|

市場調査レポート

商品コード

1406111

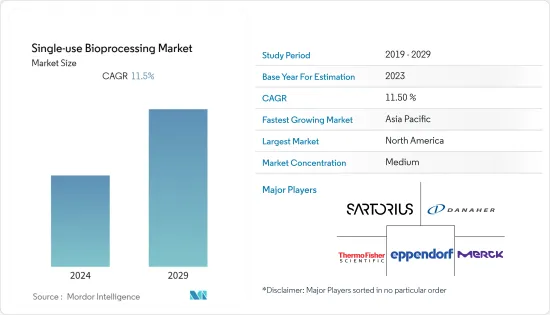

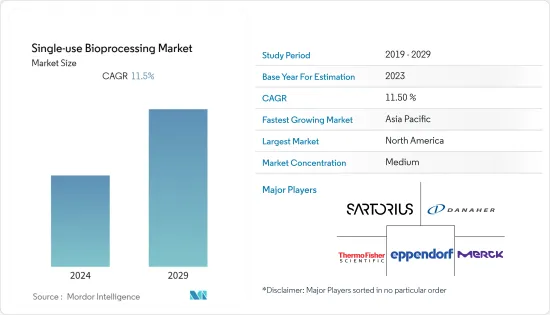

シングルユースバイオプロセシング - 市場シェア分析、産業動向・統計、2024年~2029年成長予測Single-use Bioprocessing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| シングルユースバイオプロセシング - 市場シェア分析、産業動向・統計、2024年~2029年成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

シングルユースバイオプロセシング市場は予測期間中にCAGR 11.5%を記録すると予測されています。

パンデミックの初期段階は、製造プロセスの大幅な低下と医薬品の需要と供給の制限により、シングルユースバイオプロセシング市場の成長に大きな影響を与えました。しかし、シングルユース技術(SUT)は、前臨床および臨床規模を含む商業化前の製造において主要な技術となった。COVID-19症例の増加に伴い、効果的な医薬品と多くのワクチンの需要が増加しました。また、コンタミネーションの可能性が少なく、バッチ間の滅菌テストが少なくて済むことから、バイオ製薬会社のシングルユースバイオプロセシング・システムと技術の採用も増加しました。また、シングルユース技術を使った創薬も、パンデミック対策として大きな焦点となった。例えば、2022年11月にNational Library of Medicineに掲載された論文によると、パンデミックによって、医薬品やワクチンの迅速な製造のためのシングルユースデバイスに対する需要の高まりが加速したことが観察されています。感染率の増加により、COVID-19ワクチン研究のほとんどはシングルユース技術に基づいています。したがって、こうした取り組みにはmRNAやDNA技術のような新しいアプローチが用いられています。それゆえ、COVID-19パンデミックの間、研究市場は大きな成長を示しました。

シングルユースバイオプロセシング技術の迅速な導入と製品の交差汚染のリスクの低減、バイオ医薬品需要の増加、コストの低減、環境への影響の低減といった要因が、市場の成長を押し上げると予想されます。

慢性疾患を患う人口の増加により、バイオ医薬品の需要が増加しています。そのため、治療のための効果的な医薬品や製品の必要性が高まり、シングルユース技術や関連製品の需要が高まり、市場成長が促進されると予想されます。例えば、FDAが発表したデータによると、2023年2月、2022年には約14の生物製剤が様々な慢性疾患の治療薬として承認されました。製薬業界は、予測期間中にシングルユースバイオプロセシング技術およびシステムの利用および採用を増加させると予想されます。

シングルユースモニタリングツールの導入が可能になり、センシング技術が向上したことで、生産者はプロセスをよりコントロールできるようになり、採用が増加します。また、シングルユース技術とシステムの採用は、バイオ医薬品企業が汚染リスクを根絶するという課題を克服するのに役立つため、バッチ間の滅菌の必要性が低下し、生産性が向上します。さらに、シングルユース・バイオリアクターと発酵槽は高い柔軟性を提供するため、プロセスを最適化するために様々な設計を試すことが容易になります。このシステムは、従来のバイオプロセシング・システムに比べて、エネルギー消費量、水消費量、プラントの環境フットプリントを削減することができます。そのため、製薬業界全体で好まれる選択肢となっています。また、バイオ医薬品製造の上流工程と下流工程の両方で利用される新しいシングルユースシステムの開発に各社が注力するようになっていることも、市場の成長を後押しすると予想されます。

さらに、シングルユースシステムにビッグデータベースの機械学習を採用することで、プロセス面で最大の生産性と効率を達成しながら、製品や薬剤の収率を向上させることができ、多くのバイオ医薬品メーカーが主流の戦略を採用していることも市場成長に寄与しています。

さらに、提携、パートナーシップ、新製品の発売、その他の企業の取り組みなど、さまざまなビジネス戦略の採用が増加していることも、市場成長を促進すると予想されます。例えば、2021年5月、Qosinaはシングルユースバイオプロセスインテグレーターや医療機器メーカーをサポートするため、Nordson MEDICALと販売契約を締結しました。また、2021年3月、サーモフィッシャーは3,000Lと5,000LのHyPerforma DynaDriveシングルユースバイオリアクターを発売しました。これらのバイオリアクターは、スケールを超えて細胞培養のパフォーマンスをサポートし、高密度および次世代の細胞培養プロセスに対応し、設備投資の削減、運用コストの削減、および高出力プロセスによる総コストの削減を実現する機能を備えています。また、DynaDrive S.U.B.は攪拌型タンクリアクターにおいて優れたターンダウンを実現し、シードトレインスケールアップに必要な容器の数を減らすことができます。新システムは、拡張性の向上、ターンダウン比の改善、混合の改善を提供します。

したがって、バイオ医薬品に対する高い需要、シングルユースシステムが提供するいくつかの利点、企業活動の活発化など、上記の要因により、調査対象市場は予測期間中に成長すると予想されます。しかし、溶出性・抽出性に関する問題が、予測期間中の市場成長を抑制する可能性が高いです。

シングルユースバイオプロセシング市場動向

バイオ医薬品メーカーセグメントが予測期間中に大きな成長を遂げる見込み

シングルユースバイオプロセシング市場では、予測期間中にバイオ医薬品分野が大きく成長する見込みです。その背景には、シングルユース技術やシステムの採用が増加していること、生物製剤の需要が増加していること、企業活動が活発化していることなどがあります。加えて、シングルユース技術や製品が提供する、初期投資や研究開発コストの削減、人件費や材料費の削減、従来のバイオプロセス方法と比較して廃棄が容易といった利点も、バイオ医薬品業界全体で採用を増やしています。さらに、これらのシングルユースバイオプロセシング・プラントは、従来のバイオプロセスで使用されるステンレス製リアクターよりも35%有利な二酸化炭素(CO2)バランスを生み出し、メーカーに高く採用されています。

生物製剤の承認件数の増加も、シングルユース・バイオリアクターと技術の需要増加に寄与しています。例えば、米国FDAは2023年2月、ファーストインクラスの高持続性第VIII因子補充療法であるBioverativ TherapeuticsのALTUVIIIOを承認しました。また、2022年1月には、メッセンジャーRNA(mRNA)治療薬およびワクチンのパイオニアであるバイオテクノロジー企業Moderna, Inc.が、18歳以上のCOVID-19予防を目的としたSPIKEVAX(COVID-19ワクチン、mRNA)の生物製剤ライセンス申請をFDAから承認されました。

さらに、共同研究、新製品の上市、その他のイニシアチブのような重要な戦略の採用に対する企業の注目の高まりも、このセグメントの成長を促進すると予想されます。例えば、2022年5月、ILC Dover LP社は、バイオ治療薬市場向けに無菌液体を取り扱い供給するための液体シングルユースバイオプロセシングバッグを発売しました。また、企業はタンパク質、細胞株、プロセス開発サービスを拡大するためにシングルユースバイオプロセシングプラントを開設しています。例えば、2022年4月、サーモフィッシャーサイエンティフィックはオグデンに55,000平方フィートのシングルユーステクノロジー(SUT)施設を開設しました。これはワクチンや治療法の開発用のシングルユースバイオプロセス容器の生産を増やすためのものです。この工場は、新たなワクチンや画期的な治療法の開発に必要な様々な技術や材料を生産するための追加能力を提供します。この施設では、液体の送達、処理、分離、貯蔵、輸送のためのカスタマイズ可能なバイオプロセス容器(BPC)システムを製造します。また、2021年2月、中国のWuXi Biologics MFG5 Drug Substance(DS)製造施設は、36,000リットルの容量を持つGMP操業を開始し、9つの4,000リットルのシングルユースバイオリアクターを導入しました。この立ち上げにより、同社の現在の生産能力は90,000リットルに増加しました。

従って、研究セグメントは上記の要因から予測期間中に大きく成長すると予想されます。

予測期間中、北米が大きな市場シェアを占める見込み

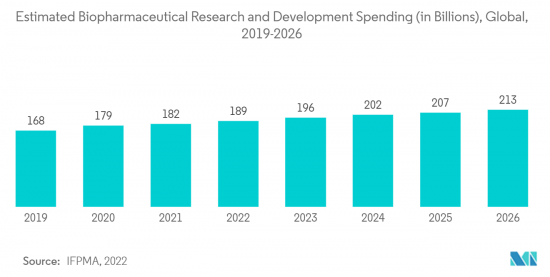

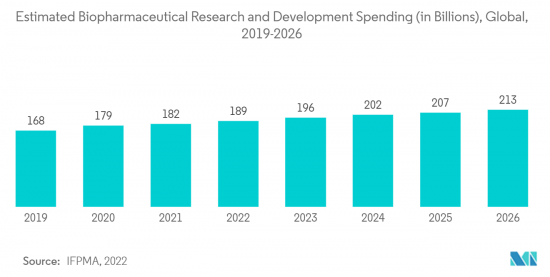

予測期間中、北米が大きな市場シェアを占めると予想されます。これは、研究開発費の増加、大規模な製造拠点の存在、ディスポーザブルの人気の高まり、ヘルスケア支出の増加、確立されたヘルスケアインフラの存在によるものです。

政府はバイオ医薬品の開発に莫大な投資を行っており、これがシングルユース・バイオリアクター、容器、培地、ろ過アセンブリなどの市場を牽引し、市場成長を促進すると予想されます。例えば、カナダ政府が2021年7月に発表したデータによると、カナダ政府は国のワクチン接種、治療、バイオ製造能力を再確立するために12億米ドル以上を投資したことが確認されています。さらに、フランソワ・フィリップ・シャンパーニュ革新・科学・産業大臣とパティ・ハジュドゥ保健大臣は、「バイオマニュファクチャリング・ライフサイエンス戦略」を立ち上げました。将来のパンデミックに対処するための強固で競争力のある分野を成長させ続けるために、7年間で22億米ドル以上が投資されました。

さらに、シングルユースバイオプロセシングプラントの設立や、バイオリアクター、ろ過アセンブリ、その他の消耗品などの新製品を発売する企業の活動が活発化していることも、この地域の市場成長に寄与しています。例えば、2022年5月、ILC Dover Lp社は、バイオ治療薬市場向けに無菌液体を取り扱い供給するための液体シングルユースバイオプロセシングバッグを発売しました。この発売により、同社は粉末の封じ込めや取り扱いから、無菌液体の取り扱いやプレフィルド液体・粉末バッグに至るまで、バイオ治療薬・医薬品製造のワークフロー全体にわたる設定を支援します。また、2021年11月、バイオノバ社はカリフォルニア州フリーモントに2,500万米ドルのシングルユース工場を開設しました。この工場は1,000リットルのCytiva XDRアップストリームトレインを備えています。同様に、2021年10月、アジリテックは、30 lから2000 lまでのシングルユース・バイオリアクターを2台まで同時に制御するアジリテック・バイオリアクター・コントローラーを発売しました。

したがって、上記の要因から、予測期間中、この地域の市場は大きく成長すると予想されます。

シングルユースバイオプロセシング産業の概要

シングルユースバイオプロセシング市場は適度な競争があり、複数の大手企業で構成されています。各社は市場での地位を維持するため、提携、新製品の発売、その他の取り組みなど、さまざまな事業戦略の採用に注力しています。市場に参入している企業には、ザルトリウスAG、サーモフィッシャーサイエンティフィック、ダナハーコーポレーション(サイティバ)、エッペンドルフAG、メルクKGaA、ベーリンガーインゲルハイム・インターナショナルGmbH、PBSバイオテックなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- より迅速な導入と製品の交差汚染リスクの低減

- バイオ医薬品需要の増加

- シングルユースバイオプロセシング技術の低コスト化と環境負荷の低減

- 市場抑制要因

- 溶出物および抽出物に関する問題

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模)

- 製品別

- ろ過アセンブリー

- メディアバッグと容器

- 使い捨て/単回使用バイオリアクター

- 使い捨てミキサー

- その他の製品

- 用途別

- ろ過

- 細胞培養

- 精製

- その他の用途

- エンドユーザー別

- バイオ医薬品メーカー

- 学術・臨床研究機関

- その他エンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Sartorius AG

- Thermo Fisher Scientific

- Danaher Corporation(Cytiva)

- Eppendorf AG

- Merck KGaA

- 3M

- CESCO Bioengineering Co., Ltd.

- PBS Biotech, Inc.

- ABEC Inc.

- Celltainer Biotech BV

- Distek, Inc.

- OmniBRx Biotechnologies

- Boehringer Ingelheim International GmbH

第7章 市場機会と今後の動向

The single-use bioprocessing market is anticipated to register a CAGR of 11.5% during the forecast period.

The initial phase of the pandemic substantially impacted the growth of the single-use bioprocessing market owing to the significant decline in manufacturing processes and restricted demand and supply of drugs. However, single-use technology (SUT) became a leading technology in pre-commercial manufacturing, including preclinical and clinical scales. With the increasing number of COVID-19 cases, the demand for effective drugs and many vaccines increased. It also increased the adoption of biopharmaceutical companies' single-use bioprocessing systems and technology due to fewer chances of contamination and reduced sterilization tests between the batches. Also, drug discovery using single-use technologies became a major focus for managing the pandemic. For instance, according to an article published in the National Library of Medicine in November 2022, it was observed that the pandemic accelerated the growing demand for single-use devices for the rapid production of drugs and vaccines. Due to the increased infection rates, most COVID-19 vaccine research is based on single-use technologies. Thus, these efforts involve using novel approaches, such as mRNA and DNA technologies. Hence, the studied market witnessed significant growth during the COVID-19 pandemic.

Factors such as faster implementation and lower risk of product cross-contamination, increasing demand for biopharmaceuticals, lower costs, and lesser environmental impact of single-use bioprocessing technologies are expected to boost the market growth.

The demand for biopharmaceuticals increased due to the high population suffering from chronic diseases. It raises the need for effective drugs and products for their treatment, which is anticipated to fuel the demand for single-use technologies and related products, thereby propelling market growth. For instance, according to the data published by the FDA, in February 2023, about 14 biologics were approved for treating various chronic diseases in 2022. The pharmaceutical industry is expected to increase the utilization and adoption of single-use bioprocessing technologies and systems over the forecast period.

The ability to deploy single-use monitoring tools and improvements in sensing technologies allow producers more control over their processes, which increases their adoption. Also, adopting single-use technologies and systems helps biopharmaceutical companies overcome the challenges of eradicating contamination risks, thus lowering the need for sterilization between batches and increasing productivity. In addition, single-use bioreactors and fermentors provide high flexibility, making it easier to experiment with various designs to optimize the process. The system offers reduced energy consumption, water consumption, and the plant's environmental footprint over conventional bioprocessing systems. It makes them a preferred choice across the pharmaceutical industry. Also, the increasing focus of the companies on developing a new single-use system that is utilized in both upstream and downstream processing of the production of biopharmaceuticals is expected to fuel market growth.

Furthermore, adopting big data-based machine learning in single-use systems increases the product or drug yield while achieving maximum productivity and efficiency in terms of process, and the use of mainstream strategy by many biopharmaceutical manufacturers is also contributing to the market growth.

Moreover, the rising adoption of various business strategies such as collaborations, partnerships, new product launches, and other company initiatives are also expected to propel the market growth. For instance, in May 2021, Qosina entered into a distribution agreement with Nordson MEDICAL to support Single-Use Bioprocess Integrators and Medical Device Manufacturers. Also, in March 2021, Thermo Fisher launched 3,000 and 5,000 L HyPerforma DynaDrive Single-use Bioreactors. These bioreactors offer features that support cell culture performance across scales, accommodate high-density and next-generation cell culture processes, and reduce overall costs through reduced capital investment, operational expenses, and higher-output processes. DynaDrive S.U.B.s also provide superior turn-down in stirred tank reactors, which lowers the number of vessels needed for seed-train scale-up. The new systems offer increased scalability, improved turn-down ratio, and improved mixing.

Therefore, owing to the factors above, such as the high demand for biopharmaceutical products, several advantages offered by single-use systems, and the increasing company activities, the studied market is anticipated to grow over the forecast period. However, the issues related to leachable and extractable are likely to restrain the market growth over the forecast period.

Single-use Bioprocessing Market Trends

Biopharmaceutical Manufacturer Segment is Expected to Witness Significant Growth Over the Forecast Period

The biopharmaceutical segment is expected to grow significantly in the single-use bioprocessing market over the forecast period. It is due to the rising adoption of single-use technologies and systems, increasing demand for biologics, and growing company activities. In addition, some of the advantages offered by single-use technologies and products, such as reduced initial investment and research and development costs, low labor and material costs, and easy disposal over conventional bioprocessing methods, are also increasing their adoption across the biopharmaceutical industry. Additionally, these single-use bioprocessing plants produce a 35% more favorable carbon dioxide (CO2) balance than stainless steel reactors used in conventional bioprocessing and are highly adopted by the manufacturer.

The rising number of biologics approvals is also contributing to the increased demand for single-use bioreactors and technologies. For instance, in February 2023, the United States FDA approved Bioverativ Therapeutics's ALTUVIIIO, a first-in-class, high-sustained factor VIII replacement therapy. It is indicated for routine prophylaxis, on-demand treatment to control bleeding episodes, and perioperative management (surgery) for adults and children with hemophilia A. Also, in January 2022, Moderna, Inc., a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines, received approval for the Biologics License Application for SPIKEVAX (COVID-19 Vaccine, mRNA) from the FDA to prevent COVID-19 in individuals 18 years of age and older.

Furthermore, the companies' rising focus on adopting key strategies such as collaborations, new product launches, and other initiatives are also expected to fuel the segment growth. For instance, in May 2022, ILC Dover LP launched liquid single-use bioprocessing bags to handle and supply sterile liquids for the biotherapeutics market. Also, the companies are opening up single-use bioprocessing plants to expand their protein, cell line, and process development services. For instance, in April 2022, Thermo Fisher Scientific opened a 55,000 sq ft single-use technology (SUT) facility in Ogden. It is to increase the production of single-use bioprocess containers for developing vaccines and therapies. The plant provides additional capacity to produce various techniques and materials needed to develop emerging vaccines and breakthrough therapies. The facility manufactures customizable bioprocess container (BPC) systems for the delivery, processing, separation, storage, and transportation of liquids. Also, in February 2021, WuXi Biologics MFG5 Drug Substance (DS) manufacturing facility in China launched a GMP operation with a capacity of 36,000 l, deploying nine 4,000 l single-use bioreactors. This launch increased the company's current capacity to 90,000 l.

Therefore, the studied segment is expected to grow significantly over the forecast period due to the above factors.

North America is Expected to Hold the Significant Market Share Over the Forecast Period

North America is expected to hold a significant market share over the forecast period. It is due to increasing research and development spending, large manufacturing unit presence, the growing popularity of disposables, increasing healthcare expenditure, and well-established healthcare infrastructure presence.

The government is investing enormously in developing biopharmaceutical products, which is expected to drive the market for single-use bioreactors, containers, media, filtration assemblies, and others, propelling the market growth. For instance, according to the data published by the Government of Canada in July 2021, it was observed that the Canadian government invested more than USD 1.2 billion to reestablish national vaccination, therapeutic, and biomanufacturing capacity. In addition, the Honourable Francois-Philippe Champagne, Minister of Innovation, Science, and Industry, and the Honourable Patty Hajdu, Minister of Health, launched the Biomanufacturing and Life Sciences Strategy. Over seven years, more than USD 2.2 billion was invested to continue growing a robust and competitive sector for facing future pandemics.

Furthermore, the rising company activities in establishing single-use bioprocessing plants and launching new products such as bioreactors, filtration assemblies, and other consumables are also contributing to the market growth in the region. For instance, in May 2022, ILC Dover Lp launched liquid single-use bioprocessing bags for handling and supplying sterile liquids for the biotherapeutics market. This launch assists the company in setting across the entire biotherapeutic and pharmaceutical manufacturing workflow, from powder containment and handling through sterile liquid handling and pre-filled liquid and powder bags. Also, in November 2021, Bionova opened a USD 25 million single-use plant in Fremont, California. The plant is equipped with a 1,000 l Cytiva XDR upstream train. Similarly, in October 2021, Agilitech launched an Agilitech bioreactor controller that simultaneously controls up to two single-use bioreactors from 30 l up to 2000 l. The design of the product allows for integration with any brand single-use bioreactor.

Therefore, owing to the factors above, the studied market is expected to grow significantly in the region over the forecast period.

Single-use Bioprocessing Industry Overview

The single-use bioprocessing market is moderately competitive and consists of several major players. The companies are focusing on adopting various business strategies such as collaboration, new product launches, and other initiatives to retain their market position. Some of the companies in the market are Sartorius AG, Thermo Fisher Scientific, Danaher Corporation (Cytiva), Eppendorf AG, Merck KGaA, Boehringer Ingelheim International GmbH, and PBS Biotech, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Faster Implementation and Lower Risk of Product Cross-contamination

- 4.2.2 Increasing Demand for Biopharmaceuticals

- 4.2.3 Lower Costs and Lesser Environmental Impact of Single-use Bioprocessing Technologies

- 4.3 Market Restraints

- 4.3.1 Issues Related to Leachables and Extractables

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD)

- 5.1 By Product

- 5.1.1 Filtration Assemblies

- 5.1.2 Media Bags and Containers

- 5.1.3 Disposable/Single-use Bioreactors

- 5.1.4 Disposable Mixers

- 5.1.5 Other Products

- 5.2 By Application

- 5.2.1 Filtration

- 5.2.2 Cell Culture

- 5.2.3 Purification

- 5.2.4 Other Applications

- 5.3 By End User

- 5.3.1 Biopharmaceutical Manufacturers

- 5.3.2 Academic and Clinical Research Institutes

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sartorius AG

- 6.1.2 Thermo Fisher Scientific

- 6.1.3 Danaher Corporation (Cytiva)

- 6.1.4 Eppendorf AG

- 6.1.5 Merck KGaA

- 6.1.6 3M

- 6.1.7 CESCO Bioengineering Co., Ltd.

- 6.1.8 PBS Biotech, Inc.

- 6.1.9 ABEC Inc.

- 6.1.10 Celltainer Biotech BV

- 6.1.11 Distek, Inc.

- 6.1.12 OmniBRx Biotechnologies

- 6.1.13 Boehringer Ingelheim International GmbH