|

|

市場調査レポート

商品コード

1332556

ベビー用おむつの市場規模・シェア分析- 成長動向と予測(2023年~2028年)Baby Diapers Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ベビー用おむつの市場規模・シェア分析- 成長動向と予測(2023年~2028年) |

|

出版日: 2023年08月08日

発行: Mordor Intelligence

ページ情報: 英文 129 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

ベビー用おむつの市場規模は、2023年の475億8,000万米ドルから2028年には591億米ドルに成長し、予測期間(2023-2028年)のCAGRは4.43%となる見込みです。

都市人口の増加に伴う人口の増加は、市場成長の最も大きな要因の1つです。そのほか、国民の可処分所得の増加、女性の労働人口の増加、識字率の上昇などは、家庭の生活水準と消費パターンを決定する要因の一部であり、不可欠な成長要因としても機能すると予想されます。消費者の健康と衛生に対する関心の高まりは、今後数年間、市場を牽引する可能性が高いです。

さらに、乳幼児の衛生維持に関する意識の高まりにより、親はベビー用おむつの使用を強く支持しています。おむつに使用される生地、吸収能力、おむつの使いやすい特別な機能などの継続的な進歩により、競合他社は高い市場シェアを獲得しています。自然で衛生的な製品に対する需要の高まりは、バイオベースの使い捨ておむつを開発するメーカーの原動力となっており、これも市場の需要を促進すると予測されています。

市場プレーヤーはおむつ技術の革新に取り組んでいます。おむつ市場の主な動向には、環境に優しい/生物分解性おむつ、電子おむつ、オーガニックおむつ、パンツ型おむつなどがあります。

ベビー用おむつ市場の動向

ベビーの衛生に対する意識の高まり

- 乳幼児の衛生に対する意識の高まりから、親はベビー用おむつの使用を強く推奨しています。おむつは、乳幼児のデイリーケア用品や赤ちゃんのおしり拭きに欠かせないもので、細菌感染を防ぎ、快適さを提供します。濡れたおむつや頻繁に交換されないおむつに関連することが多いおむつかぶれに対する懸念の高まりは、世界中でベビー用おむつの需要を増大させています。

- ハギーズやパンパースのようなブランドは、独自の技術で漏れを防ぎ、刺激を軽減した、かぶれにくいおむつを提供しています。赤ちゃん1人が毎日使うおむつは7~8枚で、1日ほぼ24時間おむつを使用していることになります。このことが、合成おむつによる皮膚アレルギーを避けるため、消費者の綿ベースのおむつへの傾倒を高めています。

- 2021年7月、インドの布おむつブランドであるスーパーボトムズは、新米の両親が赤ちゃんに使用するUNO 2.0を発売しました。すべてのおむつは100%布製で、オーガニックコットンのパッドが付いています。また、多くの政府機関が、特に若い親たちの間で子どもの健康と衛生に関する意識を高めることを目的とした健康啓発キャンペーンを開始しました。

- 例えば、汎米保健機構(PAHO)は2022年2月、ラテンアメリカ周産期センター(CLAP)を通じて、新生児に関する意識を高め、生後28日間の質の高いケアの実践を促進するキャンペーンを開始しました。スキンシップ、母乳育児、清潔で乾燥した状態を保つことなどはその一例です。

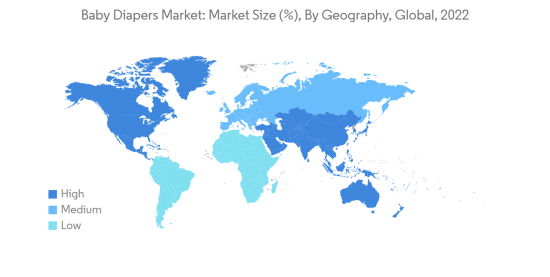

アジア太平洋が著しい成長を遂げる

- ベビーケアカテゴリーにおいて、市場の成長を促す主な要因のひとつは、この地域の人口における働く女性の数の増加です。世界銀行のデータによると、東アジア太平洋地域の女性の労働参加率は2016年の43.7%から2021年には43.94%へと大幅に上昇しています。

- さらに、デジタル革命は、この産業が加速度的に成長することを可能にする大きな要因となっています。インドの全国家庭健康調査(NFHS)によると、2021年には女性の33%(都市部+農村部)、都市部女性の52%がインターネットにアクセスできるようになります。その結果、同地域の市場成長を後押ししています。

- アジア太平洋地域では、中国だけで毎年約1,800万人の赤ちゃんが誕生しています。同国は、ベビー用おむつ市場全体で大きなシェアを占めています。中国における第3子政策の宣言は、ベビー用おむつ需要の拡大に大きな役割を果たしています。

- さらに、流通網が広く、地方市場でも数多くのブランドが容易に入手できることから、主要企業は内陸部市場に向けて販売を拡大しています。インドもまた、この地域におけるおむつ販売の増加に拍車をかけています。

- ユニ・チャームやプロクター・アンド・ギャンブルのような国際的なプレーヤーに加え、ゴドレイやヒマラヤのようなインドの多くのプレーヤーが、新しい種類のベビー用おむつを発売しています。市場はまた、変化する顧客ニーズに対応するための製品革新も示しています。2022年3月、インドのベビーケア・ブランドであるSuperBottomsは、100%環境に優しく洗濯可能な赤ちゃん用の柔らかい布おむつを発売しました。

ベビー用おむつ業界の概要

ベビー用おむつ市場は競争が激しく、多くの地域および世界企業が参入しています。これらの企業が採用する主な戦略には、製品革新、事業拡大、M&Aなどがあります。市場は主に、Procter &Gamble、Kimberly-Clark Corporation、花王株式会社、ユニ・チャーム、Essity Aktiebolagによって支配されています。

プライベートブランドの存在が競争を激化させると予想されます。さらに、プロクター・アンド・ギャンブルとキンバリー・クラーク・コーポレーションは、長年にわたって市場シェアとカテゴリー成長を拡大するための主要戦略として、製品イノベーションを採用してきました。両社は、革新的な製品を市場に投入し、ベビー用おむつを含む持続可能なベビー用品に対する消費者の継続的な関心を取り込むため、研究開発部門に多額の投資を行っています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ

- 布おむつ

- 使い捨ておむつ

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア/食料品店

- 薬局・ドラッグストア

- オンライン小売チャネル

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- その他中東・アフリカ

- 北米

第6章 競合情勢

- 市場シェア分析

- 最も採用されている戦略

- 企業プロファイル

- Procter & Gamble Co.

- Kimberly-Clark Corporation

- Essity Aktiebolag

- Kao Corporation

- Domtar Corporation

- Daio Paper Corporation

- Ontex Group

- Nuggles Designs Canada

- Unicharm Corporation

- Winc Design Limited

- Millie Moon

- DYPER

- SUMO

第7章 市場機会と今後の動向

The Baby Diapers Market size is expected to grow from USD 47.58 billion in 2023 to USD 59.10 billion by 2028, at a CAGR of 4.43% during the forecast period (2023-2028).

The rising population, accompanied by the increasing urban population, is one of the most significant contributors to the market's growth. Besides that, the growing disposable income of the people, the rising female working population, the increasing rate of literacy, etc., are some of the factors that determine the living standards and consumption patterns of families and are also expected to serve as essential growth factors. Consumers' growing health and hygiene concerns will likely drive the market in the coming years.

Additionally, owing to the increasing awareness regarding maintaining the hygiene of infants, parents have strongly adopted the usage of baby diapers. Ongoing advancements in the fabric used in a diaper, absorption capabilities, and special user-friendly features of diapers have led to competitors gaining a higher market share. Increasing demand for natural and hygienic products is driving manufacturers to develop bio-based disposable diapers, which is also projected to propel market demand.

Market players are engaged in innovating diaper technology. Some key trends in the diaper market include eco-friendly/bio-degradable diapers, electronic diapers, organic diapers, and pant-style diapers.

Baby Diaper Market Trends

Increasing Awareness about Baby Hygiene

- Owing to the increasing awareness about infant hygiene, parents are strongly adopting the usage of baby diapers. Diapers are among the essential infant daily care products and baby wipes, which help prevent bacterial infection and provide comfort. The growing concern about diaper rashes, often related to wet or infrequently changed diapers, is augmenting the demand for baby diapers worldwide.

- Brands like Huggies and Pampers provide a range of rash-free diapers, having unique technology to prevent leakage and decrease irritation. A single baby uses 7-8 diapers daily, meaning the diaper is used for almost 24 hours a day. This factor increased consumers' inclination toward cotton-based diapers to avoid skin allergies caused by synthetic diapers.

- In July 2021, SuperBottoms, India's cloth diaper brand, launched the UNO 2.0 for new parents to use on their babies. All diapers are made from 100% cloth and have organic cotton pads. A number of government institutions have also launched health awareness campaigns specifically aimed at raising awareness among young parents about their children's health and hygiene.

- For instance, in February 2022, through its Latin American Centre for Perinatology (CLAP), the Pan American Health Organization (PAHO) launched a campaign to raise awareness about newborns and promote quality care practices in the first 28 days of life. Skin-to-skin contact, exclusive breastfeeding, and keeping the baby clean and dry are a few of these practices.

Asia-Pacific Witnessed Significant Growth

- In the baby care category, one of the main factors driving the growth of the market is the growing number of working women in the population of the region. World Bank data indicates that the female labor participation rate in East Asia Pacific has increased significantly from 43.7% in 2016 to 43.94 % in 2021.

- Furthermore, the digital revolution has been a major factor in enabling the industry to grow at an accelerating rate. According to the National Family Health Survey (NFHS) of India, in 2021, 33% of women (urban+rural) and 52% of urban women had Internet access. Consequently, this is aiding the growth of the market in the region.

- In the Asia-Pacific region, China alone records the birth of approximately 18 million babies every year. The country accounts for the major share of the overall baby diaper market. The declaration of the third-child policy in China has played a great role in increasing the demand for baby diapers.

- Moreover, a wider distribution network and easy availability of numerous brands in the local markets led the key players to expand their sales to reach the inland markets. India also adds to the rising sales of diapers in the region.

- Along with international players like Unicharm and Procter & Gamble, many Indian players like Godrej and Himalaya are coming up with new varieties of baby diapers. The market is also witnessing product innovations to cater to changing customer needs. In March 2022, SuperBottoms, an Indian baby care brand, launched 100% eco-friendly, washable soft cloth diapers for babies, which helps prevent rashes and irritation.

Baby Diaper Industry Overview

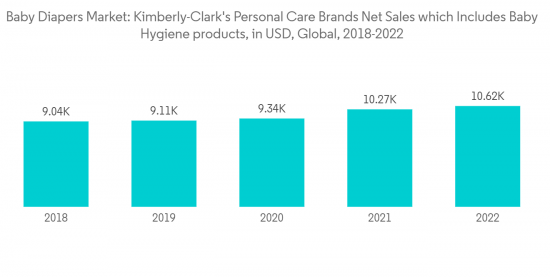

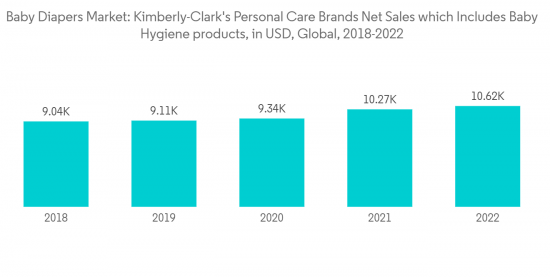

The market studied is highly competitive, with many regional and global players. The major strategies adopted by these companies include product innovations, expansions, and mergers and acquisitions. The market is primarily dominated by Procter & Gamble, Kimberly-Clark Corporation, Kao Corporation, Unicharm, and Essity Aktiebolag.

The presence of private-labeled brands is expected to augment the competition. Moreover, Procter & Gamble and Kimberly-Clark Corporation have adopted product innovation as their key strategy to increase their market share and category growth over the years. The companies invested heavily in their R&D sectors to launch innovative products in the market and tap into the ongoing interest of consumers in sustainable baby products, including baby diapers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Cloth Diapers

- 5.1.2 Disposable Diapers

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience/Grocery Stores

- 5.2.3 Pharmacy/Drug Stores

- 5.2.4 Online Retail Channels

- 5.2.5 Other Distribution Channels

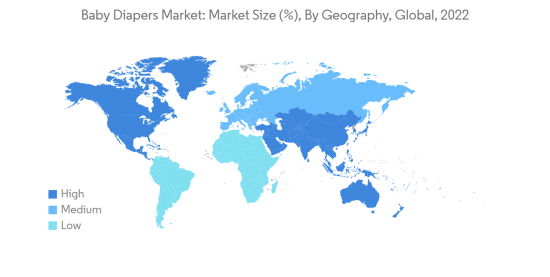

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Procter & Gamble Co.

- 6.3.2 Kimberly-Clark Corporation

- 6.3.3 Essity Aktiebolag

- 6.3.4 Kao Corporation

- 6.3.5 Domtar Corporation

- 6.3.6 Daio Paper Corporation

- 6.3.7 Ontex Group

- 6.3.8 Nuggles Designs Canada

- 6.3.9 Unicharm Corporation

- 6.3.10 Winc Design Limited

- 6.3.11 Millie Moon

- 6.3.12 DYPER

- 6.3.13 SUMO