|

市場調査レポート

商品コード

1689822

エチレンカーボネート-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Ethylene Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エチレンカーボネート-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

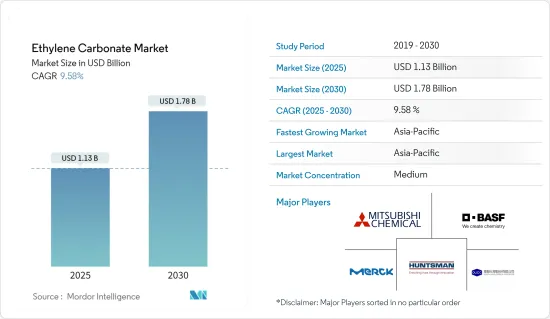

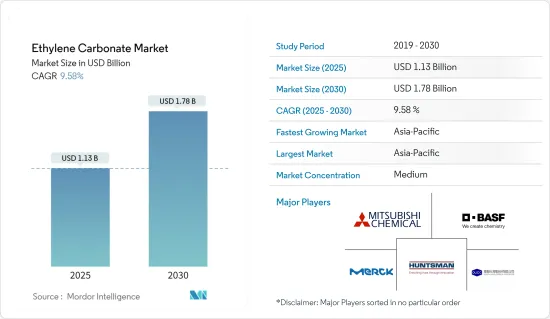

エチレンカーボネート市場規模は2025年に11億3,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは9.58%で、2030年には17億8,000万米ドルに達すると予測されています。

エチレンカーボネートの生産量と消費量はCOVID-19の影響を受けています。操業停止、生産制限、世界の景気後退により、エチレンカーボネートやその他の化学品の需要は減速しています。エチレンカーボネートやその他の化学品は、需要の減少により安価になっています。パンデミックの後、電気自動車用のリチウムイオン電池や再生可能エネルギー源からのエネルギーを貯蔵するシステムのために、炭酸エチレンの需要が増加しました。

主要ハイライト

- 炭酸エチレン市場は最近成長しました。電気自動車(EV)とデバイス製造装置の需要増加に伴い、リチウム電池とリチウム消費量が増加し、炭酸エチレン市場のプラス成長につながります。

- 中期的には、炭酸エチレン市場の成長に影響を与える要因として、化学セグメントでの中間体用途の増加や、自動車セグメントでのリチウム電池のニーズの高まりが挙げられます。

- しかしその反面、炭酸エチレンの毒性による健康被害の増加や、他の代替品による置き換えの見込みが、市場の成長を妨げると予想されます。

- アジア太平洋は、エレクトロニクスセグメントが高度に発展しており、リチウムイオン電池の生産量が多いことから、世界市場を独占すると予想されます。

エチレンカーボネート市場の動向

リチウム電池需要の増加

- エチレンカーボネートは有機溶剤の一種で、リチウムイオン電池の電解質溶液の成分として利用されます。電解液は、リチウムイオンが負極と正極の間を移動し、電池がエネルギーを貯蔵・放出できるようにするイオン伝導性を提供するため、リチウムイオン電池の重要なコンポーネントです。

- エチレンカーボネートは溶媒としての役割に加え、電解質溶液を安定化させ、負極でのリチウム金属の生成を防ぎます。リチウム金属は短絡やその他の電池性能の問題を引き起こす可能性があるため、これは極めて重要です。商業・工業用途の新しくエキサイティングな産業が、リチウムイオン電池の必要性を高めています。最近の動向では、データセンターやマテリアルハンドリング産業からのリチウムイオン電池の需要が、特に発展途上国で急増しました。

- 国際エネルギー機関(IEA)によると、バッテリー電気自動車の世界販売台数は2021年に470万台に達し、前年比135%増となりました。

- 化石燃料エンジンに対する政府の制限により、電気自動車の需要が急増し、リチウム電池に大きな影響を与えています。

- 電池のニーズは、電子機器の増加、モバイル機器の需要拡大、エネルギー効率の高いソースの増加、先進国における技術的躍進によってもたらされています。予測期間中、炭酸エチレン市場はこうした理由によって牽引されると予想されます。

市場を独占するアジア太平洋

- アジア太平洋は、エレクトロニクスセグメントが高度に発展しており、中国と日本におけるリチウムイオン電池の生産量が多いことに加え、リチウム技術を進歩させるための投資が長年にわたって継続的に行われていることから、市場を独占すると予想されます。

- さらに、アジアでは燃焼エンジンに対する政府規制が強化されているため、中国、日本、インドではさまざまな電気自動車のニーズが高まり、さまざまな用途で炭酸エチレンの需要が増加しています。

- 電子塗料、接着剤、誘電体は、溶剤として炭酸エチレンを使用して製造できます。炭酸エチレンは他の成分を溶解・混合することができ、揮発性が低いため製品の安定性を高めることができます。エチレンカーボネートは、ポリカーボネートやその他のエレクトロニクス用途のポリマーを作ることもできます。

- 日本のエレクトロニクス産業は世界有数の規模を誇る。電子情報技術産業協会(JEITA)の報告によると、日本は2021年までに世界のエレクトロニクスの10%を生産します。2021年には、国内のエレクトロニクス製造業は800億米ドルを超え、毎年11%の成長を遂げます。

- 韓国のエレクトロニクス産業は世界で最も進んでいます。消費者向け電子機器、半導体、その他の電子部品の生産で世界をリードしています。韓国には、SamsungやLGをはじめとする世界最大の電気企業があります。韓国国際貿易協会(KITA)によると、韓国の2021年の生産額は前年比25%増の2,007億7,000万米ドルだった(KITA)。

- 製薬産業では、炭酸エチレンは錠剤やカプセルなどの固形製剤を製造する際の溶媒として頻繁に使用されます。炭酸エチレンの溶媒としての性質は、医薬品有効成分(API)の溶解を助け、最終製品の混合・流動特性を改善することができます。

- 中国は世界第2位の医薬品市場です。中産階級の拡大と高齢化、所得の増加、都市化の拡大により、医薬品市場は大幅に拡大しています。

- CEICデータによると、中国における医薬品売上高は、2021年8月の2兆101億5,000万人民元(2,968億9,920万米ドル)から、2021年9月には2兆3,740億6,000万人民元(3,506億4,870万米ドル)に増加します。

- 上記の要因により、今後数年間、同地域のエチレンカーボネート需要は増加すると予想されます。

エチレンカーボネート産業概要

エチレンカーボネート市場は部分的に統合されており、少数の大手企業が市場のかなりの部分を占めています。主要企業には、BASF SE、Huntsman International LLC、Mitsubishi Chemical Corporation、OUCC、Merck KGaAなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 電気自動車メーカーからの需要増加

- 化学中間体の用途拡大

- 抑制要因

- 毒性と新しい代替品による代替の展望

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション

- 用途

- リチウム電池

- 潤滑油

- 医療用製品

- 中間体と薬剤

- その他

- エンドユーザー産業

- 自動車

- 医薬品

- 石油・ガス

- その他

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- 合併、買収、合弁事業、提携、協定

- 市場シェア(%)分析**/ ランキング分析

- 主要企業の戦略

- 企業プロファイル

- BASF SE

- Huntsman International LLC

- Liaoning Ganglong Chemical Co. Ltd

- Lixing Chemical

- Merck KGaA

- Mitsubishi Chemical Corporation

- OUCC

- Shandong Senjie Cleantech Co. Ltd

- Shandong Shida Shenghua Chemical Group Co. Ltd

- Taixing Taida Fine Chemical Co. Ltd

- Toagosei Co. Ltd

- Tokyo Chemical Industry Co. Ltd

- Zibo Donghai Industries Co. Ltd

第7章 市場機会と今後の動向

- リチウム硫黄電池の需要拡大

The Ethylene Carbonate Market size is estimated at USD 1.13 billion in 2025, and is expected to reach USD 1.78 billion by 2030, at a CAGR of 9.58% during the forecast period (2025-2030).

Ethylene carbonate output and consumption have been affected by COVID-19. Due to lockdowns, production limits, and global economic recession, ethylene carbonate and other chemical demands have slowed. Ethylene carbonate and other chemicals are cheaper due to lower demand. After the pandemic, the ethylene carbonate demand increased because of lithium-ion batteries for electric cars and systems that store energy from renewable sources.

Key Highlights

- The ethylene carbonate market grew recently. With the increase in demand for electric vehicles (EV) and device manufacturing units, there is an increase in lithium battery and lithium consumption, resulting in positive growth for the ethylene carbonate market.

- Over the medium term, the factors affecting the ethylene carbonate market growth include the rising number of applications for intermediates in the chemical sector and the growing need for lithium batteries in the automobile sector.

- However, on the flip side, rising health hazards due to the toxicity of ethylene carbonate and replacement prospects by other substitutes are expected to hinder the market's growth.

- Asia-Pacific is expected to dominate the global market due to its highly developed electronics sector and high production of lithium-ion batteries.

Ethylene Carbonate Market Trends

Increasing Demand for Lithium Batteries

- Ethylene carbonate is a type of organic solvent utilized as a component in the electrolyte solution of lithium-ion batteries. The electrolyte solution is a crucial component of lithium-ion batteries because it provides the ionic conductivity that enables lithium ions to travel between the anode and cathode, allowing the battery to store and release energy.

- In addition to acting as a solvent, ethylene carbonate stabilizes the electrolyte solution, avoiding the production of lithium metal on the anode. It is crucial, as lithium metal can create short circuits and other battery performance difficulties. New and exciting industries with commercial and industrial uses have increased the need for lithium-ion batteries. In recent years, demand for lithium-ion batteries from the data center and material handling industries surged, particularly in developing countries.

- According to the International Energy Agency, global sales of battery-electric vehicles reached 4.7 million in 2021, a 135% increase over the previous year.

- Government limits on fossil fuel engines have led to a rapid increase in the demand for electric vehicles, which substantially impacts lithium batteries.

- The need for batteries is driven by the increasing number of electronic devices, the growing demand for mobile devices, the increase in energy-efficient sources, and technological breakthroughs in developed nations. During the forecast period, the ethylene carbonate market is anticipated to be driven by these reasons.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market owing to its highly developed electronics sector and high production of lithium-ion batteries in China and Japan, coupled with continuous investments in the region over the years to advance lithium technology.

- Besides, the growing government regulations on combustion engines in Asia increased the need for various electric vehicles in China, Japan, and India, increasing the demand for ethylene carbonate in various applications.

- Electronic coatings, adhesives, and dielectrics can be made using ethylene carbonate as a solvent. Ethylene carbonate can dissolve and mix other components, and its low volatility can increase product stability. Ethylene carbonate can also make polycarbonates and other polymers for electronics applications.

- The Japanese electronics industry is one of the largest in the world. Japan produced 10% of the world's electronics by 2021, as the Japan Electronics and Information Technology Industries Association (JEITA) reported. In 2021, domestic electronics manufacturing exceeded USD 80 billion, a growth of 11% annually.

- South Korea's electronics industry is among the most advanced in the world. It is a global leader in producing consumer electronics, semiconductors, and other electronic components. South Korea is home to some of the world's largest electrical companies, including Samsung and LG. According to the Korea International Trade Association, South Korea produced USD 200.77 billion in 2021, up 25% from the year before (KITA).

- In the pharmaceutical industry, ethylene carbonate is frequently used as a solvent for manufacturing solid dosage forms, such as tablets and capsules. Ethylene carbonate's solvent qualities can aid in dissolving active pharmaceutical ingredients (APIs) and improving the mixing and flow properties of the finished product.

- China is the second-largest medicines market in the world. The medicines market is expanding significantly due to the country's expanding middle class and aging population, rising earnings, and expanding urbanization.

- According to CEIC Data, pharmaceutical sales in China increased to CNY 2,374,060 million (USD 350,648.7 million) in September 2021 from CNY 2,010,150 million (USD 296,899.2 million) in August 2021.

- All the abovementioned factors are expected to augment the demand for ethylene carbonate in the region over the coming years.

Ethylene Carbonate Industry Overview

The ethylene carbonate market is partially consolidated, with a few major players dominating a significant portion of the market. Some major companies include BASF SE, Huntsman International LLC, Mitsubishi Chemical Corporation, OUCC, and Merck KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Electric Vehicle Manufacturers

- 4.1.2 Increasing Applications of Chemical Intermediates

- 4.2 Restraints

- 4.2.1 Toxicity and Replacement Prospects by New Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Lithium Batteries

- 5.1.2 Lubricants

- 5.1.3 Medical Products

- 5.1.4 Intermediates and Agents

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Pharmaceuticals

- 5.2.3 Oil and Gas

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Huntsman International LLC

- 6.4.3 Liaoning Ganglong Chemical Co. Ltd

- 6.4.4 Lixing Chemical

- 6.4.5 Merck KGaA

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OUCC

- 6.4.8 Shandong Senjie Cleantech Co. Ltd

- 6.4.9 Shandong Shida Shenghua Chemical Group Co. Ltd

- 6.4.10 Taixing Taida Fine Chemical Co. Ltd

- 6.4.11 Toagosei Co. Ltd

- 6.4.12 Tokyo Chemical Industry Co. Ltd

- 6.4.13 Zibo Donghai Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Lithium-sulfur Batteries