|

市場調査レポート

商品コード

1907229

メチレンジフェニルジイソシアネート(MDI):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| メチレンジフェニルジイソシアネート(MDI):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

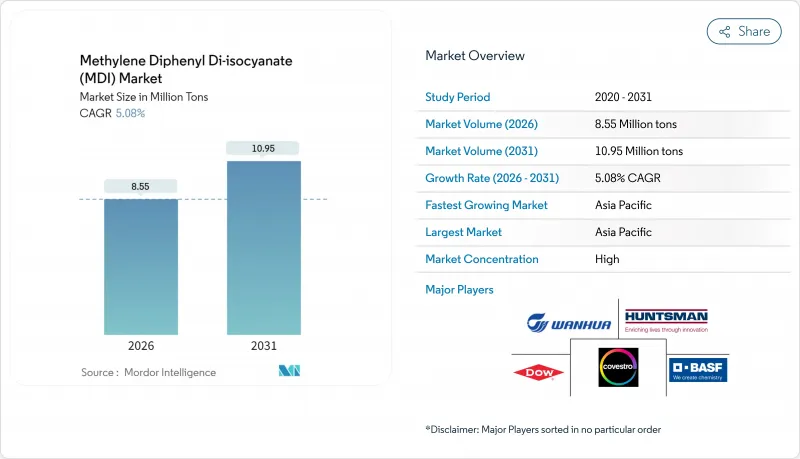

メチレンジフェニルジイソシアネート(MDI)市場は、2025年の814万トンから2026年には855万トンへ成長し、2026年から2031年にかけてCAGR5.08%で推移し、2031年までに1,095万トンに達すると予測されております。

アジア太平洋地域におけるコスト競争力のある供給拡大と、北米・欧州全域でのネットゼロ建築規制および家電効率基準の導入が、この成長軌道を支えています。業界リーダー企業は顧客ロイヤルティ維持のため、バイオ循環型およびマスバランス型グレードの拡大を進めており、一方、ホスゲンフリーのパイロットラインは長期的なプロセス変革を示唆しています。原料価格の変動(2025年にはアニリンが前年比36.81%下落)が利益率の変動要因となる一方、統合生産者はより強固な緩衝機能を有しています。労働者曝露規制の強化と新規プラントの資本集約性により、競争上の優位性は維持され、技術力に優れた既存企業を中心とした業界再編が加速しています。

世界の・メチレンジフェニルジイソシアネート(MDI)市場の動向と展望

ネットゼロビルによるPU断熱材需要の急増

EUの「建築物のエネルギー性能指令」により、加盟国は2030年までに3兆5,000億ユーロ(3兆8,000億米ドル)のエネルギー効率化投資が義務付けられています。新築建物はほぼゼロエネルギー目標を達成する必要があり、既存建物には熱伝導率0.022 W/m*Kまでの硬質ポリウレタンパネルを推奨する大規模改修が義務付けられています。カリフォルニア州の2025年建築基準における同等の規制が、北米でも同様の需要創出を促進しています。ビルオートメーション仕様は、高度な制御システムがより厳密な断熱性能を要求するため、MDI消費量をさらに押し上げます。規制と性能の相乗効果により、硬質フォームはMDI市場で最も成長率の高い分野として確固たる地位を築いています。

食品・医薬品向けコールドチェーン設備の拡充

パンデミック後のワクチン物流は温度逸脱のコストを浮き彫りにし、医薬品サプライチェーンを超低温貯蔵へ転換させました。インドの補助金を伴うコールドチェーン計画では、-80℃の断熱性能を有するポリウレタンシステムに依存する新規倉庫が追加されます。都市生活様式の変化に牽引される並行した食品コールドチェーンは、ASEANおよびラテンアメリカ全域で冷蔵輸送と小売ケースの高級化を促進します。高性能仕様により、プレミアムMDIグレードの利益率が向上し、原材料価格の上昇の中でも販売量の回復力が強化されています。

ジイソシアネート類の労働者曝露限界値厳格化

EUは職場曝露を6µg NCO/m3に制限し、全取扱者への認定訓練を義務付けました。OSHAもこれに追随しています。規制順守のため、換気設備、モニタリング、医療監視への投資が求められ、スプレーフォーム施工業者や小型家電ラインの固定費が増加しています。この負担は、資本力のある加工業者への市場集約を加速させ、価格プレミアムが得られるが配合ノウハウを要する低モノマーまたはプレポリマーソリューションへの需要を偏らせています。

セグメント分析

硬質フォームは2025年のMDI市場規模の36.78%を占め、2031年までCAGR5.63%で拡大が見込まれます。このカテゴリーは、クラス最高の0.022 W/m*Kの熱伝導率を実現するポリイソシアヌレートパネルの恩恵を受け、住宅・商業建築におけるネットゼロ基準への適合を可能にしています。軟質フォームは寝具や自動車シート分野で需要を維持していますが、成熟度の高さから成長余地は限定的です。コーティングおよびエラストマーは、産業用メンテナンスや資材運搬用途からの継続的な需要を確保し、ベースラインの生産量を支えています。新興用途としては、熱サイクル下での寸法安定性が求められるEVバッテリー封止材があり、MDI化学の汎用性を示しています。屋根改修やカーテンウォールシステムにおける硬質フォームの採用拡大は、MDI市場内での継続的な優位性をほぼ確実なものとしています。

世界的に建築基準が厳格化する中、保険会社や金融機関は最小断熱性能値(R値)を規定しており、薄肉壁構造でこれを実現可能なのは硬質ポリウレタンまたはPIR製品のみです。レティセル社の「ユーロウォール・インパクト」ボードは25%のバイオ循環素材含有率を実現し、断熱性能を損なうことなく製造時のCO2排出量を43%削減しました。接着剤およびシーラントは、自動車やインフラ修理分野におけるニッチながら収益性の高いサブセグメントを形成しており、MDIは速硬化性と構造接着性を付与します。特殊エラストマーは鉱山用スクリーンや産業用ホイールで重要な役割を担い、安定したアフターマーケット収益を生み出しています。これらのサブセグメントが総合的に、硬質フォームをMDI市場の長期成長の要としています。

メチレンジフェニルジイソシアネート(MDI)市場レポートは、用途別(硬質フォーム、軟質フォーム、コーティング、エラストマー、接着剤・シーラント、その他)、エンドユーザー産業別(建設、家具・インテリア、電子機器・家電、自動車、履物、その他)、地域別(アジア太平洋、北米、欧州、南米、中東・アフリカ)に分析されています。

地域別分析

アジア太平洋地域は2025年にMDI市場の46.35%を占め、2031年まで地域をリードする5.90%のCAGRで拡大すると予測されています。中国のグリーンビルディング基準とインフラブームが膨大な硬質発泡体の需要を吸収する一方、インドのワクチン物流推進策が冷蔵貯蔵能力の拡大を促しています。クムホ・ミツイ化学工業株式会社による20万キロトンの増産計画(麗水(ヨス)複合施設の生産能力を61万キロトンに引き上げるボトルネック解消)などの拡張プロジェクトが、現地供給を支えています。

北米市場は、改修インセンティブや高性能住宅を優遇するセクション45L税額控除により重要性を維持しています。特にコベストロ社がカーライル・コンストラクション・マテリアルズ社に供給するバイオ循環型MDIは、化石由来グレードと比較して上流工程の炭素排出量を99%削減します。また、現地家電メーカーは2025年エネルギー規制対応のため高密度フォームを指定しており、安定した基盤需要を支えています。

欧州の政策主導により、有機的成長を上回る合成需要が創出されています。欧州建物のエネルギー性能指令(EPBD)が掲げる3兆5,000億ユーロ規模の改修計画は硬質フォームの採用を加速させ、6マイクログラムの曝露上限は配合メーカーに低モノマー変種への移行を促しています。生産者の焦点は循環型経済と合致しており、BASFは上海合弁事業を分離し、190万トンの世界のMDIネットワークを最適化。これによりマスバランス生産のための資産を解放しました。一方、中東・アフリカ地域では、物流パークや気候制御農業を背景に追い上げ成長が見られますが、製品の多くは依然として欧州・アジアからの輸入に依存しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ネットゼロビルディングからのPU断熱材需要の急増

- 食品・医薬品向けコールドチェーン能力の拡充

- HVAC効率規制が家電用発泡剤を後押し

- EVパックにおけるバッテリー熱管理フォームの台頭

- 循環型経済推進によるマスバランス/ISCC-Plus MDI

- 市場抑制要因

- ジイソシアネート類の労働者曝露限界値の厳格化

- 原油価格の変動がアニリン原料に影響を与える

- ホスゲン化プラントの高い資本集約度

- バリューチェーン分析

- 規制政策分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替製品・サービスの脅威

- 競合の程度

- 生産プロセス分析

- 技術ライセンシング及び特許分析

- 価格動向シナリオ

第5章 市場規模と成長予測

- 用途別

- 硬質フォーム

- 軟質フォーム

- コーティング

- エラストマー

- 接着剤およびシーラント

- その他

- エンドユーザー業界別

- 建設

- 家具・インテリア

- 家電製品

- 自動車

- フットウェア

- その他

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua