|

市場調査レポート

商品コード

1640417

コントロールバルブ:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Control Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コントロールバルブ:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

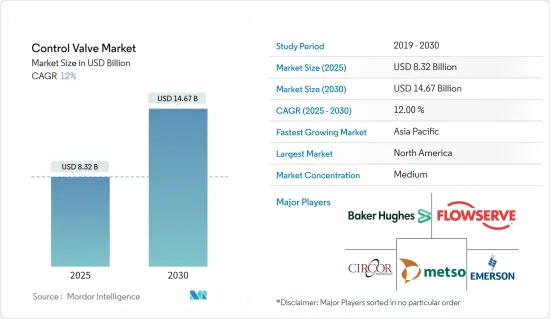

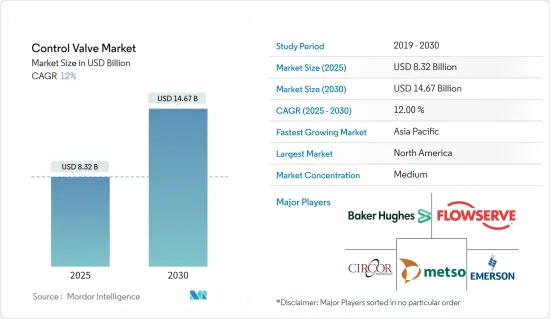

コントロールバルブ市場規模は2025年に83億2,000万米ドルと推計され、予測期間中(2025-2030年)のCAGRは12%で、2030年には146億7,000万米ドルに達すると予測されています。

予測期間中、パイプラインやインフラ拡張への投資が増加し、いくつかの産業で自動化の導入が進むことで、コントロールバルブの需要が高まると予測されています。

主なハイライト

- コントロールバルブは、コントローラーからの信号に応じて流路のサイズを調整することで、流体の流れを調整するために利用される装置です。これにより、正確な流量管理と、それに続く圧力、温度、液面などのプロセス変数の調節が容易になり、石油・ガス、水管理、発電、飲食品、自動車などの産業で極めて重要です。通常、リニアとロータリーの2種類のコントロールバルブが様々な産業で採用されており、優れた効率性と安全性を提供しています。

- コントロールバルブは、電気、空気、油圧の手段で操作することができます。プログラマブルロジックコントローラー(PLC)などのコントローラーから信号を受け、動きを開始し、結果として流れを変えます。PLCであろうと分散型制御システム(DCS)であろうと、コントローラは現在の流量を所望の設定値と比較します。その後、コントローラーはバルブを調整し、所望の流量を達成するための出力を生成します。

- 技術の進歩は、オペレーションを合理化することでプロセスプラントの効率を高める革新的なソリューションの形成に重要な役割を果たしてきました。業界の要求が進化し続ける中、コントロールバルブとバルブオートメーションソリューションのサプライヤーは、これらの新たな課題に対応する製品とプロセスを開発することが期待されています。コントロールバルブ市場は、様々なプロセス産業における自動化の増加、石油・ガスセクターにおける投資の増加、高出力要件によって、今後数年間で成長すると予想されています。

- コントロールバルブ市場の成長は、多様なプラントの機器を監視するための無線インフラへの要求の高まり、自動化への重点の高まり、プロセス産業の事業所数の増加など、いくつかの要因によって推進されています。市場の需要に応えて、多くのサイクルと高温に耐える能力を持つコントロールバルブが開発されています。さらに、代替エネルギー源、特に再生可能エネルギーへの投資が重視されるようになったことで、コントロールバルブに新たな機会と潜在的な用途が生まれました。例えば、IEAは世界のエネルギー投資の70%が再生可能エネルギーに向けられると予測しています。

- 産業オートメーションの導入が進み、スマートコントロールバルブの使用が促進されるため、市場成長は予測期間中にさらに押し上げられると予想されます。コントロールバルブの需要は、世界の発電所数の増加や新興経済諸国からのエネルギーや電力に対するニーズの高まりが原動力となっています。これらのバルブは原子力発電所でも利用されており、特に化学治療、給水、冷却水、蒸気タービン制御システムで利用されています。

- 原材料価格の変動は、コントロールバルブ市場の成長を大きく妨げます。原材料のコストは、コントロールバルブの価格を決定する上で重要な役割を果たしており、原材料価格の上昇は、利益率を低下させる可能性があるため、ベンダーにとって大きな課題となります。銅、ステンレス鋼、鋳鉄、アルミニウム、真鍮、青銅が、調節弁の製造に使用される主な原材料です。標準化された認証や政府の政策がないことが市場成長の抑制要因になると予想されます。

コントロールバルブ市場の動向

石油・ガスセグメントが市場を牽引する見込み

- 石油・ガス分野では、配管システムに不可欠なバルブが重要な役割を果たしています。バルブの主な機能には、機器の隔離と保護、流量制御、原油精製プロセスの誘導と指示が含まれます。これらのバルブは、コントローラーの電気信号、油圧信号、空気圧信号によって流量、温度、圧力を調整するように設計されています。その自動運転は遠隔操作を可能にし、オペレーターによる常時監視と調整の必要性を排除します。

- コントロールバルブは、流量、圧力、温度を調整する能力があるため、石油・ガス分野で人気を集めています。これらのバルブは、油圧、空気圧、または電気コントローラーからの信号に基づいて流路サイズを調整し、遠隔操作を可能にします。さらに、特に石油・ガスセクターにおける流体処理技術への投資の増加が、コントロールバルブ市場の成長に大きく寄与しています。

- 石油・ガスセクターにおけるデジタル化と自動化への傾斜の高まりは、コントロールバルブの必要性を高めています。その結果、コントロールバルブメーカーは、エンドユーザー業界の需要に合わせて製品を開発・強化する研究開発に取り組んでいます。中東・アフリカ、中国、北米のような地域で石油・ガス探査事業の数が増加していることは、市場の成長を大幅に強化すると予測されています。

- 2023年6月、ノルウェーは、ノルウェー大陸棚における19の石油・ガス事業の承認を宣言し、投資総額は190億米ドルを超えました。これらのプロジェクトには、新規開発、既存鉱区の拡大、既存鉱区での採掘増強プロジェクトへの投資が含まれます。ウクライナ紛争は、これまでロシアに依存していた欧州諸国が代替エネルギー源を求めたため、ノルウェーの収益を増大させました。その結果、石油・ガスセクターの自立を強化するための欧州連合における大規模な投資は、コントロールバルブのビジネスチャンスを拡大することになります。

- 石油・ガスセクターはコントロールバルブに依存しており、その利用にとって極めて重要なセクターとなっています。新しい石油・ガス探査プロジェクト、輸送パイプライン構想、メンテナンス作業により、コントロールバルブは世界的に高い需要があります。

- 国際エネルギー機関(IEA)によると、石油・ガス・石炭などの化石燃料の世界需要は2030年までに前例のないピークに達すると予測されています。この急増は、世界のエネルギー政策の進化、ソーラーパネルや電気自動車などのクリーン技術の急速な進歩、ヒートポンプの採用拡大、ロシアのウクライナ侵攻に伴う欧州でのガスからの強制的な移行などが原因となっています。さらに、この分野では自動化技術の高まりが市場成長を大きく促進すると予想されています。

- 石油・ガスの流通量の増加に伴い、陸上用途のコントロールバルブの需要は増加すると予想されています。例えば、EIAによると、2025年には世界の原油生産量の28%は洋上由来となり、残りの72%は陸上で採掘されると予測されています。

- 2024年2月現在、同地域には296基の陸上リグがあり、さらに中東のオフショアには53基、アフリカのオフショアには16基の陸上リグが95基設置されています。こうした特筆すべき能力と石油・ガス産業の成長予測は、間違いなく市場に大きな展望をもたらすと思われます。

北米が大きな市場シェアを占める見込み

- 北米は、コントロールバルブにとって世界で最も重要な市場の一つです。米国とカナダでは、石油・ガス、電力、食品・包装、化学など様々な産業から莫大な需要があります。急速な産業オートメーション化に伴い、この地域がコントロールバルブのニーズの先陣を切ると予想されています。

- これらの国々における急速な工業化と輸送部門の成長は、石油・ガスの需要を増加させると予想されます。また、増え続ける人口に飲料水を供給する必要性から、海水淡水化プラントの設置が進み、コントロールバルブの需要がさらに高まっています。廃棄物及び廃水管理もまた、将来の需要を牽引すると予想される重要な分野です。

- 米国はカナダに比べ、この地域の需要増加において重要な役割を果たしています。ほぼ全てのエンドユーザー・セグメントからの需要が増加しており、特に石油・ガス、精製、発電セグメントからの需要が増加しています。石油・ガス、再生可能エネルギー、上下水道処理といった同国の主要産業は、中央制御ステーションを通じて調整される高度な監視技術と連携するため、組み込みプロセッサとネットワーク機能を備えたバルブ技術へと移行しています。

- 米国では石油生産が大幅に拡大しています。同国の著名な石油生産者であるエクソンモービルは、2024年までに石油換算で日量100万バレル(bpd)以上の生産を目標に、テキサス州西部のパーミアン盆地での生産活動を増強する意向を発表しました。これは、現在の生産能力と比べて約80%の増加に相当します。シェブロンは、石油換算の純生産量を2020年までに60万B/D、2023年までに90万B/Dまで増加させると予測しました。

- 北米におけるシェールオイルブームは、流体処理装置と部品、特にコントロールバルブに対する大きなニーズを生み出しました。これらのバルブは、シェールオイルの探査と生産プロセスを調整し、パイプラインを通じてシェールオイルを円滑に輸送するために重要な役割を果たしています。新たな石油・ガス上流探査プロジェクトの開始は、石油・ガス産業におけるコントロールバルブの需要を促進すると予想されています。

- 米国では、新しいシェールオイル・プロジェクトの開発には、シェールオイルを輸送するための追加パイプラインの建設が必要です。ベーカー・ヒューズ社によると、北米は現在、石油・ガスのリグ数で世界一を誇っています。2023年5月現在、この地域には合計776の陸上リグがあり、さらに22のリグが沖合に位置しています。石油・ガスのリグ数は2022年後半に急増したが、これはロシアの輸出制裁が徐々に影響し、北米での探査活動が活発化したためです。

- 同地域では、再生可能エネルギーへの取り組みが重視され、太陽熱エネルギー施設の数が急増したため、コントロールバルブの利用が急増しました。この地域は、風力、太陽光、地熱、水力、バイオマス資源が豊富です。再生可能エネルギー・プロジェクトに対する需要は、豊富な資金調達機会と高度に熟練した労働力によって煽られています。

- 上下水道産業は、水の治療と清浄度に関する規制がますます厳しくなっているため、流体処理技術の重要な消費者です。この地域の上下水道産業への投資の増加は、大きな市場成長機会を提供すると期待されています。

コントロールバルブ業界の概要

コントロールバルブ市場は、世界プレーヤーと中小企業の両方が存在するため、非常に断片化されています。同市場の主要プレイヤーには、Emerson Electric Co.、Flowserve Corporation、Baker Hughes Company、Metso Corporation、CIRCOR International Inc.などがいます。市場のプレーヤーは、製品ラインナップを強化し、持続可能な競争優位性を獲得するために、提携や買収などの戦略を採用しています。

- 2024年2月エマソンは、産業用アプリケーションに設置されるバルブを変革し、エンドユーザーと対話する革新的なソリューションを世界にリリースしました。エンドユーザーは、コントロールバルブの性能を把握し、問題があれば対処し、メンテナンスを減らすなどしてバルブの性能全般を向上させる必要があります。フィッシャー(TM)フィールドビュー(TM)DVC7Kデジタルバルブコントローラは、最適化されたアクションへのパスを作成することで、これらの問題やその他の問題に対処します。

- 2023年10月アンドリッツは、フローサーブ社とNAF ABバルブ事業を買収する契約を締結。納入される生産工場と設備には、長年にわたってNAFコントロールバルブが装備されています。この買収により、アンドリッツのプロセス制御分野における製品・サービスポートフォリオがさらに拡大・強化されました。

- 2023年5月エマソンは、特別に設計された省スペース構造で、比類のない精度、定格圧力、流量特性、エネルギー効率を誇る比例流量コントロールバルブASCOシリーズ209を発表。このバルブは、最適なサイズと卓越した性能により、医療機器、飲食品、HVAC産業など、きめ細かな性能が要求されるさまざまな装置で流体の流れを正確に調整できます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 業界のサプライチェーン分析

- 市場促進要因

- 新興市場における電力と上下水道重視の高まり

- 競争力維持のための環境問題と老朽インフラ改修に対するエンドユーザーの注目

- 市場の課題

- 競争力維持のため、エンドユーザーは環境問題と老朽インフラ改修に注力

- 石油価格のダイナミックな変動がプロジェクト全体の支出に影響を及ぼすと予想されます。

- 市場機会

第6章 市場セグメンテーション

- タイプ別

- グローブ

- ボール

- バタフライ

- プラグ

- ダイヤフラム

- その他のバルブ

- エンドユーザー産業別

- 石油・ガス

- 化学、石油化学、肥料

- エネルギー・電力

- 上下水道治療

- 金属・鉱業

- その他エンドユーザー産業(飲食品、製薬、パルプ・製紙など)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- アジア

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes Company

- Metso Corporation

- CIRCOR International Inc.

- IMI PLC

- Christian Burkert GmbH & Co. KG

- GEA Group Aktiengesellschaft

- Neway Valve(Suzhou)Co. Ltd

第8章 投資分析

第9章 今後の動向

The Control Valve Market size is estimated at USD 8.32 billion in 2025, and is expected to reach USD 14.67 billion by 2030, at a CAGR of 12% during the forecast period (2025-2030).

Over the forecast period, increasing investments in pipeline and infrastructure expansion and the increasing adoption of automation across several industries are expected to boost the demand for control valves.

Key Highlights

- A control valve is a device utilized to regulate fluid flow by adjusting the size of the flow passage in response to a signal from a controller. This facilitates the precise flow rate management and subsequent regulation of process variables such as pressure, temperature, and liquid level, which are crucial in industries such as oil and gas, water management, power generation, food and beverages, and automotive. Typically, two control valves, linear and rotary, are employed in various industries, offering superior efficiency and safety.

- A control valve can be operated through electrical, pneumatic, or hydraulic means. It receives a signal from a controller, such as a Programmable Logic Controller (PLC), to initiate movement and consequently alter the flow. Whether a PLC or a Distributed Control System (DCS), the controller compares the current flow rate with the desired setpoint value. Subsequently, the controller generates an output to adjust the valve and achieve the desired flow rate.

- Technological advancements have played a key role in shaping innovative solutions that enhance the efficiency of process plants by streamlining their operations. As industry requirements continue to evolve, suppliers of control valves and valve automation solutions are expected to develop products and processes that address these new challenges. The control valves market is anticipated to grow in the coming years, driven by increasing automation in various process industries, rising investment in the oil and gas sector, and high-power requirements.

- The growth of the control valve market is being propelled by several factors, including the escalating requirement for wireless infrastructure to monitor equipment in diverse plants, an increased emphasis on automation, and a rising number of process industry establishments. In response to market demand, control valves with many cycles and the ability to withstand high temperatures have been developed. Additionally, the growing emphasis on investing in alternative energy sources, particularly renewable energy, has created new opportunities and potential uses for control valves. For example, the IEA forecasts that 70% of all global energy investment will be directed toward renewable energy.

- Market growth is expected to be further boosted over the forecast period due to the increasing adoption of industrial automation, which will drive the use of smart control valves. The demand for control valves is driven by the growing number of power generation plants worldwide and the increasing need for energy and power from developing economies. These valves are also utilized in nuclear power plants, particularly in chemical treatment, feed water, cooling water, and steam turbine control systems.

- Fluctuations significantly hinder the control valve market's growth in terms of raw material prices. The costs of raw materials play a crucial role in determining the prices of control valves, and an increase in raw material prices poses a significant challenge for vendors as it can diminish their profit margin. Copper, stainless steel, cast iron, aluminum, brass, and bronze are the primary raw materials used to produce control valves. The absence of standardized certifications and government policies is anticipated to serve as restraints to market growth.

Control Valve Market Trends

The Oil and Gas Segment is Expected to Drive the Market

- Valves play a crucial role in the oil and gas sector as they are vital to any piping system. Their primary functions include equipment isolation and protection, flow rate control, and guidance and direction of the crude oil refining process. These valves are designed to regulate flow rate, temperature, and pressure through a controller's electrical, hydraulic, or pneumatic signals. Their automatic operation allows for remote operation, eliminating an operator's need for constant monitoring and adjustment.

- Control valves are gaining popularity in the oil and gas sector owing to their ability to regulate flow rate, pressure, and temperature. These valves adjust the flow passage size based on signals from a hydraulic, pneumatic, or electrical controller, enabling remote operation. Furthermore, increased investments in fluid handling technology, particularly in the oil and gas sector, are significantly contributing to the growth of the control valve market.

- The increasing inclination toward digitalization and automation within the oil and gas sector is increasing the need for control valves. Consequently, manufacturers of control valves are consistently involved in research and development endeavors to create and enhance their offerings in accordance with the demands of end-user industries. The escalating number of oil and gas exploration ventures in regions like the Middle East, Africa, China, and North America is projected to bolster the market's growth significantly.

- In June 2023, Norway declared its endorsement of 19 oil and gas ventures on the Norwegian continental shelf, with a total investment value exceeding USD 19 billion. These projects encompass novel developments, expanding existing fields, and investing in projects to augment extraction at existing areas. The Ukraine conflict augmented Norway's revenues as European nations previously dependent on Russia sought alternative energy sources. Consequently, significant investments in the European Union to enhance self-reliance in the oil and gas sector will amplify opportunities for control valves.

- The oil and gas sector relies on control valves, making it a pivotal sector for their utilization. Control valves are in high demand globally due to new oil and gas exploration projects, transportation pipeline initiatives, and maintenance operations.

- As per the International Energy Agency (IEA), the global demand for fossil fuels such as oil, gas, and coal is projected to reach an unprecedented peak by 2030. This surge can be attributed to evolving energy policies worldwide, the rapid advancement of clean technologies like solar panels and electric vehicles, the growing adoption of heat pumps, and the compelled transition from gas in Europe following Russia's invasion of Ukraine. Furthermore, the sector's escalating automation technologies are anticipated to propel the market growth significantly.

- The demand for control valves across onshore applications is expected to rise with the increasing distribution of oil and gas. For instance, according to EIA, in 2025, it is projected that 28% of the world's crude oil production will be derived from offshore sources, with the remaining 72% being extracted onshore.

- As of February 2024, there were 296 land rigs in that region, with a further 53 rigs located offshore in the Middle East and 95 land rigs in that region, with 16 rigs located offshore in Africa. These notable capabilities and the anticipated growth in the oil and gas industry will undoubtedly generate substantial prospects for the market.

North America is Expected to Hold a Significant Market Share

- North America is one of the world's most significant markets for control valves. There is immense demand from various industries in the United States and Canada, including oil and gas, electricity, food and packaging, and chemicals. With rapid industrial automation, the region is expected to spearhead the need for control valves.

- Rapid industrialization and the growing transportation sector in these nations are expected to increase the demand for oil and gas. The need to provide potable water to the ever-increasing population also leads to the setting up of desalination plants, further resulting in the demand for control valves. Waste and wastewater management is also a considerable segment that is expected to drive future demand.

- The United States plays a critical role in increasing the demand from the region compared to Canada. The demand from almost all the end-user segments is increasing, especially from the oil and gas, refining, and power generation segments. Major industries in the country, such as oil and gas, renewable energy, and water and wastewater treatment, are moving toward valve technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station.

- The United States is experiencing a significant expansion in oil production. ExxonMobil, a prominent oil producer in the country, announced its intention to augment production activity in the Permian Basin of West Texas, with a target of producing over 1 million barrels per day (bpd) of oil equivalent by 2024. This represents an increase of almost 80% compared to the current production capacity. Chevron was projected to increase its net oil-equivalent production to 600,000 bpd by 2020 and 900,000 bpd by 2023.

- The shale oil boom in North America generated a significant need for fluid handling equipment and components, particularly control valves. These valves play a crucial role in regulating the shale oil exploration and production process and ensuring the smooth transportation of shale oil through pipelines. The initiation of new upstream oil and gas exploration projects is anticipated to fuel the demand for control valves in the oil and gas industry.

- In the United States, developing new shale oil projects necessitates the construction of additional pipelines for the transportation of shale oil. According to Baker Hughes, North America currently boasts the highest number of oil and gas rigs worldwide. As of May 2023, the region had a total of 776 land rigs, with an additional 22 rigs situated offshore. The number of oil and gas rigs experienced a surge in late 2022 due to the gradual impact of sanctions on Russian exports, resulting in increased exploration activities in North America.

- The region has experienced a surge in the utilization of control valves due to the heightened emphasis on renewable energy initiatives, resulting in a rapid rise in the number of solar thermal energy facilities. The region boasts an abundance of wind, solar, geothermal, hydro, and biomass resources. The demand for renewable energy projects is fueled by ample financing opportunities and a highly skilled workforce.

- The water and wastewater industry is a significant consumer of fluid handling technology due to increasingly stringent regulations regarding the treatment and cleanliness of water. The increasing investments in the region's water and wastewater industry are expected to offer significant market growth opportunities.

Control Valve Indsutry Overview

The control valve market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Emerson Electric Co., Flowserve Corporation, Baker Hughes Company, Metso Corporation, and CIRCOR International Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: Emerson released innovative solutions that transform valves installed in industrial applications and interact with end users globally. End users need to know how their control valves are performing, address any issues, and improve valve performance in general, for instance, by reducing maintenance. The Fisher(TM) FIELDVUE(TM) DVC7K digital valve controller addresses these and other issues by creating an optimized path to action.

- October 2023: Andritz signed an agreement with Flowserve Corporation to acquire its NAF AB valve business. The production plant and equipment deliveries have been equipped with NAF control valves for many years. This acquisition further extended and strengthened Andritz's product and service portfolio in process control.

- May 2023: Emerson unveiled the ASCO Series 209 proportional flow control valves, which boast unparalleled precision, pressure ratings, flow characteristics, and energy efficiency within a specially designed, space-saving structure. These valves, with their optimal size and exceptional performance, enable users to accurately regulate fluid flow in various devices demanding meticulous performance, such as those utilized in medical equipment, food and beverage, and HVAC industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Industry Supply Chain Analysis

- 5.2 Market Drivers

- 5.2.1 Growing emphasis on Power and Water and Wastewater in Emerging Markets

- 5.2.2 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3 Market Challenges

- 5.3.1 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3.2 Dynamic Change in Oil Prices is Expected to Influence the Overall Spending on the Projects

- 5.4 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Globe

- 6.1.2 Ball

- 6.1.3 Butterfly

- 6.1.4 Plug

- 6.1.5 Diaphragm

- 6.1.6 Other Types of Valves

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical, Petrochemical, and Fertilizer

- 6.2.3 Energy and Power

- 6.2.4 Water and Wastewater Treatment

- 6.2.5 Metal and Mining

- 6.2.6 Other End-user Industries (Food and Beverage, Pharmaceutical, Pulp and Paper, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Flowserve Corporation

- 7.1.3 Baker Hughes Company

- 7.1.4 Metso Corporation

- 7.1.5 CIRCOR International Inc.

- 7.1.6 IMI PLC

- 7.1.7 Christian Burkert GmbH & Co. KG

- 7.1.8 GEA Group Aktiengesellschaft

- 7.1.9 Neway Valve (Suzhou) Co. Ltd