|

市場調査レポート

商品コード

1910805

金属マグネシウム:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Metal Magnesium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 金属マグネシウム:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

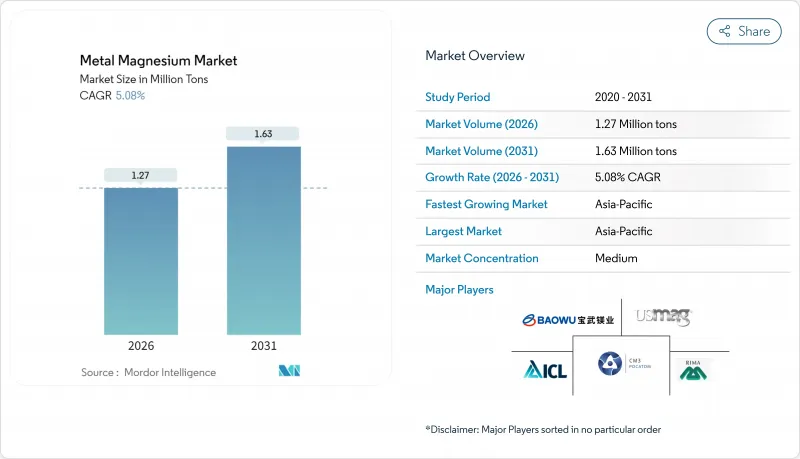

2026年の金属マグネシウム市場規模は127万トンと推定され、2025年の121万トンから成長が見込まれます。

2031年には163万トンに達する見通しで、2026年から2031年にかけてCAGR5.08%で拡大する見込みです。

自動車の軽量化政策、電気自動車製造におけるギガキャスティング技術の急速な普及、カーボンニュートラルな抽出技術の規模拡大が勢いを増しています。アルミニウム合金への持続的な需要、医療分野における生分解性インプラントへの転換、単一国依存からの脱却を目指す世界のサプライチェーンの再構築が、市場の中期的成長軌道を支えています。エネルギー使用量とCO2排出強度を大幅に削減する新たな生産ルートが投資家の注目を集め始めており、プロセス革新と地理的多様化の転換点を示しています。

世界の金属マグネシウム市場の動向と展望

自動車・航空宇宙分野における軽量化の進展

自動車メーカーは排出ガス規制対応のため材料置換プログラムを強化しており、マグネシウムはボディインホワイト部品、クロスメンバー、バッテリーハウジングに最適です。1.74-1.85 g/cm3の密度によりアルミニウム比22-30%の部品軽量化を実現。3,500トン級の新規ダイカストプレス導入により、従来は複数部品組立が必要だった大型構造部品の製造が可能となりました。電気自動車プラットフォームでは、軽量化による1キログラムあたりの航続距離向上が相乗効果をもたらします。一方、航空宇宙メーカーでは非重要キャビン構造へのマグネシウム採用が燃料消費削減のため実証されています。統合供給契約では、将来の金属供給がライフサイクル炭素排出量指標と連動し、低CO2排出生産者が優遇される仕組みが構築中です。これらの要因が相まって、軽自動車全体の生産台数が安定化する中でも、1台あたりのマグネシウム消費量は短期的に増加傾向にあります。

アルミニウム合金需要の増加

高強度アルミニウム合金における硬化剤・腐食防止剤としてのマグネシウムの役割は、EV用バッテリー筐体、ボディパネル、押出プロファイルに結びついた成長の鍵となります。0.5~1.5重量%の添加により、降伏強度、溶接性、疲労寿命が向上します。2024年に4,000万トンを超える生産量を記録した中国のアルミニウム製錬所は、世界の需要の基盤となっています。同国の合金組成は、マグネシウム含有量の高い6xxx系および5xxx系グレードへ急速にシフトしています。カーテンウォールから橋梁床板に至る建設用途は、自動車サイクルの変動から供給業者を保護する基盤消費の第二の柱を形成しています。インライン合金化システムを備えた連続鋳造ラインでは、マグネシウムの計量がより正確になり、元素の損失が3%未満に削減され、厳しいコスト目標の達成に貢献しています。

ピジョンプロセスの高いCO2フットプリント

規制当局は、排出権取引制度や炭素国境調整案を通じて、金銭的な圧力を加えています。EUの監査機関は、ピジョン法のCO2排出量を1トン当たり11~15トンと推定しており、これはEUの2030年の産業平均目標である1.6トンを大きく上回っています。クレードル・トゥ・ゲート(Cradle-to-Gate)のフットプリントを公開する自動車メーカーは、検証済みのライフサイクルデータに基づいてサプライヤーの審査を強化しており、高炭素の事業者は、廃熱回収や太陽熱焼成を後付けするか、上場廃止のリスクを負うかの選択を迫られています。二次溶解スクラップは、一次プロセスのエネルギーの5%しか必要とせず、スコープ1排出量を部分的に軽減しますが、スクラップの入手可能性は、収集の物流によって依然として制限されています。この政策の推進により、電解法および海水法の相対的な競合力が加速しています。

セグメント分析

海水電解抽出は、2031年まで5.62%のCAGRで最も急成長しているルートですが、熱ピジョン法は依然として現在の生産量の62.74%を占めています。海水抽出による金属マグネシウムの市場規模は16万トンと推定されており、パイロットプラントの商業化が成功すれば、2031年までに2倍になる可能性があります。コスト競争力は、1kWhあたり0.04ドル以下の再生可能エネルギー料金に依存しており、中東および北アフリカの沿岸地域では、この料金の提供が開始されています。これまで航空宇宙グレードの純度のバッチに限定されていた電解プロセスは、塩素排出量を大幅に削減する不活性陽極の進歩の恩恵を受け、ESGスコアの向上に貢献しています。

従来のピジョン生産者は、減価償却資産と深いオペレーターのノウハウを活かし、その優位性を維持していますが、迫り来る炭素規制対応費用がその優位性を損ないつつあります。陝西省と寧夏回族自治区の統合鉱山会社は、効率向上のために、低炭素フェロシリコンと自律的な鉱石運搬のための3億2,000万米ドルの改修予算を発表しました。自動車メーカーがリサイクル含有量の基準を設定したことで、95%の金属回収率を誇る二次リサイクルが注目を集めていますが、スクラップの流通は需要に遅れをとっています。International Battery Metals社のモジュラー式DLEプラントは、塩水事業と併設されており、複数の金属を統合することで、同じ還元炉に供給しながらプロジェクトのリスクを分散できることを実証しています。

金属マグネシウム市場レポートは、生産プロセス(熱ピジョン、電解、二次/リサイクル、海水電解抽出)、エンドユーザー産業(アルミニウム合金、ダイカスト、鉄鋼、金属還元、その他のエンドユーザー産業)、および地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)ごとに分類されています。市場予測は、数量(トン)で提供されます。

地域別分析

アジア太平洋地域は、2025年の世界の出荷量の47.85%を占め、5.96%のCAGRで成長しています。マグネシウムを「デュアルユース戦略金属」に組み入れる政府の取り組みにより、低利融資がより環境に優しい生産能力に向けられる可能性があります。日本と韓国は、家電製品の筐体やBEVバッテリーカバー用の合金技術を最適化し、インゴットを輸入しながら付加価値の高い部品を輸出しています。

北米では、2024年末に米国マグネシウム社がユタ州の操業を停止したことで、唯一の大規模一次情報を失いました。この供給不足により、自動車メーカーや防衛主要企業はアジアの在庫や小規模なカナダの委託溶解プールに依存せざるを得ず、輸送コストの上昇と供給安定性の懸念が高まっています。

欧州は、埋蔵炭素の削減に注力しています。ドイツのリサイクル業者は、スプルーやランナーを回収するクローズドループプログラムを拡大し、二次マグネシウムの供給量を地域供給量の30%以上へと押し上げています。水力発電の活用を目指すノルウェーは、世界平均と比較して炭素強度を半減させる、年間3万トンの電解セルパークの研究を進めています。ピジョンルート周辺の規制上の逆風により、OEMは2026年に起工が予定されているトルコおよびサウジアラビアの海水プロジェクトへの多様化を進めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 自動車および航空宇宙分野における軽量化のブーム

- アルミニウム合金需要の増加

- 電気自動車向けギガキャスティングの普及

- カーボンニュートラルな海水電解マグネシウム技術

- 生分解性マグネシウムインプラントの普及が進んでいます

- 市場抑制要因

- 価格およびエネルギーコストの変動性

- ピジョンプロセスの高い二酸化炭素排出量

- 腐食・防火上の懸念

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 製造プロセス別

- サーマル・ピジョン

- 電解

- 二次/リサイクル

- 海水電気抽出

- エンドユーザー産業別

- アルミニウム合金

- ダイカスト

- 鉄鋼

- 金属還元

- その他のエンドユーザー産業

- 地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited(SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry(Group)Co. Ltd

- Western Magnesium Corporation