|

|

市場調査レポート

商品コード

1837462

NaaS(Network-as-a-Service)市場:サービスタイプ、組織規模、業種別-2025年~2032年の世界予測Network-as-a-Service Market by Service Type, Organization Size, Industry Vertical - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| NaaS(Network-as-a-Service)市場:サービスタイプ、組織規模、業種別-2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

概要

NaaS(Network-as-a-Service)市場は、2032年までにCAGR 19.95%で462億1,000万米ドルの成長が予測されています。

| 主要市場の統計 | |

|---|---|

| 基準年 2024年 | 107億8,000万米ドル |

| 推定年 2025年 | 129億7,000万米ドル |

| 予測年 2032年 | 462億1,000万米ドル |

| CAGR(%) | 19.95% |

サービス中心のネットワーク提供モデルへの移行が、企業IT全体の調達基準、運用ガバナンス、アーキテクチャの優先順位をどのように再構築しているか

現代のネットワーク環境は、接続性、セキュリティ、管理の提供・利用方法を組織が再評価する中で、大きな変化を遂げつつあります。意思決定者は、従来型資本集約的なサイト中心の展開から、予測可能なサービスレベル、俊敏性の向上、ネットワーク機能とアプリケーションパフォーマンスの期待値との緊密な調整を実現する運用モデルへと移行しつつあります。この動きは、クラウドネイティブアプリケーション、分散型ワークフォース、ハイブリッド環境全体における確定的なユーザーエクスペリエンスの必要性の融合によってもたらされています。

企業はデジタル化の必要性を追求する中で、俊敏性、アップタイム、簡素化されたライフサイクル管理を重視しています。NaaS(Network-as-a-Service)の提案は、運用の複雑さを抽象化し、予測可能な経常費用モデルを可能にするため、反響を呼んでいます。利害関係者は、パフォーマンスをアプリケーションの可用性、トランザクションの待ち時間、セキュリティ体制などのビジネス指標に結びつける成果ベース契約にますます重点を置くようになっています。

その結果、調達チームとアーキテクチャチームは、サービスベースネットワーク調達に対応するために、ガバナンスモデル、ベンダー評価基準、運用準備計画を再構成しています。この進化する考え方は、ネットワークサービスをオーケストレーションプラットフォームやセキュリティフレームワークと統合する能力が戦略的優位性を決定する、よりダイナミック市場の舞台を設定します。

エッジコンピューティング、セキュリティファーストネットワーキング、オーケストレーション主導の自動化が合流することで、プログラマブルで成果にフォーカスしたネットワークサービスへの需要が加速しています

いくつかの変革的な力が、ネットワークエコシステムの競合と技術的な輪郭を再定義しつつあります。第一に、エッジコンピュートと分散アプリケーションアーキテクチャの普及により、決定論的な接続性とローカライズされたパフォーマンス管理の要件が生まれ、柔軟性とプログラマビリティが最新のネットワークソリューションに不可欠な特性となっています。第二に、ゼロトラストとセキュリティ中心のネットワーキングの加速により、後付けではなく、ネットワークサービスの一部として統合されたセキュリティ管理の需要が高まっています。

これと並行して、Software-Defined Networking、オーケストレーションAPI、インテントベース管理の進歩により、より迅速なサービスプロビジョニングと豊富な遠隔測定が可能になり、プロアクティブなパフォーマンス最適化と自動修復がサポートされています。これらの機能は、差別化されたNaaS(Network-as-a-Service)体験を提供しようとするプロバイダにとって重要な要素になりつつあります。さらに、商業モデルは成果とサービス保証を重視するように進化しており、プロバイダはより深いSLAと透明性の高いパフォーマンス測定基準を提供するよう求められています。

最後に、リモートワークの増加、マルチクラウドの採用、複雑な脅威に対するレジリエンスの必要性など、組織の変革は、相互運用性、ベンダーの柔軟性、モジュール化されたサービス設計を優先するよう企業に迫っています。これらのシフトが相まって、サービス主導型ネットワーキングの採用が加速し、競合があり、運用可能なサービス提供の構成要件が引き上げられつつあります。

2025年における関税主導の調達とサプライチェーンの力学は、ベンダーの多様化、契約の柔軟性、ハードウェアを軽視したサービスアーキテクチャへのシフトを即座に促しています

米国で2025年に向けて新たな関税措置が導入されたことで、ネットワークインフラとサービスのサプライチェーン全体で、調達戦略、サプライヤーの選択、総所有コストの計算が直ちに検討されるようになりました。関税に起因する投入コストの上昇により、一部のプロバイダは調達決定を再検討し、サプライヤーとの契約を再交渉し、オファリングのハードウェア依存要素への影響を緩和するために納期を調整するよう促されました。

実際、このような環境は、プロバイダに、ハードウェアに大きく依存したアーキテクチャから、地政学的なサプライチェーンの制約を受けずに提供できるソフトウェア定義の仮想化展開へのシフトを加速させることを促しています。バイヤーは、弾力的な調達戦略、多様な製造拠点、貿易措置が価格設定や納品確約にどのように影響するかを明確にする透明性の高いパススルー・施策を持つベンダーを優先することで対応しています。

加えて、関税は、投入コストの変動を管理し、代替履行チャネルの選択肢を拡大する条項を含む、契約の柔軟性への関心を高めています。オペレーションの観点からは、企業はベンダーのリスク管理プロセスを強化し、コンティンジェンシープランニングを拡大し、エクスポージャーを減らすためにマルチソーシングアプローチを模索しています。その結果、関税関連の力学は、より長期的なサプライチェーンの近代化と、物理的ハードウェアへの依存を減らすサービスモデルの採用の触媒として作用しています。

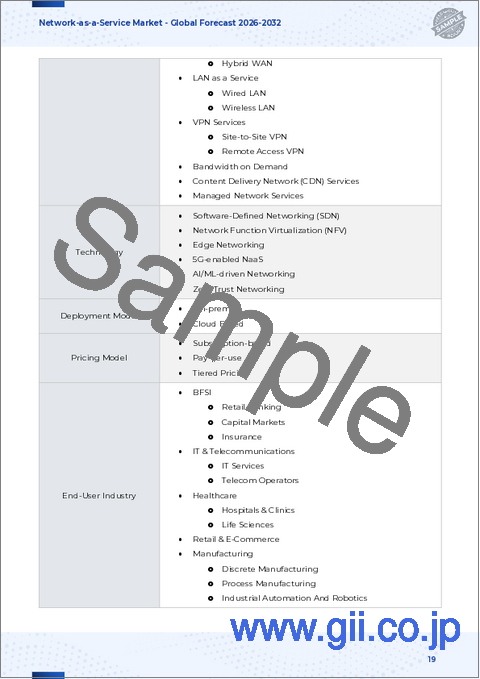

サービスタイプ、企業規模、業種にまたがるセグメントによる必須事項により、調達のきっかけや技術設計の優先順位が異なっていることが明らかになった

ニュアンスに富んだセグメンテーションアプローチにより、サービスタイプ、企業規模、業種によって異なる需要パターンと調達の優先順位が明らかになります。サービスタイプ別に評価すると、企業の中核的なニーズとしてLAN-as-a-ServiceとWAN-as-a-Serviceに注目が集まる一方、ネットワーク接続サービスでは、ブロードバンド、イーサネット、MPLSのオプションに注目が集まり、キャリアのエコシステムと調整する必要があります。同時に、モニタリングサービス、パフォーマンス最適化、セキュリティ管理から成るネットワーク管理サービスは、オプションのアドオンではなく、統合された機能として評価されるようになっており、ベンダーの選択やマネージドサービスの設計に影響を与えています。

組織の規模によって、採用の動きは異なります。大企業では、一元的なガバナンス、マルチサイトのオーケストレーション、厳格なセキュリティ管理を重視する統合型のグローバルサービス体制を追求することが多いのに対し、中小企業では、迅速な導入、コスト効率、社内運用のオーバーヘッドを最小限に抑える簡素化された管理を優先する傾向があります。このような優先順位の違いが、プロバイダの製品化戦略や価格設定を左右します。

産業別要件もまた、重要な形で形成されています。銀行、金融サービス、保険などのセグメントでは、低遅延のトランザクション接続とともに、厳格なコンプライアンスと監査機能が求められます。エネルギーや公益事業では、運用技術環境の回復力と決定論的な通信が重視されます。政府機関は、強固なセキュリティと長い調達サイクルを要求し、ヘルスケアは、プライバシーと患者ケア提供用アプリケーションの可用性を重視します。IT・通信企業は高度プログラマビリティとAPIの公開を期待し、製造業は産業制御システム用予測可能な接続性を求め、小売業はPOSとオムニチャネル体験をサポートする安全でスケーラブルな接続性に重点を置いています。これらのセグメンテーションは、技術的特徴、商業モデル、期待されるサービスレベルを顧客固有のニーズに合わせて提案するためのフレームワークとなります。

地域市場力学、規制の複雑さ、インフラの成熟度が、どのように差別化された導入チャネルとプロバイダのGo-to-Market戦略を形成するか

地域ダイナミックスは、ネットワークサービスの導入チャネル、ベンダー戦略、規制上の考慮事項に大きく影響します。南北アメリカでは、迅速な技術革新の導入、広範なクラウド統合、メトロとエンタープライズフットプリントにわたる競合接続オプションが重視されることが多く、多様な商業モデルとパートナーシップエコシステムを支えています。この地域で事業を展開する企業は、俊敏性と規模を優先する傾向があり、強力なAPI統合と測定可能なパフォーマンス・コミットメントを提供するプロバイダを求めます。

欧州、中東・アフリカでは、規制の枠組み、レガシーインフラのばらつき、地政学的な敏感さが複雑さをもたらし、現地での存在感が強く、コンプライアンスに精通したプロバイダへの採用を促しています。これらの市場のバイヤーは、包括的なセキュリティ管理とデータレジデンシーの保証を求めることが多く、ベンダーのローカライズ戦略やマネージドサービスアーキテクチャに影響を与えています。既存の通信事業者ネットワークとの相互運用性と、複数国への展開をサポートする能力は、重要な差別化要因です。

アジア太平洋は、洗練されたデジタルエコシステムを持つ大都市市場と、モバイルファーストとブロードバンド拡大が優先課題である急成長経済圏が混在しているのが特徴です。この地域では、サービスベンダーは、堅牢なエッジ接続と地域のクラウドハブへの低遅延アクセスを必要とするデジタルトランスフォーメーションのイニシアチブをサポートする必要性と価格感度のバランスを取る必要があります。どの地域においても、戦略的パートナーシップ、地域に根ざしたサポートモデル、規制の変化に対応する能力は、サプライヤーにとって重要な成功要因です。

なぜ差別化には、オーケストレーションの深さ、弾力性のあるパートナーエコシステム、卓越したオペレーションが必要なのか?

NaaS(Network-as-a-Service)の競合情勢は、技術的な深みと商業的な柔軟性、強固な運用手法を融合させるプロバイダの能力にかかってきています。大手プロバイダは、オーケストレーションプラットフォーム、テレメトリ豊富な管理コンソール、統合セキュリティスタックへの投資を優先し、明確なサービス差別化と迅速なオンボーディングを可能にしています。これらの機能は、サービス提供までの時間を短縮し、企業のガバナンス要件に沿った透明性の高いパフォーマンス洞察を記載しています。

包括的なエンドツーエンドのソリューションを提供するため、プロバイダはクラウドプラットフォーム、マネージドサービスパートナー、地域の通信事業者間で提携を結んでいます。このような連携により、プロバイダは地理的なリーチを拡大し、耐障害性を高めると同時に、エッジ接続、産業固有のコンプライアンスモジュール、垂直化されたマネージドサービスなど、対象とする顧客層にアピールする専門的な機能を提供できるようになります。

オペレーショナル・エクセレンスは、依然として重要な競争テコです。成熟したサービス保証プラクティス、プロアクティブサポートモデル、明確なエスカレーションパスウェイを通じて、一貫した予測可能なサービスデリバリーを実証する企業は、企業の購買層から信頼を得ています。成果ベース取り決めや柔軟な利用モデルを反映した価格革新は、予測可能性とビジネスニーズの変化に応じてサービスを拡大する俊敏性の両方を買い手が求める市場において、ベンダーをさらに際立たせる。

プロバイダと企業バイヤーが採用を加速し、供給リスクを軽減し、測定可能なビジネス成果を実証するため、実践的で優先順位の高い戦略的アクション

産業リーダーは、市場力学を競争優位と顧客価値に転換するために、一連の現実的な行動を優先すべきです。第一に、専用ハードウェアへの依存を最小化し、継続的統合と展開の実践を通じて迅速な機能提供を可能にする、モジュール型のソフトウェア主導アーキテクチャに投資することです。このアプローチは、サプライチェーンの露出を減らすだけでなく、差別化されたサービスイノベーションを促進します。

第二に、透明性の高いサービスレベルのフレームワークと、技術的指標をビジネス成果にマッピングする遠隔測定機能を構築します。レイテンシー、スループット、セキュリティイベントに対する明確でリアルタイムの可視化により、顧客は十分な情報に基づいた意思決定を行うことができ、成果ベース商業モデルをサポートすることができます。第三に、クラウドプロバイダ、地域通信事業者、マネージドサービスパートナーとの戦略的提携を拡大し、リーチを拡大するとともに、特定の産業のニーズに対応するバンドルサービスを構築します。

第四に、地政学的・関税的な混乱に柔軟に対応できるよう契約条件を改善し、サービスの継続性を維持するためにベンダーのリスク管理プロセスを強化します。最後に、カスタマーサクセスとプロフェッショナルサービスに投資することで、技術的能力を運用準備に反映させています。的を絞ったオンボーディング、ランブック、トレーニングプログラムは、導入を加速し、契約初期の段階で具体的な価値を実証します。このような行動を総称して、レジリエンスを強化し、調達における摩擦を減らし、混雑した市場で説得力のある差別化を実現します。

技術評価、実務家インタビュー、相互検証されたエビデンスを統合した厳格な混合手法のアプローチにより、実用的で意思決定に即応した洞察を導き出します

本調査手法は、質的な洞察と複数の領域から得られた一次調査と二次調査を組み合わせることで、堅牢性と妥当性を確保するように設計された構造化手法に従っています。このアプローチでは、まず最近の技術動向、規制当局の発表、プロバイダの公開情報を徹底的に調査し、市場促進要因とソリューションアーキテクチャの基本的理解を確立します。この基盤の上に、シニアITアーキテクト、調達リーダー、ソリューションプロバイダへの一次インタビューを行い、採用促進要因、運用上の課題、商業的嗜好に関する文脈的な視点を記載しています。

アナリストの総合評価では、オーケストレーションプラットフォーム、セキュリティ統合パターン、サービス保証プラクティスの技術的評価を、調達サイクルや運用準備などの購入者中心の基準と統合しています。一貫性のあるテーマを特定し、異なる視点を浮き彫りにするために、インタビュー結果を広範な公開情報源やベンダー資料と照合することで相互検証を行っています。終始、ベンダーのランキングはスコアベースではなく、実用的な洞察に重点が置かれ、データ源や分析上の仮定に関する透明性が確保されています。

最後に、経験豊富な実務家による反復的なピアレビューにより、調査結果が実用的で、現在の実務に根ざしており、ネットワーク戦略をより広範なデジタルトランスフォーメーションの目標と整合させようとする意思決定者にとって有用であることが保証されます。

サービス指向のネットワーク近代化を実現するために、アーキテクチャの選択、調達プラクティス、ベンダー選定を調整する統合的な意味合いと戦略的優先事項

概要をまとめると、ネットワーク消費の軌跡は、俊敏性、測定可能な成果、運用の複雑性の軽減を優先するサービス中心モデルに向かっていることは間違いないです。エッジコンピューティング、統合セキュリティ、オーケストレーション主導の自動化が相互に作用することで、買い手の期待は再構築され、迅速なプロビジョニング、透過的なパフォーマンス測定、地域横断的な回復力のある配信を可能にするベンダー機能の重要性が高まっています。

関税の変更やサプライチェーンの不安定性といった外部からの圧力は、ハードウェア軽量アーキテクチャの採用や調達先の多様化といったプロバイダ戦略を加速させており、調達基準や契約設計にも影響を及ぼしています。サービスタイプ、組織規模、業種別にセグメント化することで、差別化された技術要件や調達行動を反映した、カスタマイズ型提案の必要性が浮き彫りになります。地域による違いは、地域による専門知識と規制との整合性の必要性をさらに高めています。

最終的には、モジュール型アーキテクチャー、成果整合SLA、透明性の高い遠隔測定、強力なパートナーエコシステムを優先する組織が、運用リスクを最小限に抑えながらNaaS(Network-as-a-Service)のメリットを実現する上で最も有利な立場になると考えられます。これらの優先事項は、短期的な調達決定と長期的なネットワーク近代化ロードマップに反映されるべきです。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

第5章 市場洞察

- NaaSプラットフォーム内での自動ネットワーク最適化と自己修復用AIの統合

- 超低遅延エンタープライズ向けのエッジコンピューティングと5G対応NaaSの採用

- 分散型NaaSインフラ全体にわたるゼロトラストセキュリティフレームワークの実装

- NaaSサービスにおける消費ベース価格設定モデルと動的帯域幅スケーリングへの移行

- 仮想化とコンテナ化の技術を使用して、アジャイルなNaaSの展開とオーケストレーションを実現します。

- マルチクラウドNaaS接続用サービスプロバイダとクラウドハイパースケーラー間の連携の強化

- 次世代NaaSソリューションにおけるエネルギー効率の高いネットワークアーキテクチャによる持続可能性の重視

第6章 米国の関税の累積的な影響、2025年

第7章 AIの累積的影響、2025年

第8章 NaaS(Network-as-a-Service)市場:サービスタイプ別

- LANaaS(LAN-as-a-Service)

- ネットワーク接続サービス

- ブロードバンド

- イーサネット

- MPLS

- ネットワーク管理サービス

- モニタリングサービス

- パフォーマンス最適化

- セキュリティ管理

- WANaaS(WAN-as-a-Service)

第9章 NaaS(Network-as-a-Service)市場:組織規模別

- 大企業

- 中小企業

第10章 NaaS(Network-as-a-Service)市場:産業別

- 銀行金融サービスと保険

- エネルギーと公益事業

- 政府

- ヘルスケア

- ITと通信

- 製造業

- 小売

第11章 NaaS(Network-as-a-Service)市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋

第12章 NaaS(Network-as-a-Service)市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第13章 NaaS(Network-as-a-Service)市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第14章 競合情勢

- 市場シェア分析、2024年

- FPNVポジショニングマトリックス、2024年

- 競合分析

- Cisco Systems, Inc.

- Nokia Corporation

- Cloudflare, Inc.

- Juniper Networks, Inc.

- AT&T Inc.

- Verizon Communications Inc.

- Aryaka Networks, Inc.

- Megaport Limited

- PacketFabric, Inc.

- Tata Communications Limited

- Lumen Technologies