|

市場調査レポート

商品コード

1851781

IaaS(Infrastructure As A Service):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Infrastructure As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| IaaS(Infrastructure As A Service):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月09日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

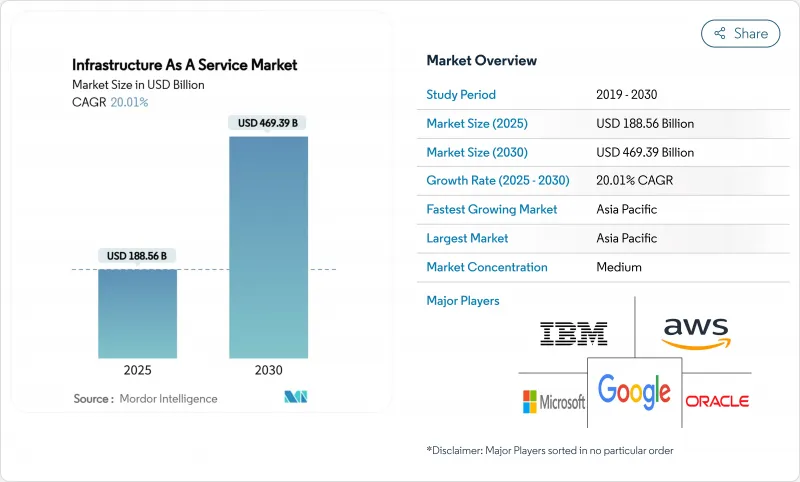

IaaS(Infrastructure As A Service)の市場規模は2025年に1,885億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは20.01%で、2030年には4,693億9,000万米ドルに達すると予測されます。

ジェネレーティブAIトレーニング、加速する企業のハイブリッド移行、年間2,500億米ドルを超えるハイパースケーラ設備投資からの需要が、この軌道を下支えします。液冷データセンター設計、5Gのレイテンシーをサポートするエッジ展開、および主権AIイニシアティブが相まって、投資レベルは高水準を維持しています。ハイパースケーラーが地域の容量を追い求める一方で、国内プロバイダーはデータ居住の義務付けを活用するため、競合は激化しています。事業者は送電網の制約を緩和し、厳しい持続可能性目標を達成する必要があるため、自然エネルギーの電力購入契約は長期化し、規模も拡大しています。クラウド・インフラストラクチャ市場は、地理的に分散し、AIに対応した成長という次のフェーズに入る。

世界のIaaS(Infrastructure As A Service)市場の動向と洞察

加速するジェネレーティブAIインフラ需要

ジェネレーティブAIトレーニングクラスタは、チップあたり700WのGPUラックを必要とし、液冷の採用を2024年のデータホールの10%から2025年には20%に押し上げると推定されます。ハイパースケーラは現在、1MWの液冷ラックを中心にキャンパスを再設計し、変換ロスを抑えるために400V DC配電を標準化している、とDataCenterFrontierは述べています。データセンター事業者の40%近くが、AIワークロードをホストするために2026年までに液冷を使用する予定です。このような技術的なシフトにより、施設の設計図が再構築され、クラウドインフラ市場全体でAI対応設計が既定の要件となっています。

企業のハイブリッドおよびマルチクラウド移行が急増

企業は現在、コストとコンプライアンスのバランスを取るため、ワークロードを複数のクラウドに分散させています。2024年のIBMによる64億米ドルのHashiCorp買収は、マルチクラウド・オーケストレーションの自動化を深化させる。オラクルとグーグルのマルチクラウド提携により、グーグルのリージョン内でのオラクル・データベースのイグレス料金が不要になり、ワークロードのポータビリティに対する長年の障壁が取り除かれました。銀行の導入は特に進んでおり、70%の金融機関がデータ常駐ルールや運用耐障害性テストに後押しされ、試験的な導入から移行しています。ハイブリッド・パターンが拡大するにつれて、専門サービス・プロバイダーはガバナンスとセキュリティのアドバイザリーで新たな収益を獲得し、クラウド・インフラ市場の好循環を強化しています。

深刻化するエネルギー・グリッド制約

データセンターは、2023年にはすでに米国の電力の4.4%を消費しています。2028年にはこの割合が12%に達する可能性があり、従来の送電網に負担がかかります。かつては一大ハブであったバージニア州北部とテキサス州は、現在ではメガワットの割り当てを制限しており、事業者は新たなキャパシティを求めてインディアナ州やミシシッピ州へと移動しています。アイルランドでは、2030年までに国全体の電力の最大70%がデジタル負荷に向かうと予測されており、一部の郡ではモラトリアムが実施されています。事業者は、施設の電力使用量を95%削減する液浸冷却で対応しているが、こうした改修には新たな資本と建設スケジュールの延長が必要です。そのため、電力不足がクラウドインフラ市場の短期的な拡大を遅らせています。

セグメント分析

パブリッククラウドは2024年の売上高の71.0%を占め、10年にわたるオンプレミススタックからの移行を反映しています。しかしハイブリッド層は、規制産業がオンプレミスのコントロールとオフプレミスのスケールを組み合わせることで、2030年までのCAGRが24.0%と最速を記録します。金融サービスのリーダーは、ハイブリッド・セットアップが規制当局の監査に合格しながら顧客体験の目標を達成できると評価しています。ハイブリッド展開のクラウドインフラ市場規模は、2030年までに1,420億米ドルに達すると予測されており、遅延の影響を受けやすいワークロードやコンプライアンスを重視するワークロードのバランスを取る上で、ハイブリッドが重要な役割を担っていることが浮き彫りになっています。

AWS OutpostsやAzure Stackのようなプライベート接続オプションの急増が、このハイブリッドの波を支えています。AuroraにあるCME GroupのGoogle Cloudプライベートリージョンは、ミッションクリティカルなトレーディングをローカルに維持しながらパブリッククラウドのツールを活用する方法を示しています。IBMのHashiCorpとの契約によって強化された多面的なオーケストレーション・ソフトウェアは、複雑性の障壁を軽減します。成熟度が高まるにつれ、クラウドインフラ業界では、導入の意思決定を二者択一ではなく、ポートフォリオとして捉える傾向が強まっています。

IaaS(Infrastructure As A Service)市場は、導入形態(パブリッククラウド、プライベートクラウド、ハイブリッドクラウド)、サービスタイプ(Compute As A Service(CaaS)、Storage As A Service(STaaS)、Database/Analytics As A Service(DBaaS)など)、エンドユーザー産業(BFSI、IT・テレコム、ヘルスケア・ライフサイエンス)、地域別に区分されます。

地域分析

アジア太平洋地域は、2024年に世界売上高の43.2%を占め、中国、日本、インドの政府AIプログラムが国内クラウドに補助金を投入しているため、CAGRは最速の21.4%を維持しています。中国のEast Data-Westイニシアチブだけでも、毎年4,000億人民元が8つのメガクラスターに投入され、コンピューティングを内陸部に再配分し、沿岸部の混雑を緩和しています。日本は、AWSの150億米ドルとオラクルの80億米ドルの誓約によって、2030年までにデータセンターの価値で2兆円(134億米ドル)に近づきます。インドは、NTTによる15億米ドルの拡張と、デジタルインフラを優遇する現地の税制優遇措置から利益を得る。

北米は依然として第2位の拠点だが、レガシー拠点が飽和状態にあるため、相対的な成長は鈍化しています。エネルギー制限により、プロジェクトは見過ごされている州に振り向けられる:AWSはインディアナ州に110億米ドル、Compassはミシシッピ州に100億米ドルのキャンパス建設に着工、STACKはバージニア州北部に1GW以上の投資を行う。カナダのデジタル・アンビション・プログラムが連邦政府のクラウド導入を加速。

欧州では、需要とカーボンニュートラル目標のバランスが取れています。DORAのような規制により、金融企業はプロバイダーの多様化を迫られる一方、ダブリンやアムステルダムのような伝統的な場所では、国のエネルギー上限により容量が制限されています。ベルリン、ワルシャワ、オスロ、チューリッヒ、ミラノ、ウィーン、マルセイユといった代替都市は、再生可能エネルギーによる送電網と支援的な許認可制度のおかげで台頭しています。EUは2030年までにゼロ・カーボン・データセンターを目標としており、熱再利用スキームや洋上風力発電との連携への投資に拍車をかけ、クラウドインフラ市場の次の段階を形成します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 加速するGen-AIインフラ需要の主流

- 企業のハイブリッド&マルチクラウド移行の主流スパイク

- ハイパースケーラのCAPEX競争の主流(2025年に2,500億米ドル超)

- 5G時代の主流エッジ間レイテンシ要件

- 注目されない長期グリーンエネルギーPPAが新たなDC用地を開拓する

- 水面下で進む政府のソブリンAIサンドボックス、ローカルIaaSノードの義務化

- 市場抑制要因

- 主流エネルギー・グリッド制約の増大

- 主流データ主権と治外法権の対立

- 水面下の液冷サプライチェーンのボトルネック

- 100MW超のハイパースケール・キャンパスの保険料が急増中

- バリュー/サプライチェーン分析

- 規制情勢

- 技術的展望(AIアクセラレーター、液体冷却、ゼロトラスト織物)

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 展開モード別

- パブリッククラウド

- プライベートクラウド

- ハイブリッド・クラウド

- サービスタイプ別

- Compute as a Service(CaaS)

- Storage as a Service(STaaS)

- ネットワーク&CDN

- Database / Analytics as a Service(DBaaS)

- Disaster-Recovery as a Service(DRaaS)

- マネージド・ホスティング/ 専用クラウド

- エンドユーザー業界別

- BFSI

- IT&テレコム

- ヘルスケア&ライフサイエンス

- メディア&エンターテインメント

- 小売&eコマース

- 政府・公共機関

- 製造・自動車

- 地域別

- 北米

- 米国

- カナダ

- 南米

- ブラジル

- アルゼンチン

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- アフリカ

- 南アフリカ

- ナイジェリア

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Amazon Web Services(AWS)

- Microsoft Azure

- Google Cloud Platform(GCP)

- Alibaba Cloud

- IBM Cloud

- Oracle Cloud Infrastructure(OCI)

- Tencent Cloud

- Huawei Cloud

- OVHcloud

- DigitalOcean

- Rackspace Technology

- Hetzner

- Equinix Metal

- Cloudflare Workers/R2

- Linode/Akamai

- Oracle Cloud(Japan)

- Liquid Sky(Africa)

- Wasabi Technologies

- Scaleway

- SAP Business Technology Platform(BTP-IaaS portion)