幅(BoD)

- 統合型ネットワーク・セキュリティ・アズ・ア・サービス

- 仮想プライベートネットワーク(VPN)

- 企業規模別

- 大企業

- 中小企業(SMEs)

- 業界別

- ITとテレコム

- BFSI

- ヘルスケア

- 製造業

- 小売とeコマース

- その他の業界別

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Cisco Systems Inc.

- Hewlett Packard Enterprise(Aruba/GreenLake)

- ATandT Inc.

- Verizon Communications Inc.

- IBM Corp.

- DXC Technology

- TD SYNNEX(Avnet)

- NEC Corp.

- Oracle Corp.

- GTT Communications

- VMware(Broadcom)

- Telstra Group

- Lumen Technologies

- Cato Networks

- Aryaka Networks

- Juniper Networks

- Nokia(Alcatel-Lucent Enterprise)

- Akamai Technologies

- Masergy(Comcast Business)

- Proofpoint/Meta Networks

- Extreme Networks

- Fortinet Inc.