|

市場調査レポート

商品コード

1687741

電気ボート・船舶:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Electric Boat and Ship - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電気ボート・船舶:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

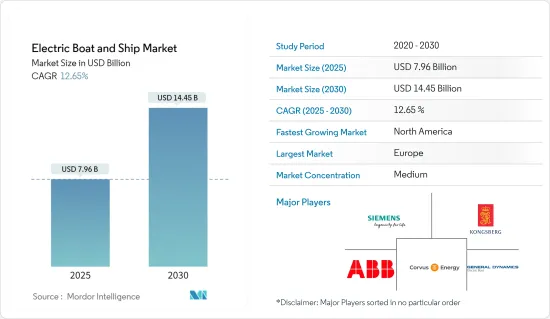

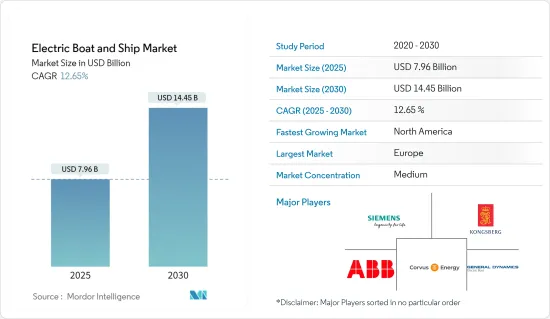

電気ボート・船舶市場規模は2025年に79億6,000万米ドルと推定・予測され、2030年には144億5,000万米ドルに達すると予測され、予測期間(2025~2030年)のCAGRは12.65%です。

COVID-19パンデミックは、製造施設の操業停止と世界の貿易制限により、電気ボート・船舶市場の成長を妨げました。船舶が海上で立ち往生し、港への入港が禁止された結果、海運会社の運航コストが大幅に上昇したため、海上輸送は大幅な落ち込みを記録しました。

ある試算によると、コンテナ船の輸送量は13.77%、旅客船の輸送量は42.77%減少しました。しかし、経済状況を改善するために各国政府が緩和を認めているため、予測期間中に市場は復活すると予想されます。多くの電気推進船企業がデジタル化に投資し、顧客がフリートをリアルタイムで遠隔モニタリングできるようにすることで、これらのOEM企業に新たな収益源を生み出しています。例えば

主要ハイライト

- 2020年6月、Kongsberg Gruppenのデジタルソフトウェア子会社であるKongberg Digitalは、フリートの所有者にフリートの位置と性能に関するリアルタイム洞察を遠隔で提供する新しいベンチマーク用途を発表しました。

ボートや船舶の増加、排出量削減のためにエコフレンドリーボートや船舶の採用を奨励する政府の注力など、長期的な要因が市場の需要を促進すると予想されます。例えば

主要ハイライト

- 2018年にノルウェー政府は、2021年までに少なくとも60隻の電気船を運航し、2026年までに国内のフィヨルドのようなユネスコ遺産に登録された観光地で運航されるすべての化石燃料船を禁止する目標を設定しました。

ノルウェーは市場成長に大きく貢献しており、欧州はこの地域で新しい電気船やボートの需要が最も高いため、市場で最大のシェアを占めると予想されます。また、英国は、2050年までに温室効果ガス排出量を正味ゼロにすることを目標とする主要G7諸国の中で最初の国となりました。

このように、前述の要因は、今後5年間で電気ボート・船舶市場に大きな成長をもたらすと予測されています。

電気ボート・船舶市場の動向

環境問題による電気ボート・船舶の採用拡大

電気ボート・船舶市場の促進要因には、海上観光の増加や海上貿易の増加といった要因が含まれます。世界経済は海運市場に依存しているため、このセグメントでは環境問題がますますクローズアップされており、電気ボート市場はこのセグメントでより大きな役割を果たすと予想されます。電気船やハイブリッドタイプの船は排出ガスが少なく、環境汚染を防ぐことができます。

さらに、排出量を削減するために電気ボートや船舶の利用を促進しようとする政府の支援や船主の意欲の高まりが、予測期間中の市場成長を後押しする可能性が高いです。例えば

- 2022年5月、フィンランド経済雇用省はサステイナブル海事産業のための開発プログラムを開始しました。このプログラムは、同国の海事産業への低炭素技術とデジタルソリューションの導入を加速させることを目的としています。同プログラムは、運輸通信省、ビジネスフィンランド、フィンランド産業投資、フィンベラ、フィンランドVTT技術研究センター、フィンランド海事産業連盟と協力して実施されます。このプログラムは2023年末まで実施されます。

- 2022年4月、オランダ政府は、2025年までにアムステルダム、ロッテルダムの都市部と国内のすべての国立公園で、すべての化石燃料を動力とするボートの使用を禁止すると発表しました。同国はまた、国内で運航されているすべてのレジャーボートを電気ボートに転換する計画を発表しました。

- 2021年4月、韓国は3,300万米ドルを投資し、グリーン船舶の最初のテストベッドを建設しました。

- 2050年までにカーボンニュートラルを達成するという韓国の計画の中核をなす2030年グリーンシップK推進戦略は、水素燃料電池や推進システムを含む低炭素船舶技術の進歩と普及を特に目標としています。このイニシアティブは、韓国の船舶の温室効果ガス排出量を今後25年間で40%削減し、2050年までに70%削減するという目標を掲げています。

- 2021年1月、海運のエレクトリフィケーションチェーン全体にわたる13社からなるグループは、「カレント・ダイレクト」と名付けられた新しいプロジェクトを立ち上げました。このプロジェクトは、海運における電池電気推進システムのコストを削減し、「サービスとしてのエネルギー」プラットフォームを構築することを目的としています。このプロジェクトは欧州委員会から1,200万ユーロ(1,236万米ドル)の資金援助を受けています。

- 2020年、韓国政府は、同国の海洋部門による汚染を削減するため、エコフレンドリー海運の開発を奨励する8億7,000万米ドルのイニシアチブを発表しました。

- 2019年、スウェーデン船主協会(Svensk Sjofart)は、2045年までにスウェーデン国内のすべての化石燃料船を廃止すると発表しました。

さらに、国際海事機関のような国際的な規制は、2020年1月に世界の硫黄キャップを展開しました。この規制により、主に商船や船舶は、排出規制区域外での運航に低硫黄燃料を必要とする可能性があり、電気船の採用が促進される可能性があります。

また、特に欧州などの地域で電気ボートを製造・販売する新興企業の参入も市場を牽引しています。

- 2022年9月、スウェーデンの電動ボート新興企業X Shoreは、2種類の船型を持つ電動スピードボートXショア1を発売した:トップとオープンの2種類で、3つの仕様があります。公益事業、パフォーマンス、プレミアムです。X Shore 1の最高速度は30ノット、巡航速度は20ノット、航続距離は低速で50海里、63kWhの電池パックを1つ搭載しています。X Shore 1は2023年第2四半期から納品可能です。

このように、前述したすべての要因が重なることで、今後5年間の電気ボート・船舶市場の健全な成長が見込まれます。

予測期間中、欧州が最大の市場シェアを占める展望

欧州が最大の市場シェアを占め、予測期間中にかなりの成長が見込まれます。スウェーデンは、ノルウェーやフィンランドとともに、環境規制や排出基準の高まりを受けて、同地域での電動ボートや船舶の採用を推進する上で重要な役割を果たしています。さらに、同地域における海洋観光、ウォーターアドベンチャー、漁業活動における電動レクリエーション・レジャー用船舶の人気の高まりは、同地域の市場成長を促進すると予想されます。

スウェーデン、フィンランド、ノルウェー、オランダなどの欧州諸国が、輸送関連のカーボンニュートラル目標を達成するために、環境に優しく、電気的な海洋モビリティを推進するために採用している政府の取り組みや施策は、欧州を電気ボート・船舶の支配的な市場の1つにする非常に大きな要因になると予想されます。

欧州に次いで、北米が最も高い成長を遂げ、アジア太平洋がそれに続くと予想されています。北米では、米国の人口の大半がボートやレジャーを好むため、米国はボート愛好家にとって大きな場所と考えられています。

アジア太平洋では、改良型蓄電池システムなどの新技術、海上貿易の増加、海洋観光が成長の原動力となっています。インド、中国、日本は市場成長に大きく貢献すると予想されます。

電気ボート・船舶産業概要

電気ボート・船舶市場は、複数の大手と地元企業が参入しているため、適度に統合されています。また、近年、特に欧州において、レジャー用電気ボートを製造する新興企業の参入が見られます。市場の主要企業には、ABB Limited、Siemens AG、Kongsberg Gruppen、General Dynamics Electric Boat、Corvus Energyなどがあります。いくつかの主要な市場参加者は、市場での地位を強化するために、他の電気船会社と協力関係を結んだり、M&Aを行ったりしています。さらに、市場参入企業は、他の参入企業に対する競合を獲得するために、電池技術の向上に注力しています。例えば

- 2022年10月、世界の電池技術革新企業であるEnevateと船舶推進会社のSealenceは、船舶用高性能電池の開発に関する提携を発表しました。

- 2022年8月、Volvo Cars Ltd.の子会社であるスウェーデンの高級電気自動車メーカー、Polestarは、スウェーデンの電気ボートメーカー、Candelaと複数年にわたる電池と充電システムの提供契約を締結しました。

- 2022年3月、DeepSpeedは蓄電容量83キロワット時、400Vの高出力液冷式電気ボート用電池を新発売しました。この新電池は、DeepSpeedが買収したイタリア・パルマ大学のeモビリティ分社eDriveLabが開発したものです。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 産業の魅力-ポーターのファイブフォース分析

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 推進力タイプ

- ハイブリッド

- 純粋電気

- 電池タイプ

- 鉛酸

- リチウムイオン

- ニッケル系

- 車種

- 旅客

- 貨物

- 地域

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- 英国

- ドイツ

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- その他

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Vision Marine Technologies Inc.

- Grove Boats SA

- Ruban Bleu

- ElectraCraft Boats

- Greenline Yachts

- Domani Yachts

- Ganz Boats GmbH

- Quadrofoil

- Duffy Electric Boats

- Groupe Beneteau

- Hyundai Heavy Industries(Hyundai Electric Limited)

- Daewoo Shipbuilding and Marine Engineering(DSME)

- ABB Ltd

- Corvus Energy

第7章 市場機会と今後の動向

The Electric Boat and Ship Market size is estimated at USD 7.96 billion in 2025, and is expected to reach USD 14.45 billion by 2030, at a CAGR of 12.65% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the growth of the electric boat and ship market due to the shutdown of manufacturing facilities and trade restrictions imposed worldwide. Maritime transport registered a massive decline since the ships were stranded on the sea and were prohibited from entering the ports resulting in significantly higher operating costs for the shipping companies.

According to some estimates, the container ship traffic dropped by 13.77% and passenger ship traffic dropped by 42.77% due to the traveling restrictions. However, with relaxations allowed by governments to improve economic conditions, the market is expected to revive during the forecast period. many electric marine propulsion ship companies invested in digitalization to help their clients remotely monitor their fleets on a real-time basis to generate new revenue streams for these OEMs. For instance

Key Highlights

- In June 2020, Kongberg Digital , the digital software subsidiary of Kongsberg Gruppen launched a new benchmarking application which provides real time insights on the location and performance of the fleets remotely to the fleet owners.

Over the long term factors such as the increasing boat and ship fleet and governments' focus on encouraging the adoption of eco-friendly boats and ships to reduce emissions are anticipated to propel the demand in the market. For instance

Key Highlights

- In 2018 the Government of Norway set a target to have atleast 60 electric ships operating in the country by 2021 and ban all the fossil fuel powered ships operating in UNESCO Heritage listed tourist sites like fjords in the country by 2026.

Norway being a significant contributor to the market growth, Europe is expected to hold the largest share in the market due to the highest demand for new electric ships and boats in the region. In addition, the United Kingdom became the first country among the major G7 countries to target net-zero greenhouse gas emissions by 2050, which includes the adoption of electric boats and ships.

Thus the aforementioned factors are projected to produce significant growth in the elctric boat and ship market over the next five years.

Electric Boat & Ship Market Trends

Growing Adoption of Electric Boats and Ships due to Environmental Concerns

The driving factors of the electric boat and ship market include factors like increased maritime tourism and increased seaborne trade, as 80% of the world's trade is carried by ships. As the global economy is dependent on the shipping market, the electric boat market is expected to play a bigger role in this sector as environmental causes have increasingly come to the forefront in this sector. Electric and hybrid types of ships cause less emission and save the environment from getting polluted more.

Moreover, growing government support and shipowners' willingness to promote the usage of electric boats and ships to reduce emissions is likely to help the market growth during the forecast period. For instance:

- In May 2022, The Ministry of Economic Affairs and Employment of Finland launched a development program for a sustainable maritime industry. The program aims to accelerate the adoption of low-carbon technologies and digital solutions for the maritime industry in the country. The program will be carried out in the cooperation with Ministry of Transport and Communications, Business Finland, Finnish Industry Investment, Finnvera, VTT Technical Research Centre of Finland and Finnish Marine Industries Federation. The progarm will run till the end of 2023.

- In April 2022, the Government of the Netherlands announced a ban on all fossil fuel powerd boats in the cities of Amsterdam, Rotterdam and all the national parks in the country, by 2025. The country has also announced plans to convert all the fleet of leisure boats operating in the country to electric boats.

- In April 2021, South Korea invested USD 33 million to build the first testbed for green marine vessels.

- The 2030 Green Ship-K Promotion Strategy, a central part of South Korea's plans to achieve carbon-neutrality by 2050, specifically targets the advancement and wider use of low-carbon ship technology, including hydrogen fuel cells and propulsion systems. The initiative has set a goal of reducing the country's shipping greenhouse gas emissions by 40% in the next 25 years and 70% by 2050.

- In January 2021, a group of thirteen companies across the entire shipping elctrification chain launched a new project named as ' Current Direct'. The project aims to reduce the cost of battery-electric propulsion systems in shipping and build an 'Energy as a Service' platform. The project is financed by European Commission with a grant of EUR 12 million (USD 12.36 million).

- In 2020, the South Korean government announced a USD 870 million initiative to encourage the development of eco-friendly shipping to reduce pollution caused by the country's marine sector.

- In 2019 Swedish Shipowners' Association ( Svensk Sjofart) announced to phase out all the fossil fuel powered ships in Sweden by 2045.

Additionally, international regulations, like the International Maritime Organization, deployed the global sulfur cap in January 2020. Under this regulation, ships, mainly commercial ships and marine vessels, may require low sulfur fuels to operate outside the emission control areas, which may propel electric ship adoption.

The market is also driven by the entry of new startups which manufacture and sell eletcric boats espaecially in geographies like Europe. For instance,

- In September 2022, Swedish electric boat startup X Shore launched X Shore 1 an electric speedboat in two configurations: Top and Open and three specifications: Utility, Performance and Premium. The X Shore 1 has top speed of 30 knots, cruising speed of 20 knots, range of 50 nautical miles at lower speeds and is powered by a single 63 kWh battery pack. The X Shore 1 is available for delivery from the second quarter of 2023.

Thus the confluence of all the aforementioned factors is likely to induce healthy growth in the electric boat and ship market over the next five years.

Europe is Expected to Hold the Largest Market Share During the Forecast Period

Europe is expected to hold the largest market share, and it is anticipated to witness considerable growth over the forecast period. Sweden is playing a significant role along with Norway and Finland in propelling the adoption of electric boats and ships in the region in the wake of growing environmental regulations and emission standards. Moreover, the growing popularity of electric recreational and leisure vessels in marine tourism, water adventures, and fishing activities in the region is expected to propel regional market growth.

The government initiatives and policies adopted by various European countries like Sweden, Finland, Norway, and the Netherlands to promote eco-friendly and electric marine mobility to achieve their transportation-related carbon neutrality goals are anticipated to be a very major factor in making Europe one of the dominant markets for electric boats and ships.

Next to Europe, North America is expected to witness the highest growth, followed by Asia-Pacific. In North America, the United States is considered a big place for boaters as the majority of the US population is fond of boating and leisure activities.

New technologies, such as improved battery storage systems, rising seaborne trade, and marine tourism drive growth in the Asia-Pacific region. India, China, and Japan are anticipated to contribute significantly to the market growth.

Electric Boat & Ship Industry Overview

The electric boats and ships market is moderately consolidated due to the presence of several major and local players in the market. The market has also seen the entry of some startups that manufacture leisure electric boats in recent years, especially in Europe. Some of the key players in the market are ABB Limited, Siemens AG, Kongsberg Gruppen, General Dynamics Electric Boat, Corvus Energy, and many more. Several key market players are entering collaborations and engaging in mergers and acquisitions with other electric ship companies to strengthen their positions in the market. Furthermore, the market participants focus on improving battery technology to attain a competitive edge over other players. For instance:

- In October 2022, Enevate a global battery innovation company, and boat propulsion company Sealence announced a collaboration to develop high-performance battery cells for marine applications.

- In August 2022, Swedish luxury electric vehicle manufacturer Polestar, a subsidiary of Volvo Cars Ltd., signed a contract with the Swedish electric boat manufacturer Candela to provide battery and charging systems in a multi year deal.

- In March 2022, DeepSpeed launched a new new high power liquid cooled electric boat battery with energy storage capacity of 83 kiloWatt hours and the 400V electric boat battery. The new battery is developed by eDriveLab, the e-mobility spinoff from University of Parma in Italy which is acquired by DeepSpeed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Hybrid

- 5.1.2 Pure Electric

- 5.2 Battery Type

- 5.2.1 Lead-acid

- 5.2.2 Lithium-ion

- 5.2.3 Nickel-based Batteries

- 5.3 Carriage Type

- 5.3.1 Passenger

- 5.3.2 Cargo

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vision Marine Technologies Inc.

- 6.2.2 Grove Boats SA

- 6.2.3 Ruban Bleu

- 6.2.4 ElectraCraft Boats

- 6.2.5 Greenline Yachts

- 6.2.6 Domani Yachts

- 6.2.7 Ganz Boats GmbH

- 6.2.8 Quadrofoil

- 6.2.9 Duffy Electric Boats

- 6.2.10 Groupe Beneteau

- 6.2.11 Hyundai Heavy Industries (Hyundai Electric Limited)

- 6.2.12 Daewoo Shipbuilding and Marine Engineering (DSME)

- 6.2.13 ABB Ltd

- 6.2.14 Corvus Energy