|

市場調査レポート

商品コード

1690814

HIPPS:市場シェア分析、産業動向・統計、成長予測(2025~2030年)HIPPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| HIPPS:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

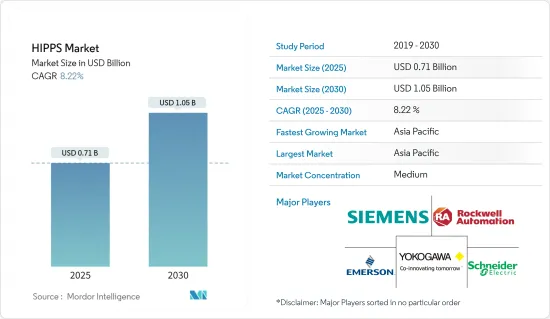

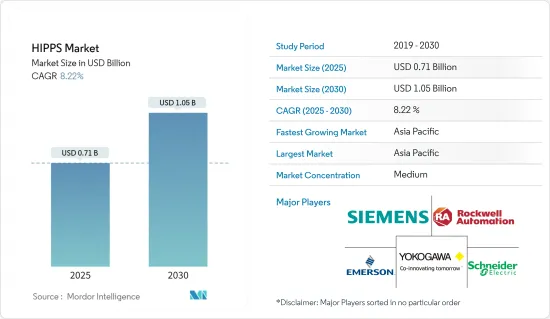

HIPPS(高信頼性圧力保護システム)市場規模は2025年に7億1,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは8.22%で、2030年には10億5,000万米ドルに達すると予測されています。

石油・ガスは、高信頼性圧力保護システム(HIPPS)市場の重要な対象セグメントの1つです。最近の発生で、この産業は下降傾向を観察し、市場成長に影響を及ぼしています。需要の観点からは、石油・ガスはCOVID-19発生の影響によって課題を抱えています。このため、生産者は設備投資や掘削計画を急速に削減しています。パンデミックはいくつかのプロジェクトの進捗に影響を与え、パイプラインの停滞や遅延を招いています。

主要ハイライト

- 新たなガス生産源をガスプラント施設に接続する場合、ガス生産施設やパイプラインを保護するための機械的なリリーフ装置が必要となることが多いです。既存のパイプラインに接続される新たな生産源は、潜在的な過圧からパイプラインを保護する必要があり、その結果、炭化水素が大気中に放出されたり、フレアシステムを通じてこれらの炭化水素が望ましくない形で燃焼されたりします。工場での事故が増加しているため、工場の安全性とセキュリティを守るための政府規制基準が高まっていることが、市場の成長を後押ししています。

- ワークステーションの安全性を高めるため、各産業における排出レベルに関する各地域の厳しい政府規制が、様々なHIPPSアプリケーションの需要を強化しています。市場の急速な開発、持続可能性施策、新技術の台頭、消費者の嗜好の変化により、エンドユーザー産業の情勢は急速に進化しています。

- 2020年7月、ネイヴェリ火力発電所(インド)でボイラー爆発事故が発生し、少なくとも6人が死亡、17人もの人が重傷を負りました。これは同発電所で2ヶ月間に起きた2度目のボイラー爆発事故でした。タミル・ナードゥ州(インド)の発電所では、過熱と高圧が爆発につながったと疑われています。

- 調査対象市場で事業を展開する参入企業は、HIPPS用途に関連する最先端技術開発に注力しています。例えば、2019年12月、High-Pressure Equipment Company(Graco Inc.の子会社)は、液体とガス管システムを過圧による損傷や故障から保護するように設計された新しいソフトシートリリーフバルブを発表しました。新型リリーフバルブは、外径9/16'チューブ用の1,500~2万5,000psiの圧力範囲で利用可能で、他のサイズにはアダプターが用意されています。同社の新開発バルブは、工場で指定圧力に設定され、それに応じてタグが付けられます。これらのバルブは、316ステンレススチール製ボディーと脱着式シートグランドを備え、標準的な用途には17-4PHのステムとシールリングを使用します。

高信頼性圧力保護システム市場動向

予測期間を通じて石油・ガスセグメントが主要シェアを占める

- 高信頼性圧力保護システムは、石油・ガス生産、精製、パイプラインシステムを過圧から保護するために設計された安全計装システムです。HIPPSは、石油・ガス会社のシステム設計と統合に関する専門知識を活用します。

- 同市場で活動する参入企業は、革新的な製品やソリューションの開発に注力しており、今後数年間のHIPPS市場の成長を後押しする可能性があります。最近では、ATV HIPPSがアラブ首長国連邦の主要顧客にHIPPSを納入しました。ATV HIPPSはATVグループとATV SpAの一部であり、石油・ガス産業向けのサブシーとトップサイドのクリティカルサービスバルブの大手企業です。同社は坑口設備と制御を専門とするHydropneumaticを買収しました。これにより、HIPPSソリューションの強化された技術ポートフォリオが活用される可能性があります。

- OCT SWの開発は、火災安全のために使用される海水サービスバルブに関するオフショア石油・ガス事業者からの市場フィードバックによって推進されました。この新しいソリューションは、海水にさらされると近隣金属の腐食感受性を高める可能性のある黒鉛部品を確実にします。

- 過剰な坑口圧力は、下流の人員、生産・生産資産、環境に深刻な結果をもたらす可能性があります。そのため、IEC 61511に準拠した保護システムの導入が必須となっています。企業は様々な戦略を実施していますが、最も一般的なのは、SIL 2またはSIL 3に準拠するための1oo2または2oo3アーキテクチャです。

- 過去には、インドの大手エンジニアリング企業であるLarsen & Toubroが、アッサム州のディロック・ガス田開発プロジェクトに、同国独自開発のHIPPSを供給しました。L&T Valvesは、Hindustan Oil Exploration Company、Oil India、IOCLのコンソーシアムが推進するDirokガス田開発プロジェクトにHIPPSを供給しました。

- HIPPSの需要はさらにサステイナブル開発施策に左右され、産業の用途要件をさらに逸脱する可能性があります。サステイナブル開発シナリオでは、決定された施策介入により、今後数年以内に世界の石油需要がピークに達する可能性があります。2018~2040年にかけて、先進国では50%以上、新興経済諸国では10%需要が減少すると推定されます。

アジア太平洋セグメントは予測期間中に著しい成長が見込まれる

- アジア太平洋のHIPPS市場は、予測期間中に最も高い成長率を示すと予想されます。これは、この地域が石油・ガス精製能力の開発に注力していることと、中国、日本、インドがこの地域の主要国のいくつかである化学産業の顕著な成長によるものです。例えば、IEAによると、アジアは引き続きLNGの主要供給先であり、2020年までにLNG輸入総量の70%を占めます。

- IEAによると、今後5年間のガス需要はアジア太平洋が牽引し、2024年までに総消費増加量の60%近くを占めると予想されています。2019年には、石油産業の拡大、生活水準の向上、ガスインフラの開発により、中国におけるガス需要が急増しました。

- アジア太平洋は、石油・ガス、化学、発電事業におけるHIPPS設置に大きな可能性を示しています。中国やインドなどでは石油化学製品の需要が急増しており、石油・ガス・化学製品の生産が拡大しています。

- 例えば、インド化学肥料省によると、2018~2019年の生産量の年間成長率は前年比4.70%で、主要化学品の場合、8年間のCAGRは3.02%でした。基本的な主要石油化学製品の年間成長率は前年比3.82%、同期間のCAGRは3.54%でした。

HIPPS産業概要

HIPPS市場の競争は中程度で、かなりの数の世界的・地域的参入企業で構成されています。これらの業者は市場でかなりのシェアを占めており、顧客基盤の拡大に注力しています。これらのベンダーは、研究開発活動、戦略的パートナーシップ、その他の有機的・無機的成長戦略に注力し、予測期間における競合を獲得しています。

- 2020年7月-MOGAS Industries, Inc.は、米国を拠点とするシビアサービスバルブメーカーWatson Valveの資産を買収し、修理とコーティングサービスを開始しました。Watson Valveは鉱業向けを中心に、化学・石油・ガス産業向けも含め、世界で3,400以上のバルブを納入しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場の促進要因

- 工場での事故増加に伴う、工場での安全・安心を守るための政府規制基準の高まり

- 市場課題

- 導入コストと必要なスキルセットの不足

- 市場機会

- 産業の規制状況(SIL、IEC 61511、IEC 61508など)

第6章 市場セグメンテーション

- タイプ

- コンポーネント

- サービス

- エンドユーザー産業

- 石油・ガス

- 化学

- 電力

- 金属・鉱業

- 飲食品

- その他プロセス産業

- 地域

- 北米

- 欧州

- アジア太平洋

- その他

第7章 競合情勢

- 企業プロファイル

- Rockwell Automation

- Emerson Electric Co.

- Severn Glocon Group

- Schneider Electric

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Schlumberger NV

- Mogas Industries Inc.

- Mokveld Valves BV

- SELLA CONTROLS Ltd

- ATV Hipps

- HIMA Paul Hildebrandt GmbH

- PetrolValves SpA

- L& T Valves Limited(Larsen & Toubro Limited)

- BEL Valves(British Engines Limited)

第8章 ベンダーのポジショニング分析

第9章 投資分析

第10章 市場機会と今後の動向

The HIPPS Market size is estimated at USD 0.71 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 8.22% during the forecast period (2025-2030).

Oil and gas are one of the significant target segments for the high integrity pressure protection system (HIPPS) market. With the recent outbreak, the industry has observed a downward trend, affecting market growth. From the demand perspective, oil and gas have been challenged by the effects of the COVID-19 outbreak. Owing to this, producers have rapidly slashed capital spending and drilling programs. The pandemic has impacted the progress of several projects, resulting in pipelines getting stalled or delayed.

Key Highlights

- The connection of new gas production sources to a gas plant facility has often required mechanical relief devices to protect gas production facilities or pipelines. New production sources connected to existing pipelines require the pipeline to be protected against potential overpressure, resulting in the release of hydrocarbons to the atmosphere or undesirable burning of these hydrocarbons via a flare system. Rising government regulatory standards to defend safety and security at industrial plants due to increasing accidents at plants drives the growth of the market.

- Strict government regulations in the regions on emission levels across industries to increase workstation safety have bolstered the demand for various HIPPS applications. Due to rapid developments in the emerging markets, sustainability policies, the rise of new technologies, and changing consumer preferences, the end-user industry landscape has been rapidly evolving.

- In July 2020, in a boiler blast at Neyveli Thermal Power Station (India), at least six people died, and as many as 17 others suffered serious injuries. This was the second boiler explosion in two months at the same plant. It is suspected that overheating and high pressure led to the power plant explosion in Tamil Nadu (India).

- Players operating in the market studied have been focusing on cutting-edge technology developments pertaining to HIPPS applications. For instance, in December 2019, High-Pressure Equipment Company (a subsidiary of Graco Inc.) introduced a new soft seat relief valve designed to protect liquid and gas tubing systems from overpressure damage and failure. The new relief valves are available in pressure ranges from 1,500 to 25,000 psi for 9/16' O.D. tubing, with adapters available for other sizes. The company's newly developed valves are factory set to the designated pressure and tagged accordingly. They feature 316 stainless steel bodies and removable seat glands, with a 17-4PH stem and seal ring for standard applications.

High Integrity Pressure Protection System Market Trends

Oil and Gas Segment Holds for a Major Share Throughout the Forecast period

- A high integrity pressure protection system is a safety instrumented system designed to protect oil and gas production, refining, and pipeline systems against over-pressurization. HIPPS leverages an oil and gas company's expertise in system design and integration.

- Players operating in the market are focusing on developing innovative products and solutions, which may bolster the growth of the HIPPS market in the coming years. In the recent past, ATV HIPPS delivered HIPPS to a major customer in the United Arab Emirates. ATV HIPPS is part of ATV Group and ATV SpA, a major player in Subsea and Topside critical service valves for the oil and gas industry. The company acquired Hydropneumatic, which is specialized in wellhead equipment and controls. This may leverage its enhanced technical portfolio of HIPPS solutions.

- The OCT SW development was driven by market feedback from offshore oil and gas operators concerning seawater service valves used for fire safety. The new solution ensures graphite parts, which can increase neighboring metals' susceptibility to corrosion when exposed to seawater.

- Excessive wellhead pressure can cause serious consequences to downstream personnel, production and production assets, and the environment. It is, therefore, mandatory to have IEC 61511 compliant protection systems. Companies implement various strategies, but the most common are 1oo2 or 2oo3 architectures for compliance to SIL 2 or SIL 3.

- In the past, the Indian engineering major, Larsen & Toubro, supplied the country's indigenously developed HIPPS to Dirok Gas Field Development Project in Assam. L&T Valves, a part of Larsen & Toubro, supplied indigenously developed HIPPS to Dirok, which is promoted by a consortium of Hindustan Oil Exploration Company, Oil India, and IOCL.

- HIPPS's demand further depends on sustainable development policies, which may deviate the industry application requirement further. In the sustainable development scenario, determined policy interventions may lead to a peak in the global oil demand within the next few years. The demand is estimated to fall by more than 50% in advanced economies and by 10% in developing economies between 2018 and 2040.

Asia Pacific Segment Expected to Grow at a Significant Rate Over the Forecast Period

- The Asia Pacific HIPPS market is anticipated to witness the highest growth rate during the forecast period due to the region's focus on developing oil and gas refining capacity and notable growth in the chemicals industry, with China, Japan India being some of the principal countries in this region. For instance, according to IEA, Asia continued to be the key destination for LNG, accounting for 70% of the total LNG imports by 2020.

- According to IEA, gas demand in the coming five years is set to be driven by Asia Pacific, and it is anticipated to account for almost 60% of the total consumption increase by 2024. In 2019, the requirement for gas in China surged sharply due to the expansion of the petroleum industry, improvement in living standards, and the development of gas infrastructure.

- Asia Pacific presents a tremendous potential for the installation of HIPPS in the oil and gas, chemicals, and power generation businesses. The burgeoning demand for petrochemicals in countries, such as China and India, is augmenting the production of oil, gas, and chemicals.

- For instance, according to the Ministry of Chemicals and Fertilizers, India, the annual growth of production during 2018-2019 was 4.70% over the preceding year, with a CAGR of 3.02% over a period of eight years, in case of major chemicals. The annual growth of basic major petrochemicals was 3.82% over preceding year, with a CAGR of 3.54% during the same period.

High Integrity Pressure Protection System Industry Overview

The high integrity pressure protection system (HIPPS) market is moderately competitive and consists of a significant number of global and regional players. These players account for a considerable share in the market and focus on expanding their customer base. These vendors focus on the research and development activities, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

- July 2020 - MOGAS Industries, Inc. acquired the assets of Watson Valve, a US-based manufacturer of severe service valves, in order to have repairs and coating services. Watson Valve has a global install base of more than 3,400 valves, majorly in the mining industry, and encompasses the chemical and oil & gas industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants, Owing to Increasing Accidents at Plants

- 5.2 Market Challenges

- 5.2.1 Implementation Cost and Lack of Required Skillsets

- 5.3 Market Opportunities

- 5.4 Regulatory Landscape of the Industry (SIL, IEC 61511, IEC 61508, etc.)

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Components

- 6.1.2 Services

- 6.2 End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Power

- 6.2.4 Metal and Mining

- 6.2.5 Food and Beverages

- 6.2.6 Other Process Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 Emerson Electric Co.

- 7.1.3 Severn Glocon Group

- 7.1.4 Schneider Electric

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 ABB Ltd

- 7.1.7 Siemens AG

- 7.1.8 Schlumberger NV

- 7.1.9 Mogas Industries Inc.

- 7.1.10 Mokveld Valves BV

- 7.1.11 SELLA CONTROLS Ltd

- 7.1.12 ATV Hipps

- 7.1.13 HIMA Paul Hildebrandt GmbH

- 7.1.14 PetrolValves SpA

- 7.1.15 L&T Valves Limited (Larsen & Toubro Limited)

- 7.1.16 BEL Valves (British Engines Limited)