|

市場調査レポート

商品コード

1440260

アルミニウム部品重力鋳造:市場シェア分析、業界動向と統計、成長予測(2024-2029)Aluminum Parts Gravity Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アルミニウム部品重力鋳造:市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

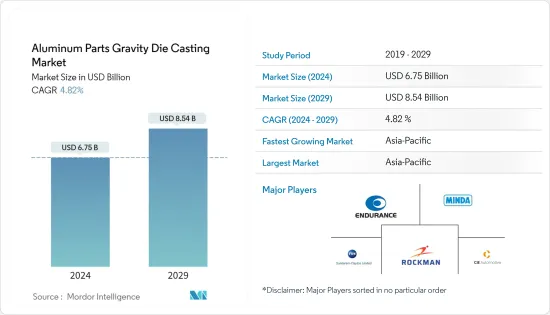

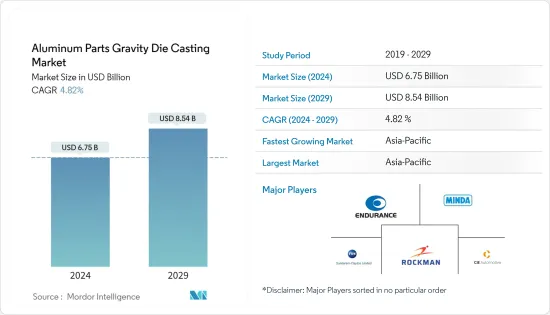

アルミニウム部品重力鋳造市場規模は、2024年に67億5,000万米ドルと推定され、2029年までに85億4,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.82%のCAGRで成長します。

2020年にCOVID-19が発生した際、自動車業界のサプライチェーン全体が大きな影響を受けました。 OEMは事業を継続するのに苦労していました。しかし、ロックダウンや制限が緩和されるにつれ、自動車産業とアルミニウム部品重力鋳造市場は勢いを取り戻しました。

この市場は主に、ダイカスト業界のサプライチェーンの複雑さ、自動車市場の拡大、産業機械におけるダイカスト部品の普及の増加、建設分野の成長、電気・電子分野でのアルミニウム鋳物の採用によって大きく動かされています。

重力ダイカストは、最も古いダイカスト方法の1つです。このダイカストプロセスは、正確な寸法、鮮明な輪郭、滑らかなまたはテクスチャーのある表面の金属部品を製造するために使用されます。重力ダイカストの主な利点は、生産速度が速いことです。

自動車の排出ガスを削減し、燃費を向上させるためのCAFE基準とEPAの政策により、自動車メーカーは軽量金属の採用により自動車の重量を削減するようになっています。その後、軽量化戦略としてダイカスト部品を採用することが、自動車分野の前者の市場を大きく牽引する役割を果たしています。

アルミニウム部品重力鋳造市場動向

厳しいEPA規制とカフェ基準が市場の需要を促進する可能性が高い

欧州と北米の自動車規制の枠組みは、自動車産業における持続可能な環境の構築に貢献してきました。 2011年に導入され、2014年 9月から施行された最新の規制枠組みであるユーロ6は、この地域の自動車市場の動向を決定する上で重要であった規制基準を変更しました。 2013年以来、EC(欧州委員会)はEEA/EMEPと協力して、欧州で登録された各新車の排出性能基準の記録を維持しています。

排ガス規制は自動車メーカーを結びつけるものです。貨物会社と車両所有者は、平均排出率の削減が期待されるテクノロジーをさらに導入する方向に急速に動いています。そのため、排出ガスレベルを下げるために車両の重量を軽減する必要があるため、車両へのダイカスト部品の採用が大幅に促進されています。

自動車メーカーは、車両の燃料効率を向上させ、二酸化炭素排出量を削減するために、車両コンポーネントをより効率的にする方法を常に模索しています。この目標を達成するには、効率的でコストが最適化されたアルミニウムダイカスト部品を使用した軽量構造が重要な役割を果たします。 Nemakのような企業は、「軽量」動向に焦点を当て、電気自動車製品(HPDCプロセスを使用して製造)を自動車業界に導入しています。前述のような環境政策により、市場の需要が高まると予想されます。

アジア太平洋地域は市場で大きなシェアを握ると予想される

アジア太平洋は、インド、中国などの主要経済国の存在、主要企業の積極的な関与といくつかの政府の取り組みにより、世界最大の自動車市場であり、これらはアルミニウム重力の発展にさらに貢献すると期待されています。ダイカスト市場。中国はアルミニウムおよびアルミニウム製品の世界有数の輸出国です。 2022年の中国のアルミニウム輸出は前年比741.4%増の100万トンとなり、2021年12月にはわずか39億6,900万トンだったが、2022年12月には5万7349万トンに達しました。

アジア太平洋地域も、世界中で中国製品に対する高い需要があるため、新型COVID-19感染症のパンデミックの影響から急速に回復しています。製造能力の向上に伴い、アルミニウム部品重力鋳造市場の需要は予測期間中に成長すると予想されます。

2022年には、ヴェダンタ(1,696,960トン)、ヒンダルコ(969,180トン)、およびナルコ(343,460トン)がアルミニウム生産の3つの著名な企業となった。インドは鋳物を生産する世界第2位の鋳物産業です。インドの鋳造工場は、国際規格に準拠した幅広い用途に対応する重力ダイカスト製品を生産できます。

政府の「メイク・イン・インディア」への注力、自動車産業の発展、厳しい排出基準が市場の成長を推進しています。 2022~23年度の乗用車(PV)輸出総量は、2021~22年度の57万7,875台に対し、66万2,891台となった。ヒュンダイ、起亜自動車、マルチ・スズキ、フォルクスワーゲンなどの企業は、低コストの製造とインドでの部品サプライヤーの入手可能性を理由に、アフリカ地域に工場を設立する代わりに、インド製の自動車をアフリカ地域に輸出しています。これらすべての要因は、予測期間中のアジア太平洋のアルミニウム部品重力鋳造市場の全体的な発展に貢献します。

アルミニウム部品重力鋳造業界の概要

アルミニウム部品重力鋳造市場は本質的に細分化されており、大規模/国際的なプレーヤーだけでなく、複数の国にわたる地域の中小規模プレーヤーも多数存在します。

主要企業はまた、さまざまな合併、拡張、提携、合弁事業、買収を通じて世界的に事業を拡大しています。これらの主要企業は、より良い生産プロセスと合金を考案するための研究開発に収益を集中させています。この戦略は、世界の自動車および産業部門向けの高品質のダイカスト部品の生産に役立つ可能性があります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 自動車および航空宇宙分野での軽量材料の重視

- 市場抑制要因

- 設計の柔軟性が限られている

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション(市場規模、金額)

- 用途

- 自動車

- 部品とコンポーネント

- トランスミッション部品

- エンジン部品

- ブレーキ部品

- その他の部品およびコンポーネント

- 車両タイプ

- 乗用車

- 商用車

- その他の車両

- 電気および電子

- 産業用途

- その他の用途

- 自動車

- 地域

- 北米

- 米国

- カナダ

- 北米のその他の地域

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- 南アフリカ

- トルコ

- 残りの中東およびアフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Rockman Industries

- Endurance Technologies Limited

- Minda Corporation Limited

- Hitachi Metals Ltd

- MAN Group Co.

- MRT Castings Ltd

- Harrison Castings Limited

- Vostermans Companies

- CIE Automotive

- Sundaram Clayton Ltd

- GWP Manufacturing Services AG

第7章 市場機会と将来の動向

- 電気自動車の導入の増加

- 改善されたツーリング設計、コンピュータ支援シミュレーション、およびプロセス制御システム

The Aluminum Parts Gravity Die Casting Market size is estimated at USD 6.75 billion in 2024, and is expected to reach USD 8.54 billion by 2029, growing at a CAGR of 4.82% during the forecast period (2024-2029).

During the COVID-19 outbreak in 2020, the entire supply chain of the automotive industry was significantly impacted. The OEMs struggled to keep their operations going. However, as the lockdowns and restrictions were relaxed, the automotive industry and the aluminum parts gravity die-casting market regained their momentum.

The market is largely driven by supply chain complexities in the die-casting industry, the expanding automotive market, increasing penetration of die-casting parts in industrial machinery, the growing constructional sector, and employing aluminum castings in the electrical and electronics sector.

Gravity die casting is one of the oldest methods of die casting. This die-casting process is used for producing accurately dimensioned, sharply defined, and smooth or textured-surface metal parts. The main advantage of gravity die casting is its high speed of production.

The CAFE standards and EPA policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of automobiles by employing lightweight metals. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment.

Aluminum Parts Gravity Die Casting Market Trends

Stringent EPA Regulations and Cafe Standards are Likely to Drive Demand in the Market

The automobile regulatory frameworks in Europe and North America have been instrumental in creating a sustainable environment in the automobile industry. The latest regulatory framework, Euro 6, which was introduced in 2011 and came into effect from September 2014 onward, changed the regulatory standards that have been crucial in determining the dynamics of the automotive market in the region. Since 2013, the EC (European Commission), along with EEA/EMEP, has been maintaining the record of emission performance standards for each new vehicle registered in Europe.

The emission regulations bind the automotive manufacturers together. Freight companies and fleet owners are rapidly moving toward incorporating more technologies that are expected to reduce the average emission rate. Thereby, a need to reduce vehicle weight to lowering emission levels has greatly encouraged the employment of die-cast parts in vehicles.

Automobile manufacturers are always looking for ways to make vehicle components more efficient to improve the fuel efficiency of vehicles and reduce carbon emissions. Lightweight construction, using efficient and cost-optimized aluminum die-casted parts, plays a key role in achieving this goal. Companies like Nemak are focusing on the 'lightweight' trend and introducing electric vehicle products (manufactured by using the HPDC process) into the automotive industry. Such aforementioned environmental policies are expected to drive the demand in the market.

The Asia-Pacific Region is Expected to Hold a Significant Share in the Market

Asia-Pacific is the largest automotive market in the world due to the presence of key economies like India, China, etc., and active engagements of key players and several government initiatives, which are expected to further contribute to the development of the aluminum gravity die-casting market. China is the world's leading exporter of aluminum and aluminum products. In 2022, China's exports of aluminum increased by 741.4% year on year to 1 million mt and reached 57,349 mt in December 2022 compared to only 3,969 mt in December 2021.

The Asia-Pacific region has also recovered quickly from the impact of the COVID-19 pandemic due to the high demand for Chinese products across the world. With growing manufacturing capabilities, the demand in the aluminum parts gravity die-casting market is expected to grow during the forecast period.

In 2022, Vedanta (1,696,960 mt), Hindalco (969,180 mt), and Nalco (343,460 mt) were the three prominent companies in aluminum production. India stands as the second-largest foundry industry that produces castings in the world. Foundries in India are capable of producing gravity die-casting products that serve a wide range of applications conforming to international standards.

The government's focus on 'Make in India', developing the automotive industry, and the stringent emission norms is driving the market growth. In FY 2022-23, total passenger vehicle (PV) exports stood at 6,62,891 units in compare to 5,77,875 units in 2021-22. Companies such as Hyundai, Kia, Maruti Suzuki, and Volkswagen are exporting Indian-made cars to the African region instead of setting up their factories there because of low-cost manufacturing and availability of parts suppliers in India. All these factors contribute to the overall development of the Asia-Pacific aluminum parts gravity die casting market during the forecast period.

Aluminum Parts Gravity Die Casting Industry Overview

The market for aluminum parts gravity die casting is fragmented in nature, with the presence of many regional small-medium scale players across several countries, as well as large-scale/international players.

Key players have also expanded their operations globally through various mergers, expansions, partnerships, joint ventures, and acquisitions. These key players are focusing their revenues on R&D to come up with better production processes and alloys. This strategy may assist in the production of premium-quality die-cast parts for the global automotive and industrial sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Emphasis on Lightweight Materials in Automobile and Aerospace sector

- 4.2 Market Restraints

- 4.2.1 Limited Design Flexibility

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Application

- 5.1.1 Automotive

- 5.1.1.1 Parts and Components

- 5.1.1.1.1 Transmission Parts

- 5.1.1.1.2 Engine Parts

- 5.1.1.1.3 Brake Parts

- 5.1.1.1.4 Other Parts and Components

- 5.1.1.2 Vehicle Type

- 5.1.1.2.1 Passenger Cars

- 5.1.1.2.2 Commercial Vehicles

- 5.1.1.2.3 Other Vehicles

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial Applications

- 5.1.4 Other Applications

- 5.1.1 Automotive

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Turkey

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rockman Industries

- 6.2.2 Endurance Technologies Limited

- 6.2.3 Minda Corporation Limited

- 6.2.4 Hitachi Metals Ltd

- 6.2.5 MAN Group Co.

- 6.2.6 MRT Castings Ltd

- 6.2.7 Harrison Castings Limited

- 6.2.8 Vostermans Companies

- 6.2.9 CIE Automotive

- 6.2.10 Sundaram Clayton Ltd

- 6.2.11 GWP Manufacturing Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Electric Vehicles

- 7.2 Improved Tooling Design, Computer-aided Simulation, and Process Control Systems