|

市場調査レポート

商品コード

1851306

モノのインターネット(IoT):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Internet Of Things (IoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| モノのインターネット(IoT):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月09日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

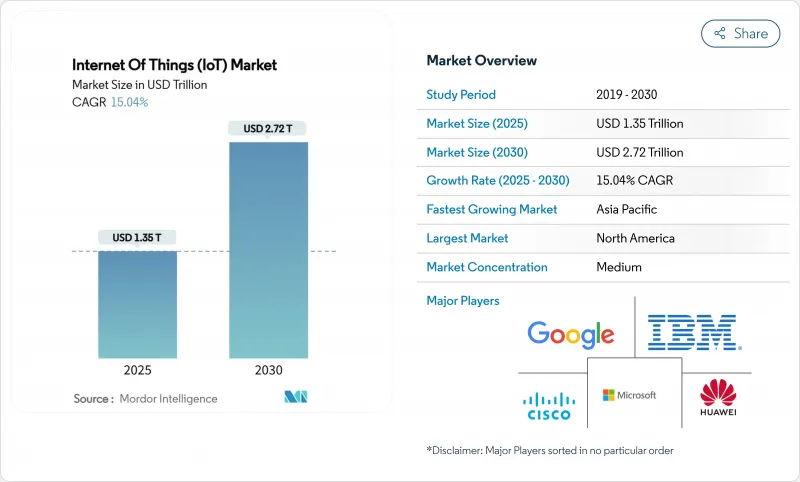

モノのインターネット(IoT)市場は2025年に1兆3,500億米ドルに達し、2030年には2兆7,200億米ドルに達すると予測され、CAGRは15.04%で推移します。

リアルタイム分析、予知保全、自律的意思決定システムに対する旺盛な需要が、工場、農場、物流ハブへの展開を加速させています。5Gの急速な展開、低電力広域ネットワークの成長、センサーコストの低下により、接続資産の対応可能ベースが拡大します。企業はまた、ミリ秒単位の応答時間を保証しながらデータ主権を保護するエッジAIを高く評価しています。その結果、投資はパイロット・プロジェクトから、あらゆる主要産業における本格的な生産へと移行し続けています。したがって、モノのインターネット市場は、弾力的な設備投資と、効率性と持続可能性を目的とした規制上のインセンティブに支えられた強固な技術基盤の上に成長を続けています。

世界のモノのインターネット(IoT)市場の動向と洞察

コネクテッド・デバイスの普及とセンサー・コストの低下

基本的な環境センサーの単価は20米ドルから5米ドル以下に低下し、工場や農場全体で高密度計測が経済的に実行可能になっています。予知保全に使用される工業用振動センサーは、わずか5年前の200~500米ドルに比べ、現在は50~100米ドルで販売されています。ハードウェアの障壁が低くなったことで、新たなソフトウェア・インテグレーターが増え、モノのインターネット市場の人材プールが広がっています。BMWのプライベート5G生産ネットワークは、すでに何千ものセンサーをリアルタイムでスループットを最適化するエッジコントローラーにつないでいます。半導体の一時的な不足はコスト圧力を生むが、部品点数を減らす設計革新は価格下落の勢いを維持します。企業がこれまで以上に小さな資産を接続するにつれ、データ量は急増し、アナリティクス・サービスが最も急成長する収益プールとなります。

5GとLPWANの展開でカバレッジが拡大

プライベート5Gは現在、超低遅延の産業制御を支えており、柔軟な製造ラインが無線の再構成に依存しているジョンディア社のウォータールー工場で実証されています。LoRaWANとNB-IoTネットワークは、セルラーの経済性がまだ遅れている遠隔地フィールド、鉱山、パイプラインを結ぶことで5Gを補完します。キネイスやその他の超小型衛星事業者は、家畜の群れや海上資産の継続的な可視化を可能にし、残されたギャップを埋める。電気通信事業者は、周波数帯とバックホールへの投資を調整し、デバイスの密度と実現可能なリターンを一致させる。こうしたアクセス・オプションの収束により、モノのインターネット市場は、人口密度の高い都市キャンパスと人口の少ない辺境の両方にまたがる包括的な道を歩むことになります。

深刻化するサイバーセキュリティとプライバシー侵害

コネクテッド・アセットは攻撃対象を拡大し、ランサムウェアはすでに工場ラインを停止させ、独自のレシピを暴露しています。EUのサイバーレジリエンス法は、暗号化とパッチ適用の最低義務を定めており、ベンダーはより高いコンプライアンスコストを負担することを余儀なくされています。産業界のバイヤーは、セキュアブート・チップセットやゼロトラスト・アーキテクチャを要求するようになっており、低コストのサプライヤーにとっては障壁が高くなっています。情報漏えいのニュースが一時的に普及を遅らせる可能性はあるが、モノのインターネット市場では、長期的なセキュリティ支出が契約総額の増加につながることが多いです。

セグメント分析

サービスは2024年の売上高の34%を占め、デバイスとデータを測定可能な成果に変えることの複雑さを浮き彫りにしています。コンサルティングチームは、ワークフローをマッピングし、安全なアーキテクチャを構築し、センサーストリームを運用価値に変換するダッシュボードを最適化します。ハードウェアの価格は下がり続けているが、統合の需要は専門家の人件費を上昇させ、サービスがモノのインターネット市場の最大のスライスであることを確固たるものにしています。コンテナ・オーケストレーションとOTAパッチを融合させたエッジ・プラットフォームは、レイテンシーとデータ・ガバナンスがオンサイトにとどまることを買い手が主張する中、CAGR 17.51%で拡大。コネクティビティ・モジュールはコスト・デフレを吸収し、何千ものエンドポイントにわたって容量を再販するソリューション・アセンブラーの利益率を拡大します。

柔軟なインフラを求める動きは、ゲートウェイ・エージェントが何をローカルに残し、何をクラウドに移すかを決定するハイブリッド・トポロジーを推進します。このようなオーケストレーションは、ハイパースケールクラウドとファクトリーフロアコントローラ間のAPI調和への要求を強める。ソフトウェア・ベンダーは、モデルを継続的に微調整する自動MLエンジンを組み込み、顧客をエコシステムに固定するサブスクリプションを強化します。一方、衛星通信事業者は地上通信事業者と提携し、フォールバック接続をバンドルすることで、モノのインターネット市場の地理的適用範囲を広げています。成果ベースの契約でハードウェア、統合、ライフサイクル管理をパッケージ化するベンダーは、コンポーネント中心のライバルからシェアを奪っています。

工場が稼働時間を守るために予知保全、ロボットの調整、サプライチェーンの透明性に依存しているため、製造業は2024年の支出の29.5%を占めました。シーメンスは、レガシーマシンをネットワーク化するブラウンフィールド改修に関連したデジタル産業の受注が記録的であると報告しています。環境、健康、安全ダッシュボードは、規制当局が排ガス監査を強化するにつれて注目されるようになります。その結果、産業プラント向けのモノのインターネット市場規模は、マクロ的な逆風にもかかわらず堅調に拡大すると予想されます。

対照的に、農業はCAGR 19.2%で最も急速に成長します。土壌プローブ、ドローン画像、衛星リンクにより、農家は肥料や灌漑をほぼリアルタイムで調整できるようになり、1ヘクタール当たりの投入コストが低下します。新興企業は、センサー、分析、信用サービスを中規模農家が利用しやすいサブスクリプション・モデルにバンドルしています。家畜の牧場主は、体温、反芻回数、位置をモニターする首輪を装着し、病気の発生や捕食による損失を減らしています。公的機関が食糧安全保障を推進する中、助成金によってコネクテッド・ファームの導入が加速し、モノのインターネット産業の顧客基盤がアーリー・アダプター以外にも広がっています。

地域分析

北米は2024年の売上の32.3%を占め、成熟した5Gの展開、プライベートセルラーライセンスの広範な普及、デジタルネイティブの強固な労働力によって支えられています。自動車から食品加工に至る産業施設では、エッジAIコントローラーに高忠実度データをストリーミングする周波数共有ネットワークが日常的に試験運用されています。その結果、モノのインターネット市場は、マクロ環境が変動しても安定した資本配分を続けています。

アジア太平洋地域は、各国政府がIoTを製造補助金やスマートシティの設計図に組み込むことで、2030年までCAGR 15.1%で成長すると予測されます。ライセンシングされた携帯電話接続数は、2030年までにインド、中国、東南アジア全体で2億7,000万に達します。中国は輸出規制の不確実性を緩和するために国内チップ鋳造への投資を加速させ、インドはセンサー組立工場を誘致するために生産に連動したインセンティブを活用します。ベトナムとインドネシアの新興企業はLPWANゲートウェイとクラウドダッシュボードを統合し、中堅工場を低コストでオンライン化します。これらの動向を合わせると、モノのインターネットの市場規模は、人口動態的に多様な地域全体で拡大することになります。

欧州では環境コンプライアンスが重視され、センサーによる排出量追跡が企業報告に不可欠となっています。プライバシー規制が現場での処理を奨励しているため、エッジの導入が増加。官民コンソーシアムは、スマート港湾物流と国境を越えた貨物の透明化システムに資金を提供しています。中東とアフリカはまだ普及の初期段階にあるが、衛星を利用した家畜のモニタリングや太陽光発電を利用した水管理で飛躍的に普及します。国際開発機関は、短期間で投資回収が可能なパイロット・プロジェクトに資金を提供し、地域に根ざした専門知識を育み、モノのインターネット市場の裾野を広げています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- コネクテッドデバイスの普及とセンサーコストの低下

- 5GとLPWANの展開でカバー範囲が拡大

- エッジAIアナリティクスがリアルタイムの価値を実現

- LEO衛星IoTが遠隔監視を解き放つ

- ESGに関連したサプライチェーン報告義務

- IoT遠隔測定による利用ベースの保険

- 市場抑制要因

- 深刻化するサイバーセキュリティとプライバシー侵害

- プロトコルの断片化と相互運用性の低さ

- 輸出規制がチップ/モジュールの供給を圧迫

- エッジAIの消費電力がデバイスのバッテリーに負担をかける

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 価格分析

- 主な使用事例とケーススタディ

- マクロ経済とパンデミック影響分析

第5章 市場規模と成長予測

- コンポーネント別

- ハードウェア(センサー、プロセッサー、接続モジュール、ゲートウェイ)

- ソフトウェア/プラットフォーム(デバイス管理、データ管理、分析、セキュリティ)

- 接続タイプ(セルラー(2G~5G)、LPWAN(NB-IoT、LoRaWAN、Sigfox)、衛星、近距離通信(Wi-Fi、BLE、Zigbee))

- サービス(プロフェッショナル、マネージド、インテグレーション)

- エンドユーザー業界別

- 製造・産業

- 輸送とロジスティクス

- ヘルスケアとライフサイエンス

- 小売とeコマース

- エネルギーと公益事業

- 住宅とスマートビルディング

- 農業

- 政府およびスマートシティ

- 用途別

- 資産追跡とフリート管理

- 予知保全

- スマートメーター

- 遠隔患者モニタリング

- スマートホームとアプライアンス

- コネクテッドカーとV2X

- 環境・気候モニタリング

- 展開モデル別

- クラウド

- オンプレミス

- エッジ/ハイブリッド

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的な動きとパートナーシップ

- 市場シェア分析

- 企業プロファイル

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- Cisco Systems

- Huawei Technologies

- Siemens AG

- IBM Corporation

- PTC Inc.

- Robert Bosch GmbH

- Honeywell International

- Oracle Corporation

- SAP SE

- AT&T

- Aeris Communications

- Fujitsu

- Wipro

- Intel Corporation

- Ericsson

- Qualcomm

- Advantech

- Sierra Wireless(Semtech)

- Quectel Wireless

- Telit Cinterion

- u-blox